VitalikVision: Ethereum’s 3 Transitions Needed For Global Adoption

Jul. 14, 2023. 9 mins. read.

40 Interactions

This article explores Ethereum's evolution, Vitalik's three transitions, and their impact on Layer 2 networks and Layer 1 chains, shaping Ethereum's growth and future potential.

Introduction

Ethereum, the second-largest cryptocurrency by market capitalization, has been a driving force behind the blockchain revolution since its inception in 2015, driving innovation and adoption across the crypto frontiers.

It’s done this by birthing new sectors such as DeFi, NFTs and Web3, cross-pollinating other chains through its EVM compatibility, and nurturing disruptive new Layer 2 networks that use experimental new technology such as optimistic and zero-knowledge proof rollup to scale the entire Ethereum ecosystem.

Renowned co-founder Vitalik Buterin serves as the frontman (and target of ETH meme lords) for the smart contracts pioneer, frequently sharing his thoughts on the future of the world’s “decentralized computer”, as Ethereum and its Ethereum Virtual Machine are often called, as well as a host of topics that range from anything from crypto adoption to stablecoins to ChatGPT.

Buterin recently outlined three significant technical transitions that Ethereum must undergo to mature from an experimental technology into a robust tech stack capable of delivering an open, global, and permissionless experience to average users. He believes that these transitions are not only crucial for Ethereum’s future but will also reshape the relationship between users and addresses on the blockchain.

As the leading smart contract-powered chain, the evolution of Ethereum will have important ramifications and lessons for both its Layer 2 networks and the slew of ‘Ethereum Killer’ Layer 1 chains, which will reshuffle their own value propositions and roadmaps in response.

Ethereum’s Evolution: A Recent History

Before delving into the three transitions, it’s essential to understand Ethereum’s evolution from a fledgling blockchain with a unique mission to the decentralized foundation of the most important technological changes and expansions in the crypto space over the last five years.

Ethereum has undergone several significant upgrades since its inception in 2015, each aimed at improving its scalability, security, and sustainability.

The Ethereum network last year underwent the ‘Merge’, transitioning from a Proof of Work (PoW) consensus mechanism to a Proof of Stake (PoS) model, making it 99.95% more energy efficient and much more attractive for institutions as an ESG-compliant investment. However, its staking mechanism has also put it in the potential crosshairs of US regulators like the SEC, who are on a witch hunt for any crypto asset it can define as a security.

The Merge transition was a vital part of Ethereum 2.0, also known as Serenity, a long-awaited upgrade aimed at addressing the network’s scalability and security issues. The Merge followed the successful deployment of the Beacon Chain in December 2020, which marked the beginning of Ethereum 2.0.

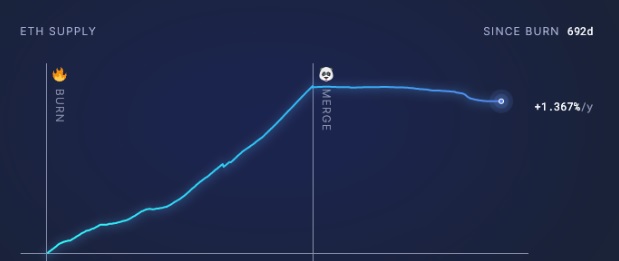

Another significant upgrade was EIP-1559, introduced as part of the London hard fork in August 2021. This upgrade changed the way transaction fees, or ‘gas fees,’ are calculated on Ethereum, aiming to make them more predictable.

It also introduced a mechanism to burn a portion of these fees, giving ETH the potential to become a deflationary asset over time, as we can see from this UltraSound Money chart below. Thanks to its PoS transition, over 3 million fewer ETH is now in circulation than if it had remained on the PoW network.

Looking ahead, Ethereum plans to introduce sharding, a scaling solution that involves splitting the blockchain into smaller pieces, or ‘shards,’ each capable of processing its transactions and smart contracts. Sharding is a hugely significant long term milestone expected to significantly increase Ethereum’s capacity and speed.

All these recent innovations have largely come without any major hiccups, a welcome departure from its first five years when upgrades such as 2019’s Constantipole were delayed several times, on one occasion at the 11th hour due to a possibly catastrophic re-entry attack vulnerability.

The Three Transitions

In short, Vitalik proposes three evolutionary changes to the Ethereum network if it is to meet its full potential (and based on predictions by the likes of Van Eck Research, a potential price of between $11.8k to $50k by 2030 if the winds blow in its favor).

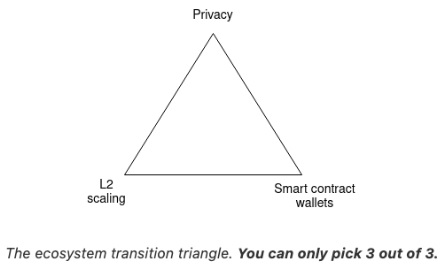

These are: L2 scaling, wallet security and privacy.

1) The L2 Scaling Transition:

- Vitalik has been outspoken in the past on the importance of Layer 2 scaling in solving Ethereum’s network congestion and fee issues, and promotes moving everyone to rollups like Optimism, Arbitrum and the new class of ZK-powered Layer 2s like ZKSync and Starknet.

- Rollups execute transactions off-chain and then post the data on-chain, significantly increasing transaction throughput. Without this transition, Ethereum risks becoming too expensive for mass-market products, leading to the adoption of centralized workarounds.

- For instance, the Ethereum network currently processes around 15 transactions per second (TPS), but with rollups, it’s expected to handle thousands of TPS, making it more suitable for mass adoption.

2) The Wallet Security Transition:

- This transition involves moving Ethereum ecosystem users to smart contract wallets. Vitalik is a big proponent of crypto self-custody, particularly through the use of multisignature (multisig) wallets, and in 2021 he proposed the use of social recovery wallets to help Ethereum users protect their assets.

- These wallets offer additional security features, such as multi-signature transactions and spending limits. Without this transition, users may feel uncomfortable storing their funds and non-financial assets on Ethereum, leading to a shift back towards centralized exchanges (centralized workarounds) that don’t require the safekeeping of a private key or recovery seed.

3) The Privacy Transition:

- Vitalik’s third transition requires ensuring that privacy-preserving funds transfers are available, and that privacy is preserved with other developments like social recovery, identity, and reputation. Without this transition, the public availability of all transactions could lead to a significant privacy sacrifice for many users, pushing them towards centralized solutions that offer more privacy.

The Implications of the Transitions

Buterin emphasizes in his article that Ethereum can’t stand without all three legs of this “Ethereum Transition triangle”. It would risk failure due to high transaction costs, user discomfort with storing funds, and privacy concerns.

Here is an overview and takeaways of the more technical parts of the blog post:

- The three transitions will radically reshape the relationship between users and addresses:

The transitions will change the way users interact with Ethereum, requiring deep changes from applications and wallets.

- The three transitions and on-chain payments (and identity):

Buterin discusses the challenges introduced by the transitions, such as the need for more information than just a 20-byte address for simple actions like payments.

- The three transitions and key recovery:

Buterin proposes an architecture that separates verification logic and asset holdings to address the issues of key changes and social recovery in a many-address-per-user world.

- Lots of secondary infrastructure need to update:

Buterin highlights the need for application-layer reform and provides examples of areas that need to be updated.

- Wallets will need to secure both assets and data:

In the future, wallets will not only protect authentication credentials but also hold user data, increasing the risk of data loss.

- Back to identity:

Buterin concludes by discussing the future of user identity on the blockchain, suggesting that the concept of an “address” will have to radically change and proposing potential solutions.

Let’s dig a little deeper.

On Users And Their Wallet Addresses

Vitalik anticipates a radical transformation in the dynamics between users and their addresses due to three key transitions.

- In a Layer 2 scaling world, users will exist on multiple Layer 2s, meaning the days of a user having only one address will be gone. For example, a user could have an account on Optimism for participating in a DAO, another on ZkSync for a stablecoin system, and yet another on Arbitrum for a different application. This will make the concept of a single address obsolete.

- Secondly, the introduction of smart contract wallets will complicate the user-address dynamic. While these wallets enhance security, maintaining the same address across the Ethereum Mainnet (Layer 1) and various Layer 2 solutions becomes complex due to the technical differences between these environments.

- Lastly, the pursuit of privacy could lead to an explosion in the number of addresses. Privacy schemes like Tornado Cash bundle funds from many users into a single smart contract, using internal systems for fund transfers.

On Payment Challenges:

Ethereum is exploring cross-layer payment solutions in its Layer 2 ecosystem, such as automated functionality for consolidating funds and cross-L2 bridging systems. Transitioning towards smart contract wallets will require technical adjustments – such as tracking Ethereum transfers from Externally Owned Accounts (EOAs) and those sent by smart contract code.

On Privacy Concerns:

With privacy remaining a key component of blockchain’s allure, Ethereum is introducing stealth protocols and meta-addresses. These secure digital boxes hold both a unique ID for spending and the key to lock or unlock your information securely. They work well with other privacy-focused systems, even those not based on Ethereum, like PGP keys.

On Data Storage:

Lastly, Ethereum is addressing data storage issues, particularly in the sphere of Zero-Knowledge (ZK) proofs. For instance, Zupass, a ZK-SNARK-based identity system dubbed Buterin’s “social experiment”, uses ‘stamps,’ a privacy-centric version of POAPs (Proof of Attendance Protocol).

To mitigate the risk of data loss or unauthorized access, Zupass proposes storing the key across multiple devices or employing secret sharing among trusted individuals. Digital wallets are likely to manage both asset and encryption key recovery in the future, making the blockchain experience more user-friendly.

On Key Recovery:

These transitions pose significant challenges due to the intense coordination required to resolve them. However, Vitalik proposes several solutions, including keystore contracts, which exist in one location and contain verification logic for addresses on different Layer 2s.

Spending from these addresses would require a proof going into the keystore contract showing the current spending public key. Another solution is to put more things into the keystore contract, such as various information about how to interact with the user. This contract could serve as the user’s primary identifier, with the actual assets they receive stored in different places.

The Future of Ethereum

Vitalik’s vision for Ethereum’s three transitions paints a picture of a more scalable, secure, and private blockchain. The transitions are not just about technical feasibility but about actual accessibility for regular users. Achieving scalability, wallet security, and privacy is crucial for Ethereum’s future.

The challenge is to ensure that these transitions do not result in an opaque “tower of abstraction” where developers struggle to make sense of what’s going on and adapt it to new contexts.

To maintain and continue to grow the incredible network effect that it currently has, Ethereum must rise to meet this challenge to ensure its future success. While the road ahead is fraught with challenges, the potential rewards are immense. As Ethereum continues to evolve, it’s clear that these transitions will play a crucial role in shaping it and the crypto sector’s future.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)

4 Comments

4 thoughts on “VitalikVision: Ethereum’s 3 Transitions Needed For Global Adoption”

🟨 😴 😡 ❌ 🤮 💩

🟨 😴 😡 ❌ 🤮 💩

thanks, glad you enjoyed it :-)

🟨 😴 😡 ❌ 🤮 💩

🟨 😴 😡 ❌ 🤮 💩