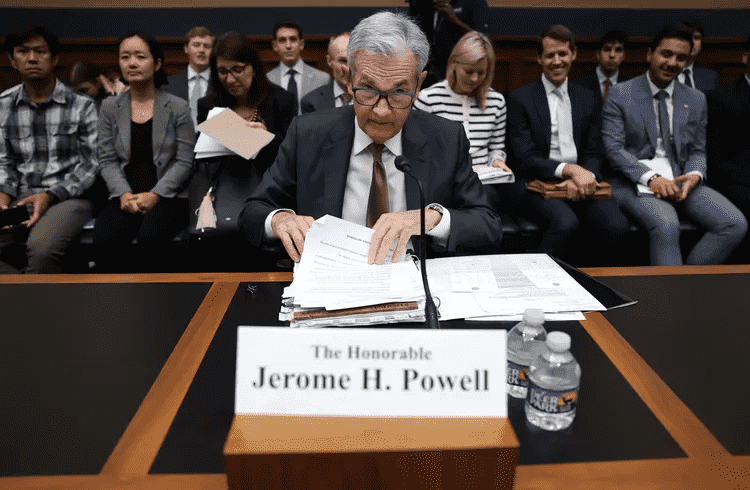

As the 2024 United States presidential election approaches, an unexpected issue has emerged as a potential game-changer: cryptocurrency policy. The contrasting approaches of the two leading candidates, Donald Trump and Kamala Harris, highlight the growing importance of digital assets in American politics, an issue that could have far-reaching implications for the future of finance and technology in the country.

At the moment, Trump is promoting himself as Crypto Jesus, using all its tools from DeFi to NFTs to boost his campaign coffers, while Harris has recently made overtures to the space and announced she’d be accepting donations via Coinbase. What is happening?

The Crypto Conversion of Donald Trump

Donald Trump’s journey from crypto skeptic to champion is a complete turnaround. In 2021, the former president dismissed Bitcoin as a “scam against the dollar”, a threat to the supremacy of the U.S. dollar. However, by 2024, Trump had done a 180° turn, positioning himself as a prominent cryptocurrency advocate in American politics.

Trump’s crypto embrace began with the launch of his NFT collection in December 2022, featuring digital trading cards commemorating key moments from his presidency. The initial release of 10,000 NFTs at $50 each sold out quickly, though subsequent releases have seen slower uptake.

The former president’s crypto strategy intensified in 2024:

- In May, Trump announced that his campaign would accept donations in various cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin.

- In June, he met with the USA’s Bitcoin mining industry at his Mar-a-Lago resort, declaring that crypto users should vote for him because he would “stand up to Biden’s hatred of Bitcoin”.

- In July, Trump made history as the first American president to address a Bitcoin event, speaking at the Bitcoin 2024 conference in Nashville.

During his Nashville appearance, Trump emphasized American leadership in the crypto space, stating he wants Bitcoin “mined, minted, and made in the USA.” This rhetoric cleverly ties crypto to his “Make America Great Again” platform, appealing to both tech enthusiasts and his nationalistic base.

Trump’s involvement with crypto isn’t limited to rhetoric. In late August 2024, he announced ‘The DeFiant Ones’, later rebranded as World Liberty Financial, a new cryptocurrency project promising “high yield” investment opportunities. While details remain scarce, this initiative, along with Trump’s sons Donald Jr. and Eric’s involvement, signals that the Trump family has big plans for crypto, particularly in decentralized finance (DeFi).

Kamala Harris: A Cautious Approach

In contrast to Trump’s enthusiastic embrace of crypto, Vice President Kamala Harris has taken a silent approach. As the Democratic nominee, Harris’s exact position on digital assets remains largely undefined.

Harris’s crypto history is closely tied to her role in the Biden administration, which has been characterized by:

- Operation Choke Point 2.0: Alleged efforts to discourage banks from serving crypto companies.

- Aggressive SEC enforcement actions against leading crypto companies like Coinbase, Binance, and Ripple.

- President Biden’s veto of a bipartisan bill that would have made it easier for financial institutions to offer crypto custody services.

However, there are signs that Harris may be open to a more conciliatory approach:

- A senior Harris campaign advisor made a brief statement indicating that Harris would “support policies that ensure emerging technologies and that sort of industry can continue to grow.”

- Reports indicate that Harris’s campaign has been reaching out to crypto industry executives, showing a willingness to listen to their concerns.

- Harris’s Silicon Valley background and support from tech companies suggest she may be more open to innovation than the current administration.

The Crypto Vote: A Potential Kingmaker

Recent polls suggest that crypto owners could be a significant voting bloc in the upcoming election. A Fairleigh Dickinson University poll found that Trump leads Harris by 12 points among crypto holders, while trailing by the same margin among non-crypto owners. The poll also revealed that crypto owners tend to be young men and members of racial minority groups, demographics that could be crucial in swing states.

According to another earlier survey, crypto is considered a key election issue for 20% of voters in six swing states, many of them ethnic minorities like African-American and Hispanic voters. This data underscores the potential impact of crypto policy on the election outcome.

Party Positions and Platform Shifts

The contrasting approaches of Trump and Harris reflect broader shifts within their respective parties:

Republican Party:

- The Republican Party platform now includes language defending Bitcoin mining and opposing a Central Bank Digital Currency (CBDC). Trump is especially vocal about the latter, saying on many occasions that it won’t happen on his watch.

- There’s increasing activity within the party to create a Bitcoin strategic reserve, led by Donald Trump and senators like Cynthia Lummis who presented a draft bill in Nashville.

- Trump has promised to fire SEC chairman Gary Gensler, the leading antagonist of crypto, on his first day in office.

Democratic Party:

- The 2024 Democratic Party Platform does not mention cryptocurrency, suggesting it’s not a high priority for the party as a whole.

- Senator Elizabeth Warren, who has significant influence over the Democratic Party’s financial policy, remains one of crypto’s most vocal critics.

- There are unsubstantiated rumors that Harris will promote Gensler to head of Treasury.

Expert Opinions and Industry Reactions

Crypto industry leaders and experts have mixed reactions to the candidates’ positions:

- Jake Chervinsky, Chief Policy Officer at the Blockchain Association, comments: “While Trump’s embrace of crypto is encouraging, we need to see more concrete policy proposals. On the other hand, Harris’s cautious approach leaves room for dialogue and potential compromise.”

- Perianne Boring, founder and CEO of the Chamber of Digital Commerce, notes: “The crypto industry needs regulatory clarity, not just friendly rhetoric. We’re looking for candidates who can provide a clear, innovation-friendly regulatory framework.”

- Caitlin Long, CEO of Custodia Bank, warns: “Whoever wins, the crypto industry needs to be prepared for continued regulatory challenges. The next administration will need to balance innovation with consumer protection and financial stability concerns.”

Challenges and Criticisms

Despite the potential benefits, both candidates’ approaches to crypto face challenges:

Trump:

- Critics point out the contradiction between his current stance and his previous skepticism.

- There are concerns about how Trump would navigate the complex regulatory landscape surrounding cryptocurrency if elected.

- The ‘World Liberty Financial’ project’s promise of high yields raises concerns about potential risks, given past crypto market crashes.

Harris:

- The recent SEC Wells notice to NFT platform OpenSea creates doubt whether Harris is sincere with her more open stance.

- Reports that Harris is using Operation Choke Point 2.0 “architects” as advisors to her economic policy plan worry crypto advocates.

- The lack of concrete policy proposals leaves uncertainty about how a Harris administration would approach crypto regulation.

- It’s worth noting that Harris understands Silicon Valley and technology very well, with a deep network in the Valley.

Looking Ahead: The Future of Crypto Policy

As the 2024 election approaches, cryptocurrency is poised to play a significant role in shaping the political landscape. The candidate who can effectively balance innovation, regulation, and economic concerns may gain a crucial advantage.

Key areas to watch include:

- Regulatory Framework: How will the candidates propose to provide regulatory clarity without stifling innovation?

- International Competitiveness: With countries like El Salvador and the Central African Republic adopting Bitcoin as legal tender, how will the USA position itself in the global crypto landscape?

- Central Bank Digital Currency (CBDC): Will the USA pursue a CBDC, and how will that impact existing cryptocurrencies?

- Tax Policy: How will crypto transactions and investments be taxed under each administration?

- Environmental Concerns: How will the candidates address the energy consumption associated with crypto mining?

In the recent debate between Trump and Harris on September 10th, both candidates steered clear of the subject, indicating they may be unable to articulate their vision for the future of crypto in the United States. As the campaign progresses, cryptocurrency stakeholders and political observers will be watching closely to see how the conclusion of the love triangle between finance, technology, and politics.

Regardless of the election outcome, one thing is clear: cryptocurrency has moved from the fringes to the center of political discourse, and it’s here to stay. The policies shaped by the next administration will have lasting implications for the future of financial innovation and regulation in the United States and beyond.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)