Trump’s ‘Strategic Bitcoin Reserve and US Digital Asset Stockpile’ Plan Underwhelms

Mar. 13, 2025.

5 mins. read.

Interactions

A Bitcoin reserve, an altcoin stockpile, and a crypto summit—hopes were high, but Trump’s Bitcoin reserve plan fell flat for traders. What’s next for the U.S. crypto strategy?

In early March, the USA’s president, Donald Trump, signed an executive order to create a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile. This aims to position the USA as a global leader in crypto.

While some in the crypto industry cheered this development as a victory, and President Trump also emphasized how this was another election promise that he fulfilled, it was a nothing-burger for traders who were expecting fireworks and massive gains.

Last Friday though, Trump and crypto figureheads like crypto czar David Sacks, Bitcoin whale Michael Saylor (MicroStrategy), Brian Armstrong (Circle), Brad Garlinghouse (Ripple) and others came together to discuss the next steps to build a government stockpile of cryptocurrencies including Bitcoin, Ethereum and Solana.

The summit provided a few positive takeaways for the USA’s long term HODLing of crypto – Bitcoin in particular – but fell short of the groundbreaking announcement that the crypto masses demanded after having a bad few weeks. Markets slid down again soon afterwards, as talk of trade wars escalated.

Let’s take a look at the brief history of Trump’s crypto reserves and what they entail.

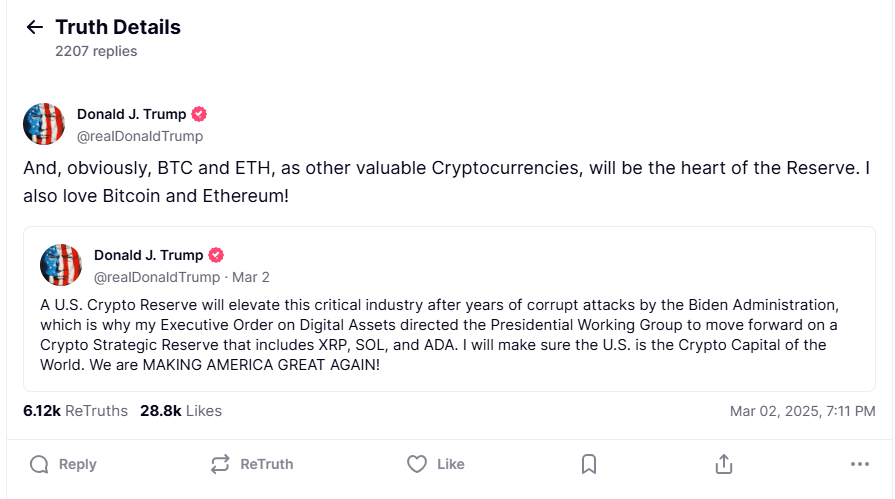

The Social Media Post that Started it All

President Trump set the ball rolling on March 2 when he took to Truth Social, a Twitter competitor owned by Trump Media and Technology Group, to announce that a U.S. crypto reserve will consist of XRP, Solana (SOL), Cardano (ADA), Ethereum (ETH), and Bitcoin. Sadly for traders, the announcement failed to kickstart an altcoin season.

The initial excitement quickly gave way to fierce criticism as crypto leaders argued that Bitcoin is the only digital asset worthy of a spot in the Strategic Reserve, and argued that the government is over-reaching by picking winners and losers. After calling Bitcoin a scam against the dollar in 2021, President Trump is now all in on crypto.

Others noted the strategic reserve gives the industry positive legitimacy. As this development unfolds, it’s time to understand what a strategic reserve is and why it matters.

What is a Strategic Reserve?

The concept of a strategic reserve in the USA dates back to the Gold Reserve Act of 1933, which aimed to hold critical resources to buffer against economic shocks like supply disruptions or price volatility.

These reserves are carefully guarded and can only be released when the government needs them.

Throughout the 20th century, the USA continued creating other strategic reserves to protect against shortages, such as the Strategic Petroleum Reserve in 1975 after the Arab oil embargo. These reserves are intended to stabilize essential assets for national defense or economic security. However, neutrals are wondering what makes BTC essential enough to warrant such a move.

Executive Order on Bitcoin Strategic Reserve

The executive order signed by President Trump on March 6 creates a Strategic Bitcoin Reserve. The naming suggests that Bitcoin is the only cryptocurrency that will be treated as a reserve asset.

Here are the key components of the executive order:

U.S. Digital Asset Stockpile

There is a difference between a reserve and stockpile. A reserve is one-way traffic: you can only deposit but not take out. On the other hand, a stockpile is flexible, with active buying and selling.

The executive order creates a Bitcoin reserve and a digital asset stockpile that includes digital assets other than Bitcoin owned by the Department of Treasury – seizures from criminal activities. The government will not acquire additional assets beyond those seized by the state, and the Secretary of Treasury may determine the strategies for maintaining the stockpile.

Strategic Bitcoin Reserve

The executive order says that only Bitcoin will be treated as a reserve asset. At this stage, it appears that the government will not be actively buying or selling Bitcoin but rather capitalizing the reserve with Bitcoin owned by the Department of Treasury. These bitcoins were acquired through criminal or civil asset forfeiture proceedings.

This is a big win for ‘Bitcoin Maxis’ who believe that BTC is the ‘one true cryptocurrency’ and the rest is just noise with a sell-by date.

The United States will not sell Bitcoin deposited into the Reserve, as it will be regarded as a store of value. Critics argued that Bitcoin is too volatile to be included in the Strategic Reserve.

The Secretaries of Treasury and Commerce are authorized to develop budget-neutral strategies for acquiring additional Bitcoin at no extra costs to taxpayers.

What Needs to be Done First?

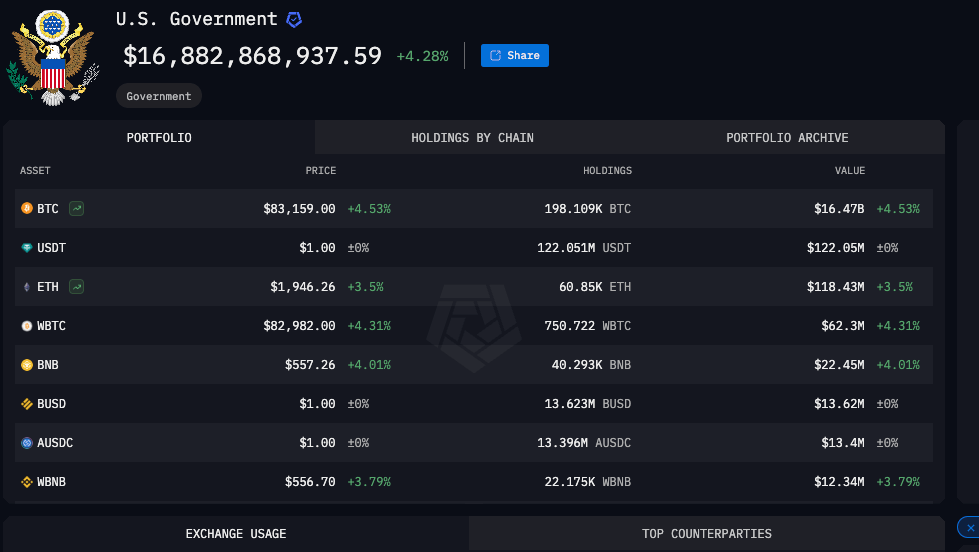

There could be a long way to go before the Bitcoin Reserve and Digital Asset Stockpile executive order goes into full effect. U.S. agencies must first fully account for their digital asset holdings to the Secretary of the Treasury and the President’s Working Group on Digital Asset Markets. The U.S. crypto czar David Sacks says the holdings have not yet been audited. Arkham Intelligence says the United States holds 198.1K Bitcoin, worth over $17 billion.

Secondly, the Treasury and Commerce Departments will need to find strategies to acquire additional BTC without spending taxpayers’ money.

There is another hurdle to jump through. The Congress may need to pass a bill to appropriate funds for the Bitcoin Reserve. This means the Trump administration needs to have the Congress on its side to cross over the line.

Potential Benefits

Whatever happens in the future, the Bitcoin Strategic Reserve is a major boost for the industry. The crypto industry is moving from the fringes of the financial world to being seen as a store of value by policymakers.

Bitcoin has long been called ‘digital gold’, and its proponents claim it can hedge against inflation and economic instability. Importantly, it could become a long-term investment in the Strategic Reserve.

Wrapping Up

It’s still uncertain if the Bitcoin Strategic Reserve and altcoin stockpile will fully materialize, but the wheels are in motion. President Trump’s early teaser on TruthSocial hinted at Bitcoin’s strong support from industry leaders while other assets play a supporting role.

These are early days, but the legitimacy of the industry is strengthening as crypto regulation becomes more favorable. And when you dig deeper, one thing becomes clear: Bitcoin is here to stay. How much it will be worth is a whole other question.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)

0 Comments

0 thoughts on “Trump’s ‘Strategic Bitcoin Reserve and US Digital Asset Stockpile’ Plan Underwhelms”