Putting A DePIn In Crypto in 2024

Feb. 01, 2024.

7 min. read.

19 Interactions

What does the future hold for decentralized networks with DePIn? Explore the game-changing technology behind this global force, propelling innovation in AI, gaming, and privacy.

Introduction

The crypto hype cycle thrives on slightly outlandish, vague narratives that help to prop prices and investors’ heart rates up. LSDs, memecoins, RWAs, anything that you can add a -Fi to – as long as it sounds exotic, it’ll likely soon come to an exchange (DEX? CEX? yes please!) near you.

The latest term on everyone’s lips in 2024 is DePIn, or Decentralized Physical Infrastructure, which sounds a little less catchy and comes with a few other monikers such as EdgeFi, Proof of Physical Work (PoPw), and Token Incentivized Physical Networks (TIPIN).

It’s still early days, but DePIn isn’t a pipe dream like metaverse circa-2021 being touted to drive up the price of crypto assets like Ethereum and Cardano; it offers real global potential as Web3, or the decentralized internet, continues to take shape in tandem with the Internet of Things, artificial intelligence and blockchain technology.

DePIn uses valuable crypto incentives to connect millions of users, and build new products that were simply out of scope previously. Some projects like frontrunners Helium, Filecoin and Render have been building and growing steadily for years, while new upstarts like Hivemapper offer some wild new practical use cases. We’ll cover all these in a follow-up article, but in the meantime, here is the DePIn leaderboard for the degens amongst you.

An in-depth Messari report on DePIn tries to make sense of the field, and how it intersects with everything from crypto to artificial intelligence (AI) VC funds are investing heavily in anticipation of it touching everything from zk-rollups to memecoins (and who knows, the metaverse?) before 2024 is done.

Before we dig in, let’s cover the basics.

What is DePIn?

DePIn can be described as hardware-based decentralized networks that use cryptocurrency tokens as an incentive for participants to help build out and maintain decentralized physical infrastructure for uses like wireless communication, information storage, computing power, and data networking.

DePIn projects require careful thought about the dynamics of the rewards system. Things like geographical considerations are relevant, e.g. building infrastructure in London must be better incentivized than in Lahore, to make the users generate real-world traction and real network effect.

By the end of 2023, there were 650+ DePIn projects with a total market cap of over $20 billion and $15 million in onchain annual revenue, across six subsectors: compute (250), AI (200), wireless (100), sensors (50), energy (50), and services (25).

Messari’s Six DePIn sectors

As mentioned above, the Messari report divides DePIn into six distinct and occasionally overlapping technology sectors, which will also be covered in a future article:

- Compute

- Wireless

- Sensors

- Energy

- Services

- AI

Centralized networks in these industries have already created trillion dollar global industries, but DePIn is capable of making these sectors more resilient and efficient, thanks to incentivising innovation and changing how networks generate and raise capital.

What separates DePIn from standard physical networks?

The decentralized incentive structure provided by crypto is the perfect accelerant for building out a physical infrastructure network. On-chain settlements are essential to employing the key features of what makes DePIn unique: namely its decentralized resiliency, and its use of crowdsourced capital.

Using on-chain settlements to support and incentivize the physical deployment of devices aids in creating a flywheel effect that further bolsters the network’s resiliency to censorship and security threats. If cryptocurrencies were not involved, it would be nearly impossible to settle transactions due to needing to use multiple currencies and DePIns could not guarantee privacy or decentralization..

Why DePIn beats TradPin

Messari sees four distinct advantages that DePIn hold over traditional infrastructure:

- Upfront capital investment vs crowdsourcing

Traditional infrastructure projects require up to billions of initial capital. This bars nearly everyone from entering the market. DePIn favors raising capital via crowdsourcing, and incentivises providing assets and labor by paying out with fair token incentives.

- Onchain settlements over outdated operating costs

An on-chain ledger that’s decentralized both reduces managerial costs and makes processing payments transparent and free of hassle if the network is international or relies on privacy.

- Removing single points of failure

Centralized networks, regardless of size or function, have multiple single points of failure. If these are non-functional or turned off, all services stop. Giant cloud servers such as Amazon Web Services (AWS) or Cloudflare have had moments of malfunction that caused millions of dollars in damages.

- Innovation requires experimentation

Traditional networks and hardware have arguably been stagnant for some time. Messari argues new tech can take decades to release and integrate, but DePIn rewards innovation and risk-taking with fair incentive models that reward forward thinking.

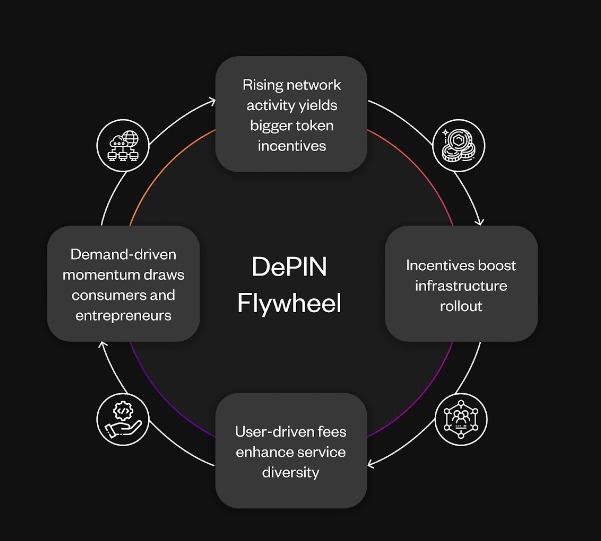

The DePIn flywheel

The Messari report lays out a clear pathway for networks to expand, a pathway they claim limits speculation that many crypto projects have trouble navigating. Unlike ‘pure’ crypto protocols, which don’t usually incorporate a hardware element or create a network, DePIn creates a system that releases tokens as network activity increases. This increased network activity increases demand to satisfy a larger userbase, further incentivizing network growth. Basically, the bigger a DePIn network gets, the stronger it gets.

This cycle has been named the DePIn flywheel. It will hopefully keep the memecoin traders disinterested and allow the native token price to more accurately reflect the utility it provides.

See below for a visualisation of how the flywheel makes networks more powerful as they increase in size.

While they don’t elaborate, Messari claims the DePIn flywheel can generate up to $10 trillion in global GDP in the next decade and up to $100 trillion the decade after that. Yes, that’s such a large number that it’s hard to believe. Hopefully a better explanation is provided in the future to explain how they arrived at such a large number.

Six DePIn Narratives in 2024

Messari believes that this year we’ll see DePIns begin to experiment more deeply with unique crypto primitives such as zero-knowledge proofs, memecoins, onchain AI and gaming.

ZK-Verifiable GPU Clouds

What’s Coming: In just 1-2 years, we’re looking at GPU clouds that can verify on-chain activities using Zero-Knowledge (ZK) proofs. This isn’t just tech jargon. It means a new kind of economy where decentralized AI can do things centralized giants can’t.

AI’s New Battleground: Centralized vs. Decentralized

Google’s Play: Imagine Google giving away its AI genius for free. Why? Same reason they gave away their search engine gratis: to learn from how we all use it. Here’s the twist – as AI gets smarter, it’s not just about more power, but more data. The race is on for massive data collections, a real treasure trove for the AI giants.

The Price of Privacy in AI

Right now, keeping AI inferences private (with ZK proofs) is pricey – 75 times more pricey than the usual way. For those embedding AI in blockchain contracts, this cost is a big hurdle. That’s the key to really bringing AI onto the blockchain stage.

Memecoins: Not Just a Laughing Matter

Memecoins, often seen as a joke, are now serious players in driving blockchain-based AI and DePIn adoption. Believe it or not, the top memecoins are worth more than the leading DePIns. Memes move the market.

Web3’s New Weapon: Vampire Attacks

The New Strategy: Thanks to ZK TLS (zero-knowledge transport-layer security) tech, blockchain projects (DePIns) can now launch ‘vampire attacks’ on traditional web apps. This isn’t just about stealing users; it’s about disrupting reputation systems and reshaping marketplaces and competitive landscapes.

Gaming Meets Real-World AI

Gaming, AI, and real-world infrastructure are merging in fascinating ways. From onchain speed tests to mapping apps, gaming is stepping out into the real world, blending daily activities with digital rewards.

Privacy’s New Frontier: The Rise of ATOR

ATOR (anonymous TOR) is a DePIn project aiming to give the Tor network a new lease on life, using tokens to motivate node operators. This could lead to faster, more efficient private routing, changing how we think about online anonymity.

Asia’s Blockchain Boom

Watch out for Asia’s DePIn ecosystem. It’s booming, and we might see some major players emerge in the next few years.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)

4 Comments

4 thoughts on “Putting A DePIn In Crypto in 2024”

im interesting

🟨 😴 😡 ❌ 🤮 💩

Good article

🟨 😴 😡 ❌ 🤮 💩

The article is exceptionally well-written, offering a thorough analysis of the intricate world of Bitcoin. It adeptly navigates complex concepts with clarity, making it an invaluable resource for both novices and experts in the field. Kudos to the author for providing such insightful and engaging content.

🟨 😴 😡 ❌ 🤮 💩

very interesting article, read the full messari report, it contains plenty of crypto investment ideas

🟨 😴 😡 ❌ 🤮 💩