Introduction

The year 2025 started with another a AI bombshell. Mayhem struck financial markets as the US hegemony over the next generation of artificial intelligence was cast in serious doubt by a new challenger who only had $10 million funding, breaking confidence in the market valuation of OpenAI, nVidia, Google and Microsoft..

DeepSeek, a Chinese AI start-up founded in 2023, shocked the tech world when it released its open-source model, DeepSeek R1, in January. The model offers ChatGPT-like performance at a very low cost. It quickly topped the charts in global mobile app downloads, with India providing the highest percentage.

Is DeepSeek’s R1 model a real threat to Silicon Valley? Is it as cheap to train as reported? Will it further affect the financial and crypto markets? Can it democratize cheaper AI adoption and connect with Web3 protocols? Questions questions questions. Let’s dig in.

DeepSeek’s R1 Launch Causes Tremors

DeepSeek’s R1 launch shook the U.S. tech industry, particularly the AI sector. It was released days after U.S. President Donald Trump announced the creation of the Stargate Project, a partnership between OpenAI, SoftBank, and Oracle to build the largest AI infrastructure in the United States of America. The private partnership plans to invest $500 billion in the project.

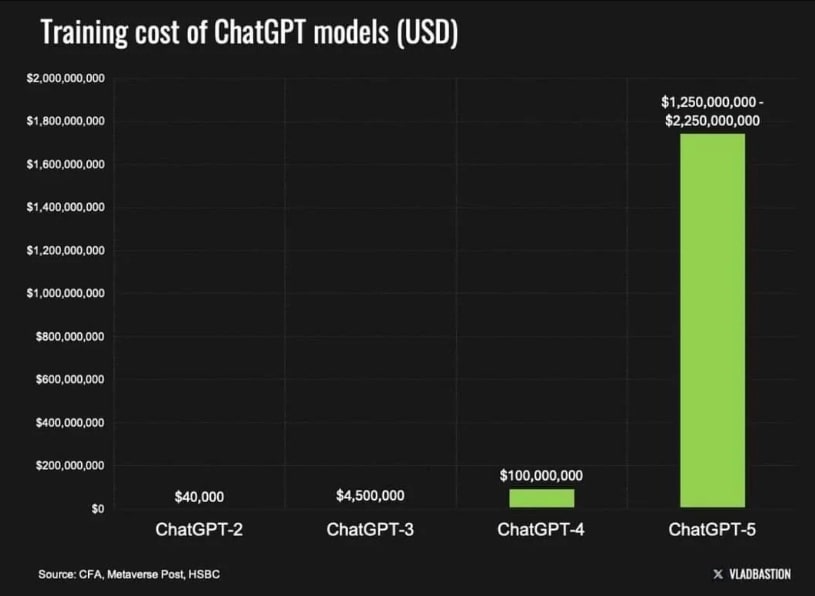

Yet, DeepSeek caused tremors when it said it spent less than $6 million to train its models. This is 50 times cheaper to run than its U.S. competitors.

Scientists have been thrilled by its performance. They say that its performance in chemistry, mathematics, and coding is comparable to that of OpenAI o1.

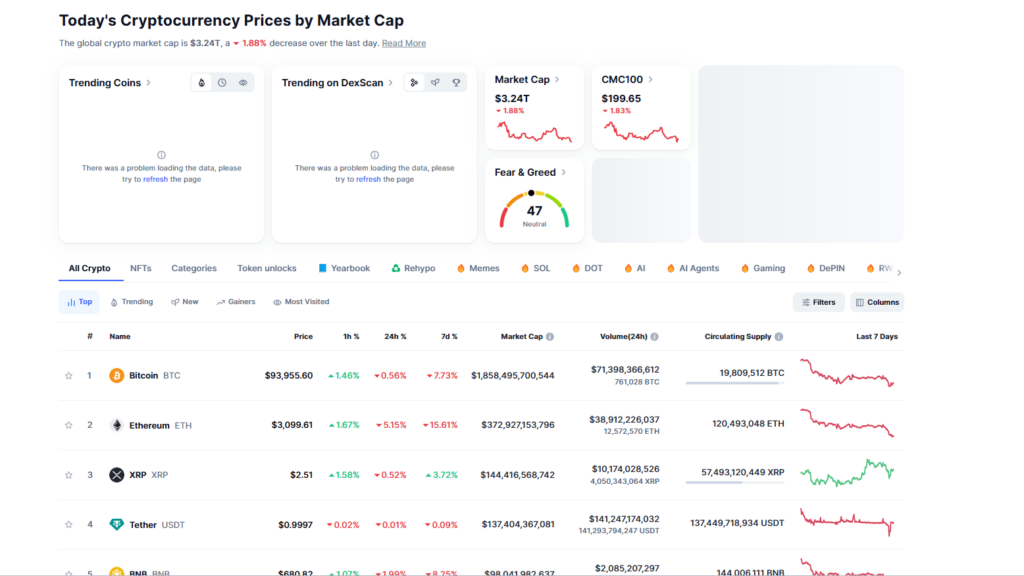

The cost-efficiency of DeepSeek’s R1 model rattled investors and financial markets suffered major losses. Nvidia Corporation, a leader in the AI sector, tanked 17% and wiped off $579 billion from its market cap: the largest single-day fall in market cap of any company in the history of the stock market. The Nasdaq, a tech-heavy stock market, lost over $1 trillion as other AI competitors recorded losses.

But was this fear justified? Or is the launch of DeepSeek’s R1 model something the AI market should have anticipated? After all, the global AI race is heating up, with new artificial intelligence advances to be expected from the competitors.

The USA has expressed privacy concerns associated with DeepSeek and a senator has introduced a bill that could criminalize downloading the app.

DeepSeek R1’s Impact on AI Markets

DeepSeek’s R1 has disrupted the AI markets and could force other startups to rethink their strategies, but the stock market sell-off was a once-off event.

Investors are questioning if they need to invest large sums of investments into AI when DeepSeek signals a shift toward more open and cheaper models.

If new AI models require fewer GPUs for training and inference, major chipmakers like Nvidia could face slower demand growth. However, despite higher efficiencies, the demand for computing power won’t decrease. The winners in the new shift are end users and AI application providers. They benefit from increased model availability and lower API costs. On the other hand, proprietary model providers (like OpenAI and Anthropic) face increasing pressure as free and customizable alternatives emerge.

These are still early days, but companies like OpenAI may need to rethink their business strategies to stay competitive.

Implications for Crypto: Risks and Opportunities

The financial bloodbath caused by DeepSeek’s R1 model extended beyond the stock market to the crypto industry, turning its markets upside down.

Apart from the fluctuations normal to the crypto industry, there are special opportunities and risks presented by DeepSeek.

Let’s start with the opportunities.

Affordable AI Agents

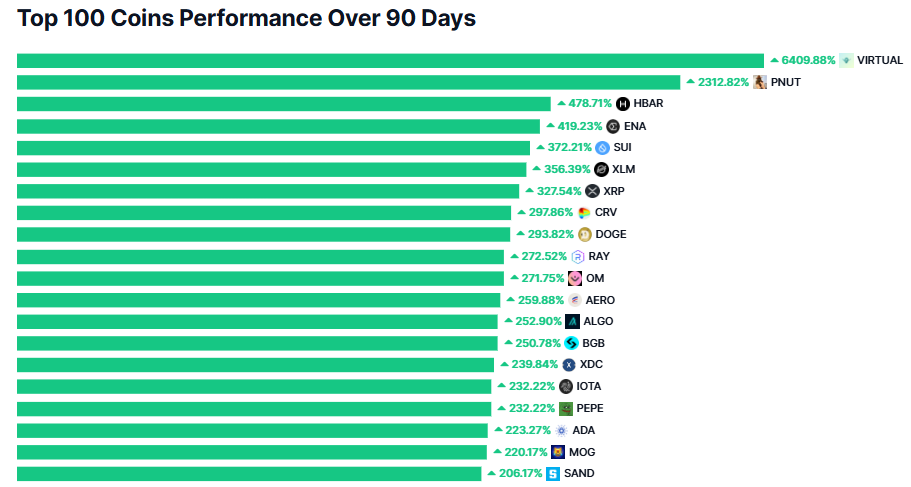

DeepSeek can help accelerate and democratize AI development, something that could benefit everyone. For the crypto industry, an early benefit will come in the form of cheaper AI agents. These agents can analyze top altcoin charts and handle tasks such as trading, portfolio management, and risk management.

Accelerated AI Adoption

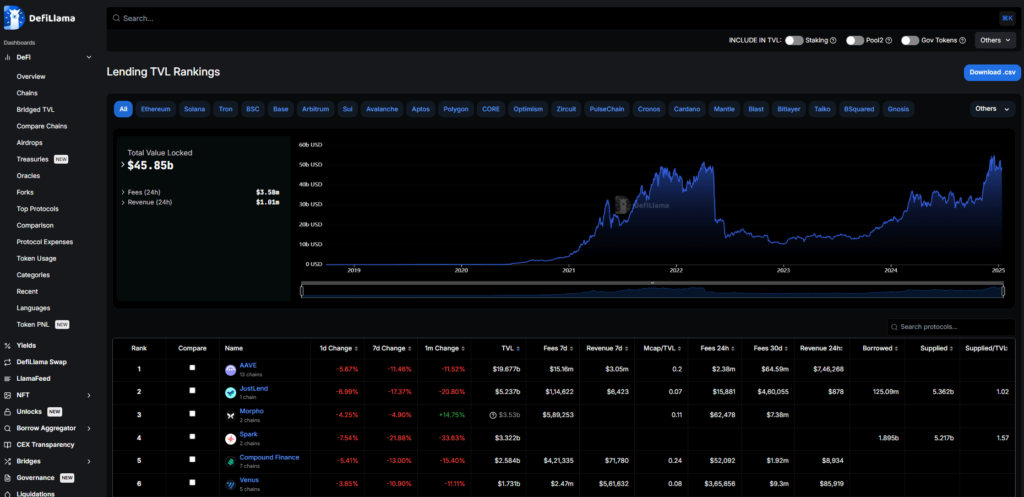

DeepSeek’s cost-efficiency and open-source model could accelerate the integration of AI into crypto sectors such as DeFi, blockchain security, and on-chain intelligence.

Democratization of AI

Many startups have been using proprietary AI models, making it impossible for smaller firms to compete in this market. However, the open-source nature of DeepSeek could lower the barrier to entry and open the crypto market to cheaper and innovative players.

Lower Inflation

The low-cost nature of DeepSeek AI may help reduce inflation, favoring non-AI-linked assets such as Bitcoin over ones affected by the recent downturn in the AI market.

A Flurry of Scam DeepSeek Tokens

Anyone who has been in the crypto industry more than a minute knows that scammers appear after any hype wave as surely as flies follow cows.

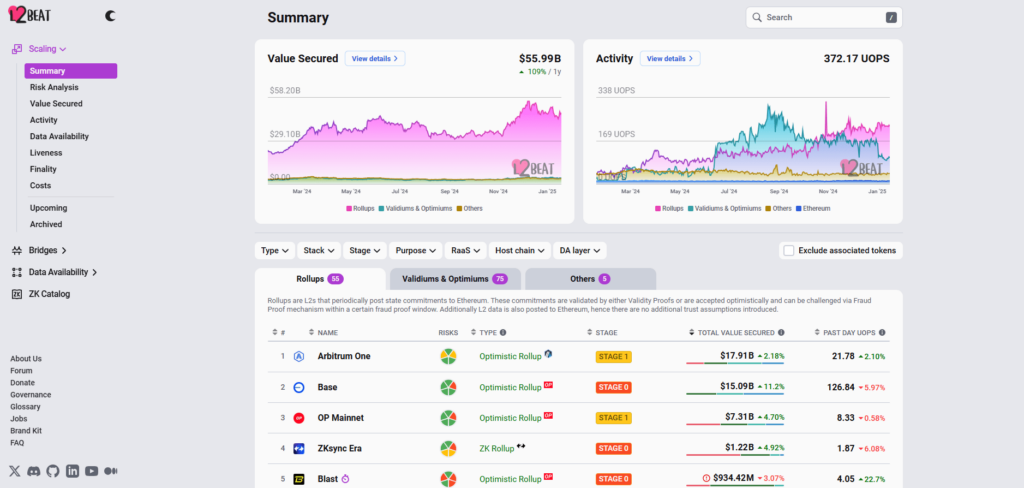

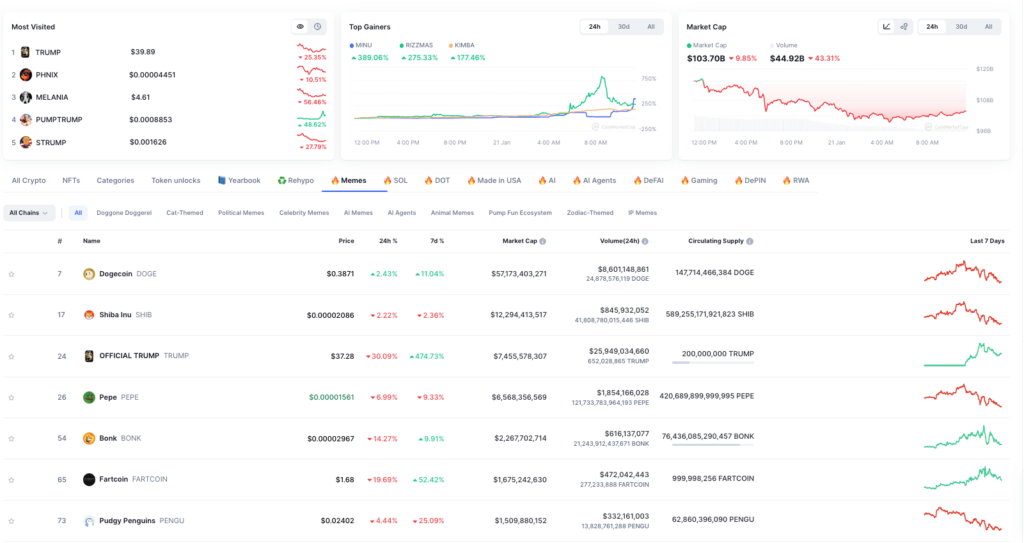

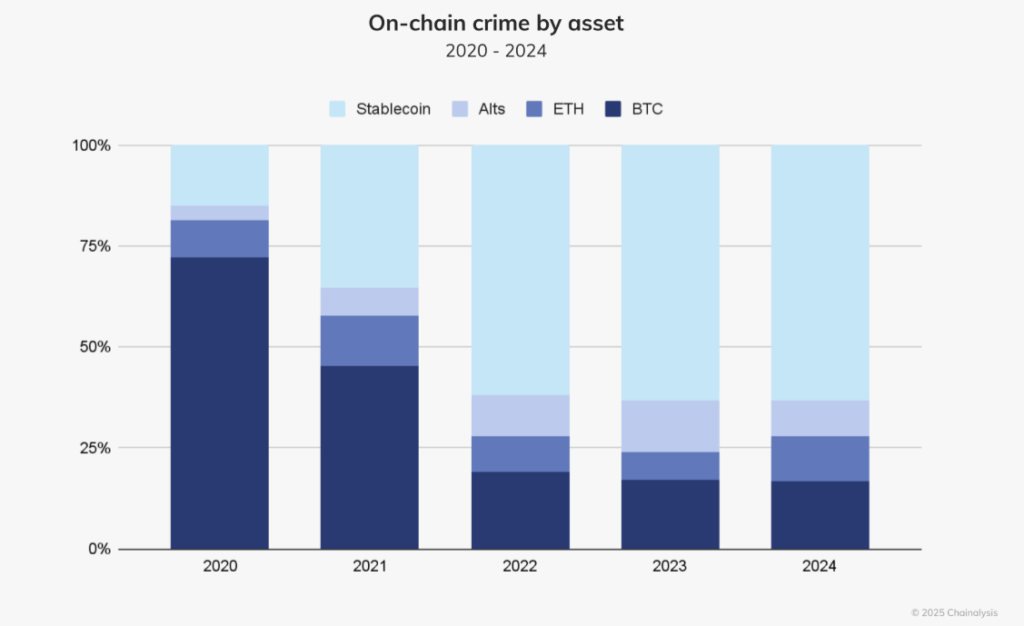

The popularity of DeepSeek’s R1 brought out grifters, with many of them launching scam tokens claiming to be associated with DeepSeek. These tokens were seen on Ethereum, Solana, and other layer-1 chains. A Solana-based DeepSeek fake token reached a market cap of $48 million before cooling off while the other peaked at $13 million. There are even many more.

In these instances, traders should check for official announcements from DeepSeek to avoid falling victim to scam pump-and-dump schemes.

Are We Entering the Golden Age of Crypto AI?

The launch of DeepSeek’s R1 model could represent a new chapter in AI development. Although SemiAnalysis argues that DeepSeek spent as much as over $500 million to train its model instead of the reported $6 million, its emergence points to a future that favors cheaper, scalable AI models. In true crypto fashion, this should lead to volatility and tons of scam projects.

However, a new future is being built, with many new crypto startups potentially using DeepSeek’s blueprint to launch blockchain-specific AI models and AI agents.

We are not yet in the golden age of AI, but these are crucial steps toward it.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)

BNB (@cz_binance)

BNB (@cz_binance)