Introduction

Despite the much-anticipated fourth Bitcoin Halving in April, which traditionally marks the beginning of a new era in the crypto cycle, the cryptocurrency market’s response in Q2 2024 was surprisingly muted, according to the latest CoinGecko report.

Q1 was a period of exuberance, driven by the approval of the USA’s spot Bitcoin ETFs and the run-up to April’s Halving event.

Q2 2024 was characterized by choppy trading conditions for Bitcoin and the broader crypto market, where major positive events like the Ethereum spot ETF approval didn’t trigger immediate price surges. The summer holidays – traditionally a bearish time – didn’t help.

What is ahead in the second half of 2024? The crypto industry faces a mix of challenges and opportunities. The looming distribution of Mt. Gox’s Bitcoin holdings and several large token supply unlocks will impact the market in uncertain ways.

However, positive developments such as the impending launch of spot Ethereum ETFs in the USA, an improving macroeconomic environment, and continued innovation from development teams offer reasons for optimism.

Let’s explore the key developments that shaped the crypto landscape from April to June 2024.

Market Capitalization: Weathering the Storm

Despite a decline in total cryptocurrency market capitalization, closing at $2.43 trillion in June, the crypto market exhibited remarkable fortitude. Throughout Q2, the market fluctuated within a defined range, unable to surpass previous all-time highs but maintaining a strong foundation.

This performance contrasted with traditional markets such as the S&P 500’s steady climb during the same period. The divergence between crypto and traditional markets highlights the unique dynamics at play in the digital asset space, and caused some concern. However, Trump’s surprising championing of Bitcoin and Ethereum spot ETF approval have led to a late Q2 surge in crypto prices and market sentiment, as electioneering efforts to capture the important crypto vote began to ramp up.

Bitcoin: Navigating Post-Halving Waters

Bitcoin, the flagship cryptocurrency, experienced a modest decline in Q2, ending the quarter at $62,734. The much-anticipated fourth Bitcoin halving occurred during this period. Historically, these halvings marked the beginning of new market cycles. However, the immediate market response to this halving was subdued.

The quarter concluded with some market uncertainty as news broke that significant Bitcoin sell pressure was to come: in the form of Mt. Gox repayments and the German government’s seized BTC sales. FUD levels were amplified as usual by the media and key influencers, causing a dump in all crypto prices before it rebounded with Trump’s endorsement.

Mining Landscape: Adapting to New Realities

The Bitcoin mining sector faced some big challenges in Q2. Hash rate reached an all-time high in April in the runup to the Bitcoin Halving, followed by a foreseeable decline. Since the halving, a lot of smaller miners have been flushed out due to the increased difficulty and cost. Despite this setback, the mining industry saw notable developments, including:

1. Major players are expanding into AI applications

2. Significant investments in the mining sector

3. Advancements in mining chip technology

These developments suggest that mining companies are diversifying their operations and investing in technological advancements like artificial intelligence to maintain competitiveness in a post-halving environment.

Airdrop Farming Yields Too Little

One of the defining features of Q2 was the proliferation of token airdrops, as many projects sought to capitalize on the bullish sentiment from Q1. However, these airdrops became a source of controversy within the crypto community, who were vocally aggrieved by the paltry amounts given to them by the likes of Layer-Zero and ZkSync after supporting these projects for months and even years.

Projects struggled to balance rewarding genuine users while filtering out opportunistic ‘airdrop farmers’. Meanwhile, many airdropped tokens experienced significant price drops post-launch, leading to complaints that the financial benefits were primarily accruing to project insiders and private investors who were looking to establish high-FDV low-float tokenomics. Creating fair and sustainable token distribution models in the crypto ecosystem remains an ongoing challenge, and retail investors are becoming increasingly jaded.

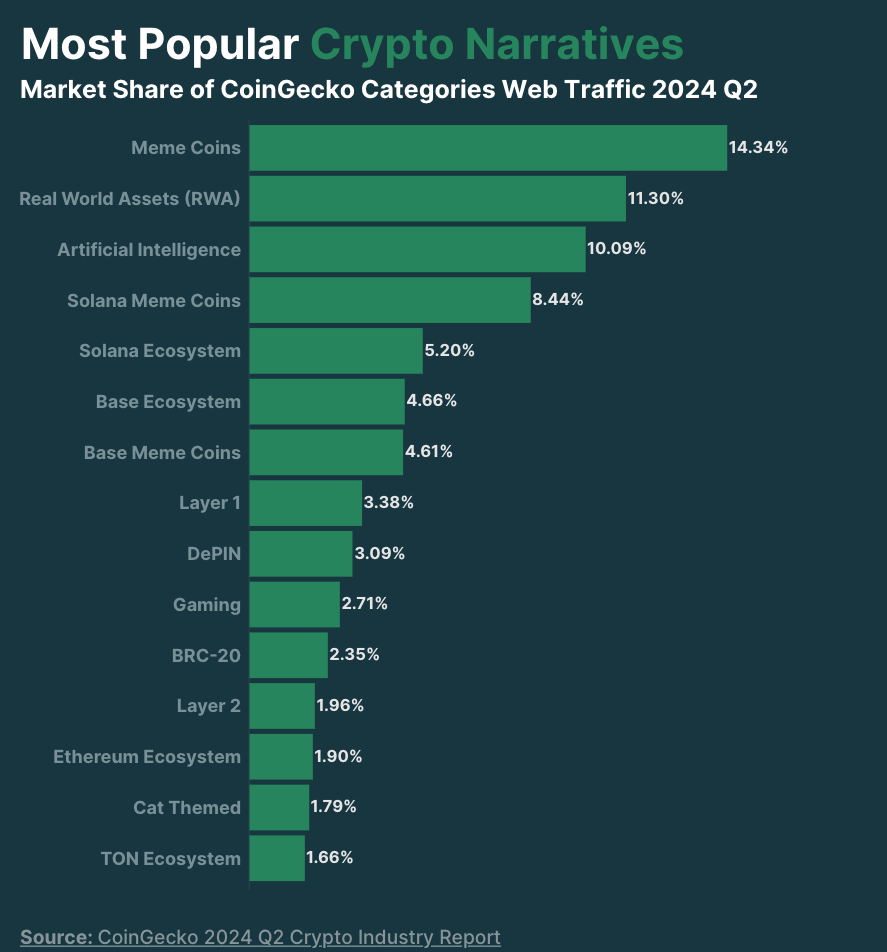

Memecoin Mania Peaks

As airdrop season flamed out, memecoins earned their new status as a dominant force in Q2 2024, capturing a significant portion of market attention and billions in trading volume. Alongside Real World Assets (RWA) and Artificial Intelligence (AI) projects, these categories accounted for a substantial share of market interest.

While new bluechip projects lined the pockets of venture capital funds, memecoin launches were considered fair and transparent by retail investors, who understood for the most part that they were devoid of any real utility other than being a fun lottery ticket. New memecoin launch platform Pump.fun enabled nearly 450,000 new Solana memes to be issued in May alone.

The return of GameStop legend RoaringKitty created pandemonium, resulting in a plethora of low-quality memecoins getting churned out, inevitably draining the wallets of their buyers when they went to zero.

As minor celebrities like Iggy Azalea, Caitlyn Jenner and Andrew Tate piled in, so did some memecoin fatigue, and the market began to dip at the end of Q2 as pump and dump scams and rugpulls became the norm.

Blockchain ecosystems also played a significant role, with platforms like Solana and Base leading in popularity. New Telegram-backed entrant Toncoin ended the quarter strongly, attracting millions of new users through TapFi games like Notcoin and Hamster Kombat.

Ethereum: Supply Dynamics Shift

Ethereum experienced an inflationary quarter, adding to its circulating supply, despite the deflationary EIP-1559 mechanism. This shift resulted from changes in the balance between burned and emitted ETH. The burn rate fell compared to Q1, indicating reduced network activity and lower gas fees. A worrying 120,000 ETH was added to its supply in Q2.

Centralized vs. Decentralized Exchanges: A Tale of Two Trends

Centralized exchanges (CEXs) saw a further decline in trading volume of 15% during Q2 for a total of $3.4 trillion, with Binance maintaining its position as the market leader despite the overall downturn. However, some exchanges bucked this trend, with platforms like Gate.io, Bitget, and HTX seeing increases in trading volume as they ramped up marketing efforts.

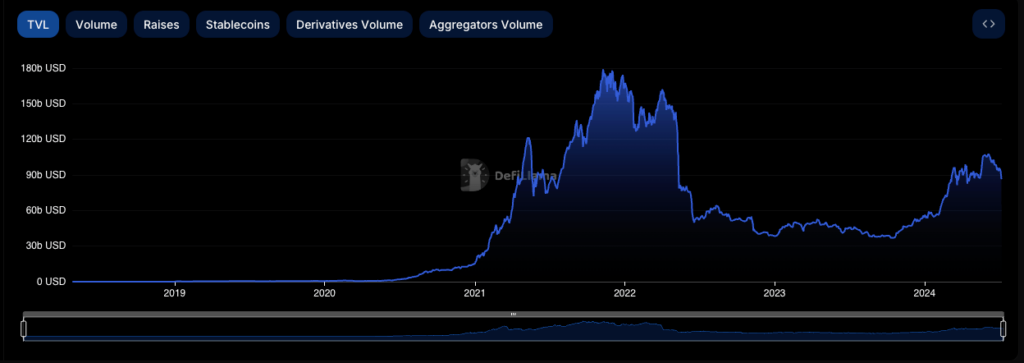

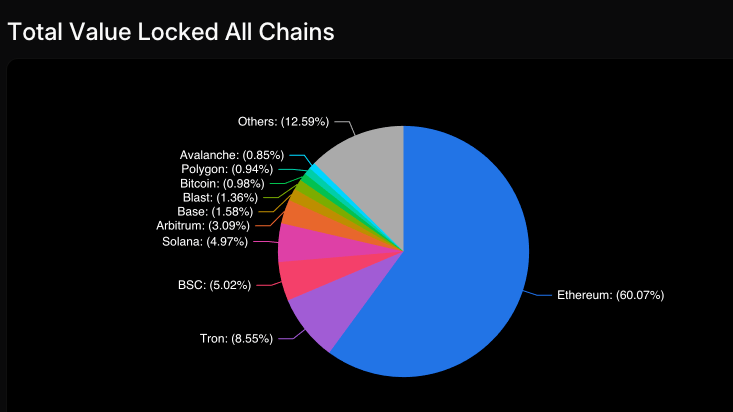

In contrast, decentralized exchanges (DEXs) experienced growth of 15%, with a total trading volume of $370 billion driven by a surge in meme coin trading and new layer-1 and layer-2 chains offering supposedly lucrative DeFi airdrops which grabbed the bulk of crypto’s mindshare and capital.

Uniswap maintained 48% dominance in the DEX space, and Top Ten newcomers like Thruster and Aerodrome made significant gains, due to Blast airdrop farming and Base trading respectively.

Conclusion

The crypto industry’s performance in Q2 2024 paints a picture of a market poised for further growth, but also nervous about macroeconomic issues.

As we move into the second half of 2024, investors and enthusiasts should keep a close eye on emerging narratives and regulatory changes ushered in by events such as the US Presidential Election, the mainstream adoption of crypto spot ETFs, a long-awaited reduction in Fed interest rates as well as the inevitable effects of Bitcoin’s post-halving supply shock coming into play.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)