Loneliness is an epidemic. It’s an epidemic that kills. It may be the greatest public health crisis of the coming decades, and, by its very nature, it remains hidden from most people’s view. Yes everyone feels lonely from time to time, but for some, loneliness is a disease that – even with their best efforts – they are not able to cure. For some people, sure, ‘getting out more’ may just be a case of overcoming bad habits, or taking a chance on a new activity. For many others, it’s a far more sinister and complex problem. Can AI help provide the solution?

Many sectors of society suffer from loneliness. Old people in particular often find themselves isolated, economically and socially, from the world around them. When people stop caring about what you have to say, and feel like your contribution to society is done, it’s hard to make new friends. It’s especially hard for those whose families have died or emigrated. They are left with no one in the world.

Those who suffer mental health problems like depression also find themselves fading out from the world, only to return to find that everyone they used to know in it has gone. The socially anxious may be desperate to make new friends, but the oppressive weight of their symptoms makes it impossible. LGBTQIA+ people often suffer extreme loneliness as their sexuality isolates them from the people around them, especially in cultures where such identification is taboo.

Even young, mentally well, culturally conformant people might simply have no friends, even though they try, and even though they are likeable. 40% of 16-24 years say they feel lonely, a frankly staggering number. Loneliness strikes everywhere. Some people work every waking hour. Some people have to travel as part of their daily lives. Some people find themselves in a new country with a difficult new language. The modern era has broken apart the foundations of community that knit our little societies together for millenia.

We humans are social creatures. Historically, humans didn’t travel very far – they barely got beyond the village. The social centres around which they operated – the baths, the brewey, the mudhif, chitalishte, Palace of Culture, and the village green – these local hubs have faded from existence, replaced by the seductive glow of tv screens.

The rise of late-stage capitalism has siphoned people away from their nuclei and increasingly individualised – and isolated – them. The cubicle existence of the modern world, both in the workplace and in housing (with ever-greater numbers living alone), and the depreciation of the family unit, have created room for loneliness to grow around all members of society. We are not evolutionarily equipped to cope: our cells, our brains, our minds, our hormonal systems weren’t built to live like this.

The information age caused the problem, but it may also have the solution. The internet has certainly done much to help people find like-minded groups. Many slip through the nets, and this is where humanity’s next great wonder, AI, may well provide a cure. Chatbots are good at, well, chatting. If you need someone (or something) to talk to, the fact of the modern world is – if you can suspend your Turing-sensitive mind – you now can.

Chatbots are now sophisticated enough to provide a good simulacrum of conversation, and they are adapted enough to be supportive, informative, helpful, and generally ‘there for you’. Almost every ChatGPT interaction ends with ‘if there is anything else you need.’ Well, some people just need it to be there and, provided Microsoft’s data centres don’t collapse, it always will be.

The powerful possibilities of this are not lost on researchers, charities, and campaigners. Many companies are now seeking to provide AI companions to provide emotional support to those who are vulnerable. One of the leading ones, Replika, promises an AI companion that is unique to you; it records your particular interactions, allowing it to target comforting and kind words, and to grow in understanding of your situation.

The modern tech world is so often geared towards polarising us and driving us apart. This is a direction of travel that is only going faster with the advent of AI, with algorithms designed to sort us into camps and feed us the ragebait so we engage. It would be good if we could instead take a difficult approach, and focus on creating AIs that are compassionate, and algorithms that are built to bring us together.

AI companions are a compelling antidote to loneliness, but we must be careful of overindulging in mimicry. Her, a movie which has only grown in cultural importance since its 2013 release, shows the perils of thinking of nothing else but this machine. In that movie, the titular AI was a more fully-fledged ‘consciousness’, but in this age of breached Turing tests – what’s the difference? Imitation companionship is close to the real thing: you still get to express your feelings. You still get someone – or something – else’s perspective on it.

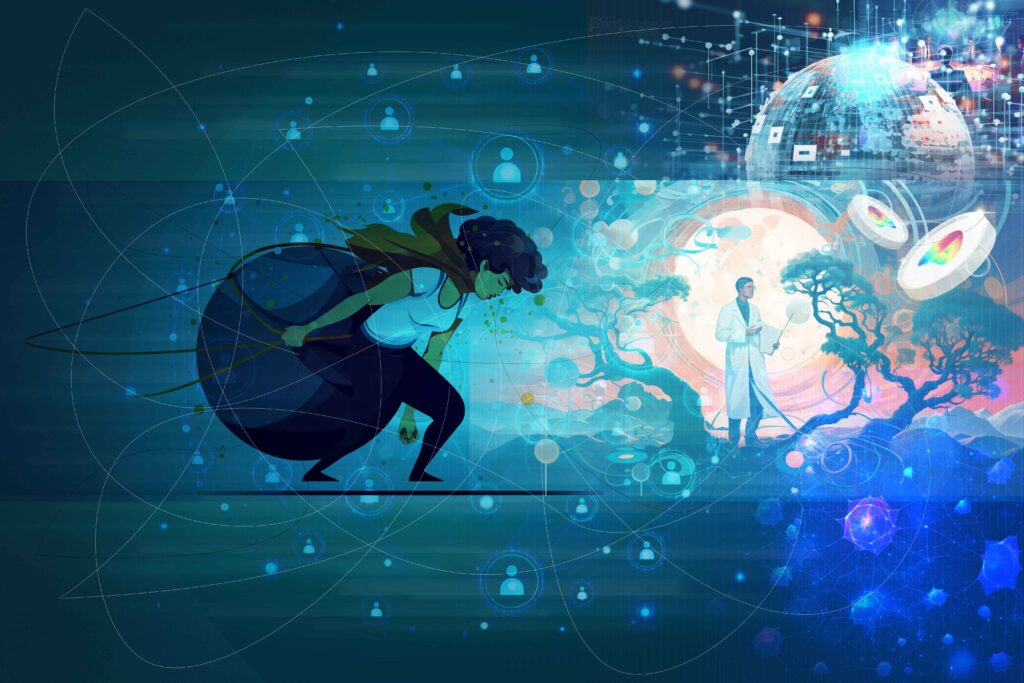

The best scenario is one where these AI companions map a route back to human-to-human relationships. Perhaps, as they become more sophisticated and more entwined with our lives, AI companions could be the jumping-off point for those with social anxiety or those who are all alone to begin to find like-minded people. An AI bot who someone spends their days talking to should know their interlocutor intimately and, with correctly safeguarded data controls, be able to perhaps ‘introduce’ them to others who feel the same way they do, and give them an opportunity to forge real connections in an increasingly unreal world.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)