The integration of crypto incentives and blockchain technology with artificial intelligence (AI) could drive widespread adoption and advancement of decentralized AI and AI cryptos over the next decade, according to a new report by digital asset manager VanEck. Its timing couldn’t be better as we’ve been seeing an absolute explosion of AI-related cryptocurrency prices so far in 2024, the most recent rally coming on the back of OpenAI’s Sora launch.

In a recent in-depth report ‘Crypto AI Revenue Predictions by 2030’, VanEck analysts made several bullish predictions about the growth and the revenue potential of businesses operating at the intersection of crypto and AI. While any predictions should be taken with a grain of salt, considering where we’re at in the current crypto 2024 bull cycle, the report asks a lot of important questions and offers some surprising answers in the process.

Van Eck analyst Gabor Gurbacs has taken a controversial stand against AI, predicting its misuse will result in the biggest spam attacks the world has ever seen. Gurbacs sees Bitcoin as its only salvation, so read on to find why.

Public Blockchains Uniquely Positioned to Aid AI Progress

The Van Eck report is extremely bullish on the benefits that blockchain can bring to AI. He feels that AI and AI Agents “provide the raison d’être” for blockchain technology. It’s a big statement, but backed up by some sound reasoning: blockchain networks like Bitcoin and Ethereum possess several key attributes that make them well-suited to address existing challenges facing the AI industry, most notably:

- Transparency – Being public ledgers recording all transactions, blockchains enable oversight related to data usage, model ownership, etc. This supports trust and accountability.

- Immutability – Records made on blockchains cannot be altered afterwards. This immutability lends integrity to data used for critical model training and testing.

- Ownership – Tokens, NFTs, and smart contracts allow us to clearly define ownership rights related to data, models, and even model outputs.

- Adversarial Testing Environment – The adversarial, incentivized environments of crypto networks that financially reward hacking and optimization force rigorous, real-world testing of systems.

He projects that these properties of blockchain will speed up the adoption of, and trust in, AI over the next seven years.

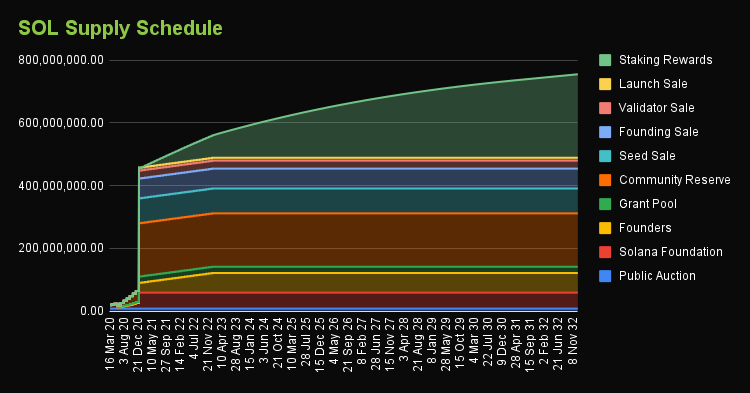

Crypto Market Share of AI Could Reach Billions Annually

Applying economic and productivity growth assumptions to previous McKinsey research, Van Eck predicts a total addressable market (TAM) for global productivity gains enabled by AI automation will clock a crazy $5.85 trillion in 2030. Assuming 33% adoption by businesses worldwide, annual AI revenues could top $250 billion within the decade.

Moreover, the report forecasts crypto’s potential market share across major AI business categories:

- Software: $6.27 billion

- Infrastructure/Compute: $1.9 billion

- Identity: $878 million

- Safety/Compliance: $1.12 billion

Tallying these up, it’s predicted that annual crypto AI revenues could approach $10.2 billion by 2030 in VanEck’s base case. Under more aggressive assumptions about adoption and market capture, AI cryptocurrencies’ stake could exceed $50 billion.

How blockchain helps AI solve identity issues

Artificial intelligence is increasingly critical to the global economy, akin to an essential utility. Web2 giants like Amazon and Google dominate current AI infrastructure, while blockchain technology supports specific, high-demand needs with its decentralized approach, offering flexibility and customization for AI development. This scenario positions blockchain as a dynamic adjunct in the AI infrastructure market, similar to how ride-sharing platforms like Uber complement, rather than replace, traditional transport services.

The importance of secure AI identities is rising, with blockchain playing a key role in preventing Sybil attacks by establishing verifiable digital identities. This defense is crucial as AI applications extend into areas like autonomous vehicles and healthcare, where safety is paramount.

Blockchain’s immutable records serve as reliable “proofs of safety,” essential for high-stakes accountability and compliance. Despite blockchain’s potential to revolutionize AI safety and identity verification, a significant portion of this market is expected to stay centralized, preferring established reliability and trust in sensitive sectors.

Bitcoin miners find surprising synergy with the AI sector

Bitcoin miners, traditionally focused on mining proof-of-work cryptocurrencies like Bitcoin, are diversifying into the AI sector due to their shared high energy consumption needs. These miners have historically invested heavily in energy infrastructure, often utilizing cost-effective but carbon-intensive power sources. This positions them uniquely to offer lower-cost energy solutions for AI’s backend infrastructure, contrasting with Big Tech’s move towards renewable energy and vertically integrated operations.

As AI’s energy demands potentially outpace current projections, bitcoin miners’ cost advantage in electricity could become increasingly significant, prompting a shift towards providing high-margin AI services, particularly in GPU provisioning.

Companies like Hive, Hut 8, and Applied Digital are leading this transition, with some reporting substantial revenue growth from AI-related operations compared to traditional bitcoin mining.

For instance, Hive’s AI operations are notably more profitable on a per-megawatt basis. However, despite the promising shift and potential for revenue diversification, bitcoin miners face challenges in scaling up for AI, including skills gaps in data center construction, the need for a specialized salesforce, and limitations imposed by network latency and bandwidth in remote locations. These hurdles could impede their pivot to AI, despite the opportunities in the sector.

Notable Blockchain Use Cases Emerging Across the AI Landscape

Public blockchains and crypto token incentives have already sparked solutions addressing several pressing needs for progress across the AI landscape:

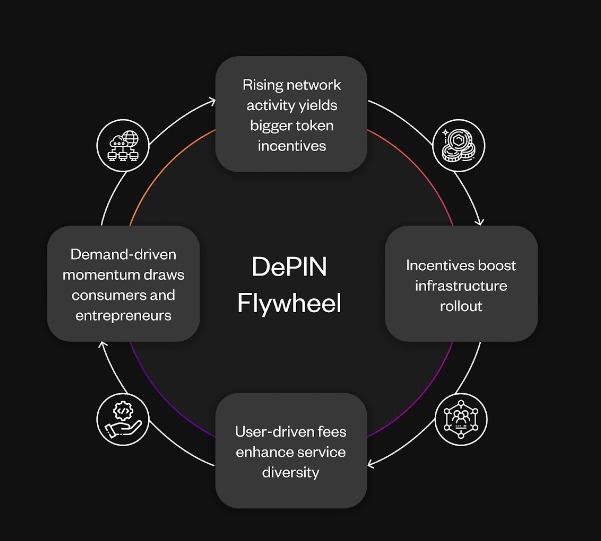

Decentralized Compute/Infrastructure

Projects like Akash, Render and Bittensor provide decentralized cloud computing platforms and infrastructure to help supply scarce GPUs for AI model training and deployment. This helps to pull down current limitations around access, cost, security, and customization options.

Model Optimization

Protocols like Numerai use tokenized incentives to organize data science competitions aimed at building optimized models for tasks like quantitative finance or natural language processing. Crypto tokens reward the most accurate and effective models.

Data Integrity

Emerging zero-knowledge proof solutions from startups like MODA allow AI model owners to mathematically prove certain claims about data usage or model performance without revealing proprietary intellectual property or sensitive information. This supports copyright protections and model accountability.

Digital Identity

Initiatives like WorldID (with its Worldcoin cryptocurrency) – spearheaded by AI thought leader Sam Altman from OpenAI and Sora – controversially leverage blockchain and biometrics to establish verified digital identity firmly linked to real humans. As automation increases, reliably determining humanity could help ensure security for computer networks and systems.

Conclusion

In summary, crypto-based networks already demonstrate clear potential to overcome some of the hardest barriers holding back innovation and mainstream adoption in artificial intelligence. However, integrating these two exponentially advancing technologies comes with persistent technical and adoption challenges.

If solutions continue maturing at their current brisk pace, crypto and AI seem well positioned to drive tremendous value for one another over the next 7 to 10 years. But uncertainties and speculation still cloud the most aggressive growth projections put forth. According to VanEck, the base case for 2030 remains strong, but the roadmap to billions in annual revenue still requires some visionary bets on both technologies to pay off.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)