In a video released in April 2022, German startup Volocopter stated their goal was to get their flying car zipping around the skies over the 2024 Summer Olympics.

Volocopter is one of hundreds of start-ups pursuing advanced air mobility – essentially flying cars – and their vehicle is called the Volocity. Publicly announcing timelines in technology is usually considered a bad idea, and as late as February 2024, Politico rubbished their bold claim.

Volocopter can now gloat at the doubters. Last week they announced Olympic success. The technology and legal permissions will be ready for the Paris Olympics, the opening ceremony of which is today, 26 July. People will indeed be able to use flying taxis to hop around Paris during the upcoming Olympics, and President Macron is invited to go for a spin.

It is an interesting moment for electric aviation. Battery technology is boldly tearing forward with sodium-ion, solid-state, silicon anode, and other improvements. Cars, boats, and trains are switching to electric motors. “The electrification of aircraft is leading to many opportunities to develop fundamentally new configurations and to take advantage of distributed and mechanically disconnected propulsion”, one paper says. At the same time: drones have established themselves as a major industry, thanks largely to improvements in computer technology that can control many rotors at once. Most consumer and military drones are electric but unmanned, but it’s time to revisit the question of 1950s futurists: When can I get my flying car?

eVTOL and eSTOL

There are two approaches to building flying cars: eVTOL and eSTOL. These stand for ‘electric vertical takeoff and landing’ and ‘electric short takeoff and landing’.

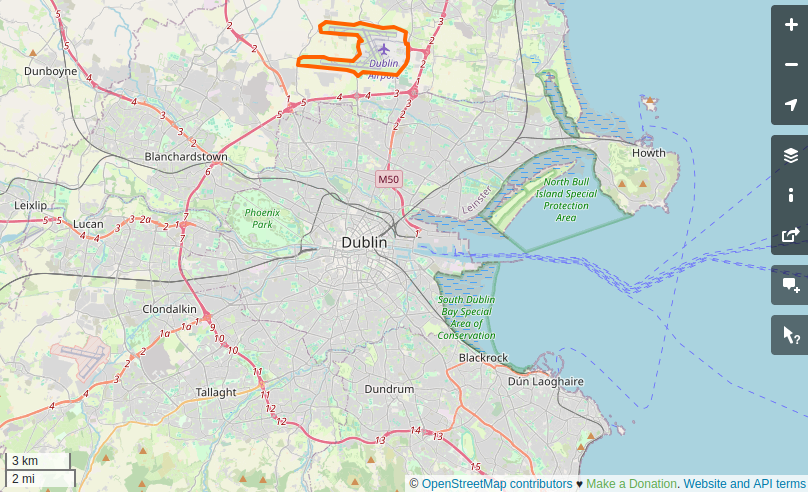

Look at a map of a city and you’ll see that in most cities, airports are the largest plots of land dedicated to any single purpose. There are two reasons for this: space and noise. Planes need long takeoff and landing distances (1.5km or 2km), and they are noisy, so they have to be set apart from homes and schools and stuff. These limitations often force airports outside of cities, and that adds an hour to your trip to Spain.

eVTOLs promise a quieter flying machine that can take off and land vertically (say on a roof). eSTOLs also aiming to run with quiet electric motors, and to take off and land a very short runway. Whereas commercial planes need 1.5-2km runways, eSTOLs aim to need “between 45 and 90 meters of runway” according to the COO of Electra.aero.

This video from Electra beautifully illustrates what an eSTOL should be: it’s simply a plane, but a battery-powered one optimised for urban deployment:

Flying with rotors, flying with wings, a bit of both

Why would anyone build eSTOLs for short runways when eVTOLs with zero runway are an option? It’s because the engineering is significantly simpler: an eSTOL uses familiar airplane technology: it drives forward to create lift under its wings and take to the sky. It is an adapted plane. This allows engineers to use well-understood principles and try to win the race-to-market.

eVTOLs are a little more complex. Most of them (Volocopter’s Volocity is one of the exceptions) require engineers to think about two phases: one where rotors or ducts pick it up and set it down for the vertical takeoff/landing, and another fixed-wing mode for cruising around. This second plane-like flight is quieter and more energy-efficient than the drone-like one.

Little planes or big drones?

Therefore eSTOLs should theoretically be simpler and cheaper than eVTOLs, but in this bubbling, surging industry, design philosophies abound. The Volocity by Volocopter that will share the skies with the Olympic polevaulters is an eVTOL with a single propulsion-type. It takes off and lands vertically like a drone, and then – unlike its competitors Joby, Beta Technologies, Lilium etc. – it continues to fly around in the manner of a drone. The simplicity of this design philosophy got the Volocopter Volocity to market before their competitors. Whereas eSTOLs are small planes, Volocopter’s machines are big drones.

A good Forbes article said, “It’s been estimated that around 300 different companies are trying to build new “flying car” electric VTOL aircraft for the anticipated revolution, and there are almost as many different design philosophies. Most are opting for hybrid designs that feature rotors for vertical takeoff and landing, but regular fixed wings for horizontal flight. There’s a good reason for that — fixed wing flight is much more efficient, and for electric aircraft, battery weight is the key issue, and that makes efficiency really important. In spite of this, one of the companies furthest along in actual deployment is using a much more basic electric multirotor design with no fixed wings. It’s effectively a human sized drone”.

So Volocopter’s approach appears to have won on simplicity and quick deployment. The tradeoffs? Range and noise. Flying with rotors is less energy-efficient than fixed-wing flight, so you drain your battery quicker. The Volocity has a range of 35km.

Is Volocity’s 35km range a problem? Not really. You only need your vehicle’s range to be as long as your trip. Hundreds of kilometers is for city-to-city. A range of 35km is grand for hopping around one city.

For comparison, a video released by Joby, another of a many eVTOL startups, in 2021, says they flew 154.6 miles (248.8km) in a test. That was their battery-powered version; for longer ranges, they feel hydrogen is the way to go, and last month (June 2024) flew their hydrogen eVTOL for 523 miles.

An invaluable resource for tracking and comparing these projects is the Advanced Air Mobility Reality Index. Tech news is so full of hype and self-awarded “breakthroughs” that it’s handy to have someone independent keeping track of the projects and their technology readiness levels. It provides a league table (Volocopter is currently winning) that usefully lists the intended use-cases (flying taxi being the most common) and whether the bird is piloted or autonomous.

Noise

I used to write about breaking tech that would change the world. Now I write about breaking tech that won’t make such a racket. I must be getting old.

The noise made by helicopters is a major nuisance and has limited them to very infrequent flying. And if you’ve ever been near a drone, you know that their noise is not a detail.

Noise is the hardest engineering problem in eVTOL/eSTOL, and, in my opinion, the biggest shortcoming of Volocopter’s Olympic success. Electric cars run much quieter than combustion ones, but no such luck with aircraft. The noise from helicopters, drones, and airplanes doesn’t mostly come from the engine, but mostly from the interaction of the craft and the air (Likewise, electric cars are actually just as noisy as combustion cars at high speed, because wheel-noise is more important than engine-noise).

A valuable paper on low-noise electric aircraft puts it this way: “Although these aircraft use quiet electric motors instead of noisier combustion engines, this is not likely to have a significant effect on the overall noise radiation of the vehicle, because the noise of rotor and propeller driven aircraft is generally dominated by the aerodynamically-generated noise of the rotating blades. Instead, the main acoustic impacts of electrification are a result of the new freedoms of electric propulsion, especially distributed electric propulsion, offered to the aircraft designer”.

The fluid dynamics of why flying machines are noisy is extremely complex. eVTOLs spin their rotors at slower speeds than helicopters do to avoid the loud thwap-thwap noise that helicopters make. Yet turbulent flows bumping the body of the bird cannot be fully avoided, and complex multirotor designs send vortexes all over the place, including into collusion with their neighbouring rotors, creating noise.

Progress is being made on these problems (for example, a March 2023 paper found that using six blades instead of four lowered noise by 5 to 8 decibels, losing only a 3.5% thrust in the process. Volocopter say they are using “the lowest disc loading currently on the market… and a low RPM (revolutions per minute) rate” to reduce noise (‘Disc loading’ is the ratio of the bird’s weight to the area of its rotors; Volocopter positively bristles with rotors.)

This detailed fluid dynamics work can chip away at the noise problem – sensible work for centibel gains – but the reality of the engineering says don’t expect a masterstroke that will suddenly make eVTOLs 100× quieter. The only technology that may be an exception is the Lilium Jet. Instead of rotors, it uses 36 small ducted fans (so that the ducts trap sound), and is an undeniably beautiful-looking product:

Lilium sits at a mediocre 11th on the ‘Reality Index’, and until independent tests have certified the noise-levels of each experimental eVTOL, we have to be cautious.

A loud note of caution

I agree with the need for electric urban mobility. But let me question the need for flight.

‘Energy-efficient flight’ is, to some extent, a contradiction in terms. Under 0.25% of international freight is transported by plane (most goes on ships), and there’s a reason for that: energy costs. When you have to expend energy to do move a load from A to B, why also expend energy fighting gravity? You need a justification. Traffic might be a justification, but there are simpler ways to solve that (such as bicycle lanes). Emergency vehicles such as ambulances should fly: they have an excellent justification.

The noise issue is the hardest engineering problem around flying cars. Safety can be solved. Autonomy can be solved. eVTOL companies are quick to make impressive claims about their quiet birds, so we need an independent agency inspecting them for sound and publishing data. As this data is missing, and as I haven’t had the chance to get up close, we have to use some guesswork to figure out how loud they are.

I lean towards skepticism, and suspect that Volocopter have not made much progress on the sound problem. The approval from the City of Paris means they have achieved good safety standards, but the approval comes with limitations: they can’t zip anywhere at any time. The authorities want them flying a limited number of flights at constrained times of the day. Volocopter’s website says they will “map out routes inside the city that ensure the Volocopter aircraft do not generate a cacophony that exceeds the city’s permitted noise levels. Part of its approach will involve flying at specific times of day.” This strongly implies there is quite a lot of noise. The most skeptical interpretation is to say they’ve simply built a small helicopter: those are also approved to fly low flight volumes at major events like the Olympics.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)