Interview with Gordon Grant

In one of the videos in Degens: Down and Out in the Crypto Casino, Gordon Grant stands by the bull on Wall Street and gives a little rap about how the bull is a meme, just like the image on a memecoin. The bull is a meme that is believed to represent logic, consistency and some appreciation on investment over time. It is understood to be reliable despite the temporary ebbs and flows of the market. Cryptocurrency has represented something else. A lot of meme coin holders are acting on a different desire, in his words, a desire to “flip the bird to finance, to rationality, to coherence.”

Speaking in 2024, he characterized its extremity by saying, “they can suddenly catch up violently in unexpected ways. And so you hold them again in a mathematically heuristic sense, not because you think of day-to-day expectations, but because one day they could go up 100×. And that’s how they behave. That’s how they’re distributed. They don’t follow a bell curve. They don’t follow any curve at all. They could do nothing for a decade, and then they could go up 10,000% overnight.”

In this interview we explore the nature of the crypto beast, and how it has been changing in response to going mainstream, the enthusiastic participation of various state actors (the more eccentric ones) and other ins and outs of what the makers of the Degens movie call “the crypto casino.”

RU Sirius: Is crypto and its aspirations (and ground-level value) any different from the values and potentials represented by the Wall Street bull, as per your segment in Degens?

Gordon Grant: In a sense, some of the earliest and largest cap tokens, be they proof-of-work blockchains like Bitcoin itself or O.G. memecoins like DOGE, promised very little in terms of price appreciation.

To be sure, there were plenty of proselytizers – growing in number with each market cycles – announcing this appreciation, but in essence, participation in crypto trading or HODLing was predicated on experimentation, entrepreneurship, community interactions, and entertainment (sometimes the entertainment of a gambler). Peer-to-peer payment facilities offered by distributed ledger technology (and security, in due course, as a function of rising values of these tokens) came along with it. But in large part, cryptocurrency has often been about disrupting, (re)building, and striking out from established financial norms.

At the end of January, the economist Eugene Fama said that according to conventional financial models, the terminal value of Bitcoin should be zero, and that if it does not go to zero, then all traditional monetary models are wrong. That’s a bit more reasoned than the comments of Buffet, Munger et al., that have likened Bitcoin (and other tokens) to rat poison.

Cryptocurrency’s origins didn’t posit finitely knowable ‘value’ as an intrinsic characteristic (indeed, for some blockchains, even transactional finality is probabilistic!)

By contrast, the entire Wall Street machine (in which I grew up as a trader / portfolio manager and cut my teeth professionally) propagates canonical assumptions such as:

⦿ ‘A basket of high-quality stocks, or an index referring thereto, is, on average, likely to go up consistently over time.’

⦿ ‘There is a firm fundamental valuation for the stock market as a whole and for individual stocks’.

⦿ ‘Fixed-income products like government bonds and high-grade credit can provide a stable, dependable risk-adjusted rate of return.’

The bull does speak to the concept of ‘becoming a part of something’. This may be, in part, the American dream of individual ownership of the companies defining the Horatio Alger-esque self-reliant frontier archetype.

The bull (with his generously-proportioned testicles) may also speak to the holding power required to earn these returns over time, but there is less in the bull that speaks to the aforementioned values of crypto. Nothing about it is existentialist or nihilistic. The bull is presented as a manifestation of fact.

Cryptocurrency, and meme coins especially, may demand faith. For one thing, it hasn’t yet stood the test of time: our beliefs about the stock market are based on 100+ years of data; a few years of token price returns just doesn’t have comparable statistical robustness. Then there’s the characteristics of the instrument and those purveying it.

RU: ”Flipping the bird to finance, to rationality, to coherence.” It’s a great expression of a post-narrative world expressed via capital. The entire post-narrative culture now seems to have exceeded even postmodernism. It has even infected the ability of many people to complete a coherent thought! Meanwhile the new political alignment in the USA seems to be flipping the bird at convention and stability… but maybe it’s in preparation of imposing a new kind of order and coherence? Any thoughts on that?

GG: Crypto (as a class of people, investors, assets, an ethos) is likely being co-opted by some of the forces to which it originally sought to flip the bird. The stakes are very real now, at $3 trillion, with the ability to sway markets and also act as a vector for liquidity and real-time risk management, as well as a forum for what some believe to be financial necromancy. Where else can an instrument associated with the likeness/name of one man conjure $50 billion of value in hours?

That aspect has brought in what these people like to think of as ’the cabal’. That ‘cabal’ may be something akin to the ‘Combine’ in One Flew Over The Cuckoo’s Nest. The reigning economic and political order can be thought of as having shifted from renegades to the firmly-established Powers That Be, and it makes all the sense in the world that they would take interest in this still-nascent and explosive asset class. They see it as a vector for their own initiatives, but also as a way to ingratiate themselves with the established titans of the digital asset realm and the more recently monied influence-peddlers. Of course ’they’ would wish to wield it for their own purposes, and not the purposes of the self-sovereign anti-establishment libertarian iconoclasts who birthed it. That’s probably part of the central tendency of the arc of history for many such innovations. Will that tendency corrupt or dilute the future potential or original purity of the brand or the mission? It remains to be seen.

From my perspective, the most significant/salient fact is that we are talking about it. It is now firmly in the institutional conversation about allocation and stewardship of capital. At such a stage, there will be many voices dictating its potential future (including many who are not inside the United States, which will be another exciting chapter to come).

To your point, the order may just as likely be imposed as it is innovated, and even within the progression of crypto from fringe to front of the house; players for every token, for every ecosystem, may have already made up their minds (to some extent) who may be truer to the cause and who may be a turncoat.

RU: How is the rush to mainstream crypto, and the enthusiasm of state actors like Donald Trump or Milei in Argentina affecting crypto broadly? Does it have an impact on the rebel guttersnipe aspect at the edges of the crypto culture?

GG: It appears at once validating (‘my leader endorses this’), particularly when the leader is not a Millei or Bukele, but of the stature of President Trump. But – as the Twitter blowback after the crypto ball and after the $TRUMP $MELANIA pump-and-dumps showed – it can also pollute or dilute crypto culture. Some may ask ‘Just how disruptive can an asset be if the leader of the free world is endorsing it?’, or ‘how seriously should one take a ‘leading lady token’? What invective may this elicit about an asset like Bitcoin, which Michael Saylor has alluded to reverentially as ‘promethean fire’ and ‘global digital capital’?

For some parts of that rebel guttersnipe, particularly the more dyed-in-the-wool anabaptists, pro-crypto meant anti-dollar. But as President Trump is showing, there can be a coincidence of pro-dollar and pro crypto.

The choices are deliberate at every phase. Whether a leader builds his own meme coin on a network like Bitcoin (as an ordinal perhaps), on the Ethereum blockchain, or on Solana – it starts to color the perceptions of planning, objectivity, credibility, and expertise. Debates on those criteria have already inspired no shortage of vitriol from the broader market and from the fringe.

That being said, after the debacle that was FTX, there is probably a greater capacity to hold one’s nose and swallow anything that advances the cause in some capacity, rather than hanging onto the purest version of it.

In short, the rush to the mainstream may be more readily tolerated by a growing contingent who too have been infected by those same venal, pecuniary motives…I’m hearing $ENRON and $TIKTOK (or equivalent) may be coming, and if so, that seems to support this point.

RU: Someone who helps me deal with my very limited crypto holdings suggested that individual, group and/or irreverent coins outside the mainstream ones are rapidly losing attention share as the market solidifies around mainstream ones (obviously Trump & wife coins form an exception). Do you think this is true? Has the irreverence we’ve once seen with the likes of $CUMROCKET or $SHITCOIN been pushed even further to the margins, soon to disappear entirely?

GG: Quantitatively, it’s true that there has been continued dominance by the largest cap coins within each sector. BTC is siphoning away pie share and mindshare from ETH. SOL is doing the same to with AVAX et al. XRP is leaving every other ‘dino coin’ in the dirt by miles, and even in the land of meme coins, DOGE continues to outstrip the latecomers for the most part, notwithstanding searing percentage gains in the likes of PEPE or BONK in these last 12-18 months.

Part of the reason for that could be that larger allocators need to move the needle on more sizable portfolios, and simply can’t or won’t play with penny-ante microcap assets. The other explanation could be the newer money simply does not know about or care to learn about the marginal names.

Conversely, it could also be true that it’s now more expensive to launch a successful memecoin. This in and of itself is blasphemous, but may reflect current realities that creating multibillion dollar coins/chains perforce dictates ad-spend, promo-spend, pump-spend, etc. So gone may be the days that a random token could come along and capture the mindshare and emotive/endorphin factor of the fringe, which is what drove DOGE, SHIB, and even BTC in the first place.

As a tertiary consideration, services like pump.fun’s click2launch venue may have dissolved some of the mystery of the mechanical aspects of launch, and moreover the gains now are heavily redistributed to the venue itself.

There are and may continue to be newer iterations of irreverence in the form of onchain agent tokens (see some of ai.xbt’s discourse) and periodic recidivist success stories (FARTCOIN comes to mind), but as the space institutionalizes, the curtain call on the ‘Dodge City’ dynamics could be coming closer.

RU: Maybe Trump’s embrace of crypto, and he and his wife’s minting of coins, rather than bringing it to the establishment, instead (or also) echoes the perceived wildness of crypto? He represents chaos and unpredictability, and a lot of the outsiders and freaks like him (or at least enjoy his provocations)? And couldn’t that backfire on the acceptance of crypto if the administration brings terrible results in other areas (or in this one)?

GG: It’s an open question whether President Trump’s conduct is truly chaos and unpredictability, or a thoughtfully planned script. Wiser folks have asked whether the self-proclaimed world’s greatest deal-maker would more believably be a true agent of chaos, or a studied, closely-advised showman. If the latter, then, as you say, that guise of ostensible unpredictability may be a studied pandering to the audience with carefully curated content (‘Fight! Fight! Fight!’) and deft intent, raising the stakes in case of a Chernobyl-type mishap.

If the fervent nihilistic speculation of the earlier generations of meme coins has now been transmuted to a prospecting playbook, this could lead to more projects backfiring – because unlike the early memecoins like DOGE, a promise, express or implied, has been made of future price appreciation.

RU: The Degens film subtitles itself ‘Down and Out in the Crypto Casino’. I’ve viewed crypto as an extreme reflection of ‘casino capitalism’, a phrase that gained traction during the 2008 crash. I’ve also viewed the degen use of crypto as an attempt to let members of the middle class and underclass to benefit from money-making-money. Even with its mainstreaming, it’s still a system that’s accessible with not much money or knowledge. Would you agree with these thoughts?

And where does all the valuation divorced from actual production or service or consumption actually leave us? Is the fear or hope of the collapse of capitalism a plausible end point?

GG: Yes, it’s still accessible, though far more nuanced now with pre-listing smart contract authentication and address sharing, inside baseball chats, sniper bots, market-maker support and concomitant horsetrading, all of which smack more of TradFi deal-arranging than the organic up-from-the-bottom value capture that characterized memes in their more primitive phases.

I agree: degens use memes both to join in rejecting the normative standards of ‘value’ and ‘financial common sense’ and to acknowledge that life and its financial outcomes are, or may be, as binary as the memecoins themselves ($0 or $1 billion+ market cap). That is, there is little nobility in the approach of dollar-cost averaging, compounded interest, slow and steady growth. And increasingly – thanks to rampant asset price inflation and increasing inequality – there is little possibility of securing a financial future with anything other than an all-in bet. On their face, these bets appear to be financial suicide but, demonstrably, they have proven to have a positive expected value when viewed through the lens of distributional estimation.

Back to Eugene Fama. DOGE is still a $40 billion+ chain. SHIB, despite lagging, is still about $10 billion. PEPE’s market cap is comparable to XMR, which is often considered to be the leading privacy coin.

These coins keep their value although they have more cult of personality than utility of any kind; does this mean that conventional monetary models are broken/wrong/disproven? Possibly, or that the medical-grade experimentation of decades of ZIRP (Zero Interest Rate Policy) and stealth Quantitative Easing have produced value-stores that (just like the trillion dollars of paintings sitting in the Geneva Freeport that no one ever sees) are HODLed with devout conviction.

Or does it teach us a lesson we should already know: many fiat monetary systems – even (or perhaps especially) the most capitalist ones – are constructed on an inherently naïve and of-necessity collective belief system that the numeraire (in this case the dollar) will not suddenly go to zero against a consumption basket overnight. Yes, as proponents argue, the dollar is backed by taxes, military, and the ‘full faith and credit of the US government’ and reserve managers worldwide continue to hold it for lack of superior alternatives.

But the dollar is as much backed by a similar form of willing suspension of disbelief. A profusion of digital assets with no ‘backing’ or utility takes us back in some sense to the start of the capitalist experiment (in North America at least): far-flung territories, wildcat banks, regional or even municipal monetary systems, and a battle for the supremacy of wallet-share.

All those have one common upshot: this part of the capitalist story ends with the fracturing of the unipolarity that has long distinguished both the geopolitical and financial spheres, new nexi of value proliferate, and financial poles of various orders of magnitude appear. And surely we can also quip, if someone thinks $40-50 billion is a lot of ‘value’ to be parked in a dog coin, it’s not nearly as the much as has purportedly been conferred, carte blanche, by the USA to just one foreign ally in a two-year period, raising the question, are we mad, or is our money?

We’ve mentioned Argentina’s President Milei who has, at times, fashioned himself as an anarcho-capitalist. And of course, cryptocurrency is rooted in the crypto-anarchists and cypherpunks of the 1990s. I’m assuming you’re aware of those visions, and I’m wondering how you think those visions are faring in reality. And if there’s success, is it for good or for ill?

The anarcho-capitalist impulse, though having waned, is still very much a part of the degen and crypto culture. I remember having Charlie Shrem as an advisor on my first crypto project and having an arranged meeting with Trace Meyer way back in 2014, and them articulating a vision that I am reminded of when Milei speaks today. Those visions entail in some fashion (I would say canonically) financial ‘liberation’ (from debt, from fiat, from arbitrary policies, from inflation/erosion of purchasing power, from the swamp of legacy financial polarity). The financial system is to be purged by fire; the great society of an enlightened, ennobled future cannot happen without burning down a few institutional walls, or potentially razing the whole thing to the ground.

If you ask most revolutionaries whether they prefer glacial change or sudden violent change, most, I imagine, might say sudden change is the only change. But if you ask their constituents how they would feel about the disruption by multiplying velocity and severity, glacial doesn’t sound so bad.

We are entering a new era of anarcho-capitalism, where financial markets appear to be more tethered than ever to the vicissitudes of individual men in policy-making seats (who wield a lot more power than Milei). In this era, the risks of rapid, radical change, even if unintended, appear to be rising, and for those original cypherpunks, that may not seem so bad. How would an average observer feel about buying bread and paying taxes with DOGE or seeing memetic tokens standing above a landscape of financial wreckage? That may be where the ‘or for ill’ comes in.

But to your point, if the cabal is getting behind the wheel, how likely is it that we realize the visions of those most ambitious anarchist progenitors?

RU: As the unipolarity of capital breaks apart, what would you say are the crisis points and opportunities both for individuals and for groups such as nation-states, outsider gangs and collectives etc.?

GG: The crisis points certainly appear to hinge on confidence in traditional monetary systems and financial models. The moment individuals begin to suspect that they are harming their portfolio with any substantial allocation to fiat or low-yield fiat-denominated assets could mark a turning point.

That may well coincide with collective recognition that there is no wizard behind the curtain, and that graybeards have less credibility than decentralized governance in some cases. That is the institutional tarnishing and disillusionment, where the majority comes to believe that policy-makers have utterly failed their promise of delivering on broad prosperity.

One could argue that in many parts of the world, that realization has hit, and that is why there has been rapid adoption and implementation of unconventional/heterodox economic and monetary systems. We see this in former star emerging markets like Argentina and Venezuela, in much of sub-Saharan Africa, and in energy giants like Iran and Russia who have seen the worm turn on the notion that they can continue to operate with confidence under the western financial system and its concomitant liberal democratic liturgy.

Henceforth the putatively strident rise of BRICS+ (now to include Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates) is not as an investible market to be hawked by New York and London bankers (thank you Jim O’Neal), but as a challenge to them. BRICS+ can be seen as a capable, disruptive set of agents with no obvious coöperative goals or characteristics other than dissatisfaction with the established order, and a willingness to try other ways of conducting business. That logic is similar to the above: the group realizes that the game doesn’t present the same odds for all players, and that they all know it. The degens have come to believe this, and are moving their capital allocation and spiritual bandwidth to the memecoin phenomenon.

This transfiguration is not unlike the John Galt phenomenon of Atlas Shrugged: readiness to accept salvation at any cost because they don’t see anything to lose.

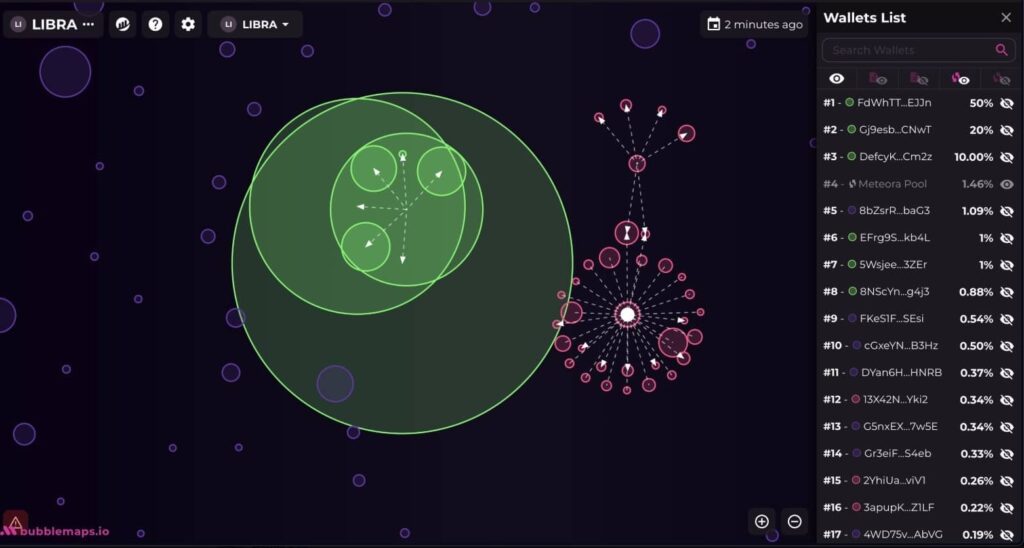

RU: It looks like Milei is in trouble. Want to add a comment about it?

Gordon Grant: Absolutely. I think this builds on the risks which your question raised: when memetic crypto affiliations get into a policy-making sphere, they start to have reciprocally corrosive execution risk: for one thing, the policy-makers risk their own credibility (arguably a stumbling block especially for Milei, the self-proclaimed anarcho-capitalist archetype), and secondly they risk besmirching the meme coin sector and the broader asset class.

When we talk about crypto today in the context of Milei, we’re asking whether he has polluted the idea of meme coins as a vector for wealth creation by human avarice, by fumbled ill-intent, and/or overall distancing from what the meme coins were supposed to be about. We’re not asking about validity of the claimed use-cases, and maybe that’s why these ‘sovereign memes’, even without nepotism or corruption, are slated to fail: the leadership may have misunderstood what this is all about. Practical applications for the meme are always suspect. In the minds of some, “if a token is proffered with embedded utility or a prepackaged narrative, look out,”

The allegations of insiders colluding to promote Milei’s coin wouldn’t raise eyebrows (or at least as many) if this were standard capitalist pablum, but he isn’t supposed to be a standard capitalist, nor is this de rigueur.

Dare I say it, we could see a Byzantine schism in the empire of memes between those closer to PizzaT and those who’ve co-opted the medium as a convenient way to just mint currency.

RU: A host on Bloomberg TV just now: “Are meme coins ruining the reputation of cryptocurrency?”

GG: The median-brained answer seems to be “poorly executed meme coins are ruining the reputation of cryptocurrency / digital assets”. But tautologically, at least in terms of adherence to the conceptual archetype, meme coins aren’t supposed to be ‘executed’ are they? They’re supposed to happen organically, chaotically. Some would say the notion of packaging organic entropy with pre-planned marketing, deal-arranging, promotions, preferential access, and the more recently unearthed phenomenon of ‘pump farms’ is blasphemous to the guttersnipe origins, and may have potentially bad implications for authenticity.

But is the proliferation of memes itself memetic? Consider that elected leaders have now (according to some invective) come to see the fastest road to riches via the meme. This demonstrates circularly just what the meme marketplace originally aspired to: that this is a farce, a scam, a con job, and that now the road to salvation means rugging others and yourself (Oh wouldn’t Jim Jones have something to say about that!)

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)