Tether Made $13 Billion in 2024 – is that good or bad for crypto?

Mar. 12, 2025.

5 mins. read.

8 Interactions

Tether’s $13B profit in 2024 has Wall Street taking notes. But with regulatory scrutiny rising, is the stablecoin king secure—or is a shake-up coming?

Introduction

Tether Holdings Limited, the powerhouse behind the world’s largest stablecoin Tether (USDT), made over $13 billion in profits in 2024. This crazy figure shows Tether’s growing influence in the broader financial sector, which is set to see growing stablecoin adoption under the Trump administration’s new crypto-focused task group.

It also gets more interesting. With a lean team of just over 100 employees, Tether’s profits trump those of major Wall Street giants that have thousands of staff. And Wall Street is noticing.

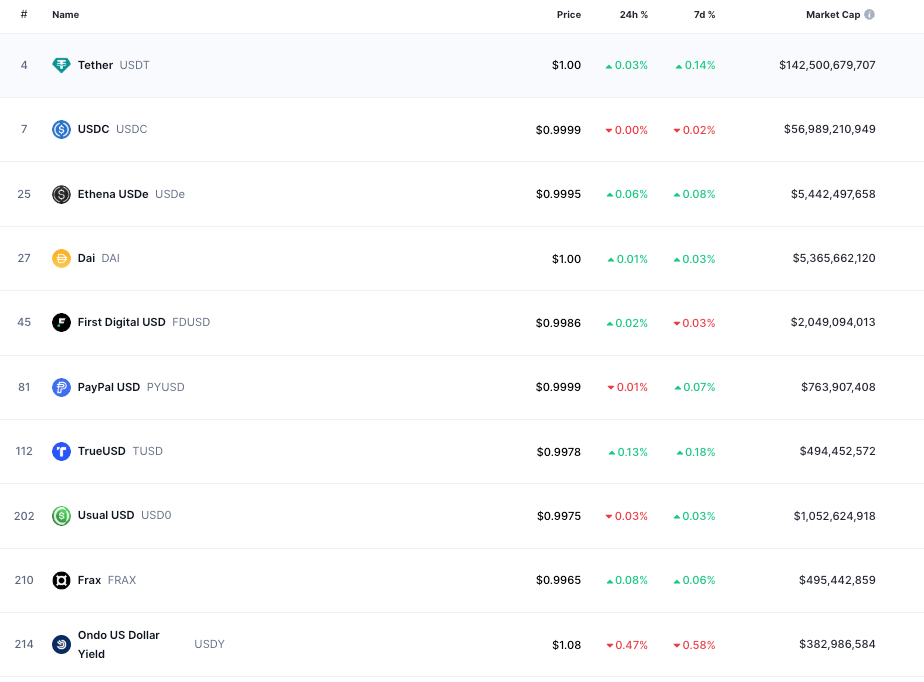

Tether generates tangible revenue from its real-world impact, setting it apart from crypto projects which rely on speculation, hype, and memes. As a result, we’ve seen more and more new entrants to the stablecoin market, such as PayPal (PYUSD), Ripple USD (RLUSD) and the controversial Ethena USD (USDe), an algorithmic stablecoin. What does this mean for the future of stablecoins and crypto?

Tether’s Bumper 2024 Financial Performance

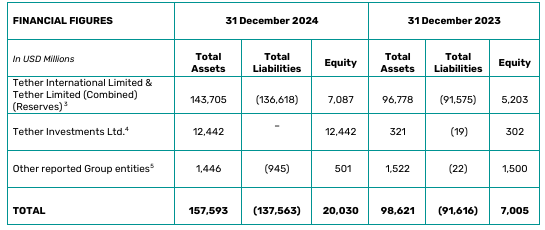

These numbers on Tether’s 2024 profits come from a fourth-quarter and year-end attestation reviewed by the independent accounting firm BDO. Tether doesn’t publicize its financial documents – and this has been a source of controversy for years, with people questioning the existence of reserve funds.

The BDO report claimed the company’s net profit exceeded $13 billion: an all-time high. This puts Tether among the most profitable financial entities in the world. To compare, TradFi giant Goldman Sachs reported $14.3 billion in net income for the same period.

The profit was driven by several key factors, including significant returns from U.S. Treasury holdings and repurchase agreements. Unrealized gains from its gold and Bitcoin investments are also included.

Tether’s equity rose to over $20 billion, reflecting its financial health and strategic investments in various sectors such as renewable energy, Bitcoin mining, AI, telecom, and education.

Record U.S. Treasury Holdings

Tether’s exposure to U.S. Treasuries reached a record high of $113 billion, making it one of the largest holders of U.S. government securities globally – ironic when you view US regulators’ largely anti-Tether stance in favor of its nearest competitor and homegrown stablecoin Circle (USDC).

Growing Reserve Buffer

Tether’s excess reserve buffer surpassed $7 billion for the first time, the report claims. This marks a 36% increase over the past year.

Fears that Tether carries systemic risk that could bring down the whole cryptocurrency industry have been around since its earliest days, especially after it was accused of creating fake volume during the 2017 bull run and its devastating hack in 2018.

Increased USDT Circulation

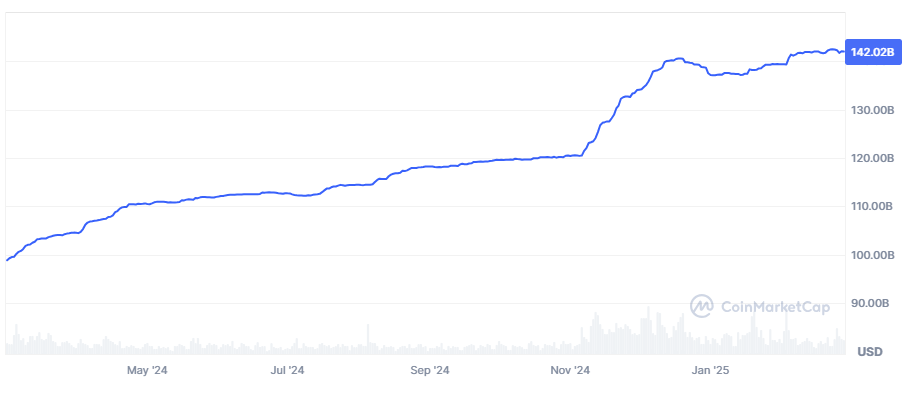

Tether’s market cap has grown to $142 billion (28 February 2025), up from less than $100 billion a year earlier. It is the most widely used stablecoin, although a separate report claims that less than 10% of stablecoin transactions involve real users.

Implications for Stablecoins and Crypto

Tether’s impressive financial performance will not go unnoticed in the financial world. It will have effects on the stablecoin market and the broader crypto landscape.

Stablecoin Dominance

Tether’s latest financial report reäffirms its position as the leading stablecoin issuer. USDT leads the stablecoin pack by a long margin.

In the crypto market, stablecoins are at the center of many DeFi protocols, because they facilitate lending, borrowing, yield farming, and activities like that. Beyond the crypto space, stablecoins offer a cheap and fast form of payment.

The adoption of stablecoins is rising in inflation-hit countries, particularly in Latin America, because they act as a hedge against inflation and currency volatility. The recent Tether report casts the stablecoin in a good light and adds credibility. This could help attract more users and strengthen its position in the stablecoin market.

Regulators Not Impressed

Tether continues to face scrutiny from regulators despite its financial success. Its reliance on quarterly attestations by BDO has drawn criticism from regulators and crypto observers who are calling for full audits in the name of transparency.

Several exchanges such as Kraken are delisting Tether. Some exchanges have been planning to delist it in the EEA (European Economic Area) since the EU’s Markets in Crypto-Assets (MiCA) went live. This regulation states that only licensed operators can issue stablecoins in the EU. National governments are releasing their crypto guidelines, which might also affect Tether’s use.

Global Influence

Tether’s global influence is growing. The company is moving to El Salvador after it received a license there as a digital asset provider. El Salvador legalized Bitcoin as a legal tender (at the top of the 2021 cycle) but had to scale back on its BTC policies to secure loans from the International Monetary Fund (IMF).

Wrapping Up

A profit of more than $14 billion with a lean team will get traditional finance firms wishing they could pull off the same. Tether has outclassed many companies by a long stretch. However, questions about its transparency are still on the table, and it will take a lot to soothe regulators.

On a positive note, its global influence is growing, and the crypto industry is the big winner if its profitability draws in new competitors with clean track records and good reputations. For investors, using new stablecoins across new ecosystems and chains could help you get substantial interest or help you qualify for airdrops down the line. So while they’re boring by design, stables could be the new crypto cash cow if you use them correctly across the DeFi landscape.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)

2 Comments

2 thoughts on “Tether Made $13 Billion in 2024 – is that good or bad for crypto?”

Well hope more country follow El Salvador. Not convenient yet here . Hope soon

🟨 😴 😡 ❌ 🤮 💩

🟨 😴 😡 ❌ 🤮 💩