Bitcoin Halving 2024: Final Countdown To 19 April

Apr. 16, 2024. 6 min. read.

Interactions

Bitcoin Halving 2024! Anticipation skyrockets as the crypto world braces for a seismic shift. Will history repeat? Find out more.

Please note: This article is for educational purposes only and doesn’t constitute financial advice of any kind. Please invest responsibly.

Intro

Tick-tock, tick-tock, get closer one more block. Despite this weekend’s crypto jitters after Middle East tensions, everyone and their cat is now tuned in for this week’s 4th Bitcoin Halving, scheduled for 19 April, 2024 around 6pm UTC, and anticipation, nerves and speculation levels are off the charts.

This momentous event, which occurs roughly every four years, will reduce the mining rewards from 6.25 BTC to 3.125 BTC per block, cutting the daily issuance of new Bitcoins in half.

Bitcoin supporters are gunning for that $100,000 price tag milestone with laser-eyed focus, and the 2024 halving is Bitcoin’s big event after the year following the Spot ETF approvals, and a defining moment for the entire crypto industry, providing high hopes that the ensuing supply pinch will kick off another crazy bull run.

What is the Bitcoin Halving?

The Bitcoin Halving is a pre-programmed event that is hardcoded into the Bitcoin protocol. It is designed to control the supply of new Bitcoins entering circulation, ensuring that the total supply will never exceed 21 million BTC. By reducing the block reward for miners every 210,000 blocks (approximately four years), the Halving helps maintain Bitcoin’s scarcity and deflationary pressure.

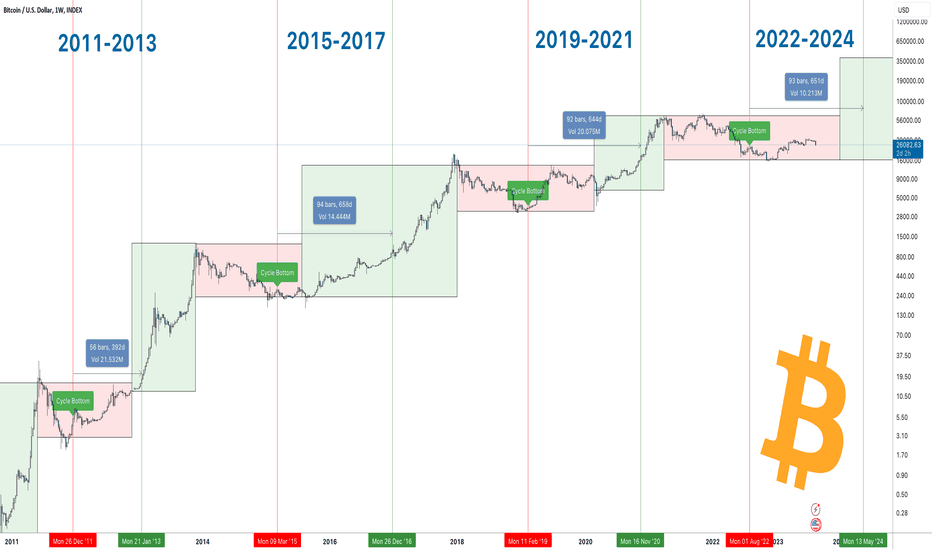

Historical Behavior of 2012, 2016, and 2020 Halvings

To better understand the reason for optimism surrounding the upcoming 2024 Halving, let’s take a closer look at the previous three Halving events and how they affected Bitcoin’s price, narratives, and overall market sentiment.

The 2012 Halving

The first Bitcoin Halving took place on 28 November, 2012, when the price of BTC was just $12.35. In the year leading up to the event, Bitcoin’s price had recovered from the fallout of the first Mt. Gox hack, rising from $2.55 to $12.35. Post-Halving, Bitcoin’s price surged by an astonishing 2000%, reaching $260 in April 2013. This period was characterized by growing interest from tech-savvy individuals and online communities, laying the groundwork for Bitcoin’s future growth.

The 2016 Halving: Leaving behind Mt. Gox

By the time of the second Halving on July 9, 2016, Bitcoin had faced several challenges, including the devastating Mt. Gox hack in 2014 and a tarnished reputation due to Dark Web-related criminal activity and prosecutions such as Ross Ulbricht of Silk Road. Despite these setbacks, Bitcoin’s price rose from $430 to $650 in the months leading up to the Halving.

In the post-Halving period, Bitcoin entered a phase of runaway growth, reaching nearly $20,000 by December 2017 – a staggering 2984% increase from the Halving day price.

The 2020 Halving: Institutions arrive

The 2020 Halving occurred on 11 May, 2020, amidst the global turmoil caused by the COVID-19 pandemic. Governments worldwide pumped trillions of dollars into their economies, leading to increased interest in Bitcoin as a hedge against inflation.

In the months preceding the Halving, Bitcoin’s price recovered from a significant drop, rising from $5,000 to $8,600. Post-Halving, Bitcoin’s price rallied to an all-time high of approximately $64,000 in April 2021, driven by a surge in institutional adoption and growing interest in decentralized finance (DeFi Summer), and those silly crypto jpegs known as NFTs.

Bitcoin Halving: A Three-Act Play (Hype, Disillusion and Accumulation)

According to Galaxy Research, Bitcoin’s halving events have historically unfolded in three distinct phases, each characterized by unique market dynamics and investor sentiment.

- Hype: The first act, dubbed the ‘Hype Phase’, sets the stage with a surge in prices leading up to the halving. Excitement and anticipation build as market participants speculate on the potential impact of the reduced supply.

- Disillusionment: As the curtain rises on the second act, known as the ‘Disillusionment Phase’, the market wakes up to a post-halving hangover. Prices dip or go sideways, leaving some investors questioning the immediate effects of the event. However, this act is merely an intermission, setting the stage for the grand finale.

- Accumulation: The third and final act, the ‘Accumulation Phase’, is where the magic happens. Prices recover and embark on a sustained upward trajectory, rewarding patient investors who held through the previous two phases and market participants who recognize the long-term implications of the halving and the growing maturity of the ecosystem.

Opinions on prices after the 2024 Halving

Uber-bullish Bitcoin predictions are a satoshi a dozen right now.

Michael Novogratz, CEO of Galaxy Digital, Morgan Creek CEO Mask Yusko, and analyst Tom Lee have all predicted that Bitcoin’s price will hit $150,000, while Skybridge founder Anthony Scaramucci thinks Bitcoin will hit at least $170,000 in the 18 months after the Halving. Additionally, billionaire investor Tim Draper has predicted that Bitcoin will reach $250,000 in 2024, and Cathie Wood’s ARK Invest has projected that Bitcoin could surpass $1 million in the long-term.

Other notable predictions include Plan B, a prominent Bitcoin analyst, who regularly shares price analyses and predictions on Twitter, ranging from $100,000 to $1 million. Fred Thiel, Chairman and CEO of Marathon Digital Holdings, also forecasts Bitcoin reaching $120,000 post-Halving.

What to Expect After the 2024 Bitcoin Halving

As Bitcoin’s daily emissions get slashed from 900 BTC to 450 BTC, the price of mining will go up exponentially over the coming years. Several factors are expected to contribute to Bitcoin’s potential price appreciation, including increased institutional adoption, growing interest from younger generations, and the reduced supply of new Bitcoins entering circulation. Additionally, the launch of Bitcoin ETFs and the continued development of Bitcoin’s core infrastructure, such as the Lightning Network and Taproot upgrade, are expected to further bolster Bitcoin’s growth.

All these will help other crypto networks such as Ethereum, Cardano and Solana and their AI cryptocurrencies, memecoins and DePIN, as Bitcoin’s rising tide has shown to raise all ships.

The Impact of Bitcoin Spot ETFs

One of the most significant developments in the lead-up to the 2024 Halving has been the introduction of Bitcoin Spot ETFs. These investment vehicles hold actual Bitcoins rather than futures contracts, and provide institutional investors with a way to enter the crypto market. With major players like BlackRock and Fidelity now holding hundreds of thousands of Bitcoins in their ETFs, the institutional demand for Bitcoin is stronger than ever.

The Cost of Bitcoin Mining After the Halving

While the 2024 Halving is expected to have a positive impact on Bitcoin’s price, it will also present challenges for miners. As the block reward is reduced, the cost of mining new Bitcoins will effectively double. Some analysts, such as CryptoQuant CEO Ki Young Ju, predict that mining costs could rise from $40,000 to $80,000 per BTC for miners using the popular Antminer S19 XP.

This increase in mining costs will likely lead to a consolidation of the mining industry, with smaller, less efficient miners being forced out of the market. However, as the difficulty of mining adjusts to the reduced hash rate, the remaining miners will become more profitable, potentially leading to a more stable and secure network.

Conclusion

As the crypto world counts down the days to the 2024 Bitcoin Halving, it’s clear that this event has the potential to be a watershed moment for the world’s first cryptocurrency. With institutional adoption at an all-time high, a dramatically reduced supply of new Bitcoins, and a range of technical upgrades in the works, Bitcoin is poised for significant growth in the post-Halving period.

While it’s impossible to predict the exact price of Bitcoin in the coming years, the historical precedent set by previous Halvings suggests that we could be on the cusp of another bull run. As always, it’s essential for investors to conduct their own research, manage risk appropriately, and stay informed about the latest developments in the ever-evolving world of cryptocurrencies.

In the meantime, sit back and count down with the entire crypto space here:

https://www.nicehash.com/countdown/btc-halving-2024-05-10-12-00

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)

2 Comments

2 thoughts on “Bitcoin Halving 2024: Final Countdown To 19 April”

it was a very nice and interaating.

🟨 😴 😡 ❌ 🤮 💩

Nice!

🟨 😴 😡 ❌ 🤮 💩