TOKEN2049 Singapore 2024, held on September 18-19 at the iconic Marina Bay Sands, was the flagship event of last month’s Singapore Blockchain Week, which culminated in the iconic F1 race on the Sunday through the streets of the city-state.

Other events included the developer-focused Solana Breakpoint, the controversial Network State conference, and more lighthearted one-day stuff like Memecon, targeted at as you can guess, meme coins.

Back to Token2049 though. Previously held in Hong Kong until Singapore wrested it away a couple years back, the two-day conference once again cemented its status as the world’s largest crypto event, where East and West meet on all matters blockchain. The two-day festival brought together over 20,000 attendees from 7,000+ companies, featuring 300+ speakers and 400+ exhibitors, with more than 70% being C-level executives.

The event featured lavish free-flowing food, coffee, and live DJ sets, and crypto mindsharing and degeneracy in its most unbridled form, with projects splurging millions on free side event parties hoping to entice attendees to support them.

It was an unparalleled experience for attendees, which included the likes of Vitalik Buterin (Ethereum), Anatoly Yakovenko (Solana), Charles Hoskinson (Cardano) and several new chain founders like Monad’s Keone Won and Mo Shaikh of Aptos.

TOKEN2049 Singapore 2024 arrived at a pivotal time for the crypto industry, with several significant developments taking place this year, including the approval of spot Bitcoin and Ether ETFs, increasing involvement of major TradFi players such as BlackRock and Fidelity, and the heating up of the arm wrestling between global crypto innovation and appropriate regulation.

Key Highlights and Takeaways

1. Crypto Becomes a Political Football

It’s an election year in the United States of America, and the stakes are especially high for crypto. The 2024 presidential election in the USA was a hot topic at TOKEN2049. Many speculated that the election could impact the industry’s prospects. The huge crypto vote in the USA in swing states (20% of voters potentially in the game) could play kingmaker/queenmaker in a month’s time. With Donald Trump, crypto has found an unlikely ally, while Kamala Harris’ motives remain unknown, but will be decidedly less friendly, if her ties to Operation Chokepoint 2.0 serve as an indicator.

However, both candidates have made overtures to the digital assets sector, and both of course now accept donations in crypto – how convenient!

While it’s unclear whether recent political endorsements of crypto are genuine or politically motivated, the industry may see the USA adopt more favorable crypto policies from 2025, regardless of the election. It’s just too big a voting bloc to ignore.

2. Spot ETFs Take Crypto Mainstream

The approval of spot Bitcoin and Ethereum ETFs in 2024 was a significant milestone, helping to bring crypto to a wider audience. This financial vehicle has been widely seen as an endorsement and validation of crypto by authorities outside the industry, while a few dissenting crypto purists have raised concerns about centralization of asset ownership.

3. TradFi Turns to Crypto

TOKEN2049 Singapore 2024 saw the increasing involvement of traditional titans, such as JP Morgan, Grayscale, and Goldman Sachs. They continue to stake their claims to Web3 territory. This shows that crypto is actively being adopted by future-facing traditional finance. Others, like PayPal, Visa and Franklin Templeton made announcements during the week that they were making specific forays into crypto payment.

4. Web3 Continues to Multiply

Despite the bear market, there was still a significant focus on Web3 projects and technologies at TOKEN2049. However, the ostentatious booths and side events were worrying to me personally. I found a huge gap between founders with excess capital trying to spend that to buy crypto clout, and those with strong products and communities. It’s likely that the majority of the projects at display in Singapore won’t be around after the next bear market.

5. Crypto Regulation Takes Shape Globally

With the first measures of the MiCA regulation in Europe going live in June 2024, Dubai’s Virtual Asset Regulatory Authority helping position the emirate as a crypto hub, and the Monetary Authority of Singapore supporting the nation’s crypto growth, the vital piece of industry infrastructure continues to strengthen.

SingularityNET Founder Takes Token2049 Stage

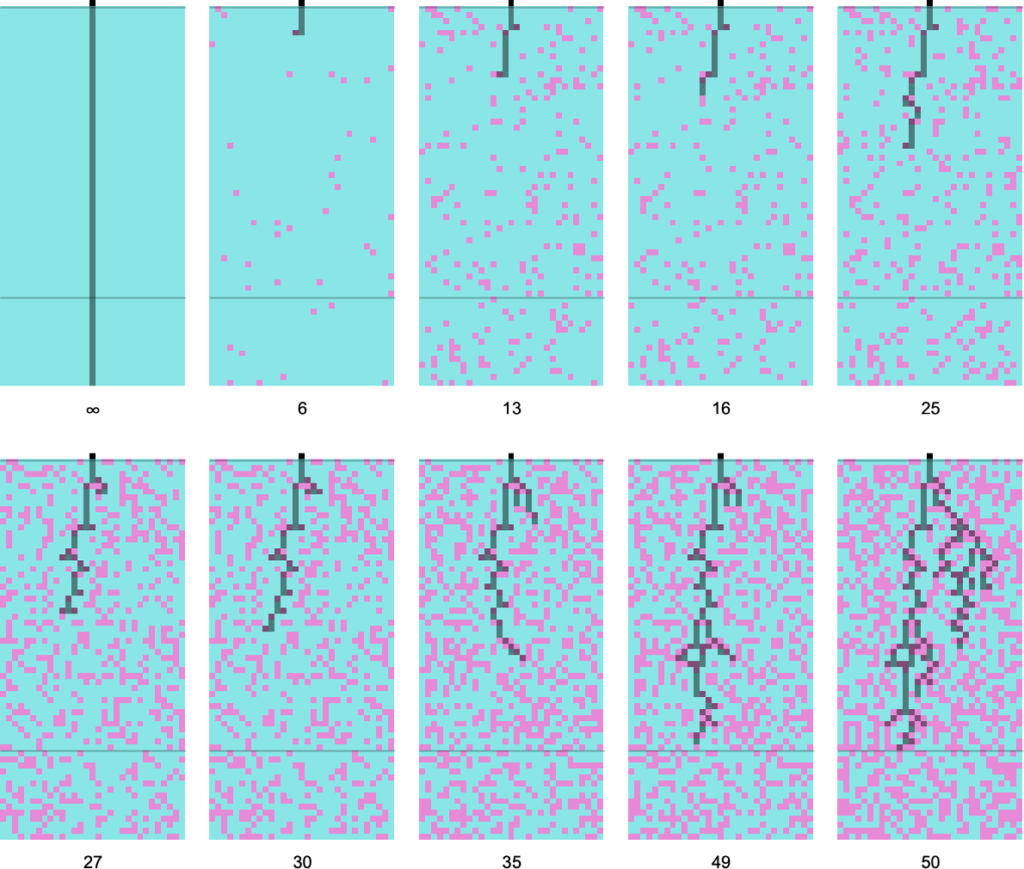

Ben Goertzel, AI pioneer and co-founder of SingularityNET (AGIX, now merged with FET into ASI), joined by humanoid robots Sophia and Desdemona, discussed the latest advances in artificial intelligence in a keynote speech. Goertzel outlined three AI revolutions:

- the current era of narrow AI applications,

- the emerging transition to artificial general intelligence (AGI)

- the future potential of artificial superintelligence (ASI)

ASI Heads Talk AI in Singapore

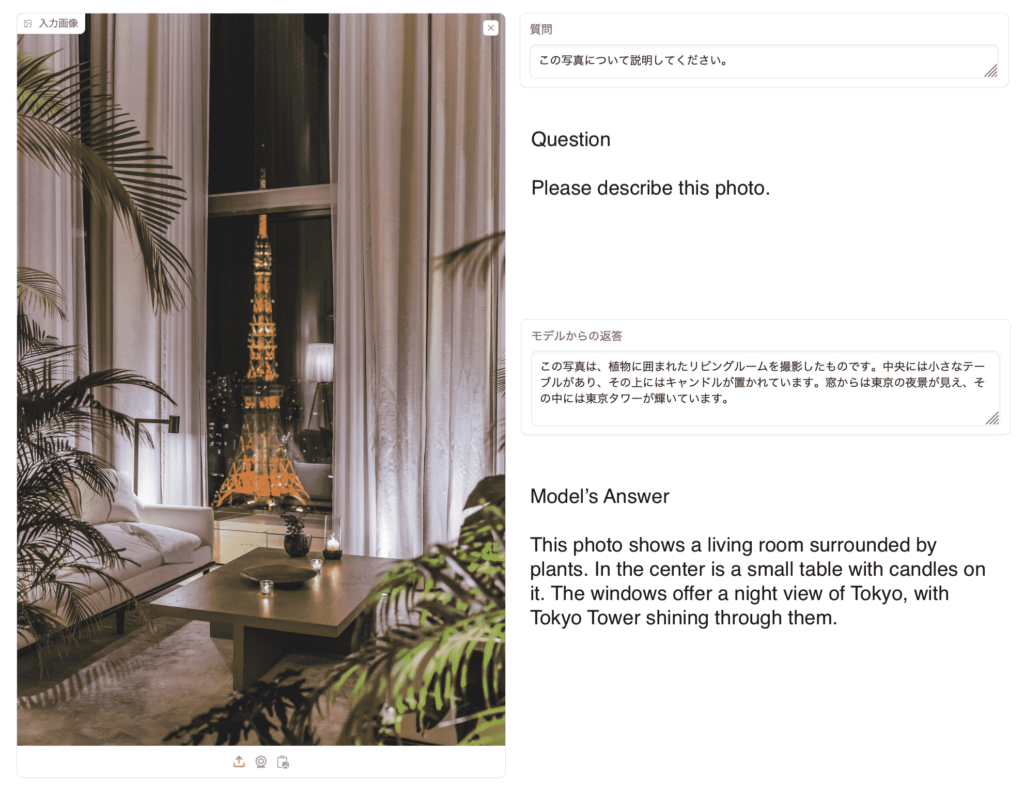

An expert panel discussion at Token2049’s AI Day featured representatives from Live Peer, Render Network and the founders of SingularityNET, and Ocean Protocol, Dr. Ben Goertzel and Bruce Pon respectively. They explored token economics, the balance between centralization and decentralization in AI development, and the potential future of artificial general intelligence (AGI). Key topics included innovative token distribution methods, project collaborations, and the urgency of decentralized AI development. I will delve deeper on these talks in a future article.

Attendee Experiences and Observations

Attendees shared their experiences and observations from TOKEN2049 Singapore 2024:

- The gap between founders who have money (either through selling tokens or raising money) and those with strong products and communities could not be wider. Many firms with excess capital (like certain centralized exchanges and NFT marketplaces) were engaging in weird and absurd marketing tactics, while battle-hardened founders were feeling the pinch of the bear market.

- There was a noticeable shift in the talent base, with many people switching to AI or going to traditional roles. Those remaining were either exceptionally smart and saw a wedge in the market or were good at taking on risk with hard problems.

- It was good to finally touch base with the teams from newish chains like EigenLayer, Sui, Aptos, Monad and more. Their founders were available for interviews to address some of the negativity they had this year due to underwhelming airdrops and the controversial low-float-high-FDV tactics they used to help early VC investors recoup their investments faster.

Networking and Side Events

TOKEN2049 Singapore 2024 certainly offers unparalleled networking opportunities, with attendees from the global Web3 industry, including entrepreneurs, investors, developers, industry insiders, and global media.

The event also featured over 500 side events, making it the world’s largest Web3 event. It was seriously overwhelming, with swarms of attendees spread across the vast corners of the Marina Bay Sands from one event to the other, to take over the city’s biggest clubs like Marquee (Sui and Magic Eden) and Ce La Vie (Aptos) with free food and booze on the menu.

Of course, this didn’t make it a cheap week out by any means. As usual the 7-day celebration of crypto coincided with the prelude to the Singapore F1 race, resulting in exorbitant prices for flights and hotels.

Conclusion

Anyone that’s ever been to Singapore can attest to its futuristic energy and landscapes: the perfect stage to showcase the money of the future, cryptocurrency, in all its variant forms.

As the crypto space continues to mature, this decentralized financial revolution requires real world meetups to chart the course ahead, TOKEN2049 remains a crucial event for the industry to gather, network, and plan for the future. With the next edition scheduled for April-May 2025 in Dubai, which also played host to the conference last year (and flooded!), the crypto community eagerly awaits the next chapter of this premier event.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)