Introduction

Choosing the right exchange is crucial for both newcomers and experienced traders. We’ll assume for this article that you keep your crypto on a custodial solution like a centralized exchange, not in a cold wallet or Dex.

As we move through 2025, several exchanges have established themselves as industry leaders, each offering unique advantages for different types of users. This guide examines the top cryptocurrency exchanges, analyzing their security measures, fee structures, and overall user experience.

Why use a Centralized Exchange in 2025?

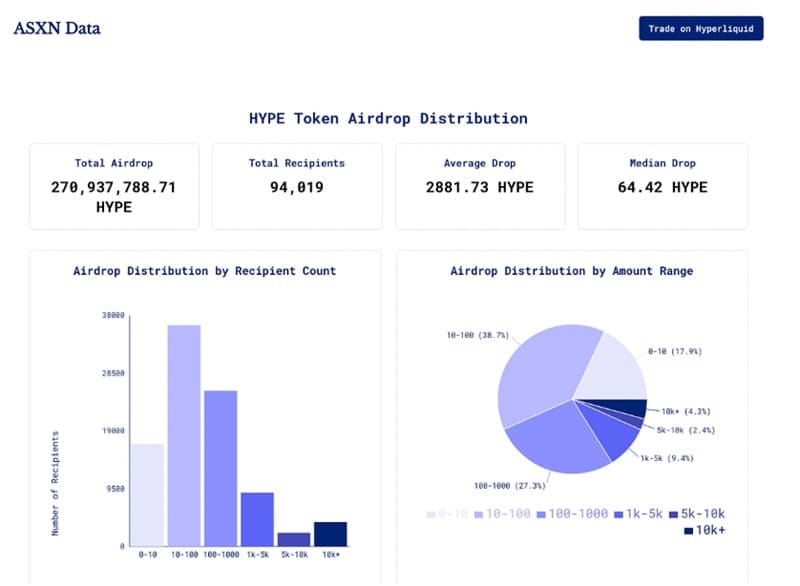

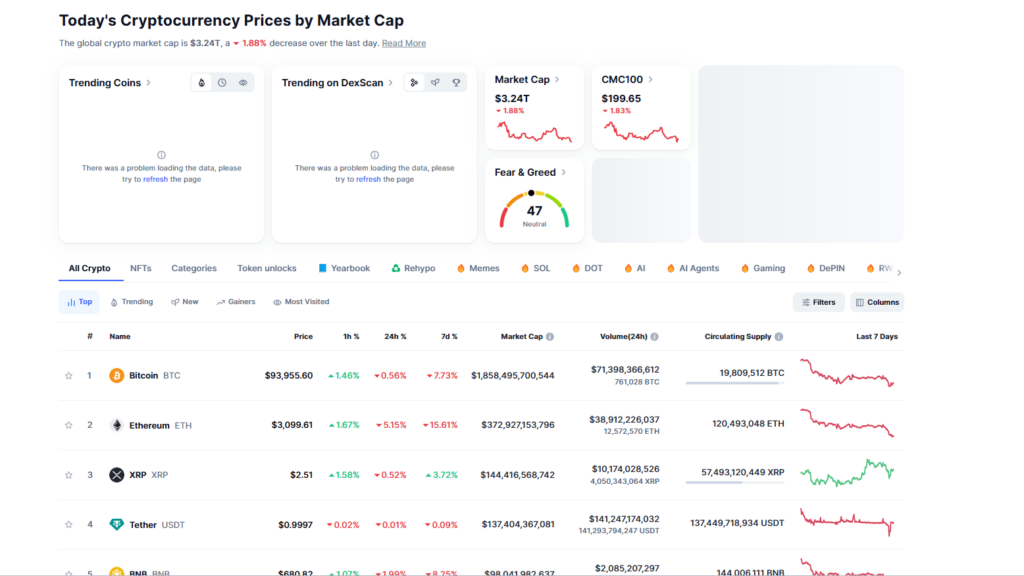

CEXs (centralized exchanges) still rule the crypto world, connecting traders with the best and latest crypto assets within the safety and familiarity of a Web2 experience. CEXs control 80% of the market – the rest being decentralized exchanges such as Uniswap and Raydium, although new challengers like Hyperliquid are making progress.

- Convenience – Easy to buy, sell, and trade crypto with a user-friendly interface and mobile apps.

- Liquidity and Speed – CEXs offer high liquidity, ensuring faster order execution and minimal slippage.

- Security Features – Many CEXs provide advanced security measures like two-factor authentication (2FA) and insurance for custodial funds.

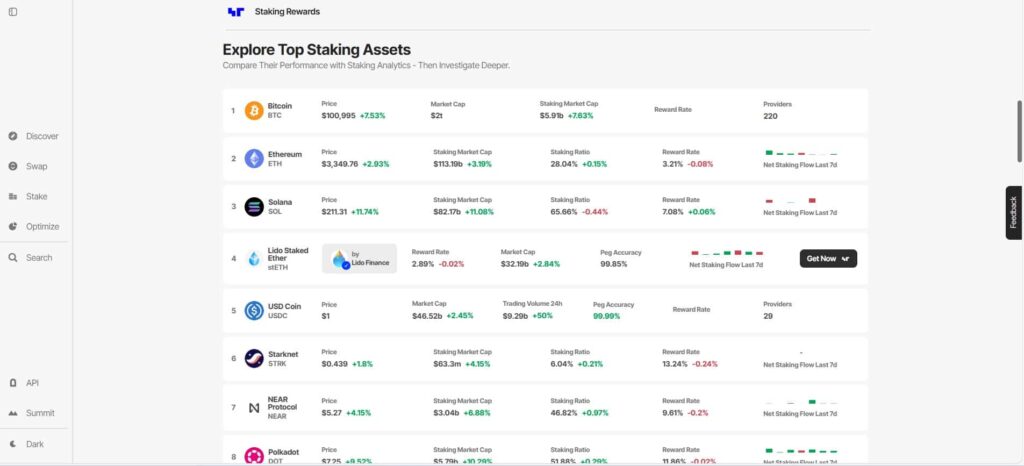

- Passive Income Opportunities – Users can stake, lend, or earn rewards through yield programs without managing private keys.

- Customer Support – Access to 24/7 customer service and dispute resolution in case of account issues or lost credentials.

Binance: The Global Leader

As the world’s largest cryptocurrency exchange by trading volume, Binance has established itself through deep liquidity pools and some of the industry’s lowest trading fees. The platform’s comprehensive feature set includes spot trading, derivatives, and numerous additional services. While its interface may be overwhelming for beginners, experienced traders appreciate the extensive customization options and advanced trading tools available.

Binance’s security measures include its Secure Asset Fund for Users (SAFU) and regular proof of reserves audits. The exchange’s strategic approach to regulatory compliance has resulted in a growing presence in regulated markets, though availability varies by region.

It has had its regulatory setbacks – its former CEO and co-founder Changpeng Zhao (CZ) landing up in jail for four months – but its problems are clearing up nicely, and the SEC last week put its case against Binance on hold.

Pros:

Industry-lowest trading fees

Deep liquidity pools

Large selection of cryptocurrencies

Cons:

Complex interface for newcomers

Regulatory challenges in some regions

Variable customer support quality

Coinbase: The Trusted Name in Crypto

Coinbase has maintained its position as the leading USA-based cryptocurrency exchange, distinguished by its regulatory compliance and institutional-grade security measures. As a publicly-traded company, Coinbase offers unparalleled transparency in its operations, with regular audits by top accounting firms. This has seen it get listed on the Nasdaq, and while the SEC has gone after it in the past, it is the exchange of choice for big institutions like BlackRock.

While its asset listing policy remains conservative compared to offshore exchanges, recent developments have shown increased flexibility in listing new cryptocurrencies, particularly following regulatory clarity in the market during the Trump administration.

The exchange’s security features include offline cold storage for 98% of their assets, and FDIC insurance for USD deposits up to $250,000. Though trading fees are higher than some competitors, Coinbase’s user-friendly interface and robust security measures make it an excellent choice for newcomers to cryptocurrency trading, especially if they’re in the USA.

Coinbase is also behind the Base network, the booming Ethereum layer-2 chain, which provides self-custodial options for its users.

Pros:

Strong regulatory compliance and security

FDIC insurance for USD deposits

User-friendly interface

Cons:

Higher trading fees

Limited cryptocurrency selection

Conservative listing policy

Bybit: The Derivatives Powerhouse

After Binance fell prey to regulators in the USA in 2023, others moved in on its markets. Bybit has emerged as a dominant force in the cryptocurrency derivatives market, powered by its sophisticated trading engine capable of processing 100,000 transactions per second. The exchange’s commitment to security is evident in its implementation of AI-driven risk management systems and comprehensive proof of reserves system.

Operating from Dubai, Bybit offers traders access to over 500 cryptocurrencies with fee structures that rival industry leaders. The platform’s advanced trading terminal, and 24/7 customer support in multiple languages, makes it particularly attractive for serious traders seeking professional-grade tools and features.

Pros:

High-performance trading engine

Competitive fee structure

Advanced trading features

Cons:

Not available in some major markets

Limited fiat currency support

Complex for beginners

Kraken: The Security Pioneer

Impressively, Kraken has an unblemished security record spanning over a decade. The platform’s commitment to security is reïnforced by its dedicated security research team and industry-leading bug bounty program. With support for multiple fiat currencies and a growing list of nearly 300 cryptocurrencies, Kraken balances accessibility with security.

The exchange’s Pro platform offers sophisticated trading tools, while maintaining competitive fee structures. Kraken’s reputation for exceptional customer service, with round-the-clock human support, makes it a compelling choice for both institutional and retail traders.

Pros:

Perfect security track record

Excellent customer service

Strong regulatory compliance

Cons:

Higher fees than offshore exchanges

Conservative listing policy

Complex for beginners

OKX: The Innovation Hub

OKX has distinguished itself through innovative trading features and a comprehensive security infrastructure. The exchange’s unique approach to cold storage security – including RAM-based private key storage and geographically distributed key management – demonstrates its commitment to asset protection.

The Seychelles-headquartered platform offers competitive trading fees and unique features such as extended timeframe options for technical analysis. While its listing policy appears conservative with fewer total assets than some competitors, OKX’s focus on quality over quantity has contributed to its reputation for reliability.

Pros:

Innovative security features

Competitive trading fees

Advanced trading tools

Cons:

Limited regional availability

Fewer listed assets than competitors

Complex for new users

MEXC: The High-Performance Contender

MEXC has established itself as a formidable player in the cryptocurrency exchange market, boasting over 10 million users across 170+ countries.

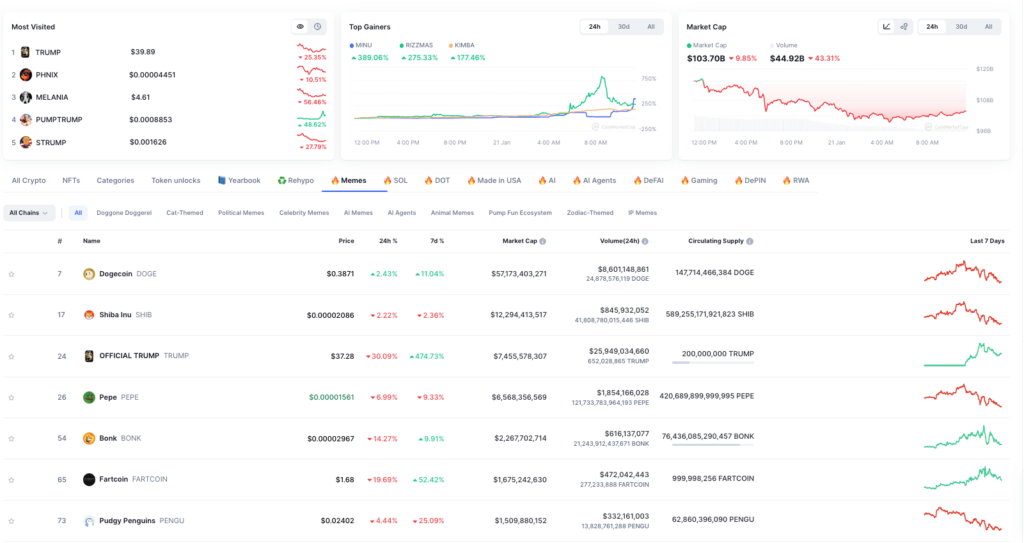

The platform supports over 2,800 cryptocurrencies and 2,900 trading pairs: one of the most extensive selections of digital assets in the market. This however opens users up to risk, as these assets are mostly high-risk in terms of price performance and volatility.

Since its founding in 2018, MEXC has demonstrated rapid growth, capturing 5% of the global digital asset trading market within its first year. While constrained by regulatory challenges in certain jurisdictions and limited fiat support, MEXC’s comprehensive trading options and high-performance infrastructure make it a compelling choice for traders seeking extensive asset selection and competitive fees.

Pros:

Zero-fee spot trading for makers

Extensive cryptocurrency selection

High-performance trading engine

Cons:

Not available for US users

Coins not vetted as well

Basic customer support

Conclusion

The cryptocurrency exchange landscape in 2025 offers options suited to various trading styles and experience levels. For beginners prioritizing security and ease of use, Coinbase and Kraken are good options. Advanced traders seeking sophisticated tools and low fees might prefer Bybit or Binance. And OKX offers a balance of innovation and security that appeals to both types of users.

When selecting an exchange, consider security measures, fee structures, available trading pairs, and geographical restrictions. Remember that the best choice depends on your specific needs, trading volume, and location. Regardless of which platform you choose, always prioritize security by utilizing available protection measures and maintaining proper custody of your digital assets.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)