Tokenomics: A Guide For Crypto Beginners

Jan. 24, 2024.

7 min. read.

6 Interactions

Whether novice or seasoned, mastering intelligent navigation through crypto's volatility is crucial. Werner explains supply, demand, distribution, and valuation essentials for navigating the 2024 bull market intelligently.

It’s 2024, the bull market is back (or nearly back), and all of crypto and Web3 is predictably awash once again with new projects launching amidst much fanfare from a horde of new investors and the influencers shilling them. It’s nothing new, and anyone that experienced the ICO boom in 2017 and the bull market of 2020-2021 can tell you that if you don’t know what you’re investing in, you’re going to be left with a big bag of nothing at the end of the day.

You could have the best project in the world, but if you don’t get the balance right for example between how many tokens you give early investors and when they unlock, your cryptocurrency is doomed.

A fundamental concept to figure out for both project founders and investors is tokenomics: the study of the supply, demand, distribution, and valuation of cryptocurrencies. Get it right, and you could be the new big thing, get it wrong, and you’re dead in the water as soon as you launch.

Understanding tokenomics

Let’s talk about the basics before we jump into the pie charts. Even if you are ready to invest, make sure you first understand how a token’s model affects its short-term and long-term price action.

Here are some essential terms to understand for new retail crypto investors.

Presales: seed rounds, private rounds and angel investors

Most token models, regardless of their current market cap or utilities, began relatively unknown and required investments from venture capitalists, founders, or early adopters taking a huge risk. This even more so during periods of low market interest, like 2022’s bear market.

Presales

Tokens are sold to a select group of investors before the public sale. This phase allows the project to raise funds and generate interest before the public launch.

Seed Rounds

Seed round funding is typically provided by angel investors, venture capital firms, or strategic partners. In the context of crypto tokenomics, a portion of the tokens is allocated to seed round investors, usually around 10%.

Private Round(s)

Private rounds in crypto tokenomics involve the sale of tokens to a limited group of investors – often institutional or accredited investors – before the public sale. This phase allows the project to raise a significant amount of capital and build strategic partnerships. The allocation of tokens in private rounds varies, but typically it’s a smaller percentage than the public sale. Private rounds are sometimes split between private and strategic rounds.

Public Round

In the public round, tokens are sold to the general public, often following a well-advertised launch event. This model aims to distribute tokens widely and build a community. It’s a crucial step in the fundraising process for a cryptocurrency project. During the public sale, interested individuals can acquire tokens using widely-used cryptocurrencies like Bitcoin or Ethereum. The public sale is essential for raising capital and fostering a sense of community among a diverse group of token holders.

Here’s an example of a breakdown of Coin A:

Seed Round: Cost $0.03 per token (5% of total supply)

Private Round: Cost $0.05 per token (7.5% of total supply)

Strategic Round: Cost $0.08 per token (5% of total supply)

Public Round: Cost $0.12 per token (12.5% of total supply)

To compensate and return the favor to these investors for helping keep the lights on, tokens are usually reserved before the launch begins, often at a much lower price than what retail investors will pay during the ICO. However, these tokens are not just handed over with no strings attached, which brings us to our next topic:

Vesting schedules and token distribution

We don’t want early investors selling their tokens for a fraction of the price retail investors did: this would crash the price due to low overall liquidity. To prevent this, their coins are often released over time, on what is called a vesting schedule. In fact, when a coin is first publicly available during its ICO, a large majority of the full supply is usually still locked up until later, when more demand is present, or locked so it can only be received by common methods such as staking or providing liquidity to the token.

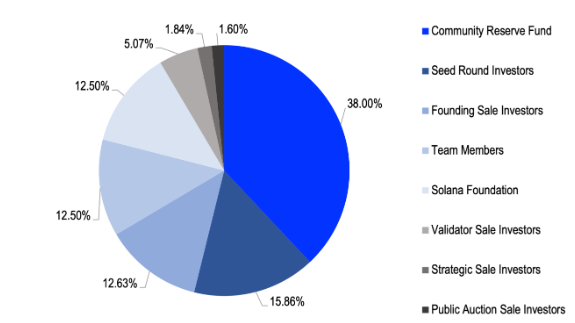

To understand the distribution system of most tokens, let’s analyze the current degen darling, Solana (SOL), and how it was allocated during its launch.

Before you ask, SBF purchased his infamous stake in Solana for $0.20 per token during the founding sale, two years before the public auction began in March of 2020.

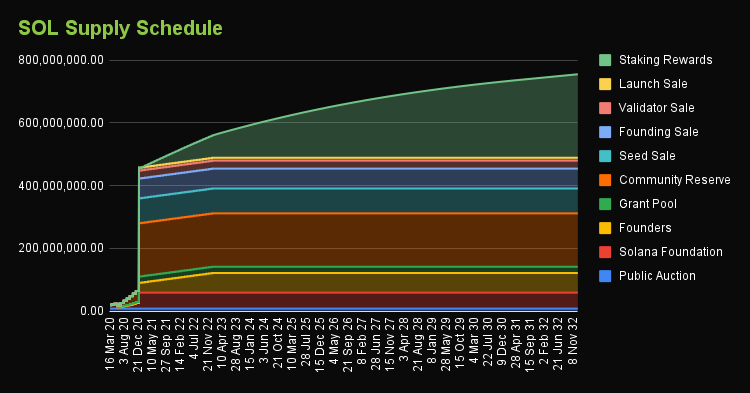

Notice that only 1.60% of the total supply was released during the ICO on Coinlist, but if we observe the chart below, besides staking rewards, very few new tokens were introduced to the market until December of the same year.

Both early investors and ICO buyers consider the longevity of a token when they purchase a brand new token. If the team gets the proportions wrong, or plans to release tokens too quickly or too slowly, private and retail investors would consider the protocol greedy or even assume a slow rug pull (where the team fade away after raising funds) is waiting for them.

Cool story, what’s the takeaway?

When you’re looking up the tokenomics of a token, make sure you take into account the vesting schedule of that coin and plan your purchase accordingly. If you fully send a market buy order, but it’s the day before the early investor tokens unlock, how will your shiny new internet monies change in value? It will put you underwater immediately.

This information is always immediately available on the project website, or the launchpad for both new and old tokens, so let’s cover what you need to be looking for before you start sprinting the first 100 meters of the 2024 bull market marathon.

Green flags

Token disclosure: If there is missing data about how many of the tokens exist, how they are allocated post-ICO, the seed sale allocations, etc, steer clear immediately. This lack of information is common with scam and low market cap tokens, and it becomes an expensive lesson in doing your research if you impulsively buy newly tokens or random coins on trendy launchpads.

Supply and demand match up: even if the tokenomics looks great and there’s high demand, does the token actually have a use case? Will it sit in your wallet collecting dust until it’s sold later? Because if it is, that’s the case for everyone else as well. Functions such as staking, yield farming, and burn mechanics dictate how much of the supply is actively being productive or locked up, lowering the supply actively being traded.

Team and community: Even if the token model looks promising and its use case is clear, are the community and team on the same page? A successful tokenomics model aligns the interests of the core project team with those of the community and early investors. This is hard to measure without going deep into the project’s Discord, Telegram group, or Twitter comments, but is time well spent. The difference between a hidden gem with 100x potential and a complete scam is often community involvement.

Red flags

Market cap is unsustainable: Have you ever looked at a token’s value and thought, “wow, this is criminally undervalued, why is that?” Immediately calculate or look up the fully diluted value (FDV), a key metric, which accounts for tokens still vesting or not yet active such as staking rewards or treasury holdings.

Slow rugs or dishonest founders will try to mislead traders into thinking they’ve found a diamond in the rough, by gaming the system that ranks their token by market cap to appear undervalued. However, when you see a new token with an FDV worth a billion, tread carefully.

Unclear use-case: Is it a gaming token, a utility token, or a meme? The use of a token will determine if its distribution model is thought out or copy pasted from DOGEcoin’s whitepaper. A gaming token that sold too much to seed investors? Prepare to fall down an escalator if the game doesn’t have enough players. A governance token that’s mostly held by founders or a DAO? Don’t expect your vote on proposals to be impactful. Consider if the distribution matches its use-case for long term success. And if you’re unsure, compare its model to one of a similar token.

Anon team: While it’s common in crypto for teams to protect their anonymity, this lack of transparency is also a risk that needs to be weighed carefully, as it opens investors up to new risks like rug pulls and just blatant scams.

Remember

Crypto is about educating yourself and being your own bank. This means due diligence is paramount if you want to succeed as an investor or a founder.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)

1 Comments

One thought on “Tokenomics: A Guide For Crypto Beginners”

Yap good i like this

🟨 😴 😡 ❌ 🤮 💩