Vini Nvidia Vici: How the AI Giant’s Earnings Impacts Crypto AI Tokens

Sep. 10, 2024.

7 mins. read.

1 Interactions

Nvidia's earnings shine a spotlight on the delicate dance between AI stocks and crypto tokens. Despite strong results, market volatility and broader economic concerns weigh on AI’s long-term potential.

Intro

Most crypto AI tokens are now on sale, trading at a huge discount on their 12-months highs, yet many crypto investors remain hopeful and bullish on the sector, in no small part due to its correlation to the TradFi juggernaut that is Nvidia Corporation. That is of course before this week’s alleged DoJ subpoena, which sent all markets down and which we will address in another article.

The Nvidia stock has come to be a key indicator to the general health of both the traditional stock market and the cryptoverse. They are both barometers of the high-tech sector. Although the crypto market had a slight resurgence during August, this was short-lived; bearish news for Nvidia and the general market has almost completely wiped out recent gains – with AI cryptos such as Near, FET and Render having seen significant downward pressure since August 26.

These downturns show an intricate relationship between traditional stocks of tech giants and these new classes of assets, offering insights into market sentiment and the many factors driving crypto price valuations in the AI era.

Understanding the Nvidia-AI Crypto Connection

Nvidia’s hardware – specifically their graphics chips – are the computational engine that trains advanced AI models. As such, Nvidia’s performance is often seen as a barometer for the overall health and growth of the AI industry. Although there is a lot of competition in the GPU space, no other company has yet been able to keep up effectively with the speed at which Nvidia has innovated and consistently produces newer and faster tech.

In the crypto sphere, a new class of tokens has emerged over the past year, focusing on AI applications within blockchain technology. In essence, these tokens finance projects in the AI space, such as AI-powered portfolio management, image-generation, pathfinding, and more. These AI crypto tokens include projects like Artificial Superintelligence Alliance (FET), Bittensor (TAO), and Render (RNDR).

As the markets become increasingly tied together, many are watching Nvidia with keen eyes for any news that might signal up or downturns in the market.

Nvidia Pre-Earnings Expectations and Market Behavior

Waiting for Nvidia to release their earnings results at the end of August, analysts were hopeful. The company was doing consistently well and new chips were being released. Prices climbed, fueled by optimistic projections for Nvidia’s performance, with analysts expecting significant year-over-year growth in both revenue and earnings-per-share.

The crypto space experienced a considerable upturn leading up to the earnings call, especially in AI-related tokens. The market cap of many AI and big data cryptocurrencies increased by as much as 80% in the weeks preceding the Nvidia earnings announcement, reaching around $32 billion. This growth reflected not just excitement about Nvidia’s potential earnings beat, but also a broader recovery in the general market following a big dip earlier in August 2024.

The Earnings Release: Numbers vs. Expectations

Nvidia’s Q2 2024 earnings report did not disappoint. It was, by most measures, exceptional. The company had seen considerable year-on-year growth in virtually every metric:

- Revenue: $30 billion (up 122% year-over-year)

- Earnings-per-share: $0.68 (up 168% year-over-year)

These figures surpassed Wall Street’s predictions of $28.72 billion in revenue and $0.64 per share in earnings. The company’s performance was driven primarily by robust demand for its AI products and services. Its other branches also grew: its gaming revenue climbed 16% from a year ago to $2.9 billion, and Nvidia’s self-driving automotive division climbed 37% from a year ago. Good news all around, but as market participants have come to know, good news isn’t always good news for stock prices.

Post-Earnings Market Reaction: A Significant Downturn

Despite Nvidia’s strong results, the market reaction in both its stock price and subsequently the price of most AI crypto projects was remarkably negative. Below are some noteworthy metrics on valuations in the hours and days since the August 29 release.

- $292 billion wiped off the Nvidia stock price, with the stock having fallen 18% since its August highs and downward pressure appearing to hold strong.

- Artificial Superintelligence Alliance (FET) dropped 20% to $1.142

- Bittensor (TAO) fell 27% to $262

- Render (RNDR) declined 26% to $4.65

This negative response to very positive news about Nvidia illustrates the counterintuitive nature of market dynamics. Expectations often matter more than absolute performance. As market commentator Lisa Abramowicz noted, “Better-than-expected doesn’t cut it for Nvidia. Evidently, investors expect this company to blow away expectations.”

Factors Influencing the Post-Earnings Dip

When broader market conditions are taken into account, negative market reactions become a little more understandable. The market in general has seen a substantial downturn recently, with the S&P500 and the Nasdaq having seen notable losses in the past week. Some other notable factors to consider for Nvidia include:

1. Priced-in Expectations: The gains that both the Nvidia stock and in AI crypto tokens made in August before the earnings report meant that much of Nvidia’s success was already factored into prices. Markets are forward-looking, and the higher pricing in mid-August implies the good news had already had its effect before it broke.

2. Impossibly High Standards: Some analysts had predicted Nvidia would beat estimates by 10% or more. While the company exceeded expectations, it didn’t do so by the margins some had hoped for. The revenue exceeded projections by 4.5%, and the earnings-per-share by 6.25%. Nvidia’s second-quarter earnings were solid but not spectacular—and these days, that isn’t good enough for Wall Street.

3. Delays and Issues with New Chips: There was recent bad news about the new generation of Nvidia’s Blackwell GeForce graphics cards, specifically the RTX 5090: production is delayed and power consumption is higher than expected, possibly reaching 600W. This may have contributed to the downturn in the AI space

4. Forward-Looking Concerns: Investors may have been looking for stronger indications of future growth that weren’t present in the earnings report. Nvidia is however expected to ramp up production of its next-generation chips in the fourth quarter of this year, which could send the stock higher.

5. Broader Market Sentiment: The reaction to Nvidia’s earnings doesn’t exist in a vacuum. Overall market conditions – including concerns about interest rates and economic stability – play a role in how investors have interpreted and reacted to earnings reports.

6. Profit-Taking: The post-earnings dip could partly be attributed to investors cashing in on the pre-earnings rally, the “buy the rumor, sell the news” phenomenon common in financial markets.

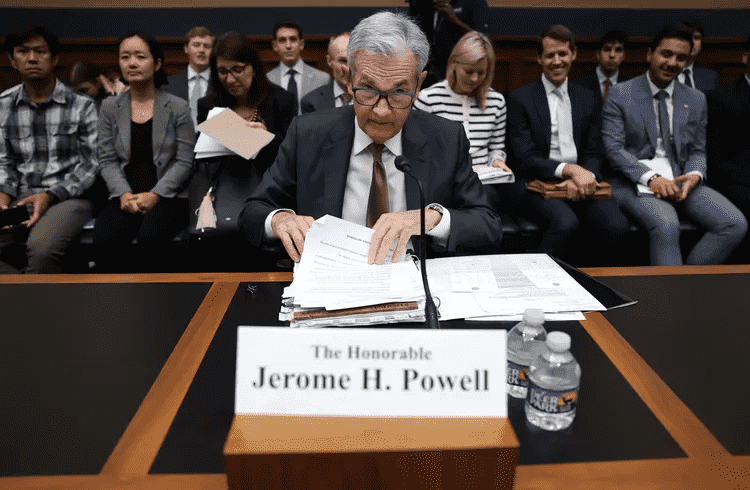

The Interest Rate Factor

The upcoming Fed meeting on 18 Sept 2024 has many investors and market participants sitting at the edge of their seats. The final decision on whether to lower interest rates or keep them stable will play a significant role in shaping market dynamics in the near-to-medium term, and that definitely includes the valuations of AI crypto tokens. Lower interest rates could encourage bullish movement in the market, with some traders expecting a cut of 25 to 50 basis points at the next meeting.

Long-Term Outlook: Beyond the Earnings Volatility

While the immediate reaction to Nvidia’s Q2 2024 earnings was negative for AI crypto tokens, it’s essential to consider the longer-term picture. Despite the post-earnings dip, many AI tokens have shown impressive year-to-date gains. For instance, FET has surged 75% since the start of 2024, while RENDER and TAO have posted gains of 18% and 10%, respectively.

These gains align with Nvidia’s own excellent performance, with its stock up 160% year-to-date. This broader trend suggests that the AI narrative remains strong, even if short-term fluctuations occur.

Conclusion: Navigating the AI Crypto Landscape

Recent price action in the AI space might be concerning. The technology is not immune to the larger market influences at play. The recent downturn and the uncertainty about the Fed’s interest rate cut puts the entire sector in a precarious spot, but the long-term trajectory of AI development and overall AI adoption appears as robust and promising as ever.

Many of the projects in the AI crypto space, like SingularityNET and its partners, are working on truly remarkable projects. New startups are promising to help drive the next generation of tech in AI, DeFi and traditional finance. For investors and market enthusiasts in the AI crypto space, the recent market volatility underscores the importance of looking beyond short-term data and focusing on the bigger picture.

The AI revolution is here to stay, and no measure of short-or-medium term bearishness, or the outcome of any one single company or federal agency interaction will stop what is coming.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)

0 Comments

0 thoughts on “Vini Nvidia Vici: How the AI Giant’s Earnings Impacts Crypto AI Tokens”