The Bitcoin Banana Zone 2025: How To Not Slip Up In Its Madness

Dec. 05, 2024.

5 mins. read.

Interactions

Bitcoin’s “Banana Zone” madness grips markets! With soaring prices and institutional frenzy, will you slip or thrive in 2025’s crypto chaos?

It’s December 2024, and all hell has broken loose in crypto markets, with everything from Bitcoin to meme coins to NFTs to AI agent coins to last-cycle “dino coins” like XRP ripping to the upside following Donald Trump’s election win which in 2025 will herald in the most crypto-friendly U.S. administration in history.

With Bitcoin kissing $100k, the crypto market has entered what veteran traders call ‘the Banana Zone’, and everyone is losing their minds. Bitcoin keeps smashing through all-time highs. It had its biggest-ever one-month jump in November 2024 (a $26,000 jump), billionaires are scrambling to buy whatever Bitcoin they can find, and investment firms are desperately telling their clients to buy Bitcoin “urgently.” Even Jim Cramer has flipped pro-Bitcoin again. What can go wrong? Welcome to the wild end of 2024.

Remember though – this isn’t financial advice of any kind. When the Fear And Greed Index sits on 90 (‘Extreme Greed’), markets are overheated. Anything can happen, particularly in the Banana Zone. The market can stay irrational longer than you can stay solvent. Keep your head straight, don’t bet the farm, and enjoy watching history unfold.

What Is This ‘Banana Zone’ Thing?

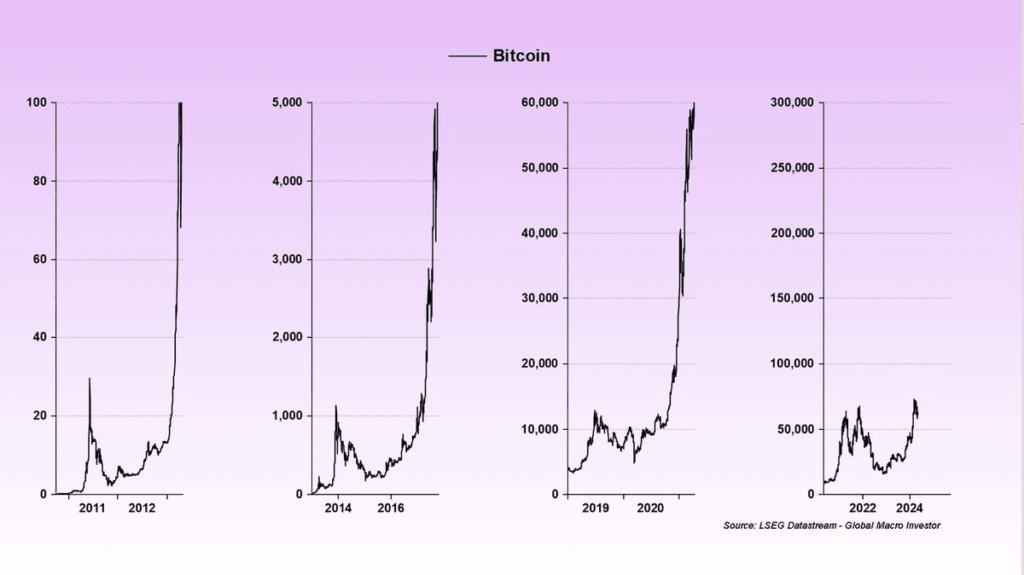

Macro investor Raoul Pal came up with this term to describe those insane periods when Bitcoin’s price chart starts looking like a banana – it goes up almost vertically. But this isn’t just about the price going crazy.

If you haven’t read his explanation on it, take ten minutes and read this post twice. And then once again.

The Banana Zone is a cyclical market pattern observed since 2008, when global interest rates were reset to zero and debt maturities standardized to 3-4 years. This created a predictable macro cycle driven by global liquidity, visible in ISM data (published by the Institute for Supply Management). The cycle involves currency debasement through liquidity increases, which helps service debt rollovers and causes asset prices to rise.

Growth assets, particularly tech and crypto, perform best during ‘Macro Summer and Fall’ periods. Crypto has outperformed tech significantly. It has grown at twice the internet’s historical rate, following Metcalfe’s Law adoption patterns.

While the cycle is generally predictable, due to debt structure, current factors like elections and China’s foreign relations may influence the outcomes. The final leg’s exact structure remains uncertain, though the pattern is expected to continue.

Banana Zone in Practice

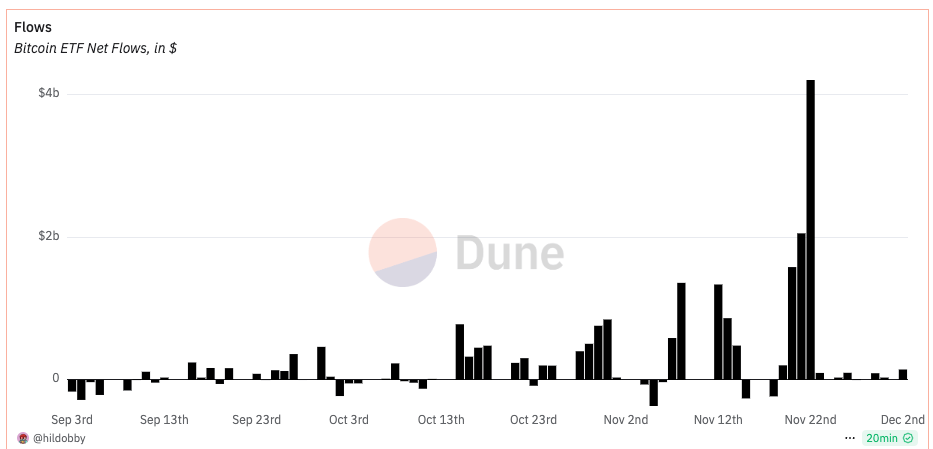

Just look at what’s happening: MicroStrategy just dropped another $2 billion to buy 27,200 Bitcoin. The over-the-counter trading desks, where the big players usually buy their Bitcoin, are running dry. Some traders are reporting there might be as little as 20,000-40,000 Bitcoin left available for large purchases. When you consider that Bitcoin ETFs have been buying roughly 100,000 Bitcoin in just the past few weeks, you start to understand why prices keep shooting up.

A Perfect Storm Has Hit

Several major factors have created the perfect conditions for this Banana Zone.

The Bitcoin halving earlier this year cut the new supply in half, right when demand started going through the roof. China has started pumping trillions into their markets to fight off recession. Central banks worldwide are beginning to lower interest rates again. Everyone is looking for somewhere to put their money that might actually keep up with inflation.

Investment firms are waking up to Bitcoin in a big way. Bernstein, a major investment firm, literally told their clients to “urgently” get Bitcoin exposure. That’s not the kind of language Wall Street typically uses. When Wall Street starts sounding like crypto Twitter, you know something unusual is happening.

This Time Hits Different

Previous Bitcoin bull markets were driven mainly by retail investors and pure speculation. This time around, the grown-ups have given their blessing: BlackRock’s ETF announcement last year gave the thumbs-up to TradFi to get behind BTC.

Major Wall Street firms are buying Bitcoin. Investment banks are creating crypto trading desks. Corporate treasuries are allocating serious money to Bitcoin. Even traditional banks are starting to offer crypto services to wealthy clients.

The supply squeeze is also more intense than ever before. Miners are holding onto their coins as their operations become more profitable with every price increase. Long-term holders aren’t selling. ETFs need to keep buying to meet demand. The available supply of Bitcoin is getting squeezed from all sides.

Warning Signs to Watch

The Banana Zone typically ends when the market reaches peak euphoria. Here are some classic warning signs to watch for as we move into 2025: your taxi driver starts giving you Bitcoin price predictions, people start quitting their jobs to become full-time crypto traders, everyone starts saying “this time is different.” When you see these signs, it might be time to start paying extra attention. Already seeing these signs? Well, it might be time to de-risk a little. After all, the key to riches is not just to make it, but to keep it.

But before that happens, we could very well see some mind-bending price action. The combination of limited supply and increasing institutional demand could drive prices to levels that seem impossible right now.

Don’t Slip in The Banana Zone

While watching the Banana Zone unfold is exciting, markets don’t go up forever. Every previous crypto bull market has ended with a significant pullback. The difference this time might be in how high we go before that happens, and how far we fall when it does.

The current Banana Zone could extend well into 2025, especially with all the institutional money flowing in and the supply getting more constrained by the day. But markets are unpredictable beasts. The best approach is to understand what’s happening and why, rather than trying to predict exactly how it will play out.

Pal says that 20 to 30% pullbacks are normal and to be expected, so it’s wise to be well prepared for these drawdowns and the pain that they’ll bring, in particular to altcoins.

One thing’s for certain: we’re living through a historic moment in financial markets. The Banana Zone of 2024-2025 is showing us what happens when an emerging asset class like Bitcoin starts to get mainstream acceptance right when its supply is getting squeezed. Whether you’re participating or just watching from the sidelines, this is going to be one hell of a show next year. If you hear the word WAGMI even in jest, run for the hills.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)

0 Comments

0 thoughts on “The Bitcoin Banana Zone 2025: How To Not Slip Up In Its Madness”