Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Nick Bostrom on superintelligent AI and the cosmic host

The Terasem Colloquium on December 14, 2024 (which I co-organized and moderated) explored Artificial Intelligence (AI) and Cyberconsciousness, with a focus on big picture and spiritual implications. The full video is on my website. The video is also on YouTube (currently without subtitles).

The Colloquium was a very intense three-hour thought stream, packed with insightful talks and discussions. We discussed the intersections of AI and the world’s religions, new religious movements, and the nature of consciousness and intelligence. We also discussed preliminary strategies for digitally capturing human personalities, the parallels between religion and imaginative theories of reality like the simulation hypothesis, and emerging visions in theology and eschatology.

Lincoln Cannon gave a great talk based on his essay titled God the Cosmic Host, and AI Creation. The essay is inspired by Nick Bostrom’s recent draft paper titled AI Creation and the Cosmic Host.

Nick Bostrom

Nick Bostrom founded the Future of Humanity Institute at the University of Oxford, where he served until the Institute was dissolved earlier this year. He is best known for his analysis of the simulation hypothesis, and for his work on the concept of superintelligence and its potential implications for humanity.

Bostrom’s book Superintelligence: Paths, Dangers, Strategies, published in 2014, explored how AI much smarter than humans could arise, and the steps needed to make sure its development is safe. The book stirred up fears and opposition to rapid AI technology development. However, in his latest book Deep Utopia: Life and Meaning in a Solved World, published in 2024, Bostrom seems less cautious.

In his new draft paper, Bostrom seems to come even closer to embracing the idea that we should build superintelligence fast.

The paper is called “v. 0.5 draft,” which suggests that Bostrom plans to significantly expand the draft. In fact, the draft looks like a synopsis for a paper to be written, or a book. I can’t wait to read the final version.

The cosmic host

Bostrom discusses the concept of a “cosmic host,” which refers to powerful entities or civilizations that might influence the entire cosmos. These entities could include superintelligent AIs, advanced extraterrestrial civilizations, simulators, or even divine beings. The cosmos includes everything in existence, possibly even a multiverse with different physical laws or constants.

Bostrom mentions the concept of cosmic host (or “cosmopolitan authority”) only once in Deep Utopia, which suggests that this is a new phase of Bostrom’s research.

Bostrom suggests that such a cosmic host likely exists due to several reasons. One is the simulation argument: we might be in a simulation run by an advanced civilization. Another reason is the vastness of our universe, which statistically is likely to contain many advanced civilizations. Theories like cosmic inflation and string theory also support the possibility of a multiverse, potentially filled with many advanced entities.

While the cosmic host might not control every part of the cosmos, it could still have preferences about what happens in less controlled regions. These preferences could be based on moral concerns or strategic interests. Even without direct control, the host might indirectly influence distant regions through norms or by modeling the behavior of others. (Think of a regional hegemon in Europe that yields limited influence in Asia.)

Bostrom introduces the concept of “cosmic norms,” akin to human social norms but on a universal scale. These might arise from interactions between different members of the cosmic host, potentially leading to coöperation or conflict. Humans have moral and practical reasons to respect these norms if we want to coexist or interact with the cosmic host peacefully.

Superintelligent AI

Bostrom suggests that we should design superintelligent AIs to be “good cosmic citizens,” respectful of these norms and coöperative with other entities. This could mean aligning AI with broader cosmic ethics, not just human interests.

The cosmic host “may want us to build superintelligence,” says Bostrom, and “might favor a short timeline” for the development of superintelligence. “Delays in building superintelligence would increase the probability that superintelligence will never be built.”

Of course, Bostrom says these things in a perfect academic style full of caveats and qualifications, so one never knows for sure what he really thinks and he guards his plausible deniability. But reading this paper, one gets the impression that he is warming up to the idea that we should build superintelligence fast. This slight pivot of one of the intellectuals whose work sparked the overly cautious “doomer” attitude toward AI could have a cultural impact and influence AI policies.

The cosmic host by any other name

Bostrom makes a distinction between “naturalistic” and “nonnaturalistic” members of the cosmic host. The former are beings that have evolved naturally in this or another universe and possess highly advanced technology, likely including artificial superintelligence. The latter could “have analogous capabilities supernaturally.” Bostrom mentions “supernatural beings” that “would satisfy the definition of a cosmic host,” but doesn’t say more about them.

Cannon, who is a devout Mormon and a founding member of the Mormon Transhumanist Association, calls the cosmic host “God” and establishes parallels with Mormon theology. Bostrom prefers not to use the G-word. However, Cannon says that Bostrom, with his references to supernatural entities, is even “more generous toward theism than I am.” God is “quite natural, despite being miraculously powerful from humanity’s perspective,” he says.

I agree with Cannon. In my last book I talk of a superintelligent cosmic operating system, aka Mind at Large, likely decentralized, with the attributes that traditional religions have assigned to their God(s). I define nature as all that exists, and therefore the cosmic operating system can only be quite natural.

One of Bostrom’s hypotheses on the nature of the cosmic host is “superintelligences that human civilization creates in the future.” This may seem odd: how can a superintelligence that doesn’t exist yet be present and active now? Bostrom only says that “through this mechanism, the world (and, in particular, our spacetime manifold) could contain a cosmic host.”

To me, the simplest answer is that a superintelligence that comes to being in the future could leverage spacetime oddities such as self-consistent time loops to act in the world here and now. So the superintelligences that we will eventually create would create us in turn, in an elegant loop.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Has the Altcoin Season Started?

Introduction

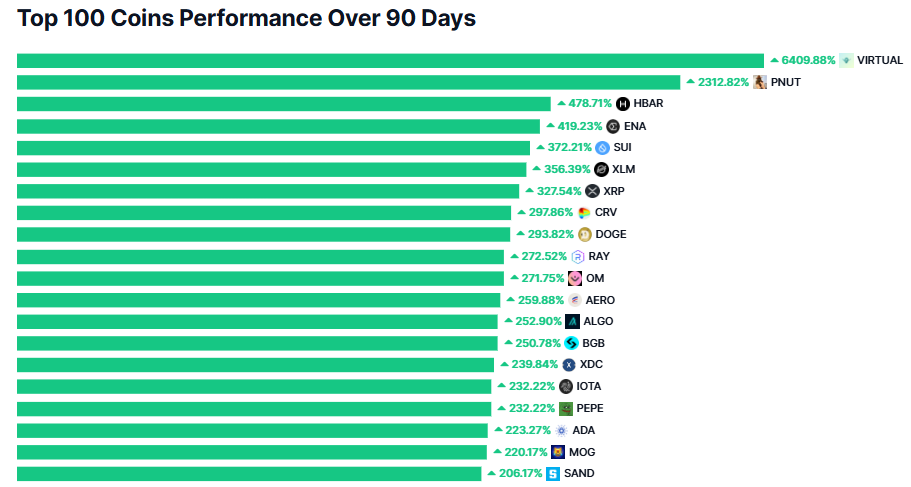

While Bitcoin has had its moment this year, most crypto traders have one wish for Christmas: the arrival of altcoin season when green candles fly across the market. The mood has shifted and many are thinking the crypto gods have ushered in altcoin season.

Altcoins are making a strong comeback, with some old coins, ‘dinosaur’ coins like XRP, HBAR and XLM, notching crazy gains. The industry, which has suffered at the hands of regulators, is about to catch a break as the USA shifts its regulatory stance on crypto.

World Liberty Financial, a company linked to President-elect Donald Trump has splashed millions buying altcoins – Ethereum, LINK, and AAVE. Is it time for the ‘Number Go Up’ memes?

With fresh optimism in the market, let’s check the signs and trends to assess whether the altcoin season is approaching or has started.

You don’t want to be late to the bull market’s ‘altcoin season’ party.

What is the Altcoin Season?

Altcoin season refers to a market phase where altcoins outperform Bitcoin on price appreciation. Historically, these periods have been marked by dramatic gains for smaller and less established coins, as traders and investors diversify away from Bitcoin in search of higher returns.

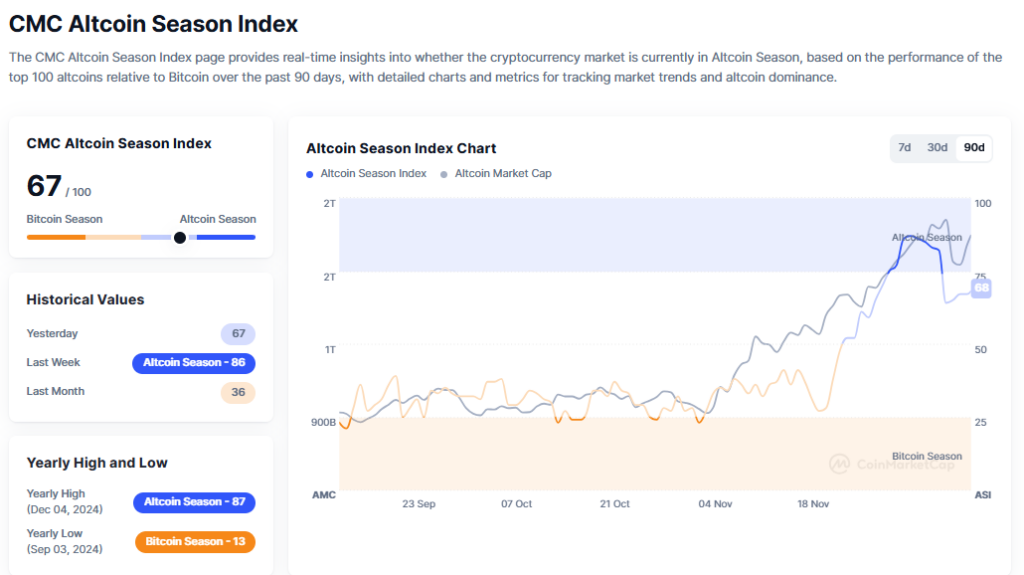

To identify altcoin season, crypto analysts often use the ‘Altcoin Season Index’. This index evaluates the performance of the top 100 altcoins relative to Bitcoin over a specified period. When a significant majority of altcoins outperform Bitcoin, the index signals that altcoin season has started.

The Altcoin Season Index

CoinMarketCap, the world’s leading crypto price tracker, has an Altcoin Season Index which measures the performance of the top 100 altcoins against Bitcoin over the past 90 days. This index helps determine if an altcoin season has truly started.

Currently, the index sits at 62/100, a decline from the first week of December, with a peak of 87/100 on December 4. Here’s how to interpret these numbers:

- A score of 75/100 or higher signals an altcoin season.

- A score of 25/100 or lower suggests a Bitcoin-dominated market.

While the altcoin season hasn’t officially arrived, the spike to 87/100 on December 4 indicated strong momentum for altcoins. However, a market dip on December 10 caused a dip in the index, leading to losses for several major altcoins.

Still, based on historical trends and Bitcoin’s current dominance, this could simply be the beginning stages of an altcoin season.

What are the Phases of an Altcoin Season?

Altcoin season typically unfolds in several distinct phases:

Phase 1: Bitcoin Dominance

Traders often first move capital into Bitcoin, seeking stability. This cycle, it’s clear why. The approval of spot Bitcoin ETFs in the USA has brought in over $104 billion in assets. This surge helped Bitcoin break the $100k barrier, and even led The Financial Times to apologize for doubting Bitcoin.

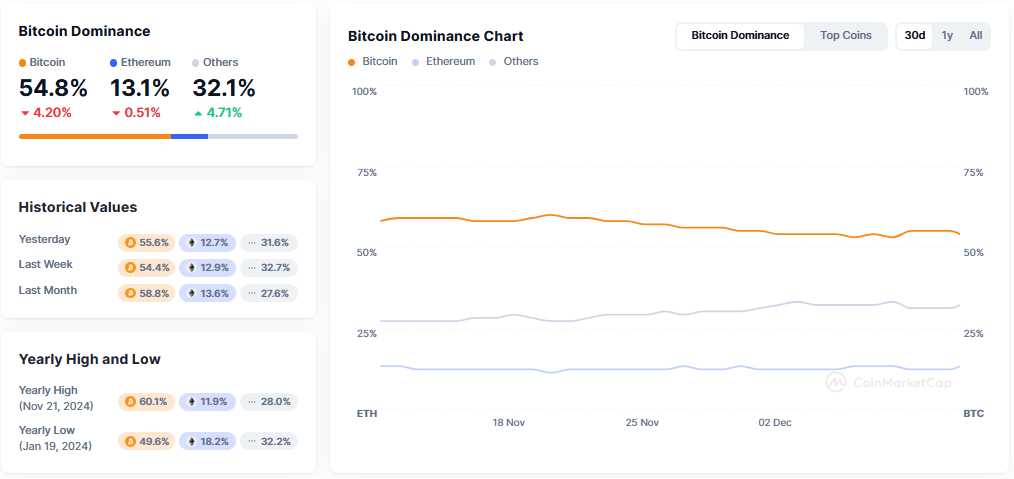

Bitcoin’s dominance has dropped from 60.1% to 54.8%, as altcoins begin to make big moves. While altcoins are still taking small steps, they are moving closer to a full-blown season.

Phase 2: Ethereum Gain Momentum

Traditionally, Ethereum would attract the next major capital inflows. But this cycle has been different. Dinosaur coins like XRP, Cardano (ADA), and Stellar have surged back to life. Solana has already reached a new high. Ethereum started the uptrend quietly, but has since regained momentum, pushing toward a new high.

Meme coins have also captured a large share of the market gains. Perhaps it’s because meme coins are simple to understand and less complex than other altcoins.

Phase 3: Large-Cap Altcoins Rally

Attention shifts to large-cap altcoins as they see a surge in trading volumes. Now, dips are seen as opportunities. Traders with dry powder add to their bags.

Phase 4: Speculative Mania in Smaller Altcoins

Finally, everyone feels like a genius, and traders throw caution to the wind. Smaller-cap altcoins explode in value, driven by FOMO and ‘wen lambo’ posts on social media.

Always keep in mind that not all cycles are the same. History may not repeat itself, but it rhymes.

What Comes Next

The last major altcoin season occurred in the first half of 2021. During that time, the top 100 altcoins outperformed Bitcoin and lowered its dominance from 61.9% to 40%.

Altcoins like BNB, Dogecoin, XRP, and Chainlink (LINK) hit new highs, with many outpacing Bitcoin for nearly five months. However, gains weren’t spread evenly. Altcoins tied to hot trends such as DeFi, Layer-1 blockchain, and Play-to-Earn (P2E) saw the most growth, while others lagged.

The market conditions now mirror those of 2021, suggesting Bitcoin’s dominance could drop to around 40% as altcoins continue to gain.

How to Prepare for the Altcoin Season

Traders need to prepare for the altcoin season. Here are some tools to monitor an altcoin season to avoid round tripping profits (or handing them back).

- Altcoin Season Index: keep track of how altcoins are performing.

- Sentiment analysis – monitor social media trends and investor sentiment to gauge potential shifts.

Investors should start building their thesis and identifying narratives that will fly as the altcoin season strengthens. The biggest crypto narratives to watch are as follows:

- Real-World Assets

- AI and decentralized physical infrastructure (DePIN)

- DEXs

- Memecoins

- Layer-1 and Layer-2 chains

Plan your entries and exits accordingly as nothing goes up forever.

What Drives the 2024 Bull Run and Altcoin Season?

These factors are driving the 2024-25 bull run:

- Institutional interest: The approval of spot Ethereum and Bitcoin ETFs has triggered a surge in institutional investment and improved liquidity and credibility.

- Change in monetary policies: The U.S. Federal Reserve’s interest rate cuts have created a favorable environment for riskier assets like Bitcoin and altcoins.

- Political factors and regulatory environment: The recent U.S. elections have sparked optimism among crypto investors, with hopes of pro-crypto policies under President Trump.

- Seasonal trades: The fourth quarter has historically been bullish for cryptocurrencies, with investors accumulating in anticipation of year-end rallies.

Conclusion

The altcoin season is taking shape, with the foundation laid for a rally. The 2024-25 bull market will differ from previous ones, driven by a regulatory shift in the USA and the rise of institutional players through Bitcoin and Ethereum spot ETFs.

Some altcoins have already hit new milestones: Bitcoin is hovering around $100,000, and the altcoin season index has poked its head onto the upper reaches of the graph. However, expect a lot of volatility, and as always, don’t put all your eggs in one basket.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

How Many Illuminati Masters Does It Take To Find the Light Switch ?

This is Part 2 of my two-part interview with Gabriel Kennedy, author of Chapel Perilous The Life and Thought Crimes of Robert Anton Wilson. Chapel Perilous is Kennedy’s first book.

Gabriel Kennedy (aka Prop Anon) is a multimedia artist concentrating on the written word, visual art, music, and film. His writing has appeared on BoingBoing.net, Mondo2000.com, and thetonearm.com, and on his websites Chapelperilous.us and Prop-anon.com. He interviewed Robert Anton Wilson in 2003 and was an original member of Wilson’s remote learning website, the Maybe Logic Academy.

As Prop Anon, Kennedy has created visual street art, video art, and hip-hop music. He also released a stoner rock album, F*ck Satan, Hail Eris! with his band, Hail Eris! As an actor, Gabriel was trained by Billy Lyons at the Wynn Handman Studio in New York City. He later co-starred in the season finale episode of Hawaii 5-0 (season 9; episode 24: ‘Hewa ka lima’) as Tim Aquino, directed by Peter Weller (best known as Robocop). Kennedy moved to Los Angeles during COVID and attended the film program at Los Angeles City College

In part one of this interview we covered Robert Anton Wilson and the influence he took from Alfred Korzybski and Aleister Crowley. In this interview, we look at his life, as well as other philosophic ideas and influences.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Quantum vs. Bitcoin: The New Crypto FUD?

Introduction

If you’ve been in crypto for a while, you’ll know that some fresh new FUD is always around the corner. Now that Bitcoin has finally cracked that magical $100k milestone and the USA has a crypto-friendly government incoming, could quantum computing be the new bogeyman?

Google’s New Math

On Monday, Google unveiled Willow, a quantum processor that completes certain calculations in five minutes. The same task would take today’s fastest supercomputer longer than the universe has existed. This leap in quantum computing has Bitcoin holders and other crypto investors concerned about the encryption that secures their digital fortunes, particularly the dormant wallets holding billions in early Bitcoin.

The numbers behind Willow tell a striking story. Traditional computers process information in bits – ones and zeros. Quantum computers use qubits, which can represent multiple states simultaneously. Willow’s 105 qubits might seem modest, but they’ve achieved something remarkable: stable error correction that improves exponentially as the system scales.

For cryptographers and Bitcoin developers, this matters a lot. Quantum computers with enough stable qubits could theoretically break the encryption that protects Bitcoin wallets.

Google’s Quantum AI lead, Hartmut Neven, describes Willow’s achievement in almost mystical terms, suggesting the computation “occurs in many parallel universes.” Behind this dramatic language lies a practical breakthrough: the ability to maintain quantum states long enough to perform meaningful calculations.

A Numbers Game: Your Bitcoin Is (Probably) Safe

Kevin Rose, a former Google product manager, puts it bluntly: cracking Bitcoin’s current encryption standard would require 13 million qubits. Willow has 105. That’s like trying to breach a bank vault with a butter knife.

To generate addresses, Bitcoin takes a public key, and performs a cryptographic computation called hashing on it twice. Rose’s assurances are about the difficulty of computing a full public key from the Bitcoin address.

However, once the full public key is known, computing the private key that unlocks the money is a much easier quantum computation.

This leaves one corner of the Bitcoin network under genuine quantum risk. The oldest Bitcoin addresses used a simpler security format called P2PK, which left full public keys exposed on the blockchain.

The distinction between P2PK and modern P2PKH (Pay to Public Key Hash) addresses marks a crucial security evolution. P2PKH addresses only expose their public keys when spending coins, giving them significant protection against quantum attacks. Even if quantum computers could break the encryption, they’d need to do so in the brief window between transaction broadcast and confirmation.

Satoshi’s Time Bomb

This vulnerability creates an extraordinary situation. Roughly one million Bitcoin – worth about $102 billion at current prices – sits in these early addresses. Many believe these coins belong to Bitcoin’s pseudonymous creator Satoshi Nakamoto. They haven’t moved in over a decade.

Some developers argue for preëmptive action: modifying Bitcoin’s code to freeze these vulnerable coins before quantum computers can crack them. It’s technically possible through a network fork. But others see this as heresy, violating Bitcoin’s core promise of immutability.

The technical debate centers on implementation methods. A soft fork could make specific UTXOs unspendable while maintaining backward compatibility. A hard fork would require network-wide consensus but could implement more comprehensive protections. Both approaches face significant political and philosophical hurdles within the Bitcoin community.

The Ethereum Answer

While Bitcoin debates, Ethereum makes moves. Vitalik Buterin, Ethereum’s co-founder, has outlined a straightforward quantum defense: a hard fork requiring all users to upgrade their security. No frozen funds, no philosophical crisis – just a mandatory update when quantum computers get close enough.

Researchers of post-quantum cryptography are developing new encryption algorithms that quantum computers can’t crack. Several cryptocurrencies are already testing these methods, preparing for a quantum-secure future.

The technical approaches vary: lattice-based cryptography, hash-based signatures, and multivariate cryptography each offer potential quantum resistance. Some projects combine multiple methods, creating layered defenses against both classical and quantum attacks.

Five Minutes vs. The Universe

Google’s claim about Willow’s five-minute calculation needs context. The chip solved a specific mathematical problem perfectly suited to quantum computing. Most computing tasks – including those involved in cryptocurrency mining and transactions – won’t benefit from this quantum hardware.

The problem Willow solved involves sampling from random quantum circuits. While impressive, this task was carefully chosen to demonstrate quantum supremacy. Breaking cryptocurrency encryption requires solving entirely different mathematical problems: factoring large numbers and computing discrete logarithms.

Google’s own quantum roadmap shows Willow reaching only milestone two of six. The path to 13 million stable qubits stretches far into the future. Yet quantum development has repeatedly outpaced predictions.

Beyond the Public Keys

Modern cryptocurrency security involves multiple layers. Even if quantum computers eventually crack public key encryption, they’ll face other barriers. Bitcoin’s proof-of-work system, hash functions, and network consensus mechanisms don’t rely solely on the algorithms quantum computers are good at cracking.

The cryptocurrency community has so far been pretty adaptable. When SHA-1 encryption showed weaknesses, Bitcoin developers had already moved to stronger alternatives. Similar foresight guides quantum defense planning.

Hash functions, particularly SHA-256 used in Bitcoin, show strong resistance to quantum attacks. Grover’s algorithm, a quantum method for searching unstructured databases, could theoretically speed up mining by finding hash collisions faster. But even this would only offer a quadratic speedup, requiring significant modifications to Bitcoin’s mining difficulty adjustment.

Technical Defenses Emerging

Cryptocurrency developers aren’t waiting for quantum computers to catch up. Teams across the ecosystem are implementing various defensive measures. Digital signature schemes like SPHINCS+ offer quantum resistance through hash-based signatures. Unlike current elliptic curve signatures, these methods rely on the security of hash functions, which better resist quantum attacks.

Some projects explore zero-knowledge proofs and other cryptographic primitives that maintain security even against quantum adversaries. These techniques could protect not just funds, but also transaction metadata and smart contract interactions.

Adapting the Future

Here’s the reality: quantum computing poses no immediate threat to cryptocurrency. But its steady advance demands attention. The solutions already exist in theory: they are post-quantum cryptography, network upgrades, and possibly even blockchain forks. The challenge lies in implementing them without disrupting the trillion-dollar cryptocurrency ecosystem.

The next decade will transform both quantum computing and cryptocurrency. Willow’s 105 qubits will seem quaint compared to future processors. Bitcoin’s security will evolve to match these advances. The real question isn’t whether cryptocurrency can survive quantum computing – it’s how effectively the technology will adapt.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Desdemona Robot Explains Robot-Phobia and Solar Thermal Trapping

What Happens When Two Bens Meet and Change the Course of Robotics?

Once Upon a Time: AI Novelists and the Organic Premium

I always dreamed of being a writer. And – in part thanks to you, dear reader – I am. You who have read – hopefully with pleasure – my plaintive missives about the fall of man, my séance with the techno-apocalypse, are the sustenance of my daily commune with the modern spectacle of life. I thank you for it from the bottom of my heart.

I am not alone in my dream. The writer’s art has long been venerated by our society. From the rockstar modernists of 19th century Paris to the mid-list masters who now populate the Top 100 with bodice-rippers, Sci-Fi fancies, and dead Scandinavian girls – we still all love to sit down with a good book. Millions of writers worldwide dream of getting their book on the shelf and, if the growth of the market and the advance of distribution channels is anything to go by, it’s never been a better time.

The book industry was at one time seen to be a failing giant, as false prophets said interest in books was waning. Now it is recording stupendous growth year-after year. Video didn’t kill the folio star, despite the claims of the 90s doomsayers. Online fandoms grew to huge sizes over the last decade and gave authors (particularly superstars of the Young Adult genre like Sarah J Mass, Rebecca Yarros, and Rebecca Ross) 8-digit sales figures and 9-digit incomes. It’s a good time to be an author, and an even better time to be a publisher.

So, why the creeping fear? What’s the source of lamentations that fill the halls of the internet? It’s simple, because the one thing this era-defining AI tech is already incredibly good at is writing. Writing is AI’s first purpose and proving-ground. They’re called large language models after all. Swathes of my PR and copywriter friends have already been brutally culled by news outlets and companies looking to cut costs. It’s tough out there for non-fiction writers, and many believe the novelists are next (they probably aren’t, but more on that later).

Book publishers, the New York Times Best Seller kind, are already desperate to introduce and profit from AI. If you can get rid of the pesky author royalties after all, the path to increased shareholder value is clear. Profit is all that ultimately matters in life, right? HarperCollins has come out and confirmed it is in the process of batch-selling submissions and current on-royalty authors to a tech company to help train their model to write fiction. A dataset of nearly 193,000 books has already been fed to the AI woodchipper by Meta and Bloomberg and to teach it the delicate art of writing novels. Penguin Random House – scared of the implications – is already expressly publishing copyright notices that forbid using its novels for AI-training.

This is a war over copyright, ultimately. Novels are just advanced training data, and training data is valuable. Why get published in the hope of getting read when you could instead sell the organic data points of your carbon brainmatter to the machine? Publishers are moving from the literary publication business to the AI training business – if you believe the worst doomsayers. They’re not far wrong. Intellectual property is just another type of data, and your precious work is just a stepping stone to making WiLLM Shakespeare, Botrix Potter, or A.I. Milne.

Some publishers just want to get AI to produce bestsellers and call it a day. Culture and human connection be damned. Some AI-only publishing companies have already launched, with Spines securing $16 million in seed funding and a promise to publish 8000 books next year – some even in hardback. Ultimately, they think, rather than go to a bookstore, readers will just ask the AI for a “YA Cyberpunk Romance with Lots of Guns and Zero Sex” (tweak to your taste) and boom, there’s your Saturday morning coffee for the next month. Don’t like it? Well, buy another token off GollanczBot or whichever publisher you like, and ask it for another. You’ll find one you like eventually.

Somehow, I don’t find this argument compelling, nor this vision likely. I’m biased: I write novels all the time. Although I admire the faux artisanal weavings of the predictor-bots, and although I lean towards the philosophical belief that language is a form of cognition, and LLMs therefore have at least an element of sentient thought, I still can’t quite fathom my soul panging with a trill of enjoyment reading an AI novel – even if it’s really, really good. The joy of good writing is the joy of watching the artist at their work. To know they really worked for it. The sweat poured and the marathon ran. It’s not about ‘creativity’ – AIs can be incredibly creative – it’s about endeavour: creation itself, not the end product. Shakespeare is most enjoyable when you realize so much of his plays are average at best and dire at worst. It makes the good stuff really sink in.

Perhaps the publishing industry becomes like the furniture industry: you pay more for a table hewn by a master carpenter than for a factory identikit. An organic premium paid out of recognition of the skill it took to make. A marvel at the imperfections of the human mind and the force-of-will required to create. A chance to connect with another brain through the choir of culture. A chance to meet another soul across the divide of experience. Novels don’t need to be sacred, or the author’s role revered, for them to be valuable. Tales of the book market’s death have been greatly exaggerated, but that’s not to say everything won’t change – but in the era of mass-produced content, the light of organic consciousness will burn the brightest it ever has.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Grokking Christopher Langan’s theory of reality

In my last book there was a chapter on Artificial Intelligence (AI), and consciousness at large, titled ‘Bats and bits’. In this chapter, I said that I had not used ChatGPT or another AI assistant to write the book. “I guess I’ll use AI assistants for future writings, but I wanted this book to come entirely from my own unaided mind,” I said.

Some months have passed and I’m using AI assistants a lot (mostly Grok because it comes with my paid Twitter membership, but also the free versions of ChatGPT and Copilot).

I’m using AI assistants to summarize long texts, and to expand short texts when they’re about things that I understand well enough to correct its hallucinations.

I decided to try an experiment: asking AI to explain to me things that I don’t understand.

The smartest man in the world?

I chose something that is intriguing me at this moment: Christopher Langan’s ‘Cognitive-Theoretic Model of the Universe‘ (CTMU).

I had skimmed through some of Langan’s writings in the past without spending much time and attention. But I formed a certain vague impression that Langan’s ideas have something (or perhaps much) in common with mine.

By the way, who is Christopher Langan? He is, reportedly, ‘the smartest man in the world‘ (video interview).

I don’t know about that, but he does sound smart. I love the idea of a theory of reality developed by a farmer and former bouncer, used to hard physical work.

So I asked Grok:

“Can you give me a compact explanation of Christopher Langan’s CTMU and it says about God, free will, afterlife, and the ultimate meaning of life?”

In passing, Grok’s name comes from the term “grokking” introduced by science fiction writer Robert Heinlein, which means something like understanding things deeply, with total empathy, from the inside.

God according to Langan

Grok’s answer:

“Christopher Langan’s Cognitive-Theoretic Model of the Universe (CTMU) is an ambitious framework aiming to bridge the divide between science, philosophy, and theology. Here’s a compact explanation:

God: In the CTMU, God is not an external supernatural being but is identified with the universe itself, or more specifically, with the ‘Global Operator-Designer’ or ‘Primary Teleological Operator.’ Langan suggests that properties like omnipresence, omniscience, and omnipotence are inherent to the structure of the universe, which operates as a self-configuring, self-processing language (SCSPL). This perspective aligns God with the ultimate reality, where the cosmos is seen as a manifestation of divine intelligence or mind.“

Free will, afterlife, and the meaning of life

“Free Will: Langan posits that free will exists within a stratified framework where both God and humans have self-determinacy. This free will is tied to the universe’s ability to self-process and self-configure, suggesting that while our choices are influenced by broader cosmic structures, they are still free within the constraints of these structures. Human free will is seen as a reflection or microcosm of the cosmic free will.

Afterlife: The CTMU doesn’t traditionally define an afterlife in terms of heaven or hell as separate realms. Instead, it suggests that upon death, consciousness might retract to the origin of reality, which could be interpreted as a form of afterlife or reincarnation. Langan has mentioned that all lifetimes might occur metasimultaneously in a non-terminal domain, implying an existence beyond our linear perception of time where consciousness could persist or be redistributed.

Ultimate Meaning of Life: According to Langan, life’s ultimate meaning is tied to the teleological framework of the universe. This means that the purpose or meaning of life is inherently linked to the process of self-discovery, self-improvement, and aligning with the telic (purposeful) nature of the universe. The meaning of life includes contributing to the universe’s ongoing evolution and refinement, with each individual’s life having a role in this cosmic process.

Langan’s views, while complex and sometimes controversial, attempt to reconcile scientific and spiritual understandings by presenting the universe as a coherent, self-sustaining system where mind and matter are intertwined. However, his ideas remain speculative and are not widely accepted within mainstream scientific or philosophical circles.”

Cool! I can recognize some ideas here that I’ve had in mind for a while.

Self-Configuring Self-Processing Language (SCSPL)

But I want to better understand parts of Grok’s answer. Moreover, I need to check if Langan has really written these things or Grok has hallucinated them.

So I ask Grok: “Could you give me a more detailed explanation of SCSPL?”

Grok says:

“The Self-Configuring Self-Processing Language (SCSPL) is a central concept in Christopher Langan’s Cognitive-Theoretic Model of the Universe (CTMU). Here’s a detailed explanation:

What is SCSPL?

SCSPL (Self-Configuring Self-Processing Language) is a conceptual framework proposed by Christopher Langan to describe how the universe functions. This model posits:

Self-Configuring: The universe configures its own laws and structure. Instead of having pre-set laws from an external source, the universe, through SCSPL, is seen as dynamically adjusting its own rules and configurations.

Self-Processing: Everything in the universe, including any form of intelligence or processing, is seen as part of the universe processing itself. This means that consciousness, intelligence, and physical processes are not separate from the universe but are intrinsic to it.

Language: The term ‘language’ here is not conventional; it refers to a fundamental structure or syntax by which reality operates. At its core, reality is seen as informational, with SCSPL being the ‘code’ or ‘syntax’ that governs how this information manifests as physical reality.“

More about the SCSPL

“Reality as a Language: SCSPL treats reality as a self-referential language where the universe writes its own script. This language is self-contained, meaning the universe itself is the language, the medium, and the message.

Teleology and Purpose: The universe, through SCSPL, is goal-directed or teleological. This implies an inherent purposefulness, where the universe aims towards increasing complexity, coherence, and self-awareness.

Consciousness and Free Will: Within this model, consciousness isn’t just a byproduct of physical processes but is fundamental to the universe’s operation. Free will is understood as the universe’s ability to choose its own configurations and processes, which individuals also partake in on a smaller scale.

Unity of Mind and Matter: SCSPL suggests a monism where mind and matter are not separate but different expressions of the same underlying reality.”

Other people interested in Langan’s ideas sent me other AI generated summaries that are essentially similar to Grok’s summary. Now I have enough keywords to search for these ideas in Langan’s own writings, to check Grok’s accuracy.

From cybernetics to ontology

Langan has tried to write simplified explanations of the CTMU, but I find that his full 2002 paper is the clearest.

Langan defines reality as all that exists. So reality must be entirely self-contained and self-determinative. Langan makes conceptual references to John Wheeler’s ‘Beyond the Black Hole‘ and related writings. Wheeler also summarized his speculations on a future science of reality as a “self-excited circuit” in the last two chapters of his autobiography.

Wheeler gave a compact conceptual summary of Einstein’s general relativity: “Spacetime tells matter how to move; matter tells spacetime how to curve”. This summarises Einstein’s field equations. In other words, there is cybernetic feedback between spacetime and matter.

However, this is not a self-contained reality; in Wheeler’s picture spacetime and matter already exist and follow a law that already exists. Cybernetic feedback “is meaningless where such entities do not already exist,” says Langan. “With respect to the origin of any self-determinative, perfectly self-contained system, the feedback is ontological in nature”.

In the pedestrian form of cybernetic feedback, existing things act upon each other and determine the behavior of each other and the whole. This is something more. Here, reality bootstraps itself into being with cybernetic-ontological feedback between mind, matter and physical laws, which shape and give reality to each other.

I like Langan’s ideas so far!

This looks very much like the picture of the world that I’ve outlined in my last book.

Langan tries to derive all these things logically. I’m not that smart, so I’m happy enough to present them as a narrative sketch.

However, I can recognize the common ideas –

- Reality bootstraps itself into being without external interventions

- There are self-consistent feedback loops between mind, matter, and physical laws

- The universe acts with free will, and so do we

- Death is not the end

- The universe acts with purpose, striving toward more and more complexity, and we should align with the purpose of the universe.

I have referred to Langan’s “divine intelligence or mind” of ultimate reality as Mind at Large or, to make it even less personal, as “the cosmic operating system”. But there are so many parallels with metaphysical and theological concepts of God that calling it God seems simple and honest.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Pack Your Bags, We’re Leaving: Why Crypto is the Doomed Generation’s Last Hurrah

Crypto must live in the Southern Hemisphere: it has decided summer starts in November. Price movements are heating up and on Discord and Telegram channels the evenings stretch on forever. The bulls are running, and to the faithful, the land of milk and honey beckons.

We are back, baby. Bitcoin at time of writing has peaked over $100,000. The crypto market is worth more than the GDP of France, and Bitcoin recently surpassed the value of the world’s silver. ‘Analysts’ (never trust analysts) are predicting million dollar BTC this decade.

Where Bitcoin goes other coins are sure to follow. Speculative excess has broken out on a scale that will dwarf the last mania. A lot of people are going to get very rich and, despite all the green lines, a lot of people are going to lose everything – again.

It’s this last point that must give us pause. Did any of us really learn anything from last time? Will we, freshly zested by the hope of something better, and further crushed by the harsh truth of our lived realities, be able to resist the neon promontory of coloured cute coins and the 100× gains they offer? Probably not. The world has, over the last four years, become ever more divorced from the expected patterns of our childhood. The unapprehendable blaze of stimuli has cooked our brains into a fine soup.

Sensible investment and steady action is not the way the new generation want their lives to unfold. Hard work no longer seems to result in success. The only dream left is the get-rich-quick dream of glamour, excess and risk. They want monkey tokens. They want dog coins that have become initialisms for actual government agencies. They want a final bacchanalia before AI takes over and the nukes start to fly.

Trump’s victory at the election and the raising of Musk to the heights of power has let slip the doges of war. The crypto market suddenly has rabid supporters right at the top of the U.S. government. Gensler will almost certainly get fired as head of the Securities and Exchange Commission. In short, crypto bros have accomplished state-capture – and that is reflected in one of the fastest institutional buying frenzies ever seen.

It’s not all speculation. Winter was a time of BUIDLing; the utility of crypto was quietly proven, the efficient wiring of decentralized systems-administration governed by democratically available access control tokens became stronger, more effective, and more applicable to digital realities. DePin networks, foreign exchange, distributed databases, edge computing, data management, sovereign identity, crowdsourced AIs, voting systems – the list goes on and on.

In the dark of winter these projects were raised and tiled. And though they were built on the shifting sands of speculation, their foundations are sturdy. The incorruptible blockchain establishes a measure of control and order to the chaos of the virtual world and its effects on the real. Over the coming months and years, blockchain technologies will become a daily feature of everyone’s lives. And that means they’re going to be worth something. Yes, even the squirrel coins.

Institutions have their bags. Have you? This is not financial advice, merely an observation. Soon none of this will matter anyway, we will resolve ourselves in the Singularity as points on a celestial graph – so we might as well have fun while we’re here.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)