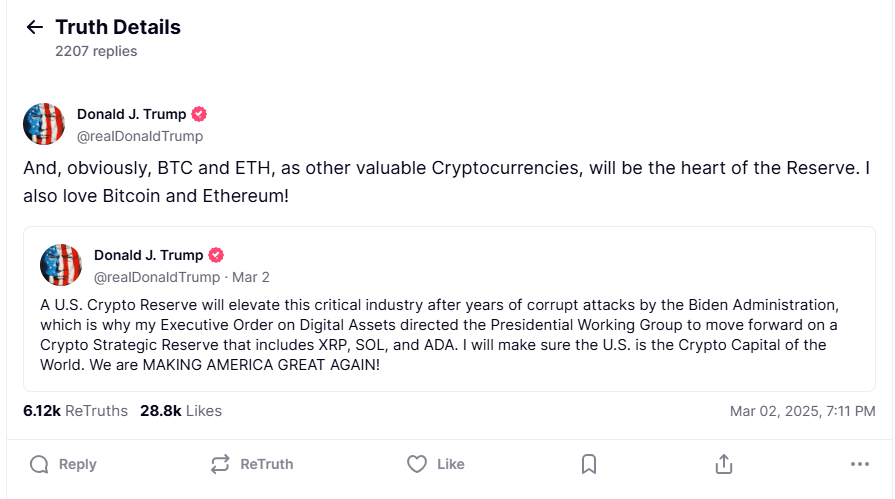

President Donald Trump’s transition from skeptic to supporter has been a double-edged sword for the cryptocurrency sector. Initially heralded as its savior after his surprising endorsement of Bitcoin in 2024, Trump’s presidency failed to ignite crypto markets in 2025, and his cynical $TRUMP and $MELANIA meme coin cash grabs stripped billions from retail investors.

On one hand, Bitcoin jumped from around $70,000 in early November to a historic high of $109,356 on January 20, 2025, the day of his inauguration. However, his tariff wars have negatively impacted the crypto industry: Bitcoin tumbled nearly 30% from its peak to $76K before recovering above $85K

President Trump has hardened his stance on tariffs, and their impact is still unfolding. It is important for crypto stakeholders to understand how these tariff wars affect the industry going forward.

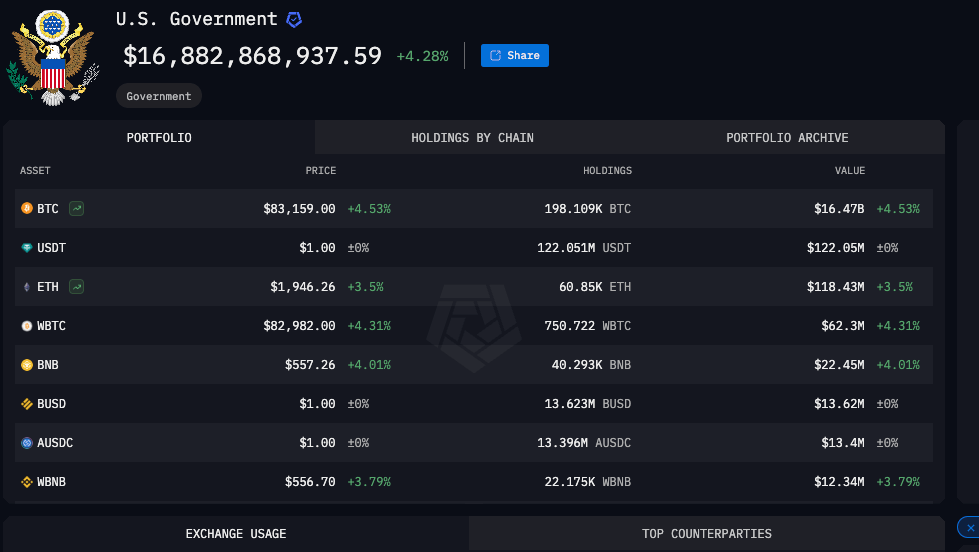

While the crypto industry cheered Trump’s Bitcoin Strategic Reserve, his tariffs could be the kryptonite to the 2025 Bull Run.

What Are Tariffs?

Tariffs are taxes imposed by governments on imported goods or services. They aim to protect domestic industries by making foreign products more expensive, hence encourage consumers to buy local products.

President Trump says tariffs will protect local jobs, increase revenue, address trade imbalances, and grow the U.S. economy. Critics argue that tariffs lead to higher inflation, disruption of global supply chains, and slow down economic growth.

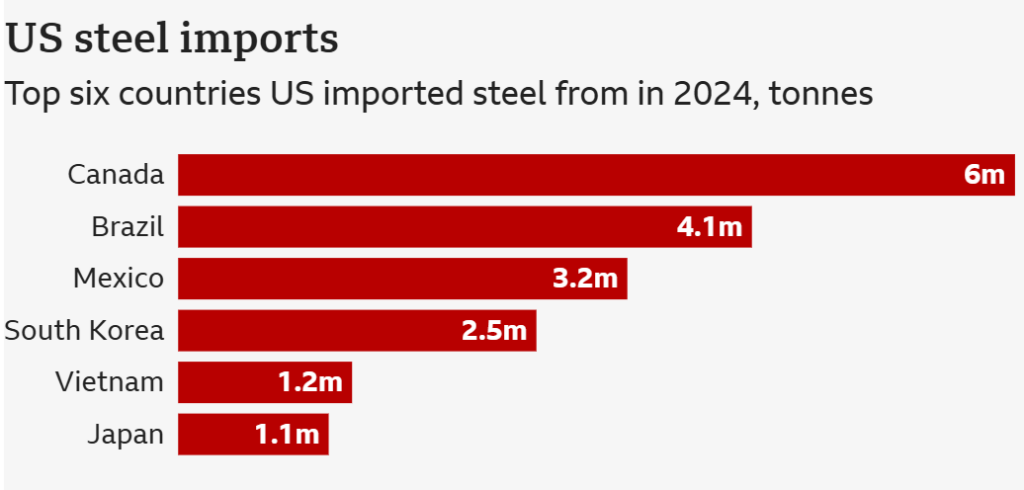

President Trump’s tariffs have threatened or targeted countries like China, Mexico, Canada, and the EU.

Impact of Trump’s Tariff War on Crypto

Trump’s tariff war has led to global macro uncertainty due to heightened trade tensions, disrupted supply chains, and fears of a global recession. The U.S. Secretary of Commerce, Howard Lutnick, conceded that tariffs are worth it even if they trigger a recession.

Targeted countries have taken retaliatory measures, driving short-term volatility as investors weigh risks.

Here are the implications of Trump’s tariff war on crypto:

BTC Price Volatility

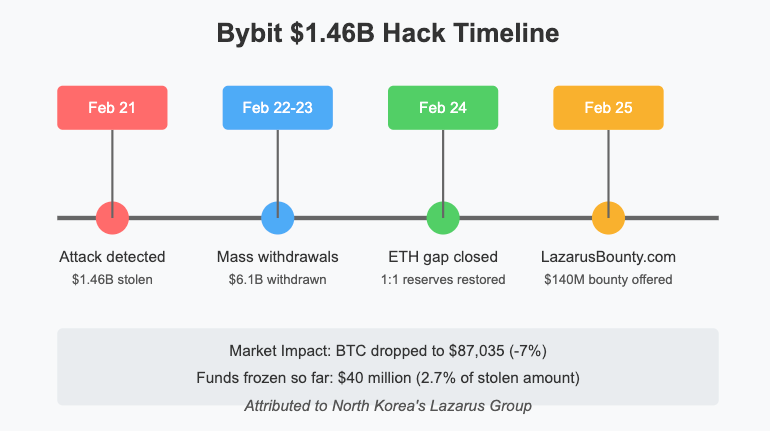

Trump’s tariff war has had a direct impact on Bitcoin’s price, causing wild swings. When Trump ignited trade wars in February, the crypto market tanked, with investors losing anywhere between $2 billion to $10 billion in liquidations.

Bitcoin’s price dipped between 5% and 10% following following tariff announcements and swung in the $92K-$100K range as the market reacted to tariff delays, then crashed to bellow $78k before rebounding after bullish CPI inflation numbers. This highlights how the crypto market has become sensitive to macro policy shifts. With the tariff wars, when will Bitcoin hit $100K again? No one knows right now.

The unpredictability of trade wars makes it difficult for investors to plan by gauging future price movements, contributing to increased volatility.

Consumption Slowdown

Tariffs lead to higher costs for businesses and consumers as they disrupt global trade channels. This has several trickle-down effects in crypto.

The economic strain can force investors and businesses to tighten the purse when it comes to crypto. Businesses may delay their involvement in buying Bitcoin or altcoins until the dust has settled. Tariffs also dampen retail investors’ sentiment, pushing them to remain sidelined until the trade wars have calmed down.

Overall, tariffs suck liquidity out of the crypto market and reduce the buying pressure.

Inflation and Fed Policy

President Trump’s tariff war has also raised concerns about inflation, as trade barriers push up the costs of imported goods.

Federal Reserve Chair Jerome Powell says U.S. inflation won’t slow down this year due to Trump’s tariffs. This is a concern for crypto investors, as Powell claims these tariffs could delay the central bank’s progress toward reaching the 2% annual inflation target before it can lower interest rates. The Fed held the benchmark rates steady in March as it is reluctant to take a policy shift.

Trump has acknowledged that Americans will feel “some pain” due to his tariff war. With rising inflation, investors will likely steer clear of risky assets such as Bitcoin and possibly flee to safe-haven assets such as gold, which rose to an all-time high of $3,052 per ounce on March 19.

Market Risks

Tariff-induced fears have led to increased selling pressure as investors may be less willing to hold crypto assets. However, Bitcoin could regain its appeal as a long-term inflation hedge if the market stabilizes.

Why is Trump Engaging in Tariff Wars?

Donald Trump’s tariff wars stem from a mix of economic, political, and ideological motivations, though his administration has presented conflicting rationales.

Protectionism

He claims tariffs will boost domestic manufacturing by penalizing foreign competitors. Trump also wants to minimize US reliance on imports and generate revenue to offset federal debt.

Additionally, he argues that other nations levy higher tariffs on the U.S., and his trade war is meant to level the playing field. He also uses tariffs as retaliatory measures.

For example, President Trump threatened to double the tariffs on steel and aluminum when Canada hiked the costs of energy exports to the U.S. Canada, the largest exporter of steel to the U.S., reversed its plan.

For Bitcoin miners, access to cheap electricity is a must. Additionally, miners are feeling the squeeze as they import most of their hardware from China. They are also facing delays.

However, the companies that make Bitcoin mining equipment can set up shop in other countries to avoid tariffs and delays.

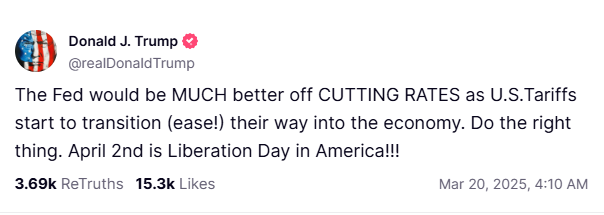

Trump Wants to Force the Fed’s Hand

Observers speculate that Trump uses tariff-induced inflation and economic slowdown to pressure the Fed into rate cuts. The Fed Chair has already said the tariffs are driving up inflation, leading to heightened recession fears.

Trump argues that the rate cuts would offset the economic strains and is betting that the slowed growth will force the Fed to lower rates.

Will Bitcoin Become Tax-Exempt?

Trump wants the revenue generated from higher tariffs on imported goods to fund tax cuts. While this plan may face opposition, tariffs may be used to cover tax cuts. It could benefit Bitcoin holders as cryptocurrencies will be subject to lower taxation, with the chances of being tax-exempt a bit far off, but still possible.

Wrapping Up

President Trump’s tariff wars are impacting the crypto industry as much as the entirety of the financial markets. Analysts speculate that Trump is using tariffs to force the Fed to cut rates. Conversely, the Federal Reserve is blaming Trump for increasing inflation, but signs are that it will start quantitative easing (QE) soon.

Until the smoke begins to clear, it is certain that tariff wars will continue to impact Bitcoin and the crypto industry negatively. However, Trump’s impact on crypto extends beyond tariffs and with a mandate to boost the US sector to lead the world, he likely has a long-term plan in place to build the market up again.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)