Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

BlackRock’s RWA Vision: Pioneering the Future of Tokenized Assets and Securities

BlackRock, the world’s largest asset manager with over $10 trillion in assets under management, first stirred the crypto pot in August 2022 when it announced that it would use Coinbase to service its Aladdin clients. In late 2023, it came to the rescue when the SEC besieged the crypto industry by announcing its iShares spot Bitcoin ETF application. That sent BTC on a rocket ride from $25,000 to nearly $75,000 this year, as I predicted last year.

The ETF approvals in January 2024 finally made the world’s biggest cryptocurrency an accessible mainstream investment that anyone and their grandmother could own without fear of security or regulatory risks.

Almost immediately after the SEC greenlit Bitcoin spot ETFs, BlackRock execs began to endorse Ethereum and unveiled plans for an ETH spot ETF, which has now also come to fruition and will start trading imminently (2 July) if analysts are to be believed.

The ETFs are all roads however that legitimize blockchain and smart contract technology to lead to BlackRock’s Grand Plan:

Tokenizing the world’s assets, or real world assets (RWA). Why trade Monday to Friday in US office hours only, if you could allow the whole globe to trade the US stock market and treasuries anywhere, anytime?

BlackRock goes all out on RWAs

To that effect, BlackRock already announced in April 2024 that it would be launching a new RWA fund called the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) that will invest in tokenized treasuries and repos. Coinbase, yet again, will play an important role as a key infrastructure provider.

The TradFi behemoth doubled down on RWAs by investing $47 million into Securitize, an RWA tokenization firm. With a significant portion of its portfolio dedicated to real estate assets, approximately $39 billion, the potential impact of tokenizing property investment is immense.

Larry Fink, CEO of BlackRock (and of Bitcoin as well? just kidding maxis, put down the pitchforks) sees the big picture very clearly:

I believe the next generation for markets, the next generation for securities will be tokenization of securities, and if we could have a distributed ledger that we know every beneficial owner, every beneficial seller, we all have our code of who’s buying, who’s selling – instantaneous settlement – think about it! It changes the whole ecosystem!

What exactly are Real World Assets (RWAs), and why is this significant for BlackRock?

What are RWAs?

As we discussed in a previous article, Real World Assets (RWAs) is a very hot new crypto narrative about converting ownership rights of various tangible and intangible assets into digital tokens using blockchain technology. These assets can be bonds, equity, and real estate, or even cultural assets like art and collectibles.

Tokenizing RWAs offers several compelling benefits:

- Enhanced liquidity: Traditional assets, particularly real estate and fine art, are often illiquid. Tokenization allows these assets to be broken down into smaller, tradable units, increasing their liquidity.

- Transparency: Blockchain technology provides a transparent and immutable ledger, ensuring that ownership and transaction histories are easily verifiable.

- Access to investment opportunities: By lowering the barriers to entry, tokenization makes it possible for a broader range of investors to participate in markets that were previously inaccessible.

BlackRock USD Institutional Digital Liquidity Fund (BUIDL Fund)

The launch of the BUIDL fund in March 2024 on the Ethereum blockchain represents BlackRock’s first tokenized offering, and is a crucial component of its broader strategy. The BUIDL fund attracted $245 million in its first week of operations, showing massive investor interest and confidence in tokenized assets.

The fund is represented by the BUIDL token, which is fully backed by cash, U.S. Treasury bills, and repurchase agreements to ensure its stability and confidence among investors.

Token holders receive daily yield payouts via blockchain rails, providing a seamless and efficient way to distribute earnings.

BlackRock’s partnership with Coinbase is notable because it represents a collaboration between a traditional financial institution and a cryptocurrency exchange. Cross-industry collaboration between crypto and TradFi is crucial for growing and developing the RWA market, bringing together the traditional financial world and the emerging world of digital assets.

Secondly, BlackRock’s involvement is likely to get RWAs adopted into the mainstream quicker. With its vast network of institutional clients and its reputation as a trusted asset manager, BlackRock has the potential to bring significant capital and credibility to the RWA market, helping to drive growth and attract new investors.

BlackRock’s Partnerships and Ecosystem

BlackRock’s strategy is to create a robust ecosystem through strategic partnerships, ensuring the seamless operation and security of its tokenized assets. Partners include:

- Securitize: As the transfer agent and tokenization platform for the BUIDL fund, Securitize plays a pivotal role in managing the token issuance and lifecycle. BlackRock’s investment in Securitize, coupled with Joseph Chalom’s appointment to Securitize’s board, underscores its commitment to this partnership.

- BNY Mellon: Serving as the custodian of the BUIDL fund’s assets, BNY Mellon ensures the safekeeping and proper management of the underlying assets.

- Other Key Participants: The fund’s ecosystem includes prominent names like Anchorage Digital Bank, BitGo, and Fireblocks, each contributing to the security and functionality of the tokenized assets.

- Circle’s Smart Contract Feature: This feature enables BUIDL holders to exchange shares for the USDC stablecoin, adding another layer of flexibility and liquidity.

- Ondo Finance’s OUSG Token: By moving $95 million of assets to BlackRock’s BUIDL fund, Ondo Finance’s OUSG token achieves instant settlement, showcasing the efficiency of tokenized assets.

Future of Tokenized MMFs and RWAs

The future of tokenized Money Market Funds (MMFs) and other securities is not confined to centralized platforms. BlackRock envisions a broader distribution across various trading platforms and decentralized finance (DeFi) protocols.

This decentralized approach can unlock numerous opportunities:

- Collateral for lending: Tokenized MMFs can serve as collateral in smart contract loans, providing additional security for borrowers and lenders.

- Liquidity pool deposits: These tokens can be deposited into the liquidity pools of automated market makers, enhancing market efficiency and liquidity.

What is the ERC-3643 Token Standard?

Compliance with existing regulations is key to the success of tokenized assets. The ERC-3643 token standard is designed to address this requirement by embedding compliance at the token level.

ERC-3643 ensures that tokens adhere to regulatory requirements, providing a level of assurance that is crucial for institutional investors.The standard is being spearheaded by a non-profit community, and has been presented to regulators worldwide. It’s steadily gaining recognition for its ability to uphold security laws while facilitating innovation.

Cogito Moves Into RWA Space

Cogito, Mindplex’s partner in the SingularityNET ecosystem, is making waves in the RWA market with its innovative approach. The platform recently obtained a tokenized fund license from CIMA, allowing it to offer fully regulated RWA investment products.

Cogito’s unique offerings include TFUND (tokenized treasury bonds), GFUND (tokenized green bonds), and XFUND (an AI-managed basket of tech stocks), catering to various investor preferences.

By leveraging AI to manage investments and providing crypto and fiat on-ramps, Cogito is making RWAs accessible to a wide range of investors, driving adoption and growth in the market.

Conclusion

No matter what you think about their powerful financial and political influence in our world, BlackRock’s involvement in crypto has so far helped to champion the sector to new regulatory and market highs. Its vision for the RWA market is a forward-thinking strategy that promises to revolutionize the investment landscape and bring crypto and TradFi closer together than ever before.

By tokenizing a significant portion of its assets, BlackRock is enhancing liquidity and transparency, and also opening access to traditionally exclusive investment opportunities. The successful launch of the BUIDL fund and the strong assembly of partners will give it a precedence that other traditional firms will find irresistible.

BlackRock, as usual, can never be counted out.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Real World Assets (RWAs) Primer: Crypto’s Ultimate Use Case?

Introduction

With the Bitcoin Halving and Bitcoin and Ethereum spot ETF approval in the rear view mirror in mid 2024, crypto investors’ are now asking what’s next for the world of Decentralized Finance (DeFi).

The recent regulatory approval of Ethereum can help spread one of the biggest crypto narratives for 2024, known as Real World Assets, or RWAs in short. These hybrid financial assets are offering investors a unique opportunity to diversify their portfolios and tap into the potential of tokenizing traditional financial assets.

The RWA market is expected to experience significant growth in the coming years; some predict a 5-10 trillion USD market cap by 2030. As more investors seek to bridge the gap between traditional finance and the digital realm, RWAs are emerging as an attractive option for those looking to invest in tangible assets while enjoying the benefits of blockchain technology. It’s easier to understand, less volatile and can unlock all the benefits that come with decentralized networks.

Let’s dive in with a primer on RWAs.

What are RWAs?

RWAs are physical or non-physical assets from the real world that are tokenized and represented on a blockchain. This can include a wide range of assets, such as

- real estate,

- precious metals,

- stocks,

- bonds,

- commodities,

- art, and

- collectibles

When these assets become tokens, they become more accessible, tradable, and divisible within the crypto ecosystem, opening up new opportunities for investors who may have previously been excluded from certain markets by high barriers to entry, or by lack of liquidity. They can be traded 24/7 from anywhere in the world, without geographical or technological barriers.

How are Real World Assets tokenized?

The process of tokenizing real-world assets can get very complex, but these are the broad strokes:

- First, the asset must be appraised to determine its value.

- Next, a legal framework is established to define the rights and responsibilities of token holders.

- The token is then issued on a blockchain platform, making it available for trading.

Platforms like Cogito, a SingularityNET ecosystem partner, are simplifying this process for investors, providing user-friendly interfaces and streamlined workflows for creating and managing RWA tokens.

Why are RWAs Gaining Popularity?

While they’re not as sexy as other crypto trends such as AI cryptocurrencies, GameFi and memecoins (and even DePIN), there are several reasons why RWAs are touted as the ultimate use case for blockchain technology.

- They’re stable

RWAs introduce real, tangible value into the often volatile crypto market, providing a level of stability that pure cryptocurrencies may lack.

- They bridge the gap with TradFi

The involvement of major players like BlackRock is bringing massive growing institutional interest in RWAs, potentially leading to mainstream adoption.

- They bring liquidity to assets

Tokenization allows previously illiquid assets to be traded 24/7 on crypto exchanges, giving investors greater flexibility and liquidity.

- They make TradFi assets more accessible

RWAs lower the barriers to entry for high-value investments by enabling fractional ownership, making these assets more accessible to a wider range of investors.

BlackRock’s RWA Plans

Earlier this year, BlackRock, the world’s largest asset manager, doubled down on its long-term plans for crypto by announcing it was entering the RWA market. Through a partnership with Coinbase, BlackRock launched BUIDL (BlackRock’s USD Institutional Digital Liquidity Fund) a fund investing in tokenized treasuries and repos.

This move validates RWAs as a viable investment opportunity, and could potentially accelerate mainstream adoption. In previous years US regulators like the SEC have come down hard on previous attempts to tokenize securities, such as securitized token offerings (STOs), and prosecuted exchanges like Binance and Kraken.

With BlackRock’s vast network and massive influence on Capitol Hill, the company could bring significant capital and credibility to the space, driving growth and attracting new investors. The collaboration between a traditional financial giant and a crypto exchange is crucial to bridging the gap between the two worlds.

In fact, with the Ethereum spot ETF now approved, many crypto experts believe that BlackRock’s real ambitions for crypto stretch far beyond just ETFs – that they ultimately aim to tokenize all real world assets! Just listen to how their CEO Larry Fink waxes lyrical on tokenization here.

Top RWA Projects in 2024

Several notable projects and platforms are leading the way in the RWA space, each offering unique features and benefits for investors.

Ondo Finance: Tokenizing Traditional Assets

Ondo Finance is currently the biggest player in the RWA space with a market cap of $1.7 billion. It leads the pack thanks to its ability to bridge TradFi and DeFi. Ondo’s partner with established financial institutions to help ensure the security and stability of tokenized assets.

Ondo focuses on tokenizing traditional assets like corporate bonds and treasuries, and works with BlackRock, moving nearly $100 million over to the BUIDL network. The platform aims to provide investors with access to these assets through a user-friendly interface, making it easier for them to diversify their portfolios.

Mantle: Bringing Real Estate to the Blockchain

Mantle is a platform that focuses on tokenizing real estate assets, allowing investors to gain exposure to this traditionally illiquid market through fractional ownership. The platform uses blockchain technology to ensure the security and transparency of these investments, providing investors with a new way to participate in the real estate market without the large upfront capital or extensive paperwork that would be required to buy houses or commercial buildings.

RealT

RealT is another platform that tokenizes real estate, turning ownership of properties into digital tokens, allowing people to invest in fractional ownership, and trade with less friction. Like Mantle, RealT is making it easier for investors to access the real estate market without the need for large upfront investments or lengthy paperwork processes.

Pendle: Unlocking Yield Opportunities

Pendle is a platform that is focused on unlocking yield opportunities in the RWA market. The platform achieves this by tokenizing future yield, allowing investors to buy and sell the rights to future cash flows from various assets.

This innovative approach provides investors with a new way to generate passive income and potentially earn higher returns than traditional fixed-income investments. Pendle’s platform is designed to be user-friendly and accessible, making it easier for investors to participate in the RWA market and take advantage of the unique yield opportunities it offers.

MakerDAO

Stablecoins are a core component of a resilient RWA market. As such, MakerDAO is playing an important role by using RWAs as collateral to stabilize the value of its DAI stablecoin.

By accepting real-world assets as collateral, MakerDAO is able to create a more stable and reliable stablecoin that is backed by tangible value. This innovative approach has helped to establish MakerDAO as a leader in both the RWA and stablecoin spaces, paving the way for other projects to follow suit. MakerDAO has restored much-needed trust in algorithmic stablecoins following the brutal 2022 demise of Terra Luna that wiped tens of billions from investor accounts.

Centrifuge

Centrifuge is another notable player in the RWA market, offering a platform for tokenizing and financing real-world assets like invoices and loans. It unlocks liquidity and provides new financing options for businesses and investors alike.

SingularityNET’s Cogito Gets RWA License

Cogito, a SingularityNET ecosystem partner, is another sleeping giant in the RWA market that is starting to wake up, making huge strides in tokenizing real-world assets in 2024. Recently, Cogito obtained a tokenized fund license from the Cayman Islands Monetary Authority (CIMA), becoming one of the first companies to offer fully regulated RWA investment products.

Cogito is committed to making RWAs accessible to a wide range of investors, including both institutional and retail investors. The platform offers both crypto and fiat on-ramps, making it easy for investors to purchase RWA tokens using their preferred currency. This accessibility is key to driving adoption and growing the overall market for RWAs.

Cogito’s approach to RWAs is unique in several ways:

- The platform offers a range of innovative investment products, including the TFUND (tokenized treasury bonds), GFUND (tokenized green bonds), and XFUND (an AI-managed basket of tech stocks).

- These products are designed to cater to different investor preferences and risk profiles, providing a diverse range of options for those looking to invest in RWAs.

- Importantly, Cogito is leveraging the power of artificial intelligence to help manage and optimize its RWA investments. By using AI algorithms to analyze market data and identify investment opportunities, Cogito is able to make more informed decisions and potentially generate higher returns for its investors.

Conclusion

There’s no room left for doubt: Real World Assets are here to stay. In fact, they might dominate the crypto sector by the end of the decade. With the potential to introduce real, tangible value into the digital asset ecosystem, RWAs offer investors a compelling opportunity to diversify their portfolios and gain exposure to a wide range of assets.

As more institutional behemoths like BlackRock enter the market and innovative platforms like Cogito continue to develop new investment products and services, the future looks bright for RWAs. While there are certainly challenges and risks to be aware of, such as regulatory uncertainty and the need for robust security measures, the potential benefits of RWAs are simply too great to ignore.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

A Look Back at Mondo 2000 | Highlights from S2EP20

Ten Key Crypto Technical Indicators for Beginners To Know in 2024

Note from the editor: This is not financial advice. The claim that technical indicators predict future price movements better than chance has not been validated by Mindplex.

The Bitcoin halving has come and gone, and crypto markets are in the doldrums of summer. Explosive growth has settled into a cruise, presenting the perfect opportunity to master an important component of crypto investment success: technical indicators, which are tools used to perform technical analysis (TA).

Are you new to the world of cryptocurrency trading and feeling overwhelmed by the sheer number of technical indicators available? Or you’re an inexperienced investor that just can’t figure out what’s going to happen next? That’s because the crypto market is dominated by short-term trading, mostly with bot trading tools, that look at specific indicators to devise an optimal strategy. Therefore, while you don’t have to be a pro trader, you should at least know the rules of the trading game before you invest in shorter time frames.

In this article, I’ll cover ten important crypto trading indicators that any crypto trader can try and master in 2024 to manage their Bitcoin and Ethereum. These indicators (which I’ll explain in descending order of importance) will help you make more informed trading decisions in the dynamic crypto market.

It’s important to note that no single indicator should be viewed in isolation. Instead, traders should use a combination of indicators to confirm signals and make more informed decisions. By using multiple indicators together, you can gain a more comprehensive understanding of market trends, potential entry and exit points, and overall market sentiment.

1. Moving Averages

What is a Moving Average?

A moving average is a technical analysis tool that smooths out price data by creating a constantly updated average price over a specific period.

What does it do?

Moving averages help identify trends and potential support and resistance levels. They can also serve as a foundation for other technical indicators.

How it works

The two most common moving averages are the simple moving average (SMA) and the exponential moving average (EMA). An SMA is calculated by taking the average price over a set number of periods – while an EMA gives more weight to recent prices.

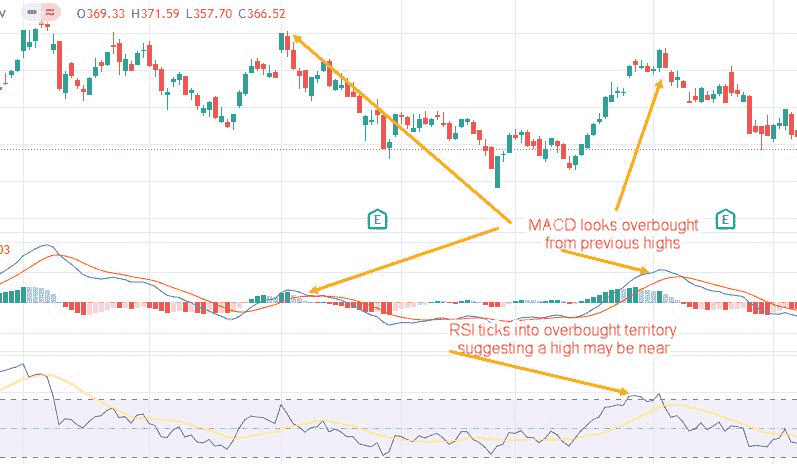

2. Relative Strength Index (RSI)

What is a RSI?

The Relative Strength Index (RSI) is an unmissable momentum indicator that measures the speed and magnitude of price changes. Its stochastic RSI variant is said to provide an easy visual way to see whether prices are bottoming or topping.

What does it do?

RSI helps identify overbought and oversold conditions, which can signal potential reversals or trend confirmations.

How it works

RSI oscillates between 0 and 100. Readings above 70 suggest an overbought condition, while readings below 30 indicate an oversold condition.

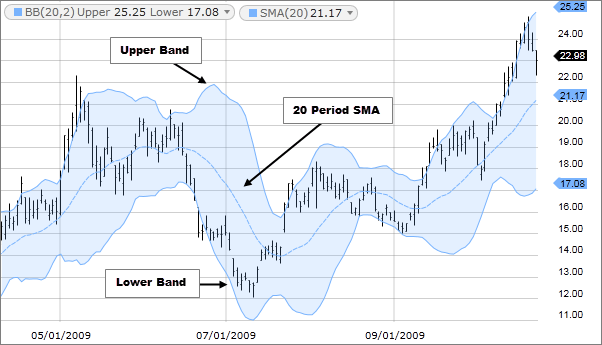

3. Bollinger Bands

What are Bollinger Bands?

Bollinger Bands are volatility indicators that consist of a middle band (typically a 20-day SMA), plus two outer bands set two Standard Deviations above and below that middle band.

What does it do?

Bollinger Bands help identify potential overbought and oversold conditions, as well as potential breakouts when the price moves outside the bands.

How it works

When the price touches the upper band, it’s considered overbought, and when it touches the lower band, it’s considered oversold. A squeeze in the bands often precedes a breakout.

4. Fibonacci Retracement

What is a Fibonacci Retracement?

Degen traders’ favorite tool of choice, Fibonacci retracement levels are based on the controversial Fibonacci sequence and are used to identify potential support and resistance levels.

What does it do?

Fibonacci retracement levels allegedly help traders set price targets and determine entry and exit points.

How it works

The most commonly used Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels are plotted on a chart by drawing a line from a swing high to a swing low (or vice versa) and then dividing the vertical distance by the key Fibonacci ratios.

5. On-Balance-Volume (OBV)

What is an OBV?

On-Balance-Volume (OBV) is a volume-based indicator that helps confirm price trends and predict potential reversals.

What does it do?

OBV can help identify divergences between price and volume, which can signal a potential trend reversal.

How it works

OBV adds or subtracts volume based on whether the price closes higher or lower than the previous day. If OBV is rising while the price is flat or declining, technical analysts claim that suggests a potential price increase, and vice versa.

6. Moving Average Convergence Divergence (MACD)

What is a MACD?

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages.

What does it do?

MACD helps identify trend changes, momentum, and potential buy and sell signals.

How it works

MACD consists of a MACD line (the 12-day EMA minus the 26-day EMA) and a signal line (a 9-day EMA of the MACD line). When the MACD line crosses above the signal line, it’s a bullish signal, and when it crosses below, it’s a bearish signal.

7. Stochastic Oscillator

What is a Stochastic Oscillator?

The Stochastic Oscillator is a momentum indicator that compares the closing price of an asset to its price range over a specific period.

What does it do?

The Stochastic Oscillator helps identify overbought and oversold conditions and potential reversals.

How it works

The indicator consists of two lines: %K and %D. When %K crosses above %D, it’s a bullish signal, and when it crosses below, it’s a bearish signal. Readings above 80 suggest an overbought condition, while readings below 20 indicate an oversold condition.

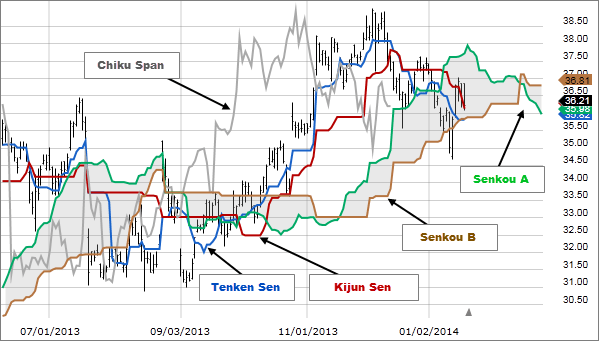

8. Ichimoku Cloud

What is an Ichimoku Cloud?

The Ichimoku Cloud is a comprehensive indicator that provides a quick overview of an asset’s price action, trend direction, and potential support and resistance levels.

What does it do?

The Ichimoku Cloud helps traders identify the prevailing trend, gauge momentum, and spot potential buy and sell signals.

How it works

The Ichimoku Cloud consists of five lines: the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and the Chikou Span. When the price is above the cloud, it’s considered bullish, and when it’s below the cloud, it’s considered bearish.

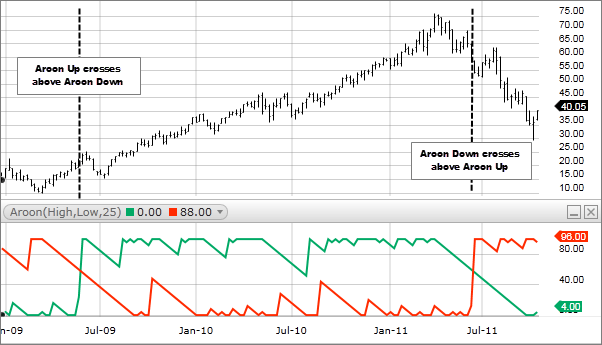

9. Aroon Indicator

What is the Aroon Indicator?

The Aroon Indicator is designed to identify trend changes and measure the strength of a trend.

What does it do?

The Aroon Indicator can help traders spot trend changes and potential entry and exit points.

How it works

The indicator consists of two lines: the Aroon Up and the Aroon Down. When the Aroon Up is above the Aroon Down, it indicates an uptrend, and when the Aroon Down is above the Aroon Up, it indicates a downtrend.

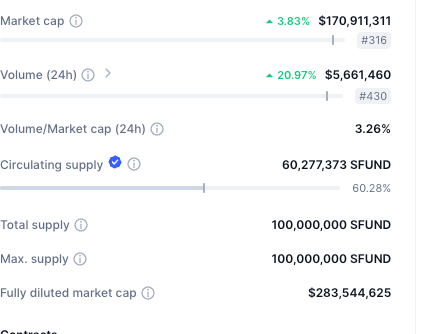

10. On-Chain Metrics

What are On-Chain Metrics?

On-chain metrics provide valuable insights into the fundamental health and activity of a cryptocurrency network. Looking at data such as total market cap, circulating supply, fully diluted value, total value locked, dApp activity, transaction count, user activity and more can help you see through all the smoke and mirrors in a bull market.

What do they do?

By monitoring on-chain metrics, traders can gauge the overall sentiment and growth potential of a particular cryptocurrency.

How it works

Some important on-chain metrics include transaction volume, active addresses, network value to transaction ratio (NVT), and realized cap. These metrics can be tracked using various blockchain explorers and analytics platforms.

Conclusion

In conclusion, these ten essential crypto technical indicators provide a powerful foundation for beginner traders in 2024, but it’s good to keep in mind that it barely scratches the surface of what’s possible in technical analysis.

You can test out applying these indicators for yourself, and see if they help you make more informed trading decisions or improve your chances of success in the dynamic crypto market.

However, it’s crucial to remember that no single indicator is perfect, and relying on just one can lead to suboptimal results. Maybe using a combination of indicators to confirm signals will help you gain a more comprehensive understanding of market trends and sentiment.

As you continue your trading journey, stay committed to continuous learning and adapting to the ever-changing crypto landscape. With dedication and practice, you’ll be well on your way to becoming a proficient trader in the exciting world of cryptocurrencies.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

W’ETH Done It! Ethereum Spot ETF Approval Opens World to Web3

Introduction

While the traditional crypto wisdom is to sell in May and go away, Ethereum had other plans. On 23 May 2024, the U.S. Securities and Exchange Commission (SEC) surprisingly greenlit spot Ethereum (ETH) exchange-traded funds (ETFs) in principle. This has sent its price skyrocketing and turned its future very bright. Most crypto investors thought this would never come, due to the United States’ onslaught on cryptocurrency technology, or would require a multi-year political struggle.

It marked a pivotal and triumphant moment for the cryptocurrency market that will boost its development even further and bolster a beleaguered US crypto sector dragged down by heavy-handed regulation the last few years. It also again showed that politics and finance always intertwine, coming soon after Donald Trump’s embrace of crypto in the US essentially forced that country’s Democrat party to make a dramatic U-turn on the sector in what will be a tough election year to keep Joe Biden in power.

In this article, we’ll explore the implications of this approval, the impact its had on Ethereum and the broader crypto market, and the potential benefits for retail investors.

What is an Ethereum ETF?

An Ethereum ETF is a financial product that allows investors to buy shares representing a stake in Ethereum, without needing to directly purchase or manage the cryptocurrency itself. ETFs are traded on traditional stock exchanges, making them accessible to a wider range of investors. The approval of these ETFs means institutional and retail investors can now gain exposure to Ethereum through regulated financial products.

The Road to Approval

The journey to the approval of Ethereum ETFs has been long and difficult, and fraught with regulatory hurdles since Vitalik Buterin – with co-founders including Cardano’s Charles Hoskinson and Polkadot’s Gavin Wood – launched Ethereum in 2015 as a novel application of blockchain technology.

The SEC’s approval of Bitcoin ETFs earlier in the year laid a path down for Ethereum ETFs to follow. This path was studded with rigorous analysis and a public comment period, during which stakeholders provided feedback on various aspects of the proposed ETFs, including custodianship, sponsor fees, and creation and redemption models.

Market Reactions and Expectations

Impact on Ethereum’s Price

A tweet from influential analysts Eric Balchunas and James Seyffart increased the estimated odds of an Ethereum ETF to 75%. The result: the price of ETH spiked within hours to nearly $4,000, before retracing.

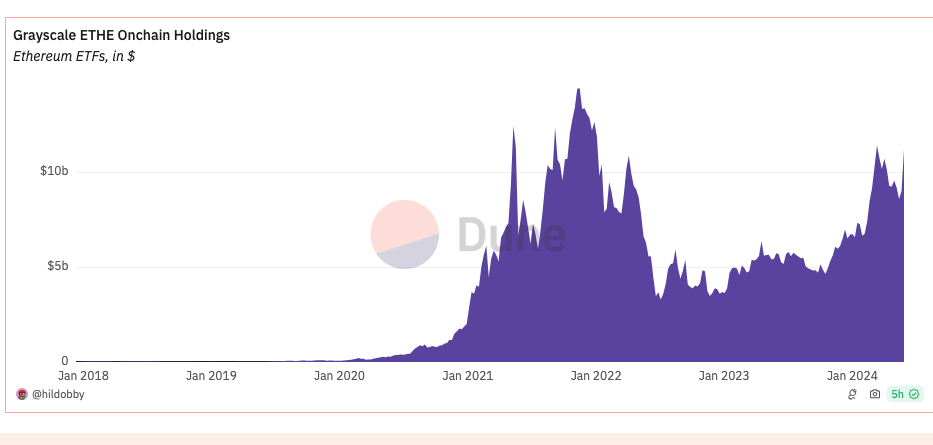

Following the announcement, the price of Ethereum remained largely unchanged, soon dropping to as low as $3,500 in typical “sell the news” behavior. A number of other factors also impacted the ETH price blowoff. Notably, additional hurdles must be cleared first before an actual Ethereum ETF is approved, such as the final filing of amended S1 applications for each issuer (BlackRock is pushing for a July 4th launch) as well as another round of Mt Gox FUD. And of course, there’s also the question of whether we’ll see another huge sell-off from Grayscale holders.

This price movement is reminiscent of the initial reactions seen with Bitcoin ETFs, suggesting a pattern of bullish sentiment following regulatory endorsements. However, investors had more time to ladder into their BTC buys, knowing that it was almost certainly coming, whereas Ethereum went into the ETF battle as an underdog.

What does an Ethereum ETF mean longterm for crypto?

Regulatory Greenlight

The SEC’s decision brings Ethereum closer to being classified as a commodity, like Bitcoin. The devastation of being labeled a security has been hanging like a sword over its head for years, despite earlier statements by both the SEC’s William Hinson in 2018 and the CFTC in 2022 that it was not a security. Classification as a commodity will simplify regulation for Ethereum, providing clearer guidelines for future developments and investments in the ecosystem. Additionally, the recent crypto-friendly legislative movements in Congress have created a more supportive environment for digital assets.

This regulatory clarity helps to clear the way for the network to scale and become the world’s computer. Ethereum’s ongoing technological upgrades – such as the implementation of zero knowledge roll-up technology and sharding – are poised to increase the network’s transaction capacity and efficiency which will help maintain Ethereum’s competitiveness against rivals such as Solana, Sui and Cardano and support its growing ecosystem of layer-2 networks such as Arbitrum, Optimism, Base, Linea, Stark and ZkSync. On all these networks in turn reside hundreds of thousands of decentralized applications (dApps).

Web3 Stays Free

Classifying Ethereum as a security would significantly impact the Web3 industry, affecting dApps, DeFi, and NFTs that rely on Ethereum’s layer-2 solutions. With Ethereum leading the DeFi space, holding over 60% market share and $100 billion in total value locked, regulatory challenges could arise that could kill any other crypto layer-1 and layer-2 network, especially proof-of-stake ones.

Benefits for Retail Investors

One of the primary benefits of Ethereum ETFs for retail investors is the ease of access. Investing in ETFs does not require the digital know-how or cybersecurity measures needed for direct cryptocurrency investments. There’s no private key management, no hacking and scam risks, which cost crypto investors billions each year. This accessibility can encourage more widespread participation in the crypto market.

ETFs offer a diversified investment option: they can include a range of assets within a single product. For retail investors, this means a more balanced exposure to Ethereum, potentially reducing the volatility risks of individual cryptocurrency investments, and also means insured investments.

On the downside though, ETF investors will not earn any ETH staking rewards yield (at least not initially). This reward is around 5%. Ethereum’s Shanghai upgrade last year kicked off a liquid staking (LST) and Eigenlayer restaking frenzy that has rejuvenated its struggling DeFi sector.

Trading Strategies Around Ethereum ETFs

With the approval of several Ethereum ETFs now just over the horizon, traders can adopt various strategies to navigate the evolving market landscape. We won’t speculate on the future price of Ethereum, as there are too many variables at play, both on an industry and macro-economic level. However, market sentiment is quite bullish for the next year, especially if the bull market resumes and ETH can turn deflationary again thanks to its EIP-1559 upgrade.

Conclusion

The approval of Ethereum ETFs is a transformative event for the cryptocurrency market that could unlock a new era of mainstream crypto adoption. This regulatory milestone validates Ethereum’s role in the financial ecosystem, and opens the door for increased institutional investment and greater market liquidity. It also boosts the development of Web3 technology and infrastructure, particularly in the USA.

For retail investors, Ethereum ETFs offer a convenient and regulated way to participate in the growth of the crypto market, providing opportunities for diversification and risk management. As Ethereum continues to innovate and evolve, ETFs will shape its future trajectory and solidify its position as a leading digital asset.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Cyberpunk Legend RU Sirius | Mindplex Podcast S2EP20

Bittensor (TAO): The Crypto Neural Network for AI and ML Model Development

As we never tire of saying at Mindplex and SingularityNET, progress in developing advanced AI and ML models is tainted by the chances of centralized institutions gaining undue control over one of the most important technological evolutions in human history.

The race is afoot: key players in AI are under the thumb of institutions, even if they started off as non-profit and open-source projects. Decentralized AI proposes free-roaming AIs to combat fortress-style AI solutions; it uses protocols and facilities built on the blockchain to promote multi-point control systems for AI infrastructures.

Bittensor, a decentralized AI project with a native cryptocurrency called TAO, has recorded exponential growth in 2024, growing an ecosystem of applications on its network, and gathering a community of contributors advancing the AI revolution.

Let’s discuss the key elements of Bittensor, and how they work in synergy to create a distributed network for the development of AI and ML models and algorithms.

What is Bittensor?

Bittensor is a decentralized network designed for peer-based commodity development and provisioning of computing resources.

Bittensor is basically a marketplace for compute resources (storage space etc.), with a collaborative network for developing AI and Machine Learning models. Bittensor embraces competition as a strategy to ensure that commodities, resources, and models developed on its network are top-notch. It is a mesh consisting of computers performing different roles and collectively controlling a distributed network.

The Bittensor network has a more pronounced role in AI and ML model development. However, it is capable of doing even more. It is a modular network, built for flexibility. Key concepts of the network can be applied to many sectors. Other digital commodities that can be built using the Bittensor network include financial market prediction tools, marketplaces for computing power, and algorithms for protein folding experiments. Bittensor is a multi-purpose decentralized network. Requests are posted to a ‘request and solution’ network with advanced data intelligence for the development of AI tools. The Bittensor network is an enterprise-grade tool, opening doors to industry-level adoption for getting. It is also stable for micro implementations by individuals and small organizations.

The Bittensor network consists of harmonized subnets designed to share data on AI and ML models and provide digital resources. The key role players on the Bittensor network are –

- The Bittensor Subnets

- The Bittensor API

- Bittensor blockchain (Known as a subtensor) and

- The Yuma Consensus.

Understanding Bittensor subnets

Bittensor subnets are neural networks of advanced knowledge and data-sharing nodes. Nodes on the network are called ‘Neurons’, and can be Miner or Validator nodes. Validators are the input layer of the network: they create a communication portal between the external environment and the rest of the network.

First, Validators communicate with the hidden layer (miners) via the Synapse module, feeding them information on the task(s) to be done. Next, Miners compete on who provides the best answer or results for the task. Then, Validators assess the results provided by the Miners and feed the rest of the network with their evaluations. Miners are only in communication with the validators, hence, isolated from the rest of the network. There are about 36 subnets on the Bittensor network at the time of writing.

The Bittensor API connects the Subnets to the subtensor. Validators’ evaluations are processed as separate inputs and transported through the API to the Subtensor for consensus.

Understanding Bittensor subtensors

The subtensor is the final validation layer for results from the subnets. The Subtensor is a blockchain operating the Yuma Consensus. The Yuma consensus uses a weighted algorithm to compute validator evaluations and decide which model (developed by subnet miners) is best. The network rewards miners with TAO tokens as specified by the subnet’s incentive mechanism. Validators are also rewarded for their input.

Bittensor operates two subtensors, the Nakamoto and the Kusanagi blockchain. Each of these subtensors can perform final validations.

The Bittensor network is a supernet, housing several subnets created to solve different tasks. Subnets operate a network of validators who feed miners with information on the tasks to be done and assess their results for quality. Validators mediate between subnets, the external environment, and the subtensor to ensure a steady flow of information on the network. This way, Bittensor creates a network where participants can trustlessly share intelligence.

Making a case for the Bittensor network

The Bittensor is, first, an attempt to lower the barrier to developing AI Models. Bittensor caters for resource-intensive digital ventures. Through a collaborative network, it splits the financial burden across various participants, making it cheaper to develop digital facilities.

The network uses input from several network contributors and a decentralized assessment system to promote more efficient models and solutions. Unlike the siloed systems used by centralized organizations, the collaborative environment makes for more efficient products.

But even more important is trying to promote decentralization in developing and managing these tools. Blockchain technology gives Bittensor a multiple-point-of-control system that easily resists censorship attempts and taps the power of the community.

Bittensor (TAO) tokenomics

TAO is the Bittensor Network utility token. With TAO, Bittensor is creating an economy to keep the network in operation, promote adoption, and oversee its security.

TAO use cases

Incentivization: TAO is used to reward miners and validators on the network for their contributions to providing computing resources and developing AI and ML models. Subnet owners define the reward system for their subnets. Miners whose solution emerges the best are rewarded with TAO according to the subnet’s incentive mechanism. Validators also receive TAO rewards.

Network consensus: To create a value layer for the network’s security facility, validators stake TAO to their hotkeys to run a node on the network. Other TAO holders can also delegate their assets to their desired validator. The Validator stake is a commitment to the network.

Governance: TAO holders decide on project improvement through community voting. Proposed additions to the projects must be approved by a majority of the community before they are implemented.

TAO distribution

- Total TAO supply is 21 million coins, just like with Bitcoin.

- TAO block rewards also halve every four years

- New TAO tokens are generated through mining and validating

- One TAO is generated per block.

- The circulating TAO supply is about 6.8 million.

- TAO can be traded on centralized exchanges like Binance and Kucoin.

Who uses Bittensor?

Anyone can use the Bittensor network as a client or a participant in the network. Enterprises and individuals who wish to create a task on the network can set up their own subnet and define their incentive mechanism based on the TAO economy. Anyone can also plug their facility into the network as a Miner to help problem-solving, or as a Validator to contribute to assessing solutions. The incentive system ensures participants always have a point of attraction, keeping the network operational.

Conclusion

Bittensor’s neural network builds a base for developing decentralized intelligence systems, and a marketplace of AI solutions. The economy built on the TAO token ensures that this network stays in charge of the finance that fuels it. Advanced AI facilities are delicate and almost unlimited in ability.

A centralized administration is a bottleneck for developing and using AI. As a network that supports the development of AI models, Bittensor promotes the development of battle-tested models powered by a censorship-resistant system.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

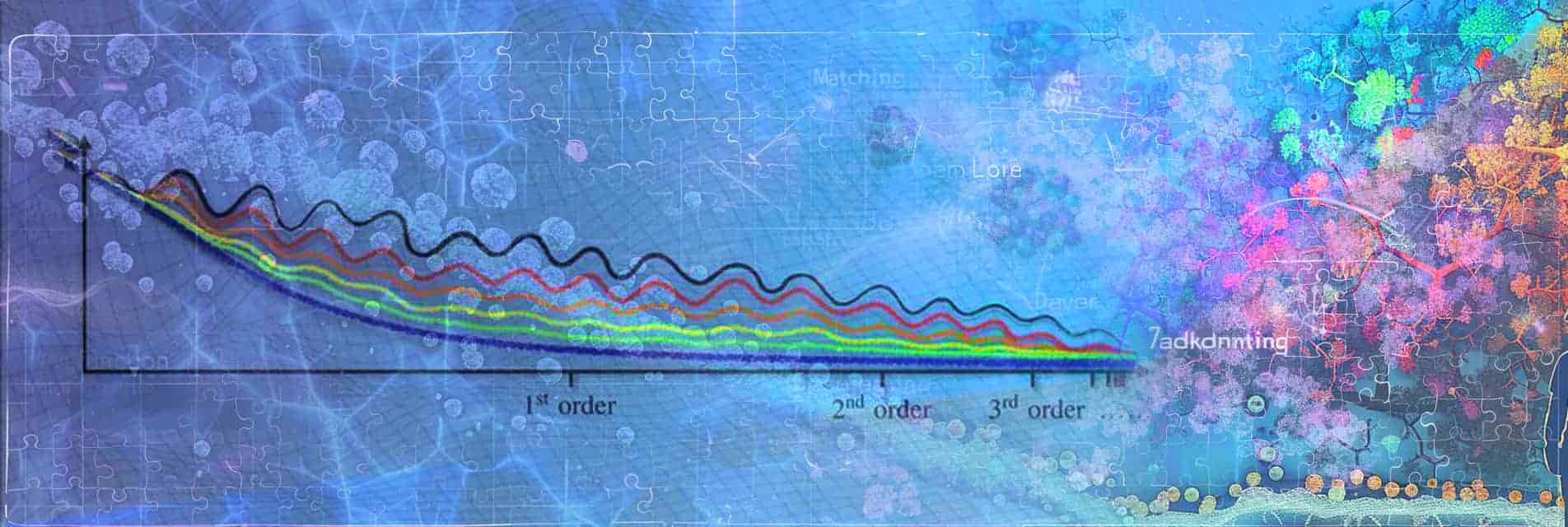

Wavefunction Matching: A Breakthrough in Quantum Calculation Accuracy

Introduction

Picture a world where we can peer into the tiniest particles that make up our universe, understanding their behaviors and interactions with stunning precision. This is the realm of quantum physics, a field that delves into the mysteries of protons, neutrons, and other minute particles known as “quantum many-body systems.” To unlock these secrets, scientists prefer to use an approach called “ab initio,” which means starting from the most basic principles and using them to derive the behavior of the system. Within this approach, the Quantum Monte Carlo Simulation plays a crucial role, using randomness to help make sense of complex calculations, via simulating a large number of possible ways a system may evolve and probabilistically combining the results. However, in many applications this technique has faced a major technical challenge: the “sign problem,”

This issue arises when positive and negative results offset each other, leading to erroneous conclusions. To tackle this challenge, researchers devised a solution known as “Wavefunction matching.” Imagine a complex puzzle simplified into a more manageable form—this is akin to what Wavefunction matching accomplishes. It involves mapping the intricate problem onto a simpler model devoid of oscillations, and any discrepancies are resolved using perturbation theory. By streamlining the problem and addressing differences, accurate calculations become feasible.

Applying this technique, researchers successfully computed the masses and radii of all nuclei up to a mass number of 50, aligning closely with real-world measurements. Furthermore, the utility of Wavefunction matching extends beyond rectifying Monte Carlo Simulations—it holds promise in the realm of quantum computing. By enhancing calculation accuracy and reliability, it serves as a valuable tool for understanding how nature actually works and applying those insights to problems in chemistry, physics, and quantum computing.

As Dr. Meißner suggests, this method’s versatility spans both classical and quantum computing domains, ushering in a new era of precision and reliability in calculations. This advancement isn’t just confined to rectifying existing methodologies; it holds the potential to revolutionize quantum algorithms, paving the way for swifter computations and superior outcomes across various quantum applications.

Conclusion

Richard Feynman said, ‘Any field for which there is a prize that is defined is a field that already has its best days behind it. It’s a field that barely has a name and is going to have the most fertile moment.’ Wavefunction matching is a good example of such a fertile moment in a research area still in its most exciting, early, innovative phase.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)