Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Tron Goes For Throne Via memecoin Minions

The Tron blockchain, established by the TRON Foundation in Singapore in July 2017, has recently cemented its position as a significant new player in the ever growing memecoin sector.

As an EVM-compatible chain, Tron supports smart contracts written in the Solidity programming language, functioning similarly to Ethereum and Binance Smart Chain. Tron’s shrewd founder, Justin Sun, emphasizes the blockchain’s speed and low transaction fees as key network advantages, positioning and aggressively marketing Tron as the ideal network for NFT and memecoin trading.

Despite its growth, Tron has faced skepticism, particularly concerning centralization, the large amounts of stablecoins it has in circulation, and potential market manipulation.

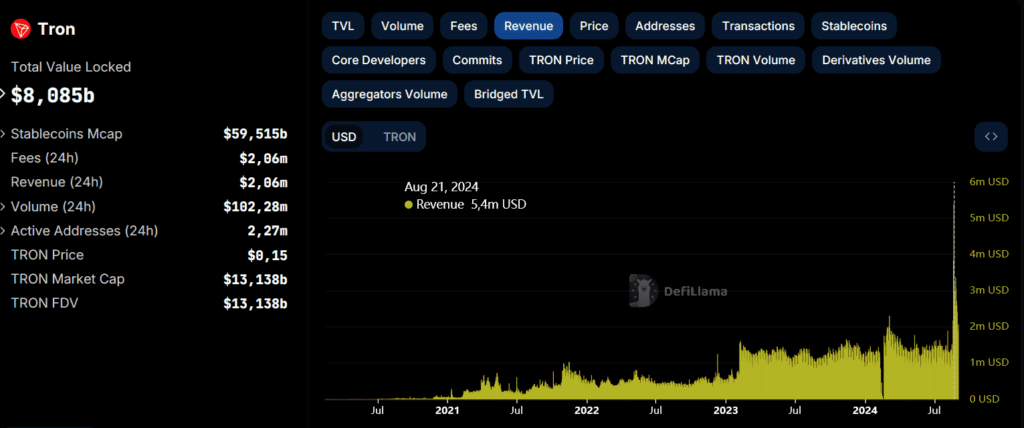

However, there has been consistent bullish momentum of Tron’s native TRX token (and other coins on its blockchain) ever since the bear market lows in December 2022, and this has quieted many critics. Tron’s trading volumes have surged, with the network recently hitting $280.4 million in daily volume and generating $5.4 million in revenue on August 21 alone – a new all-time high.

Tron’s Bullish Price Action

The bullish performance of Tron and its native TRX token remains an outlier to its EVM competitors and other layer-1 chains, which have struggled with low or poor price action in mid 2024 as the early bullrun fizzled out. When comparing the charts, Tron is less than 10% from its 2021 bull run highs, while its most obvious competitor; Solana, is approximately 50% from its own 2021 highs.

Tron’s Effect on Solana

Many market spectators have suggested that Solana’s bullish price action after its lows in 2022 are caused by memecoin mania. This craze arose primarily in the Solana ecosystem – with coins such as PEPE, BONK and WIF becoming deeply entrenched names due to their massive gains during this past year. WIF in particular is now ranked as the 55th most valuable crypto by market cap, with a staggering $1,606,879,830 in total market cap.

The effect that these memecoins have had on the Solana blockchain is undeniable. But with Tron recently launching SunPump, many believe that an even greater number of crypto users might soon be migrating over to Tron. One attraction is the relatively low market cap of many of the Tron memecoins, which offers the possibility for greater gains if the crypto market turns bullish.

Time will tell what effect this will have on Solana, but competition from Tron has thrown a bear among the pigeons of the Solana memecoin community. Metrics have shown a recent decline in transactions on the Solana network as Tron continues to attract memecoin users.

The rise of Tron created challenges for other blockchain networks – especially at a time when the markets are in limbo and prices generally trending lower in anticipation for rate cuts and presidential elections in the USA.

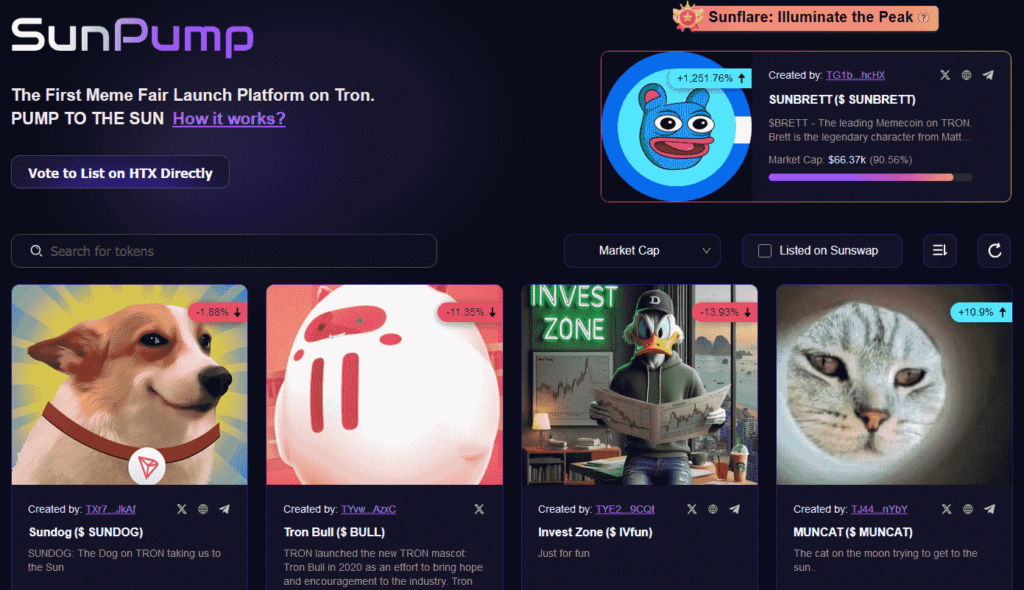

What is SunPump

A significant development for Tron has been the launch of SunPump, a platform for deploying and trading memecoins. Similar to PumpFun on Solana, SunPump allows users to create and launch their own memecoins on the Tron network, providing a new stimulus to the memecoin sector, which had previously relied heavily on Solana tech. Since its launch on August 9, SunPump has generated over 8.4 million TRX in revenue. That’s valued at approximately $1.4 million.

Justin Sun has suggested that the fees from SunPump could reach $100 million by the end of 2024, with him promising on Twitter that 100% of the revenue generated will go towards burning TRX, a move aimed at reducing supply and potentially increasing the token’s market price. This strategy has bolstered investor confidence and greater interest in the crypto sector, with many viewing it as a positive step toward growing the value of the TRX token. Justin Sun has been very proactive in marketing their new memecoin platform and it underscores his confidence in Tron’s future.

Biggest coins on SunPump

Before mentioning some of the biggest gainers on the SunPump ecosystem, a word of caution to all novice traders; SunPump and other similar memecoin deployers allow anyone to make their own coins. The inherent risk from ‘rug pulls’ is very real so do your own research, and only trade what you are willing to lose. Mindplex does not give financial advice. That being said, many traders have already made small fortunes in the few weeks since the launch of the SunPump platform. Some of the biggest gainers have been:

- Sundog ($SUNDOG): Up over 260× since its launch two weeks ago

- Tron Bull ($BULL): Up over 18× since launch

Visit the SunPump website for a complete list.

Tron Stablecoins Spark Concerns

However, Tron’s rapid growth in 2024 has brought up several concerns that could affect its future. A primary concern is the large amount of stablecoins circulating on the Tron blockchain, particularly Tether (USDT).

Stablecoins have long been an integral part to the crypto ecosystem, but the dominance of stablecoins on Tron has led to questions about the network’s decentralization.

Additionally, the reliance on stablecoins like USDT, which is controlled by a centralized entity, contradicts the core principles of decentralization that blockchain technology was built upon. As of 2024, a higher portion of USDT transactions occur on the Tron blockchain than any other blockchain (even Ethereum).

While the large amount of stablecoins have increased liquidity and user activity on Tron, it could increase regulatory scrutiny in the U.S. and European markets.

Regulatory challenges loom large for Tron. In 2023, it received charges from the SEC for violating securities laws. In 2024, regulators worldwide have further increased scrutiny on stablecoin issuers and the platforms that host them, calling for greater transparency, audits, and compliance with anti-money laundering and KYC regulations.

Tron’s DPoS consensus mechanism, while allowing for fast and efficient transactions, concentrates power in the hands of a few validators, raising concerns about potential centralization and the room for actions being taken on the network without sufficient consensus from network participants.

The Tron network’s rapid growth has raised concerns about its security and scalability. As more dApps, DeFi projects, and memecoins are built on Tron, the network’s infrastructure is being put to the test. While Tron’s network allows for high throughput, it is not immune to network congestion and potential vulnerabilities. Ensuring the security and scalability of the Tron network will be crucial to maintaining its leading position in the blockchain industry.

Conclusion

The rise of Tron in 2024 has been remarkable. From its origins as a content-focused platform to its current status as a major blockchain player and memecoin platform, Tron has demonstrated it can innovate and adapt to market demands. The launch of SunPump and the subsequent memecoin boom have highlighted Tron’s strengths, but also brought to light important concerns that must be addressed.

But for now, things are looking very positive for the Tron network and its TRX token.With plans to enhance the use of their own USDD stablecoin, and founder Justin Sun’s belief that the blockchain’s revenue could soar to $4 billion within the next year if its current meme strategy proves successful, things are certainly looking up, especially if overall market conditions improve as many market participants are hopeful it will. Time will tell whether Justin Sun’s call to arms of “TO THE SUN” will become the battle cry for enthusiastic and profit-hungry crypto investors across the globe.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

2024 US Election: The Crypto Divide Between Trump and Harris

As the 2024 United States presidential election approaches, an unexpected issue has emerged as a potential game-changer: cryptocurrency policy. The contrasting approaches of the two leading candidates, Donald Trump and Kamala Harris, highlight the growing importance of digital assets in American politics, an issue that could have far-reaching implications for the future of finance and technology in the country.

At the moment, Trump is promoting himself as Crypto Jesus, using all its tools from DeFi to NFTs to boost his campaign coffers, while Harris has recently made overtures to the space and announced she’d be accepting donations via Coinbase. What is happening?

The Crypto Conversion of Donald Trump

Donald Trump’s journey from crypto skeptic to champion is a complete turnaround. In 2021, the former president dismissed Bitcoin as a “scam against the dollar”, a threat to the supremacy of the U.S. dollar. However, by 2024, Trump had done a 180° turn, positioning himself as a prominent cryptocurrency advocate in American politics.

Trump’s crypto embrace began with the launch of his NFT collection in December 2022, featuring digital trading cards commemorating key moments from his presidency. The initial release of 10,000 NFTs at $50 each sold out quickly, though subsequent releases have seen slower uptake.

The former president’s crypto strategy intensified in 2024:

- In May, Trump announced that his campaign would accept donations in various cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin.

- In June, he met with the USA’s Bitcoin mining industry at his Mar-a-Lago resort, declaring that crypto users should vote for him because he would “stand up to Biden’s hatred of Bitcoin”.

- In July, Trump made history as the first American president to address a Bitcoin event, speaking at the Bitcoin 2024 conference in Nashville.

During his Nashville appearance, Trump emphasized American leadership in the crypto space, stating he wants Bitcoin “mined, minted, and made in the USA.” This rhetoric cleverly ties crypto to his “Make America Great Again” platform, appealing to both tech enthusiasts and his nationalistic base.

Trump’s involvement with crypto isn’t limited to rhetoric. In late August 2024, he announced ‘The DeFiant Ones’, later rebranded as World Liberty Financial, a new cryptocurrency project promising “high yield” investment opportunities. While details remain scarce, this initiative, along with Trump’s sons Donald Jr. and Eric’s involvement, signals that the Trump family has big plans for crypto, particularly in decentralized finance (DeFi).

Kamala Harris: A Cautious Approach

In contrast to Trump’s enthusiastic embrace of crypto, Vice President Kamala Harris has taken a silent approach. As the Democratic nominee, Harris’s exact position on digital assets remains largely undefined.

Harris’s crypto history is closely tied to her role in the Biden administration, which has been characterized by:

- Operation Choke Point 2.0: Alleged efforts to discourage banks from serving crypto companies.

- Aggressive SEC enforcement actions against leading crypto companies like Coinbase, Binance, and Ripple.

- President Biden’s veto of a bipartisan bill that would have made it easier for financial institutions to offer crypto custody services.

However, there are signs that Harris may be open to a more conciliatory approach:

- A senior Harris campaign advisor made a brief statement indicating that Harris would “support policies that ensure emerging technologies and that sort of industry can continue to grow.”

- Reports indicate that Harris’s campaign has been reaching out to crypto industry executives, showing a willingness to listen to their concerns.

- Harris’s Silicon Valley background and support from tech companies suggest she may be more open to innovation than the current administration.

The Crypto Vote: A Potential Kingmaker

Recent polls suggest that crypto owners could be a significant voting bloc in the upcoming election. A Fairleigh Dickinson University poll found that Trump leads Harris by 12 points among crypto holders, while trailing by the same margin among non-crypto owners. The poll also revealed that crypto owners tend to be young men and members of racial minority groups, demographics that could be crucial in swing states.

According to another earlier survey, crypto is considered a key election issue for 20% of voters in six swing states, many of them ethnic minorities like African-American and Hispanic voters. This data underscores the potential impact of crypto policy on the election outcome.

Party Positions and Platform Shifts

The contrasting approaches of Trump and Harris reflect broader shifts within their respective parties:

Republican Party:

- The Republican Party platform now includes language defending Bitcoin mining and opposing a Central Bank Digital Currency (CBDC). Trump is especially vocal about the latter, saying on many occasions that it won’t happen on his watch.

- There’s increasing activity within the party to create a Bitcoin strategic reserve, led by Donald Trump and senators like Cynthia Lummis who presented a draft bill in Nashville.

- Trump has promised to fire SEC chairman Gary Gensler, the leading antagonist of crypto, on his first day in office.

Democratic Party:

- The 2024 Democratic Party Platform does not mention cryptocurrency, suggesting it’s not a high priority for the party as a whole.

- Senator Elizabeth Warren, who has significant influence over the Democratic Party’s financial policy, remains one of crypto’s most vocal critics.

- There are unsubstantiated rumors that Harris will promote Gensler to head of Treasury.

Expert Opinions and Industry Reactions

Crypto industry leaders and experts have mixed reactions to the candidates’ positions:

- Jake Chervinsky, Chief Policy Officer at the Blockchain Association, comments: “While Trump’s embrace of crypto is encouraging, we need to see more concrete policy proposals. On the other hand, Harris’s cautious approach leaves room for dialogue and potential compromise.”

- Perianne Boring, founder and CEO of the Chamber of Digital Commerce, notes: “The crypto industry needs regulatory clarity, not just friendly rhetoric. We’re looking for candidates who can provide a clear, innovation-friendly regulatory framework.”

- Caitlin Long, CEO of Custodia Bank, warns: “Whoever wins, the crypto industry needs to be prepared for continued regulatory challenges. The next administration will need to balance innovation with consumer protection and financial stability concerns.”

Challenges and Criticisms

Despite the potential benefits, both candidates’ approaches to crypto face challenges:

Trump:

- Critics point out the contradiction between his current stance and his previous skepticism.

- There are concerns about how Trump would navigate the complex regulatory landscape surrounding cryptocurrency if elected.

- The ‘World Liberty Financial’ project’s promise of high yields raises concerns about potential risks, given past crypto market crashes.

Harris:

- The recent SEC Wells notice to NFT platform OpenSea creates doubt whether Harris is sincere with her more open stance.

- Reports that Harris is using Operation Choke Point 2.0 “architects” as advisors to her economic policy plan worry crypto advocates.

- The lack of concrete policy proposals leaves uncertainty about how a Harris administration would approach crypto regulation.

- It’s worth noting that Harris understands Silicon Valley and technology very well, with a deep network in the Valley.

Looking Ahead: The Future of Crypto Policy

As the 2024 election approaches, cryptocurrency is poised to play a significant role in shaping the political landscape. The candidate who can effectively balance innovation, regulation, and economic concerns may gain a crucial advantage.

Key areas to watch include:

- Regulatory Framework: How will the candidates propose to provide regulatory clarity without stifling innovation?

- International Competitiveness: With countries like El Salvador and the Central African Republic adopting Bitcoin as legal tender, how will the USA position itself in the global crypto landscape?

- Central Bank Digital Currency (CBDC): Will the USA pursue a CBDC, and how will that impact existing cryptocurrencies?

- Tax Policy: How will crypto transactions and investments be taxed under each administration?

- Environmental Concerns: How will the candidates address the energy consumption associated with crypto mining?

In the recent debate between Trump and Harris on September 10th, both candidates steered clear of the subject, indicating they may be unable to articulate their vision for the future of crypto in the United States. As the campaign progresses, cryptocurrency stakeholders and political observers will be watching closely to see how the conclusion of the love triangle between finance, technology, and politics.

Regardless of the election outcome, one thing is clear: cryptocurrency has moved from the fringes to the center of political discourse, and it’s here to stay. The policies shaped by the next administration will have lasting implications for the future of financial innovation and regulation in the United States and beyond.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

How Intelligence Emerges From Our Social Networking Data Trails | Dweb Series – Part 3

Vini Nvidia Vici: How the AI Giant’s Earnings Impacts Crypto AI Tokens

Intro

Most crypto AI tokens are now on sale, trading at a huge discount on their 12-months highs, yet many crypto investors remain hopeful and bullish on the sector, in no small part due to its correlation to the TradFi juggernaut that is Nvidia Corporation. That is of course before this week’s alleged DoJ subpoena, which sent all markets down and which we will address in another article.

The Nvidia stock has come to be a key indicator to the general health of both the traditional stock market and the cryptoverse. They are both barometers of the high-tech sector. Although the crypto market had a slight resurgence during August, this was short-lived; bearish news for Nvidia and the general market has almost completely wiped out recent gains – with AI cryptos such as Near, FET and Render having seen significant downward pressure since August 26.

These downturns show an intricate relationship between traditional stocks of tech giants and these new classes of assets, offering insights into market sentiment and the many factors driving crypto price valuations in the AI era.

Understanding the Nvidia-AI Crypto Connection

Nvidia’s hardware – specifically their graphics chips – are the computational engine that trains advanced AI models. As such, Nvidia’s performance is often seen as a barometer for the overall health and growth of the AI industry. Although there is a lot of competition in the GPU space, no other company has yet been able to keep up effectively with the speed at which Nvidia has innovated and consistently produces newer and faster tech.

In the crypto sphere, a new class of tokens has emerged over the past year, focusing on AI applications within blockchain technology. In essence, these tokens finance projects in the AI space, such as AI-powered portfolio management, image-generation, pathfinding, and more. These AI crypto tokens include projects like Artificial Superintelligence Alliance (FET), Bittensor (TAO), and Render (RNDR).

As the markets become increasingly tied together, many are watching Nvidia with keen eyes for any news that might signal up or downturns in the market.

Nvidia Pre-Earnings Expectations and Market Behavior

Waiting for Nvidia to release their earnings results at the end of August, analysts were hopeful. The company was doing consistently well and new chips were being released. Prices climbed, fueled by optimistic projections for Nvidia’s performance, with analysts expecting significant year-over-year growth in both revenue and earnings-per-share.

The crypto space experienced a considerable upturn leading up to the earnings call, especially in AI-related tokens. The market cap of many AI and big data cryptocurrencies increased by as much as 80% in the weeks preceding the Nvidia earnings announcement, reaching around $32 billion. This growth reflected not just excitement about Nvidia’s potential earnings beat, but also a broader recovery in the general market following a big dip earlier in August 2024.

The Earnings Release: Numbers vs. Expectations

Nvidia’s Q2 2024 earnings report did not disappoint. It was, by most measures, exceptional. The company had seen considerable year-on-year growth in virtually every metric:

- Revenue: $30 billion (up 122% year-over-year)

- Earnings-per-share: $0.68 (up 168% year-over-year)

These figures surpassed Wall Street’s predictions of $28.72 billion in revenue and $0.64 per share in earnings. The company’s performance was driven primarily by robust demand for its AI products and services. Its other branches also grew: its gaming revenue climbed 16% from a year ago to $2.9 billion, and Nvidia’s self-driving automotive division climbed 37% from a year ago. Good news all around, but as market participants have come to know, good news isn’t always good news for stock prices.

Post-Earnings Market Reaction: A Significant Downturn

Despite Nvidia’s strong results, the market reaction in both its stock price and subsequently the price of most AI crypto projects was remarkably negative. Below are some noteworthy metrics on valuations in the hours and days since the August 29 release.

- $292 billion wiped off the Nvidia stock price, with the stock having fallen 18% since its August highs and downward pressure appearing to hold strong.

- Artificial Superintelligence Alliance (FET) dropped 20% to $1.142

- Bittensor (TAO) fell 27% to $262

- Render (RNDR) declined 26% to $4.65

This negative response to very positive news about Nvidia illustrates the counterintuitive nature of market dynamics. Expectations often matter more than absolute performance. As market commentator Lisa Abramowicz noted, “Better-than-expected doesn’t cut it for Nvidia. Evidently, investors expect this company to blow away expectations.”

Factors Influencing the Post-Earnings Dip

When broader market conditions are taken into account, negative market reactions become a little more understandable. The market in general has seen a substantial downturn recently, with the S&P500 and the Nasdaq having seen notable losses in the past week. Some other notable factors to consider for Nvidia include:

1. Priced-in Expectations: The gains that both the Nvidia stock and in AI crypto tokens made in August before the earnings report meant that much of Nvidia’s success was already factored into prices. Markets are forward-looking, and the higher pricing in mid-August implies the good news had already had its effect before it broke.

2. Impossibly High Standards: Some analysts had predicted Nvidia would beat estimates by 10% or more. While the company exceeded expectations, it didn’t do so by the margins some had hoped for. The revenue exceeded projections by 4.5%, and the earnings-per-share by 6.25%. Nvidia’s second-quarter earnings were solid but not spectacular—and these days, that isn’t good enough for Wall Street.

3. Delays and Issues with New Chips: There was recent bad news about the new generation of Nvidia’s Blackwell GeForce graphics cards, specifically the RTX 5090: production is delayed and power consumption is higher than expected, possibly reaching 600W. This may have contributed to the downturn in the AI space

4. Forward-Looking Concerns: Investors may have been looking for stronger indications of future growth that weren’t present in the earnings report. Nvidia is however expected to ramp up production of its next-generation chips in the fourth quarter of this year, which could send the stock higher.

5. Broader Market Sentiment: The reaction to Nvidia’s earnings doesn’t exist in a vacuum. Overall market conditions – including concerns about interest rates and economic stability – play a role in how investors have interpreted and reacted to earnings reports.

6. Profit-Taking: The post-earnings dip could partly be attributed to investors cashing in on the pre-earnings rally, the “buy the rumor, sell the news” phenomenon common in financial markets.

The Interest Rate Factor

The upcoming Fed meeting on 18 Sept 2024 has many investors and market participants sitting at the edge of their seats. The final decision on whether to lower interest rates or keep them stable will play a significant role in shaping market dynamics in the near-to-medium term, and that definitely includes the valuations of AI crypto tokens. Lower interest rates could encourage bullish movement in the market, with some traders expecting a cut of 25 to 50 basis points at the next meeting.

Long-Term Outlook: Beyond the Earnings Volatility

While the immediate reaction to Nvidia’s Q2 2024 earnings was negative for AI crypto tokens, it’s essential to consider the longer-term picture. Despite the post-earnings dip, many AI tokens have shown impressive year-to-date gains. For instance, FET has surged 75% since the start of 2024, while RENDER and TAO have posted gains of 18% and 10%, respectively.

These gains align with Nvidia’s own excellent performance, with its stock up 160% year-to-date. This broader trend suggests that the AI narrative remains strong, even if short-term fluctuations occur.

Conclusion: Navigating the AI Crypto Landscape

Recent price action in the AI space might be concerning. The technology is not immune to the larger market influences at play. The recent downturn and the uncertainty about the Fed’s interest rate cut puts the entire sector in a precarious spot, but the long-term trajectory of AI development and overall AI adoption appears as robust and promising as ever.

Many of the projects in the AI crypto space, like SingularityNET and its partners, are working on truly remarkable projects. New startups are promising to help drive the next generation of tech in AI, DeFi and traditional finance. For investors and market enthusiasts in the AI crypto space, the recent market volatility underscores the importance of looking beyond short-term data and focusing on the bigger picture.

The AI revolution is here to stay, and no measure of short-or-medium term bearishness, or the outcome of any one single company or federal agency interaction will stop what is coming.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

The Importance of Coexisting with AGIs | AGI 24 Series – Part 4

How Biomimetics Gets Us Closer to AGI | AGI 24 Series – Part 3

Stacey Engle – CEO, Twin Protocol | Mindplex Podcast S2EP22

Black Monday 2024: Why Did TradFi and Crypto Markets Crash?

Introduction

The cryptocurrency sector had its usual sluggish performance during the summer, exacerbated with a catastrophic one-day collapse which swept across the entire global economy. Let’s analyze that crash and what has happened since.

The crash in August drew comparisons with 1987’s brutal Black Monday Wall Street crash, and took an especially heavy toll on tech stocks and crypto assets, often seen as high-risk high-reward investments. Markets have recovered in the month since, but talk of a recession still roams out there.

Let’s take a look at what happened on the day, what happened since, and why it was so heavy.

The Crash in Broad Strokes

TradFi Markets

S&P 500

The S&P 500 saw a sharp decline, dropping 3% on August 5: its worst single-day performance in two years. This drop extended a losing run that began weeks prior, influenced by fears of a weakening U.S. economy and overvalued tech stocks. Key factors included disappointing earnings reports from major corporations and broader economic concerns.

Nasdaq Composite

The tech-heavy Nasdaq Composite was hit particularly hard, falling more than 6% in early trading before recovering slightly to close down around 3%. This decline was driven by significant losses in major tech stocks, including Nvidia, Apple, and Microsoft. The combined market capitalization of the leading tech companies, often referred to as ‘The Magnificent Seven’, saw a massive dip, losing nearly $1 trillion intraday.

Crypto Markets

This turmoil spilled over into the crypto market, with Bitcoin plunging about 20% in just three days, from $67,000 to just above $49,000. On August 5, the total crypto market capitalization plummeted by $314 billion: one of the most severe sell-offs in recent history. ETH fell 18% and other cryptocurrencies, such as Solana, were even harder hit, with Solana’s price falling over 30% since late July.

Aftermath: The Bounce

The immediate aftermath of the crash saw heightened volatility across all markets. The Cboe Volatility Index (VIX), which measures market volatility, spiked dramatically, peaking above 65 before settling at 38.6 by the end of the trading day, its highest closing level since 2020.

Since the crash we have seen a significant recovery, indicative of a resilient market with real interest. Bitcoin rebounded by over 20%, returning to around $60,000 where it sits now, as investors bought the dip and market confidence slowly returned. The broader crypto market also showed signs of recovery, as recession fears subsided when Japan vowed to not increase interest rates for the remainder of the year.

Investor sentiment was heavily impacted, with the Crypto Fear & Greed Index dropping to “fear” territory.

What Caused The Black Monday 2024 Crash?

Rate Hike in Japan causes Stock Drop Contagion

The Bank of Japan’s unexpected decision to raise interest rates was definitely a big catalyst. This move caused a surge in the yen’s value, causing yen carry trade to unwind – where investors borrow in yen to invest in higher-yielding assets elsewhere. The rate hike also heightened concerns about global economic stability, contributing to widespread market anxiety.

Japanese stocks declined and it spread to other markets, creating a domino effect as investors reacted to global market turmoil.

US Economy Concerns

In the USA, a few factors combined to bring market growth to an abrupt halt:

- a disappointing jobs report exacerbated fears of an impending recession

- The Sahm Rule recession indicator (which its creator later said was open to interpretation) was triggered and amplified fears.

- Weak economic data and the Federal Reserve’s anticipated rate cuts in September created a risk-off sentiment among investors: they sold off riskier assets, including stocks and cryptocurrencies.

- The Federal Reserve kept upping interest rates in an effort to combat inflation. This, coupled with signs of an economic slowdown, heightened investor concerns about a potential recession.

Global geopolitical tensions

Israel’s assassination of a senior Hamas leader in Iran was just the latest potential spark that could set off a broad regional war in the Middle East. Coupled with other conflicts such as in the Ukraine, markets are extremely jittery about geopolitics driving prices down even further.

Concerns over AI market bubbles

Investors in AI leaders like Nvidia have been on the ride of their lives the last couple years, as they saw absolutely mouthwatering returns on investment. There were growing fears that certain sectors, particularly those related to artificial intelligence, had become overvalued and were due for a correction. This played out as expected.

Crypto sell-offs spook markets

Jump Crypto’s significant selloff of Ethereum (ETH) played a crucial role in the market crash on August 5, 2024. This selloff was part of a broader liquidation strategy by the firm, which involved offloading hundreds of millions of dollars in assets. This large-scale liquidation exacerbated the already fragile market conditions, contributing to the sharp declines in cryptocurrency prices.

The firm, which is behind big crypto plays like Solana’s Firedancer consensus mechanism, Wormhole and Pyth Network, was slated on social media for apparently selling over the weekend prior to the crash. Speculation is that it is preparing a war chest for its legal battles with the SEC over its investment in the collapsed Terra Luna project.

The liquidation of Bitcoin holdings by Mt. Gox creditors and rumors of the U.S. government moving its Bitcoin holdings.

Portfolio insurance hedging strategies

Similar to the 1987 crash, the use of computer-based models to automatically buy or sell index futures based on market conditions may have accelerated the sell-off.

Conclusion

Crypto was invented at the end of the major 2008 recession, and since then it’s faced off against a pretty smooth TradFi market. This changed at the Covid-19 pandemic, which battered it at first, then made it soar to all time highs when stimulus money flooded into the space.

Since then, crypto has struggled to deal with any sustained bearish macro-economic conditions, as we’ve seen with its reaction to the Fed’s interest rate hikes. You could argue that the most important dates each month are the CPI number reports and Fed FOMC meetings, where interest rate changes are announced.

Analysts believe we’re not out of the woods, so keep a close eye on markets and de-risk where you can. We have seen the effects of uncertainty on the market when investors respond to economic data and to policy responses from central banks. The potential for further rate cuts by the Federal Reserve will keep affecting market stability in the immediate future, as will ongoing geopolitical tensions.

The dramatic 5 August market crash once again drove home the interconnectedness of global financial systems and the sensitivity of markets to policy changes and economic indicators.

The immediate losses were substantial, but recovery was quick and longer-term impacts depend on subsequent economic developments and policy responses. Investors remain cautious, with many seeking safer assets amid the heightened volatility and uncertainty.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Bitcoin Nashville 2024: Trump and Others Go All In On BTC

Introduction

Bitcoin Nashville 2024, the annual flagship event for the world’s most important digital asset a month back. Organized by Bitcoin Magazine, it again provided a stellar showcase for BTC, loaded with big personalities, bold predictions, and the kind of energy you only get when money and politics collide in the USA.

This year’s conference, held from July 25-27, was one for the ages, and likely the most anticipated edition to date, with good reason. With over 35,000 attendees packed into Music City, it felt like a political rally crossed with a rock concert – all centered around that digital gold we call Bitcoin.

I attended Bitcoin 2023 in Miami last year as a journalist for a well-known crypto publication, which gave me unfettered backstage access to the event. At that time, around mid-May, Bitcoin was gasping for air at around $27k, getting throttled by mean-spirited US regulators. Still, people were optimistic about the year ahead. I listened to Michael Saylor wax lyrical about BTC for four hours in the press room, and was fortunate enough to ask new Bitcoin convert Vivek Rahmasamy a question or two. Also at the conference were Robert F Kennedy JR (RFK), Tulsi Gabbard, and a few lesser-known politicians.

A month after the event, BlackRock announced their Bitcoin spot ETF application – and we were off to the races. Now 12 months later, at this year’s edition in Nashville, ex-president Donald Trump has become an unlikely crypto evangelist and is speaking on the Nakamoto main stage. Coming on the back of his shocking recent foiled assassination attempt, this was impossible to fathom a year ago, especially if you dig up anti-crypto statements Trump made during his term in office.

But there he was, the former (and possible future) president, standing on stage at Bitcoin 2024 in Nashville, promising to create a ‘strategic BTC reserve’ if he wins in November. If you ever had doubts about Bitcoin going mainstream, retire them.

Trump Steals the Show

Trump’s keynote appearance was always going to be the headline act. Love him or hate him, he has fame and knows how to work a crowd. As he took the stage, the energy in the room was electric. Bitcoiners who’d waited over an hour to hear him speak were practically buzzing with anticipation. You can watch his full keynote speech here.

And he delivered, despite some uneven moments. He came out swinging, vowing to fire SEC Chair Gary Gensler “on day one” and end what he called the Biden administration’s “anti-crypto crusade”. It was music to the ears of many in attendance who’ve felt stifled by recent regulatory crackdowns. He promised to free Silk Road martyr Ross Ulbricht: pitch perfect to his libertarian-leaning audience.

But between the familiar self-praising soundbites and vitriol aimed at his opposers, Trump showed that he did his homework, or had the right crypto people give him the lay of the land. He wasn’t just there to bash the current administration, but ticked all the right boxes that Bitcoin maxis care about.

Trump’s pro-Bitcoin promises

The Donald laid out a surprisingly detailed pro-Bitcoin agenda:

- Establish a “strategic Bitcoin reserve” for the USA.

- Prevent the USA from selling its existing Bitcoin holdings.

- Create a “Bitcoin and crypto presidential advisory council” with members who support the industry.

- Fire SEC Chair Gary Gensler on his first day in office.

- End what he called the Biden administration’s “anti-crypto crusade”.

- Keep 100% of the Bitcoin the U.S. government currently holds or acquires in the future.

- Appoint a new SEC chairman who is more favorable to crypto.

- Shut down the controversial Biden administration-led “Operation Chokepoint 2.0,” which he claimed was aimed at choking crypto businesses out of existence.

- Work to keep Bitcoin jobs and businesses in the United States rather than seeing them flee to other countries.

- Aim to make the United States the lowest-cost energy and electricity provider of any nation on Earth, to support Bitcoin mining.

- Transform the U.S. into the “crypto capital of the world” and the “Bitcoin superpower of the world.”

- Commute the sentence of Ross Ulbricht, the founder of Silk Road.

- Create rules for the crypto industry written by “people who love your industry, not hate your industry.”

- Oppose Central Bank Digital Currencies (CBDCs).

It was surreal hearing a prominent politician shout “Never Sell Your Bitcoin” and compare it to the steel industry of the last century. Whether you’re a Trump fan or not, whether it’s mere political theater or not, it marks a shift in how politicians are approaching crypto.

Not Just a Trump Show

While Trump might have stolen the spotlight, he wasn’t the only political heavy-hitter at the conference. Robert F. Kennedy Jr., then running as a third-party candidate, proposed a reserve of a whopping 4 million Bitcoin. Senator Cynthia Lummis pitched her plan for a 1 million BTC federal stockpile. Even Senator Tim Scott got in on the action, floating the idea of Bitcoin “opportunity zones” for underserved communities.

Bitcoin was the belle of the ball, and every politician there was a-courting. What a time to be alive!

Big Money Takes Notice

It wasn’t all politics, though. The suits showed up in force too. Robert Mitchnick from BlackRock, and Chris Kulper from Fidelity talked about Bitcoin’s investment potential – a reminder of how far we’ve come from the days when crypto was just for rebels and cypherpunks.

And then there was Michael Saylor. The MicroStrategy CEO and Bitcoin über-bull didn’t disappoint, predicting Bitcoin could hit $13 million per coin by 2045.

Market Madness

All this bullish talk had an impact. Bitcoin’s price surged close to $70,000 during the conference, reaching levels not seen in weeks. It was a reminder of how much influence these high-profile endorsements can have on the market.

Regulation Fears Take A Backseat

Of course, it wasn’t all moonshots and lambos. The specter of regulation loomed over the proceedings, but less darkly than in previous years. Trump’s promise to fire Gary Gensler got some of the biggest cheers of the conference, reflecting the frustration many feel with the current regulatory environment.

There was also plenty of discussion about Central Bank Digital Currencies (CBDCs), with most speakers (including Trump) coming out strongly against them. The battle lines are being drawn between centralized and decentralized visions of digital money.

Looking Ahead

The Bitcoin Nashville conference could well be a turning point for crypto, thanks to such a high-profile endorsement by someone who is currently the slight favorite to be the next US president. Factor in that Kamala Harris, his Democrat opponent, apparently wanted to attend too, and is making overtures to the crypto community, and it becomes clear that the crypto vote is now strongly coveted by both US parties. Crypto is especially popular with minorities like African Americans and Latinos, meaning politicians can no longer ignore it.

In 2023 I asked several speakers whether Bitcoin and crypto would be a major political issue in the 2024 election. The overwhelming consensus was that it was still years too early for that. Things have moved faster than expected, with the approved ETFs and patronage from the world’s biggest finance firms. It’s not even a question anymore. Bitcoin adoption is accelerating in all arenas, and the intertwined worlds of finance and politics are no exception.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)