Introduction

While Bitcoin has had its moment this year, most crypto traders have one wish for Christmas: the arrival of altcoin season when green candles fly across the market. The mood has shifted and many are thinking the crypto gods have ushered in altcoin season.

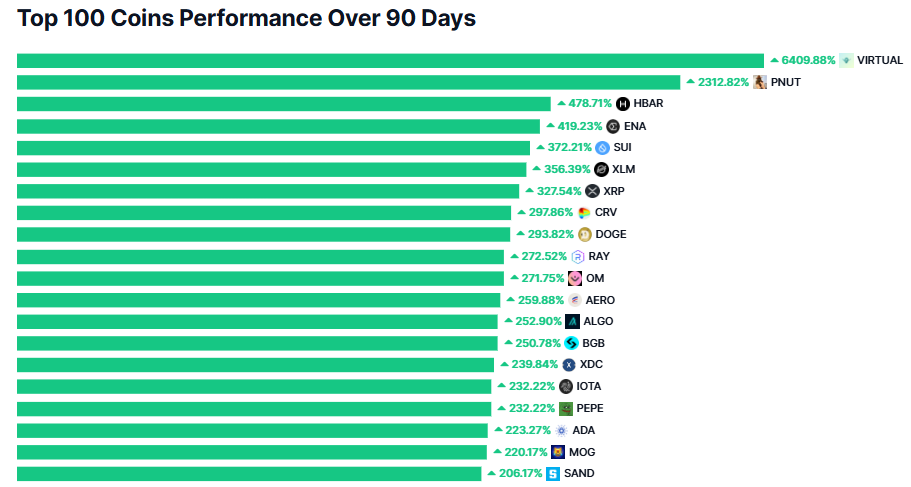

Altcoins are making a strong comeback, with some old coins, ‘dinosaur’ coins like XRP, HBAR and XLM, notching crazy gains. The industry, which has suffered at the hands of regulators, is about to catch a break as the USA shifts its regulatory stance on crypto.

World Liberty Financial, a company linked to President-elect Donald Trump has splashed millions buying altcoins – Ethereum, LINK, and AAVE. Is it time for the ‘Number Go Up’ memes?

With fresh optimism in the market, let’s check the signs and trends to assess whether the altcoin season is approaching or has started.

You don’t want to be late to the bull market’s ‘altcoin season’ party.

What is the Altcoin Season?

Altcoin season refers to a market phase where altcoins outperform Bitcoin on price appreciation. Historically, these periods have been marked by dramatic gains for smaller and less established coins, as traders and investors diversify away from Bitcoin in search of higher returns.

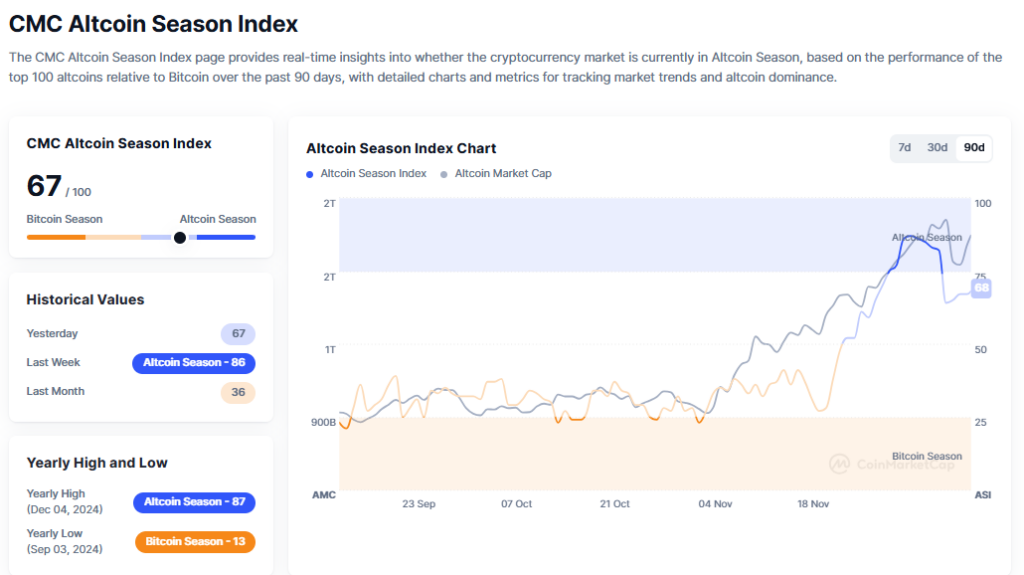

To identify altcoin season, crypto analysts often use the ‘Altcoin Season Index’. This index evaluates the performance of the top 100 altcoins relative to Bitcoin over a specified period. When a significant majority of altcoins outperform Bitcoin, the index signals that altcoin season has started.

The Altcoin Season Index

CoinMarketCap, the world’s leading crypto price tracker, has an Altcoin Season Index which measures the performance of the top 100 altcoins against Bitcoin over the past 90 days. This index helps determine if an altcoin season has truly started.

Currently, the index sits at 62/100, a decline from the first week of December, with a peak of 87/100 on December 4. Here’s how to interpret these numbers:

- A score of 75/100 or higher signals an altcoin season.

- A score of 25/100 or lower suggests a Bitcoin-dominated market.

While the altcoin season hasn’t officially arrived, the spike to 87/100 on December 4 indicated strong momentum for altcoins. However, a market dip on December 10 caused a dip in the index, leading to losses for several major altcoins.

Still, based on historical trends and Bitcoin’s current dominance, this could simply be the beginning stages of an altcoin season.

What are the Phases of an Altcoin Season?

Altcoin season typically unfolds in several distinct phases:

Phase 1: Bitcoin Dominance

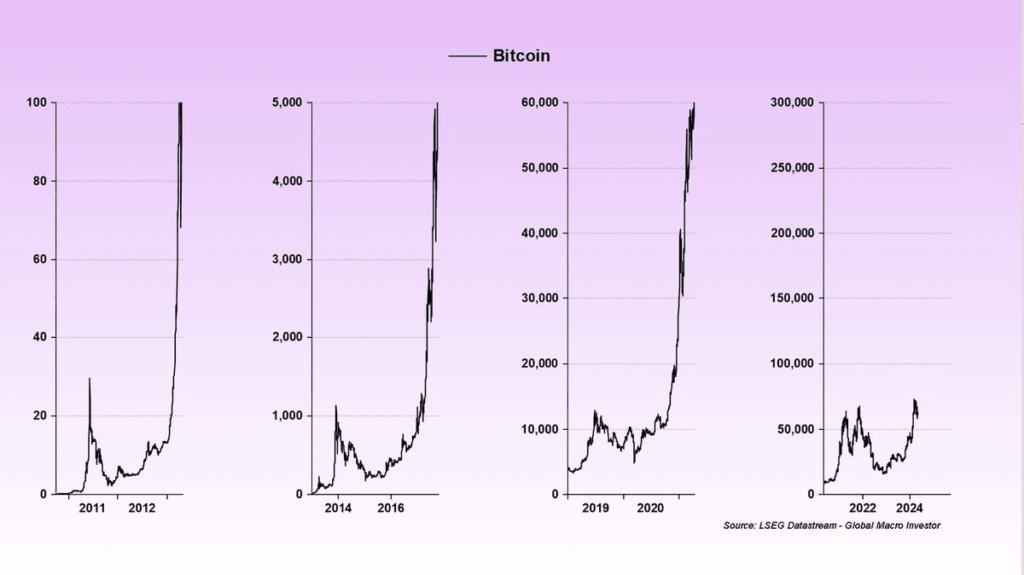

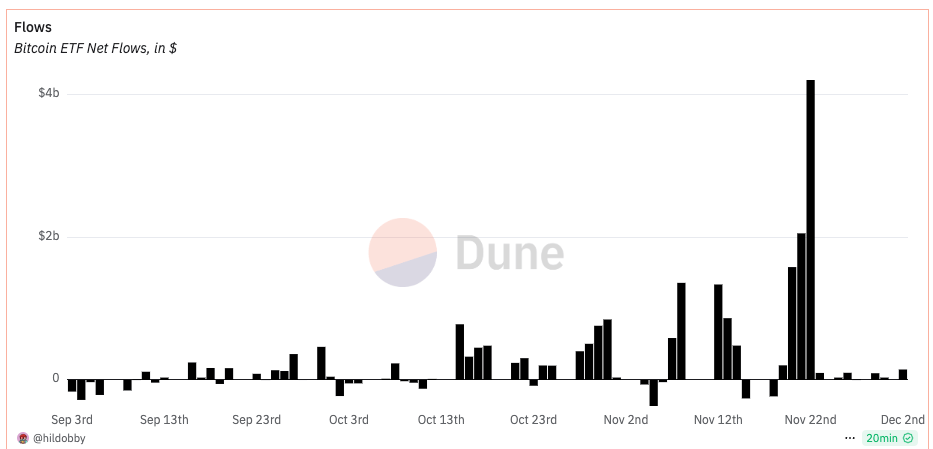

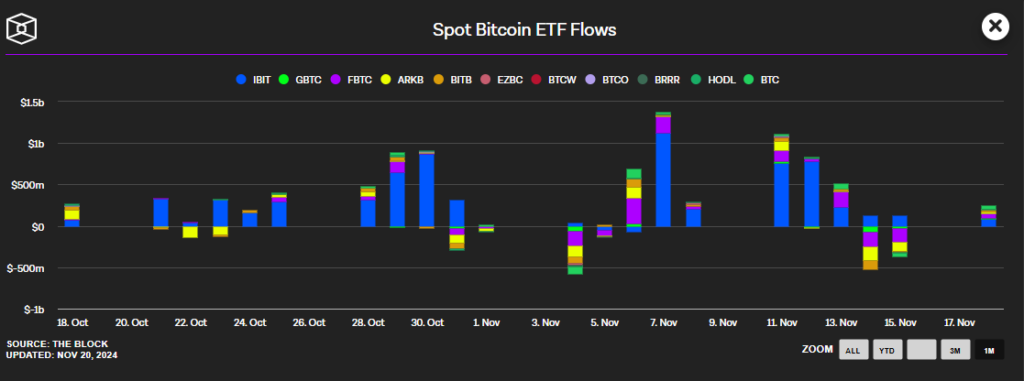

Traders often first move capital into Bitcoin, seeking stability. This cycle, it’s clear why. The approval of spot Bitcoin ETFs in the USA has brought in over $104 billion in assets. This surge helped Bitcoin break the $100k barrier, and even led The Financial Times to apologize for doubting Bitcoin.

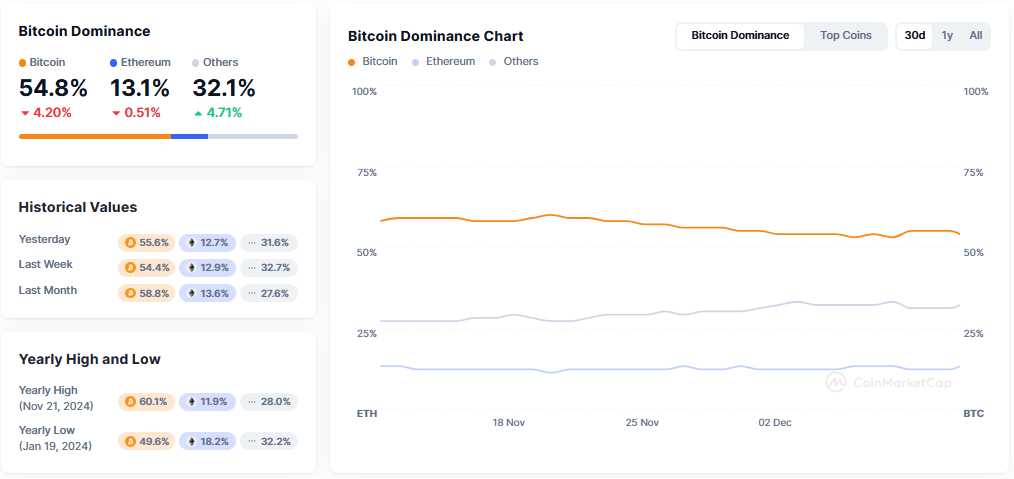

Bitcoin’s dominance has dropped from 60.1% to 54.8%, as altcoins begin to make big moves. While altcoins are still taking small steps, they are moving closer to a full-blown season.

Phase 2: Ethereum Gain Momentum

Traditionally, Ethereum would attract the next major capital inflows. But this cycle has been different. Dinosaur coins like XRP, Cardano (ADA), and Stellar have surged back to life. Solana has already reached a new high. Ethereum started the uptrend quietly, but has since regained momentum, pushing toward a new high.

Meme coins have also captured a large share of the market gains. Perhaps it’s because meme coins are simple to understand and less complex than other altcoins.

Phase 3: Large-Cap Altcoins Rally

Attention shifts to large-cap altcoins as they see a surge in trading volumes. Now, dips are seen as opportunities. Traders with dry powder add to their bags.

Phase 4: Speculative Mania in Smaller Altcoins

Finally, everyone feels like a genius, and traders throw caution to the wind. Smaller-cap altcoins explode in value, driven by FOMO and ‘wen lambo’ posts on social media.

Always keep in mind that not all cycles are the same. History may not repeat itself, but it rhymes.

What Comes Next

The last major altcoin season occurred in the first half of 2021. During that time, the top 100 altcoins outperformed Bitcoin and lowered its dominance from 61.9% to 40%.

Altcoins like BNB, Dogecoin, XRP, and Chainlink (LINK) hit new highs, with many outpacing Bitcoin for nearly five months. However, gains weren’t spread evenly. Altcoins tied to hot trends such as DeFi, Layer-1 blockchain, and Play-to-Earn (P2E) saw the most growth, while others lagged.

The market conditions now mirror those of 2021, suggesting Bitcoin’s dominance could drop to around 40% as altcoins continue to gain.

How to Prepare for the Altcoin Season

Traders need to prepare for the altcoin season. Here are some tools to monitor an altcoin season to avoid round tripping profits (or handing them back).

- Altcoin Season Index: keep track of how altcoins are performing.

- Sentiment analysis – monitor social media trends and investor sentiment to gauge potential shifts.

Investors should start building their thesis and identifying narratives that will fly as the altcoin season strengthens. The biggest crypto narratives to watch are as follows:

- Real-World Assets

- AI and decentralized physical infrastructure (DePIN)

- DEXs

- Memecoins

- Layer-1 and Layer-2 chains

Plan your entries and exits accordingly as nothing goes up forever.

What Drives the 2024 Bull Run and Altcoin Season?

These factors are driving the 2024-25 bull run:

- Institutional interest: The approval of spot Ethereum and Bitcoin ETFs has triggered a surge in institutional investment and improved liquidity and credibility.

- Change in monetary policies: The U.S. Federal Reserve’s interest rate cuts have created a favorable environment for riskier assets like Bitcoin and altcoins.

- Political factors and regulatory environment: The recent U.S. elections have sparked optimism among crypto investors, with hopes of pro-crypto policies under President Trump.

- Seasonal trades: The fourth quarter has historically been bullish for cryptocurrencies, with investors accumulating in anticipation of year-end rallies.

Conclusion

The altcoin season is taking shape, with the foundation laid for a rally. The 2024-25 bull market will differ from previous ones, driven by a regulatory shift in the USA and the rise of institutional players through Bitcoin and Ethereum spot ETFs.

Some altcoins have already hit new milestones: Bitcoin is hovering around $100,000, and the altcoin season index has poked its head onto the upper reaches of the graph. However, expect a lot of volatility, and as always, don’t put all your eggs in one basket.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)