Introduction

After years of legal battles and regulatory uncertainty, the SEC finally dropped its lawsuit and crusade against Coinbase in a stunning reversal that shocked both supporters and critics.

This February 2025 decision ends a legal fight that began in June 2023 (and as far back as 2021) when the SEC charged the centralized exchange with operating without proper registration. Former SEC Chair Gary Gensler, the most hated man in the sector, viewed many cryptocurrencies as securities requiring SEC oversight, and was a key player in the fight to stifle innovation in the States, together with the Biden administration’s Operation Choke Point 2.0 campaign.

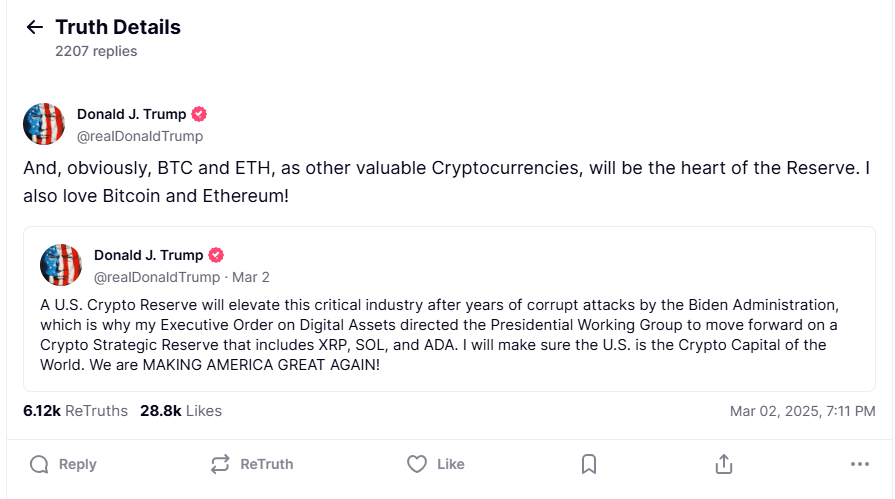

Under the crypto-friendly Trump administration, the federal securities regulator’s move represents one of the most significant regulatory shifts for digital assets in US history.

Trump favors crypto-specific regulations rather than applying traditional securities laws to digital assets, and on January 23, he created a working group to develop a new regulatory framework.

Why does all of this matter? Chiefly, It signals a major shift in how digital assets will be regulated in the US to the benefit of all crypto firms and could reshape the entire industry for years to come. Also, it clears the way for Coinbase to have a massive 2025 and beyond, which I cover towards the end.

Let’s see how one of the biggest battles in digital asset history finally started and concluded, and what’s next for Coinbase as the re-annointed leading exchange in the now pro-crypto United States.

SEC vs Coinbase: A Brief History of Legal Battles

The SEC and Coinbase have clashed repeatedly over how cryptocurrency should be regulated:

- September 2021: SEC threatened to sue Coinbase over its planned “Lend” feature, which would let users earn interest on crypto. The SEC considered it an unregistered security. Coinbase abandoned the product.

- March 2022: A lawsuit claimed Coinbase facilitated trading of 79 unregistered securities, including Shiba Inu and Dogecoin. A judge dismissed this in February 2023, ruling customers couldn’t prove Coinbase held title to the tokens.

- July 2022: Seeking clarity, Coinbase filed a “petition for rulemaking” asking the SEC for specific digital asset regulations. The SEC didn’t respond directly but increased enforcement actions.

- March 2023: The SEC issued a Wells Notice to Coinbase, formally declaring intent to bring enforcement action against several products. Coinbase responded firmly: “Coinbase does not list, clear, or effect trading in securities.”

- April 2023: Coinbase took the unprecedented step of suing the SEC to force a response to its earlier petition. Over 1,700 entities and individuals supported this call for clarity.

- June 2023: The SEC charged Coinbase with operating as an unregistered securities exchange since 2019. The lawsuit also classified several tokens as securities and targeted Coinbase’s Staking Program. Coinbase stock dropped 16%. Days after, BlackRock, an important partner, announced it would launch a Bitcoin ETF.

- February 2025: Under the new administration, the SEC dropped its case without imposing fines, marking a major shift in US crypto regulation.

How The Coinbase vs SEC Saga Ended

On February 21, Coinbase announced the SEC agreed to end its case, pending final approval from commissioners. The resolution came under President Trump’s administration, which has taken a different approach to crypto regulation.

During a CNBC interview, Coinbase CEO Brian Armstrong called the lawsuit “bogus” and confirmed the company would pay no fines.

“This is a huge day for Coinbase and the entire crypto industry,” Armstrong said. “We can finally turn the page and get clear rules in America.”

Coinbase stock jumped on the news but later fell 8% amid broader market declines.

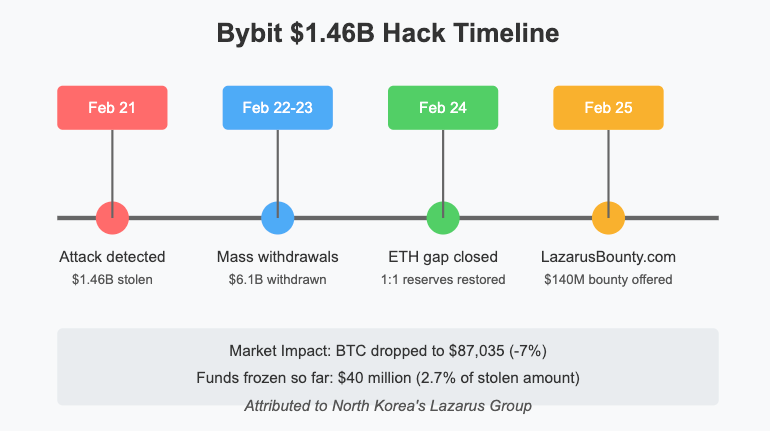

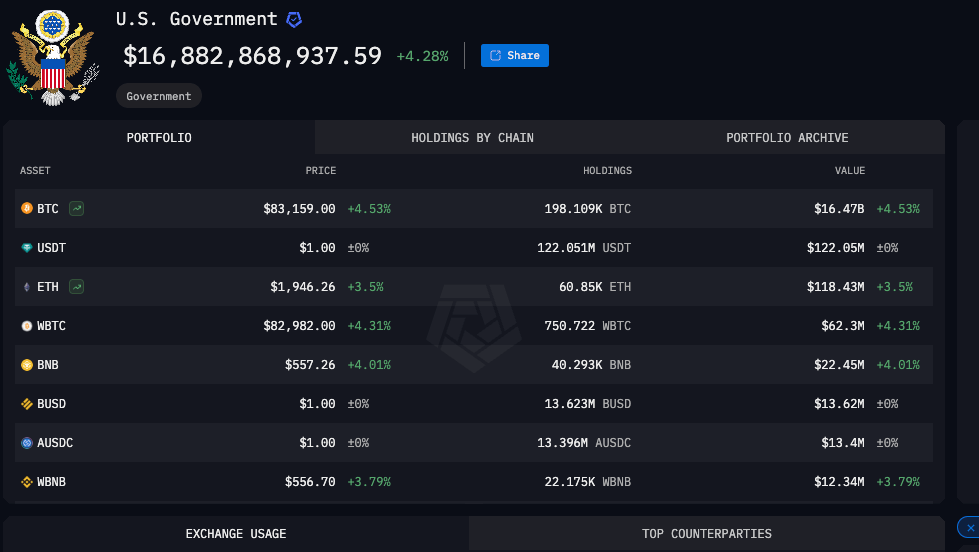

Market Impact

The crypto market responded positively:

- Bitcoin broke $100,000 for the first time after Trump’s election

- Coinbase can now operate without the threat of penalties or restrictions

- Other crypto businesses may reconsider the US market as a viable option

Political Connections

The case resolution has sparked debate. Critics point to the crypto industry’s campaign spending during the 2024 election. Coinbase alone spent $46 million on election influence and donated $1 million to Trump’s inauguration.

Robert Weissman of Public Citizen said: “The SEC abandonment of its case against Coinbase proves the crypto industry’s flood of campaign spending has paid off.”

Supporters counter that previous regulations were too restrictive and hindered innovation.

What Changes Now?

The case dismissal points to several shifts in US crypto regulation, chief among them:

- New crypto-specific rules instead of applying old securities laws like the controversial and outdated Howey Test

- Fewer enforcement actions against crypto companies

- Clearer guidelines from the presidential working group

- Potential for the US to lure back its homegrown talent and become a stronger crypto innovation hub again

For investors, this means less regulatory risk, and for consumer advocates, it raises concerns about reduced protections.

Global Context

The US shift comes as other regions define their own approaches:

- The European Union implemented its Markets in Crypto-Assets regulation

- Singapore and UAE have established themselves as crypto-friendly jurisdictions

- The US approach may influence regulatory decisions worldwide

What’s Next For Coinbase in 2025?

In 2025, Coinbase has been making big moves as it finally enjoys the sanctuary of regulatory clarity. Here are some of its boldest moves:

- One of the most notable developments is Coinbase’s planned return to India after securing registration with the country’s Financial Intelligence Unit (FIU). This move allows Coinbase to reintroduce its trading services in this huge market, with plans to start retail services later this year and expand its product offerings.

- In the US, Coinbase is set to launch 24/7 Bitcoin and Ethereum futures trading, in order to bridge the gap between the continuous nature of crypto markets and traditional fixed trading hours of Monday to Friday, providing traders with more flexibility.

- Coinbase CEO Brian Armstrong announced plans to hire 1,000 new employees in the US in 2025, driven by a shift in the US government’s stance on cryptocurrencies. This hiring spree follows a White House crypto summit and reflects a more favorable regulatory environment under the Trump administration.

- Lastly, Coinbase is accelerating its Base network strategy with ambitious 2025 goals including $100 billion in on-chain assets, 25,000 developers, and 25 million users. The Ethereum layer-2 solution targets 1 billion transactions by October 2025, focusing on transaction efficiency and global liquidity improvements. Base is exploring innovative options like tokenizing Coinbase’s COIN shares for trading on the network, which could streamline transactions and portfolio management.

- Coinbase’s partnership with BlackRock remains important for helping institutions invest in cryptocurrencies. This partnership, which started in 2022, allows BlackRock’s clients to buy and store Bitcoin using Coinbase’s systems. Recently, BlackRock has been expanding its crypto services, including a plan for a tokenized private equity fund, with Coinbase providing the necessary infrastructure. This partnership shows how big financial companies are starting to use digital assets.

Looking Forward: What This Means For Crypto

Will this new approach balance innovation and investor protection? The next few months will be critical as the working group develops its framework.

What’s clear is that the crypto industry has gained political influence. As digital assets become more mainstream, finding the right regulatory balance remains essential.

If you invest in crypto, this case dismissal reduces your regulatory risk. Clear rules may attract more institutional investors, potentially bringing more stability to crypto markets.

But stay cautious. Regulatory changes aren’t permanent. Future administrations could take different approaches, and reduced oversight might lead to more market manipulation if proper safeguards aren’t created.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)