Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Top Ten Crypto Games for Q3 2024

Introduction

The crypto gaming industry reached a brief but explosive peak in late 2021, hitting its GAME OVER screen as all the metaverse mania quickly fizzled out. Since then, the generally vastly overvalued leading GameFi projects have dropped the bulk of their market cap, as reality met fantasy and we find out that most crypto games were just… well, turn-based gaming crap better suited to the 1990s.

Fast forward to 2024, the Web3 games sector is still here, and everyone continues to hunt for the next Axie Infinity breakout star of this new bull cycle.

As a result, the sector has seen substantial growth, even while prices continue to plummet in most cases, with a variety of games that blend immersive experiences with blockchain technology.

Here are the top ten crypto games to explore in Q3 2024.

1. Heroes of Mavia

Overview

Heroes of Mavia is a strategy-based MMO where players build bases, manage resources, and engage in battles involving whimsical characters and vehicles. It operates on a play-to-earn model, allowing players to earn MAVIA tokens (on Ethereum and Base).

Why It’s Popular

The game’s strategic depth and vibrant community make it appealing to both casual and hardcore gamers. Its unique combination of resource management and tactical combat provides a challenging and rewarding experience.

Key Features

- Base-building and Resource Management: Players construct and upgrade their bases, manage resources, and develop strategies to defend against enemy attacks.

- PvP and PvE Battles: Engage in intense battles against other players or AI-controlled enemies to earn rewards and climb the leaderboards.

- Robust In-game Economy: Players can trade resources and items within the game, enhancing their gameplay experience.

2. Shrapnel

Overview

Shrapnel is a gritty, realistic first-person shooter (FPS) that integrates NFTs and blockchain technology. Players can own, trade, and upgrade in-game items.

Why It’s Popular

The high-quality graphics and intense gameplay of Shrapnel, combined with the ownership of digital assets, create a compelling experience. The game also features a dynamic environment where players’ actions can significantly impact the game world. It feels and looks like a AAA title.

Key Features

- High-Octane FPS Gameplay: Fast-paced and strategic, requiring quick reflexes and tactical thinking.

- Customizable Weapons and Gear: Players can modify and upgrade their weapons and gear using NFTs.

- NFT-Based In-Game Items: True ownership of items allows players to trade or sell them on the marketplace.

3. Pixels

Overview

Pixels is a cozy farming simulation game with pixelated graphics. Players cultivate crops, raise animals, and trade produce. The game utilizes blockchain technology to enable true ownership of in-game assets and had a massive launch earlier in 2024. According to Dappradar, there are 720,000 unique address wallets created for the game thus far.

Why It’s Popular

Its relaxing gameplay and vibrant visuals appeal to a wide audience, while the blockchain aspect adds an extra layer of engagement. The community-driven economy allows players to collaborate and trade, enhancing the social aspect of the game.

Key Features

- Farming and Crafting: Grow crops, raise animals, and craft items to develop your farm.

- NFT-Based Land and Items: Own and trade land and other assets on the blockchain.

- Social Trading and Interaction: Collaborate with other players to trade goods and resources.

4. Guild of Guardians

Overview

Guild of Guardians is a fantasy RPG for mobile. Players assemble a team of heroes to battle through dungeons and earn rewards. The game emphasizes cooperative gameplay and NFT ownership.

Why It’s Popular

The game’s focus on team-building and cooperative play, along with its mobile-first approach, makes it accessible and engaging. The ability to own and trade heroes and items as NFTs adds significant value for players.

Key Features

- Hero Collection and Team-Building: Collect and upgrade a diverse roster of heroes.

- Dungeon Crawling and PvE Challenges: Engage in exciting battles and complete challenging quests.

- NFT-Based Hero and Item Ownership: True ownership of in-game assets allows for trading and selling.

5. Aurory: Seekers of Tokane

Overview

Aurory is a JRPG-inspired Solana game set in a vibrant fantasy world. Players explore, battle, and collect creatures called Tokane, which can be used in various in-game activities.

Why It’s Popular

Its rich lore and engaging gameplay mechanics, combined with the ability to own and trade Tokane NFTs, make it a standout title. The game’s cutesy visuals and intricate storyline captivate players and keep them coming back for more.

Key Features

- Exploration and Combat: Traverse a beautifully designed world and engage in strategic battles.

- Tokane Collection and Trading: Collect and trade various Tokane creatures, each with unique abilities and attributes.

- Story-Driven Quests and Adventures: Immerse yourself in a deep and engaging narrative.

6. Hamster Kombat

Overview

Following in the footsteps of ‘TapFi’ game Notcoin, Hamster Kombat has recently emerged on the surging Telegram platform, reportedly attracting a massive 250 million user base since its mid-2024 debut. This innovative game blends elements of cryptocurrency management with casual gameplay, allowing users to take on the role of hamster executives running virtual crypto exchanges.

Why It’s Popular

The game’s core mechanic revolves around a tap-to-earn system, where players can accumulate in-game currency through simple screen interactions and task completion. By leveraging Telegram’s mini-app capabilities, Hamster Kombat offers an accessible gaming experience directly within the messaging app. The developers behind Hamster Kombat will airdrop a large portion of its coin supply to its players based on their points.

Key Features

- Integration with The Open Network (TON) enables secure digital transactions.

- Players will be able to transform their in-game achievements into actual cryptocurrency tokens during a planned token distribution event.

7. Parallel

Overview

Parallel is a sci-fi card game where players collect, trade, and battle with NFT cards. The game’s lore and strategic depth make it a favorite among card game enthusiasts.

Why It’s Popular

The intricate card mechanics, and the ability to own and trade cards as NFTs, appeal to both casual and competitive players. The game’s deep strategic elements and immersive storyline keep players engaged.

Key Features

- Collectible Card Battles: Build and customize your deck to compete against others.

- Deep Strategic Gameplay: Utilize a wide range of strategies to outsmart your opponents.

- Rich Sci-Fi Lore: Immerse yourself in a detailed and captivating sci-fi universe.

8. Hytopia

Overview

Hytopia is a Minecraft-type game where players can build, explore, and interact with others. The game uses blockchain technology to allow for true ownership of in-game assets.

Why It’s Popular

Its expansive world and creative freedom attract players who enjoy sandbox games and the added value of NFT ownership. The game’s robust creation tools and active community foster a collaborative environment.

Key Features

- Open-World Exploration: Discover and explore a vast, dynamic world.

- Building and Crafting: Create and customize your own structures and items.

- NFT-Based Assets and Items: Own and trade unique assets on the blockchain.

9. Legends of Elumia

Overview

Legends of Elumia is a fantasy MMORPG with high-end graphics. It features epic quests, PvP battles, and a player-driven economy. The game’s integration of blockchain technology allows players to own and trade in-game items.

Why It’s Popular

The game’s rich world and extensive gameplay, combined with blockchain integration, provide a deep and engaging experience. The ability to own and trade items as NFTs adds a layer of depth to the gameplay.

Key Features

- MMORPG Gameplay: Embark on epic quests and engage in intense PvP battles.

- Experience thrilling adventures and compete against other players.

- Player-Driven Economy with NFT Items: Own and trade unique items within the game’s economy.

10. Axie Homeland

Overview

Axie Homeland is a continuation of the popular Axie Infinity franchise, focusing on building and managing a homeland for cute little critters called Axies. The game incorporates NFT-based land and Axie ownership.

Why It’s Popular

The established fanbase of Axie Infinity and the new features in Axie Homeland make it a must-try for fans and newcomers alike. The game’s focus on community and collaboration enhances its appeal.

Key Features

- Land Management and Building: Develop and manage your own Axie homeland.

- Axie Breeding and Battling: Breed and battle Axies to earn rewards.

- NFT-Based Assets and Land: Own and trade land and Axies on the blockchain.

The games covered here really showcase the diverse and innovative landscape of crypto gaming in Q3 2024. Whether you’re interested in strategic MMOs, relaxing farming sims, or intense FPS action, there’s something for everyone in blockchain gaming. With a prediction of an industry size totaling $614 billion by 2030, it’s a smart move to keep playing.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Bitcoin Boundaries

In the 2017 alt-currency wave and 2020s’ DeFi summer blockchains were built to be much faster and smarter than Bitcoin, the original blockchain, and with on-chain capacity for much more diverse financial and social primitives (identity, art, savings, loans, and more). The transaction speeds of these currencies far outstripped their by-now plodding ancestor. Yet the antiquated Bitcoin technology is king among blockchains. Coins that work better than Bitcoin have been around almost as long as Bitcoin itself – yet Bitcoin still has more financial value than the rest of the industry combined.

Still the King

Ultimately, it’s all about trust. This is the people’s money we’re talking about. The value of a decentralized ledger or blockchain is fundamentally underwritten by the fact that people know it works. Bitcoin has performed exactly as outlined in the whitepaper ever since its inception, supported by a vast chorus of computers all over the world. It hasn’t double-spent, it hasn’t failed a transaction, and its network of miners is now so vast that its security is immutable. Humanity has achieved a peer-to-peer electronic cash network with no centralized oversight. An achievement so intoxicating that our race to consecrate and order other digital interactions using the blockchain has led to a sector worth over $2 trillion. A brand new asset class that, with the dawn of Bitcoin ETFs, is now traded by pension funds all over the world. The new utilities that distributed ledgers provide have proven they can change the world.

The altcoin market has its problems: slow technical development, overindulgence in capital raises, and vulture-like VC activity, alongside outright criminal fraud. This has led to slower progress than some expected. Blockchain has gotten traction in certain use-cases: supply chain tracking, sending remittances, controlling access to fandom communities and more. But crypto’s mainstream deployment in everyday sysadmin still feels distant. One reason is Bitcoin’s grip on investors’ capital. Along with perhaps Ethereum, Bitcoin is the only trusted mainstream, and broadly stable, asset the market has yet produced. Hedge funds, neobanks, and long-term HODLers keep their capital frozen in the assets at the summit of the market, stopping that liquidity from irrigating the thousand flowers in the valley below.

Building Better Bitcoin

So the question arises. Rather than look to new networks to establish new utility for crypto, can’t we use the one we’ve already got? Maybe we can polish the pistons of the Bitcoin core code and use that trust as the foundation on which new utility can run. Can we employ cryptographic lessons we have learned to make it run faster? Now everyone agrees it’s awesome, can we make it harder, better, faster and stronger?

It’s not a new thought. Bitcoin Cash was the first major attempt to upgrade Bitcoin. Yet it did it through a fork, not a rewrite – and when it comes to money, people like what they already know. Although Bitcoin Cash does have market cap, it’s ultimately a footnote in the Bitcoin network’s broader history. For new utility to exist on Bitcoin, to upgrade Bitcoin – technologies need to be built that work using the main Bitcoin consensus itself. Attempts have been legion. However it is recently that there is a sense that the Bitcoin developer community is getting somewhere useful.

Utility projects have seen the best progress in recent years. Ordinals are a way to uniquely identify and order satoshis, and inscriptions allow users to attach arbitrary data on the resultant tokens. BRC-20 tokens, inspired by Ethereum’s ERC-20, leverage these by inscribing metadata onto uniquely numbered individual satoshis, delineating them as special tokens – which can then be used for utilities like stablecoins, NFTs, and access-control. This process runs entirely on the Bitcoin blockchain, and that’s good for trustworthiness, but it does clog up the network with data on an already constrained blocksize – leading many to question the practicality of such efforts, not to mention the need for wallets and infrastructure to engage with these specialized tokens.

Utility and Scale

Following on from BRC-20, Runes were deployed to much fanfare. By using UTXOs to mark individual satoshis, Runes drastically reduced the congestion overhead for Bitcoin, while also making it far simpler for users to mint their own runic satoshis. Despite an initial surge in activity as a result of Runes, the promise of ‘DeFi on Bitcoin’ quickly tapered off in the face of how cumbersome they are to trade, and the fact that the market efficiency of trading runic satoshis still operated on a direct barter system rather than decentralized liquidity pools – something anathema to a crypto market used to trading on Ethereum. Recent attention has fallen on ‘Fractal Bitcoin’ as an antidote to this, but the tech is in its infancy.

What about scaling the network? The Lightning Network is the stalwart of the space, creating off-chain payment channels between users, reducing load and facilitating micropayments. For all its scaling potential, it suffers from having a third party settlement layer, so that as Bitcoin scaling grows so do settlement fees on Lightning.

Then there are parallel blockchains, sidechains, and layer-2s like Liquid Network, Rootstock, and the Spiderchain. All of these peg to Bitcoin, and all offer the potential for smart contracts and additional utility – but they all suffer from the same old issue of consensus. You may use Bitcoin as authority for the transaction you validate, but what if your validators go rogue? Ultimately, if the scaling used doesn’t use the main Bitcoin consensus network and core code – then you’re just another altchain. Bitcoin, it seems, may never solve the trilemma, and may never grow wings to become an all-purpose blockchain.

Mastering the Old Ways

And maybe that’s okay. Maybe those liquidity glaciers never need to melt. Maybe sometimes the old ways are best. Save the utility for the new kids. The purpose-built speedsters use the latest tech, rather than trying to stick a brand new V12 engine in a forty year old car – it’s just not built for it. The Bitcoin tortoise has led the race for 15 years – perhaps we should just let it do what it’s good at.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

What are Layer-2 Blockchains and Why Does Ethereum Need Them?

Introduction

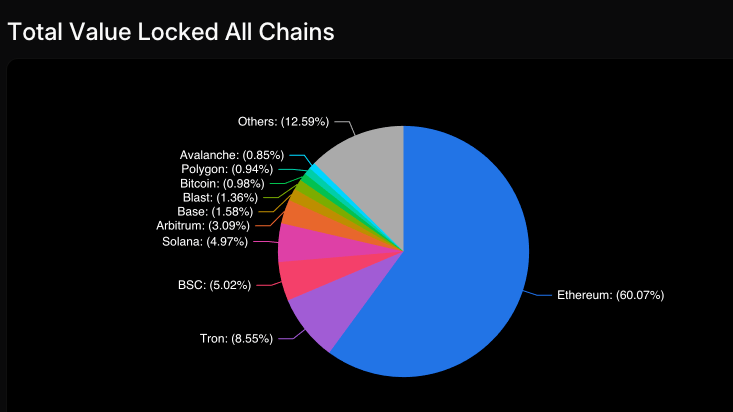

Ethereum still reigns supreme in 2024 as crypto’s leading smart contract platform. There is growing competition from other layer-1 chains like Solana, Cardano, Avalanche, BNB Chain and the surging Tonchain, but no one’s quite ready to come for the king.

Ethereum was the first chain to enable decentralized applications (dApps), decentralized finance (DeFi), NFTs, and more, and it rightly deserves its reputation of excellence – a reputation that earned it spot ETF approval in 2024.

Ethereum always prioritized decentralization over scalability, never compromising. This led to major network congestion at times over the years, especially when its popularity surged. At periods of high demand, ETH transactions become slow and gas fees skyrocket. This remained true after the move from proof-of-work consensus to proof-of-stake in 2021 during ‘the Merge’. Ethereum’s failure to evolve in its early years saw co-founders like Charles Hoskinson and Gavin Wood leave the project (to found rival projects Cardano and Polkadot respectively).

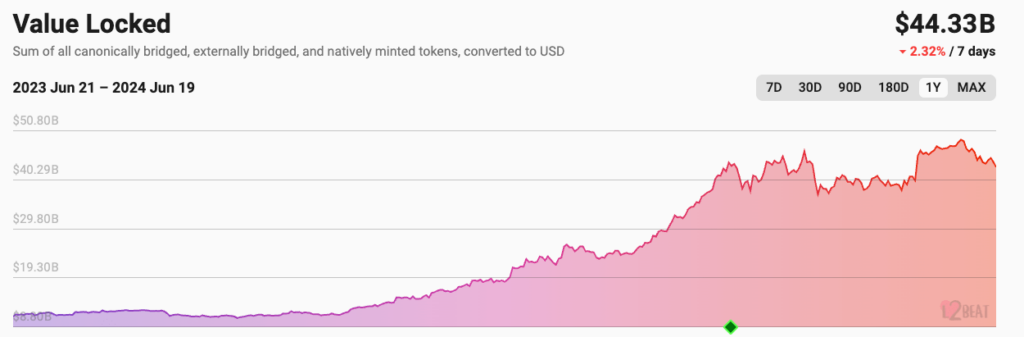

Evolve it did. Finally. The early 2020s saw a slew of so-called Layer-2 (L2) scaling solutions come in, battling for crypto dollars and the ETH of DeFi investors in an ultra-competitive frontier. At present, the total Ethereum layer-2 ecosystem has captured a total value locked of over $40 billion in crypto, according to L2Beat.

With new entrants like ZkSync recently joining the fray, it’s the perfect time to take stock of the Ethereum layer-2 landscape to figure out what’s nice to know and what you actually NEED to know.

What are Layer-2 Chains?

Layer-2 blockchains are secondary networks built on top of Ethereum to offload transaction processing from the main Ethereum chain (Layer-1). By handling transactions on a separate chain, Layer-2s provide a faster and cheaper way to use Ethereum without compromising on the security of the base layer. You can think of Layer-2 chains as an efficient assistant that processes the bulk of Ethereum’s transactions separately, then sends the processed data back to Ethereum for final approval and addition to the Ethereum ledger.

The need for Layer-2 solutions stems from the blockchain trilemma: the tradeoff between decentralization, security, and scalability faced by all blockchains. By design, Ethereum prioritizes decentralization and security at the expense of scalability. With Ethereum currently processing only 15-30 transactions per second on its main network (compare traditional payment networks like Visa which handle 1700 TPS), L2 chains are crucial for Ethereum to scale and support mainstream adoption.

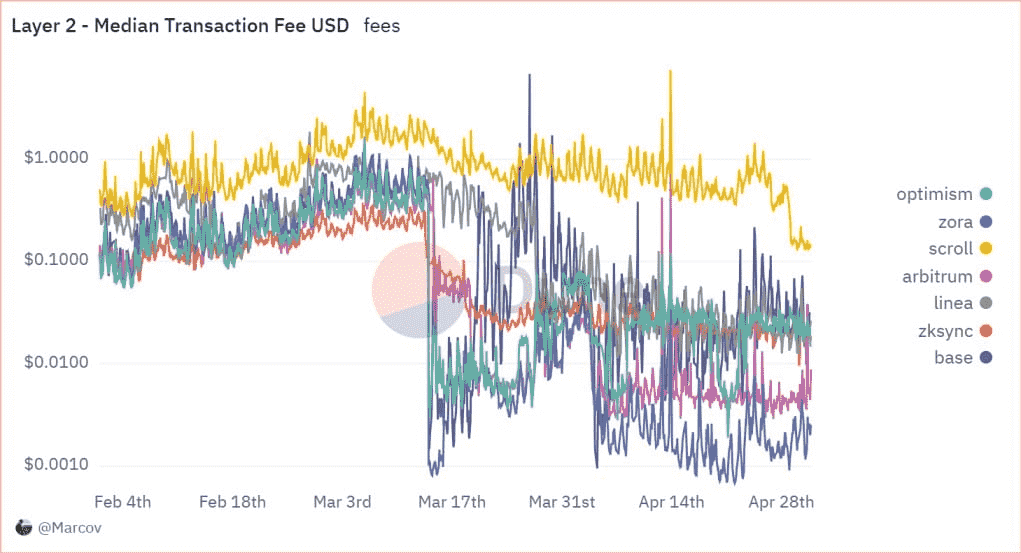

EIP-4844 drops Layer-2 transaction fees

A huge boost for layer-2s came in March 2024 when the network implemented EIP4884 during its Dencun upgrade.

EIP-4844, also known as ‘proto-danksharding’, is an Ethereum improvement proposal that aims to help Layer-2 solutions by introducing a new transaction format called ‘shard blob transactions’. These transactions allow Layer-2s to store large amounts of data on Ethereum at a dramatically lower cost, helping them to offer cheaper transactions and onboard more users to compete with ultra-cheap chains like Solana, thereby further improving Ethereum’s scalability and accessibility, as we can see in this Dune chart below.

Types of Layer-2 Solutions: Sidechains vs. Rollups

The two main categories of Ethereum L2 scaling are sidechains and rollups.

Sidechains

Sidechains are independent blockchains with their own consensus mechanisms and native tokens. They connect to Ethereum through a two-way bridge, allowing users to move assets between the chains.

Sidechains don’t actually transfer assets to Ethereum – instead they ‘lock’ the original tokens in an Ethereum smart contract and ‘mint’ pegged versions of those assets on the sidechain. Polygon is a prominent example of an Ethereum sidechain focused on scalability. Sidechains are no longer very popular, and the top ten layer-2 chains are all rollups.

Rollups

Rollups, on the other hand, keep transaction data on Ethereum. Rollups “roll up” or bundle hundreds of transactions together off-chain, then post a cryptographic proof of those transactions to ETH. By compressing transaction data in this way, rollups reduce the data footprint on Ethereum, resulting in lower fees.

There are two types of rollups:

- Optimistic rollups assume transactions are valid by default, only running a fraud proof if a transaction is challenged.

- Zero-knowledge (zk) rollups generate a validity proof for each rollup block, verifying the accuracy of the off-chain transactions.

Leading optimistic rollups include Arbitrum and Optimism, while examples of ZK rollups are Immutable X and zkSync. An advantage of optimistic rollups is EVM-compatibility: compatibility with the Ethereum virtual Machine that makes it easier for Ethereum developers to port their dApps to the rollup. However, ZK rollups can offer faster transaction finality and higher throughput.

Benefits and Use Cases of Layer-2 Networks

The core benefit of Ethereum L2s is massively improved scalability. Rollups like Arbitrum have achieved 40,000 TPS compared to Ethereum’s 15-30 TPS. This allows for near-instant transactions at a fraction of the cost of Ethereum base layer.

Major brands are turning to Ethereum L2s to make their Web3 initiatives viable. Starbucks chose Polygon for its Odyssey loyalty program to provide a seamless, low-cost user experience. Blockchain gaming, which requires high volume, low-latency transactions, is another growing use-case. ImmutableX is a ZK rollup purpose-built for NFT gaming with features like gas-free minting.

DeFi protocols are also expanding to L2s to offer users lower fees and faster settlement. Uniswap v3, Aave, and other top Ethereum dApps are now deployed on optimistic rollups. Even blockchain-powered social media platforms like Reddit’s Community Points and decentralized Eternal platform have launched on Arbitrum for cheaper costs and better scale.

And as layer-2 chains continue to blossom, we see task-specific layer-3 chains built on top of them in turn.

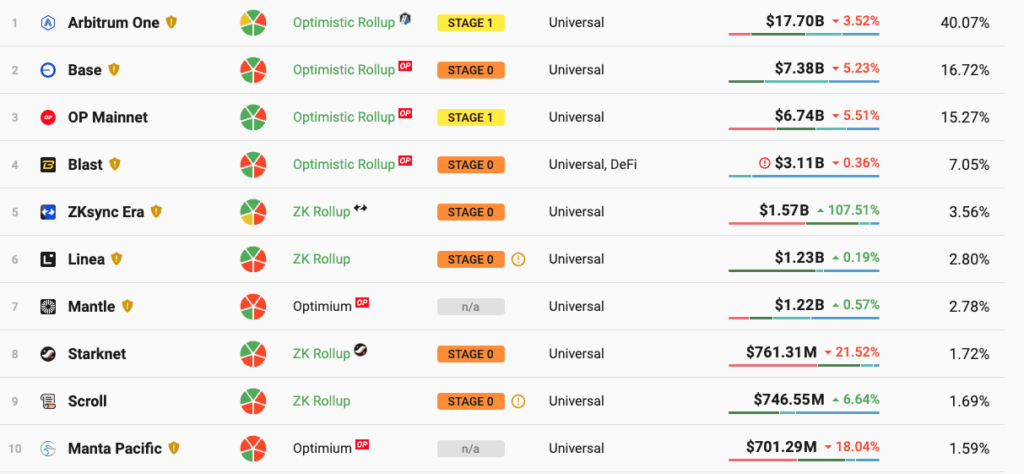

Top Ethereum Layer-2 chains in 2024

Tools like L2Beat and CoinMarketCap provide a wealth of excellent on-chain data about all the best layer-2s, which are worth mastering before you make any investments. Core metrics to grasp include total value locked (TVL), which means how much funds are contained within the project ecosystem, total active users and wallet addresses, and of course fully diluted value (FDV), which is total market cap of the layer-2 asset if all the coins to be issued were already in circulation.

Here’s a quick rundown of some of the best layer-2s right now. We’ll do a deeper dive in a follow-up article:

- Arbitrum One: Is a leading Layer-2 rollup that processes transactions off-chain. It achieves 40,000 TPS, reduces transaction costs, and has $17 billion TVL and 40% market share.

- Optimism: Uses optimistic rollups (ones that assume valid transactions), creating faster processing and lower costs. It is compatible with Ethereum tools and contracts.

- Base: Incubated by Coinbase, Base uses Optimism’s tech. Their stated aim is to create a ‘super-chain’. They have achieved an impressive $7.4 billion TVL since Nov 2023.

- Polygon: Migrated from sidechain to zkEVM. Currently clocks 7,200 transactions per second at $0.01 average cost. Its accessibility for everyday use-cases is shown by the fact that Starbucks chose it to host their loyalty program.

- Linea: EVM-compatible ZK rollup by Consensys, with higher throughput, and lower fees. Uses an innovative lattice-powered prover, zkSNARK tech, and no trusted setup.

- Immutable: Designed for NFTs and gaming, Immutable uses zero-knowledge proofs, for fast, gas-free, carbon-neutral minting and trading, and offers a streamlined experience.

- Ronin: Created by Axie Infinity team, Ronin achieves near-instant and low-cost transactions for gaming and NFTs, using proof-of-authority consensus.

- zkSync Era: Uses zero-knowledge proofs for scalable, low-cost payments and smart contracts. It is accessible and user-friendly for various applications.

- Starknet: Starknet is a ZK rollup that supports general-purpose smart contracts. It uses the Cairo language, is efficient and easy to use, and attractive for complex dApps.

- Mantle: Built on BitDAO, BitDAO improves user experience for dApps, DeFi, and decentralized governance. It enables faster transactions and lower fees to drive adoption.

Is The Future Still Ethereum and Layer-2?

Ethereum L2s are not a replacement for the Ethereum base chain, but rather a complement to make Ethereum more accessible for users and developers. In return, they benefit from Ethereum’s battle-tested technology. Even with future Ethereum upgrades like sharding, L2 chains provide a powerful scaling solution that preserve’s Ethereum’s decentralization and security.

With benefits like sub-second settlement times, negligible fees, and improved capacity, layer-2 chains are key to bringing Ethereum to the masses and to drive the next wave of Web3 adoption.

However, layer-2s are not always that easy to use, and it can be burdensome moving funds across Ethereum layers and chains in order to transact and invest.

Disruptive and ultra-cheap chains like Solana, TON and SUI continue to offer growing competition for the Ethereum ecosystem in blossoming new fields such as memecoins, DePin, Real World Assets (RWA) and artificial intelligence. Therefore these developments – in particular, the arrival of the Base Network and Linea – should really help Ethereum retain its lead, thanks to the influence of Coinbase and the ease of use of its Base Wallet.

Add to that the innovation brought by ZK rollups like ZkSync, and it’s safe to say that Ethereum’s bull case and its stable of layer-2 chains remain intact. Read this year’s Van Eck report to see their crazy price predictions for 2030.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Use AI Agents For Spontaneous Behavior In Your Games: Super AI Series – Part 7

Sluggish Crypto Q2 2024 Saved By Memecoins and Airdrops

Introduction

Despite the much-anticipated fourth Bitcoin Halving in April, which traditionally marks the beginning of a new era in the crypto cycle, the cryptocurrency market’s response in Q2 2024 was surprisingly muted, according to the latest CoinGecko report.

Q1 was a period of exuberance, driven by the approval of the USA’s spot Bitcoin ETFs and the run-up to April’s Halving event.

Q2 2024 was characterized by choppy trading conditions for Bitcoin and the broader crypto market, where major positive events like the Ethereum spot ETF approval didn’t trigger immediate price surges. The summer holidays – traditionally a bearish time – didn’t help.

What is ahead in the second half of 2024? The crypto industry faces a mix of challenges and opportunities. The looming distribution of Mt. Gox’s Bitcoin holdings and several large token supply unlocks will impact the market in uncertain ways.

However, positive developments such as the impending launch of spot Ethereum ETFs in the USA, an improving macroeconomic environment, and continued innovation from development teams offer reasons for optimism.

Let’s explore the key developments that shaped the crypto landscape from April to June 2024.

Market Capitalization: Weathering the Storm

Despite a decline in total cryptocurrency market capitalization, closing at $2.43 trillion in June, the crypto market exhibited remarkable fortitude. Throughout Q2, the market fluctuated within a defined range, unable to surpass previous all-time highs but maintaining a strong foundation.

This performance contrasted with traditional markets such as the S&P 500’s steady climb during the same period. The divergence between crypto and traditional markets highlights the unique dynamics at play in the digital asset space, and caused some concern. However, Trump’s surprising championing of Bitcoin and Ethereum spot ETF approval have led to a late Q2 surge in crypto prices and market sentiment, as electioneering efforts to capture the important crypto vote began to ramp up.

Bitcoin: Navigating Post-Halving Waters

Bitcoin, the flagship cryptocurrency, experienced a modest decline in Q2, ending the quarter at $62,734. The much-anticipated fourth Bitcoin halving occurred during this period. Historically, these halvings marked the beginning of new market cycles. However, the immediate market response to this halving was subdued.

The quarter concluded with some market uncertainty as news broke that significant Bitcoin sell pressure was to come: in the form of Mt. Gox repayments and the German government’s seized BTC sales. FUD levels were amplified as usual by the media and key influencers, causing a dump in all crypto prices before it rebounded with Trump’s endorsement.

Mining Landscape: Adapting to New Realities

The Bitcoin mining sector faced some big challenges in Q2. Hash rate reached an all-time high in April in the runup to the Bitcoin Halving, followed by a foreseeable decline. Since the halving, a lot of smaller miners have been flushed out due to the increased difficulty and cost. Despite this setback, the mining industry saw notable developments, including:

1. Major players are expanding into AI applications

2. Significant investments in the mining sector

3. Advancements in mining chip technology

These developments suggest that mining companies are diversifying their operations and investing in technological advancements like artificial intelligence to maintain competitiveness in a post-halving environment.

Airdrop Farming Yields Too Little

One of the defining features of Q2 was the proliferation of token airdrops, as many projects sought to capitalize on the bullish sentiment from Q1. However, these airdrops became a source of controversy within the crypto community, who were vocally aggrieved by the paltry amounts given to them by the likes of Layer-Zero and ZkSync after supporting these projects for months and even years.

Projects struggled to balance rewarding genuine users while filtering out opportunistic ‘airdrop farmers’. Meanwhile, many airdropped tokens experienced significant price drops post-launch, leading to complaints that the financial benefits were primarily accruing to project insiders and private investors who were looking to establish high-FDV low-float tokenomics. Creating fair and sustainable token distribution models in the crypto ecosystem remains an ongoing challenge, and retail investors are becoming increasingly jaded.

Memecoin Mania Peaks

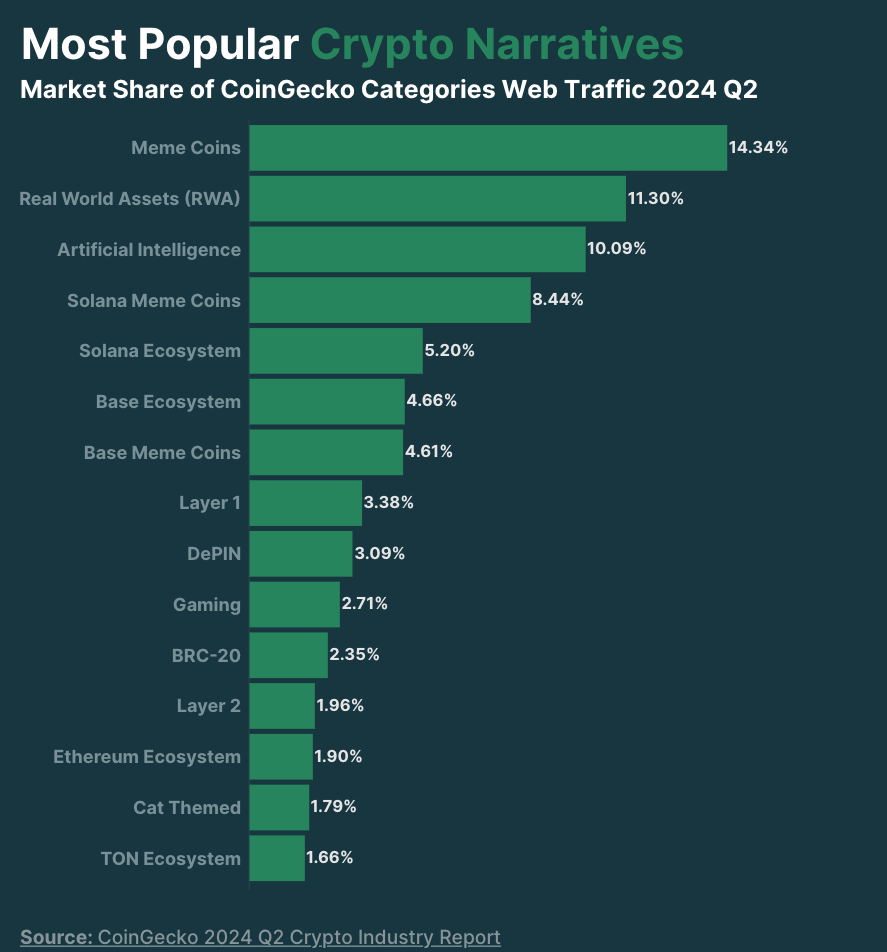

As airdrop season flamed out, memecoins earned their new status as a dominant force in Q2 2024, capturing a significant portion of market attention and billions in trading volume. Alongside Real World Assets (RWA) and Artificial Intelligence (AI) projects, these categories accounted for a substantial share of market interest.

While new bluechip projects lined the pockets of venture capital funds, memecoin launches were considered fair and transparent by retail investors, who understood for the most part that they were devoid of any real utility other than being a fun lottery ticket. New memecoin launch platform Pump.fun enabled nearly 450,000 new Solana memes to be issued in May alone.

The return of GameStop legend RoaringKitty created pandemonium, resulting in a plethora of low-quality memecoins getting churned out, inevitably draining the wallets of their buyers when they went to zero.

As minor celebrities like Iggy Azalea, Caitlyn Jenner and Andrew Tate piled in, so did some memecoin fatigue, and the market began to dip at the end of Q2 as pump and dump scams and rugpulls became the norm.

Blockchain ecosystems also played a significant role, with platforms like Solana and Base leading in popularity. New Telegram-backed entrant Toncoin ended the quarter strongly, attracting millions of new users through TapFi games like Notcoin and Hamster Kombat.

Ethereum: Supply Dynamics Shift

Ethereum experienced an inflationary quarter, adding to its circulating supply, despite the deflationary EIP-1559 mechanism. This shift resulted from changes in the balance between burned and emitted ETH. The burn rate fell compared to Q1, indicating reduced network activity and lower gas fees. A worrying 120,000 ETH was added to its supply in Q2.

Centralized vs. Decentralized Exchanges: A Tale of Two Trends

Centralized exchanges (CEXs) saw a further decline in trading volume of 15% during Q2 for a total of $3.4 trillion, with Binance maintaining its position as the market leader despite the overall downturn. However, some exchanges bucked this trend, with platforms like Gate.io, Bitget, and HTX seeing increases in trading volume as they ramped up marketing efforts.

In contrast, decentralized exchanges (DEXs) experienced growth of 15%, with a total trading volume of $370 billion driven by a surge in meme coin trading and new layer-1 and layer-2 chains offering supposedly lucrative DeFi airdrops which grabbed the bulk of crypto’s mindshare and capital.

Uniswap maintained 48% dominance in the DEX space, and Top Ten newcomers like Thruster and Aerodrome made significant gains, due to Blast airdrop farming and Base trading respectively.

Conclusion

The crypto industry’s performance in Q2 2024 paints a picture of a market poised for further growth, but also nervous about macroeconomic issues.

As we move into the second half of 2024, investors and enthusiasts should keep a close eye on emerging narratives and regulatory changes ushered in by events such as the US Presidential Election, the mainstream adoption of crypto spot ETFs, a long-awaited reduction in Fed interest rates as well as the inevitable effects of Bitcoin’s post-halving supply shock coming into play.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Quantum Bitcoin Mining: The Future of Cryptocurrency?

Spoiler Introduction

Ah, the apocalyptic headlines: “Quantum computers will break the blockchain and destroy Bitcoin!” But fear not, dear readers, for we’re not quite there yet. In fact, we’re still a ways off from having the necessary 4 million qubits to pose a real threat to the blockchain. So, let’s take a deep breath and explore a more exciting application of quantum computers: Quantum Bitcoin mining.

What’s Bitcoin Mining, Anyway?

Before we dive into the quantum stuff, let’s cover the basics. Bitcoin is a digital currency that uses classical cryptographic technologies to secure transactions. The blockchain is a public ledger that stores all these transactions, divided into blocks. Miners compete to solve complex mathematical problems to validate these blocks and add them to the chain. It’s a bit like solving a giant puzzle, but with more computers and less actual puzzle pieces.

The Blockchain: A Chain of Blocks

Think of a blockchain as a chain of blocks, each one connected to and affecting the others, sharing the weight. Each block contains a list of transactions. When a new transaction occurs, it’s broadcast to the entire network. Miners collect these transactions into a block and add this block to the blockchain. Each block references the previous one, creating a secure and chronological order of transactions. This setup ensures that once a block is added, it’s incredibly difficult to alter the information without changing all subsequent blocks, providing the security and immutability that blockchain technology is known for.

Nonces and Hash Functions: The Key to Mining

The key aspects of Bitcoin mining are nonces and hash functions.

- Nonces: These are arbitrary numbers that miners tweak to find a hash value that meets the target difficulty. Imagine nonces as the secret ingredient in your grandma’s cookie recipe that you keep adjusting until the cookies come out perfect.

- Hash Function (SHA-256): This function takes an input and generates a 256-bit output. No matter how many times you input the same data, the output will always be the same. However, even a tiny change in the input will produce a vastly different output. It’s a bit like a magical blender where putting in different fruits always gives you a unique smoothie, but you can’t reverse-engineer the smoothie to get back the original fruits.

The Goal: Finding the Right Nonce

Miners aim to find a nonce that, when combined with the data in the block and passed through the hash function, produces a hash that meets a certain target – usually a hash with a specific number of leading zeros (PoW). This process is like playing a massive game of slot machines, where you pull the lever (change the nonce) over and over, hoping to hit the jackpot (the correct hash value).

Classical Mining: A Computational Nightmare

In classical mining, miners iterate through a massive search space to find the right combination of nonce values that satisfy the proof-of-work conditions. This is a computationally costly problem, which is why miners use high-powered machines specifically designed for this task. The total complexity of this operation is a whopping O(2^256/t), where t is the time it takes to perform the calculation. Imagine trying to find a needle in a haystack, where each strand of hay represents a possible nonce. Now imagine that haystack is the size of the sun – that’s the scale miners are working with!

Enter Quantum Algorithms

This is where quantum computers come in. Quantum algorithms like Grover’s algorithm can search this vast space much faster, thanks to the power of superposition and parallel processing.

Quantum Superposition and Parallelism

Quantum computers leverage superposition, where qubits can exist in multiple states simultaneously. This is unlike classical bits, which are strictly either 0 or 1. It’s as if you could be in multiple places at once, doing multiple tasks. This allows quantum computers to process a vast number of possibilities simultaneously, rather than sequentially as classical computers do.

Grover’s Algorithm

Grover’s algorithm is a quantum algorithm that provides a quadratic speedup for unstructured search problems. In the context of Bitcoin mining, it can theoretically reduce the time needed to find the right nonce significantly. Instead of searching through all possible nonces one by one, Grover’s algorithm allows us to find the correct one in roughly the square root of the number of possibilities.

The Reward: New Bitcoin

Assuming we find the right nonce, what happens next? When a miner successfully solves the puzzle, they broadcast the block to the network, and other miners verify the solution. The winning miner is rewarded with new Bitcoin (currently 3.125BTC per block as of April, 2024), plus transaction fees from the transactions included in the block. This reward system incentivizes miners to keep participating and securing the network.

The Current State of Quantum Bitcoin Mining

So, where are we now? The short-term impact of quantum computers on Bitcoin is likely to be minimal. For quantum mining, we need extremely fast quantum hash rates, which are still a ways off.

Quantum Hardware Limitations

Quantum computers are still in their infancy. Current quantum computers, like those developed by Google and IBM, have achieved around 100 qubits. However, to outperform classical miners and pose any significant impact on Bitcoin mining, we would need millions of qubits, operating with low error rates. This level of quantum hardware is still many years, if not decades, away.

Potential Vulnerabilities

There is a vulnerability in pending transactions due to elliptical curve cryptography, which is used in Bitcoin’s public key infrastructure. Quantum computers could theoretically break this cryptography, allowing them to alter transactions before they are confirmed. However, the Bitcoin community is already aware of this and is researching quantum-resistant cryptographic algorithms to mitigate this risk.

Stability and Adoption

The mere possibility of quantum computers existing could potentially destabilize Bitcoin. Investors might be wary of the security implications, and this uncertainty could affect Bitcoin’s value. However, until quantum computers are practically feasible and scalable, this remains a theoretical concern rather than an immediate threat.

Conclusion

In conclusion, Quantum Bitcoin mining is an exciting development that could revolutionize the way we mine cryptocurrency. While we’re not quite there yet, the potential benefits are undeniable. With the right quantum algorithms and hardware, we could see a significant increase in mining efficiency. So, let’s keep an eye on this space and see where it takes us. Who knows? Maybe one day we’ll be mining Bitcoin with the power of quantum computers.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

A New Way To Earn Money Licensing Your Data: Super AI Series – Part 6

DeFi Summer: Will We See a 2024 Revival?

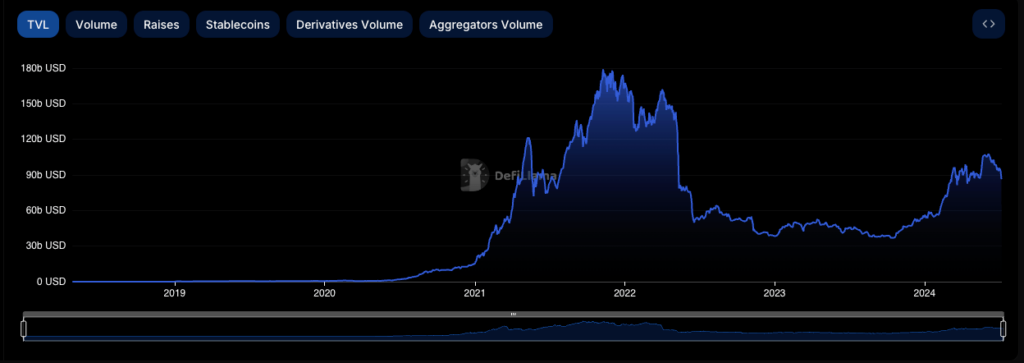

The decentralized finance (DeFi) landscape finds itself at a critical juncture: will the second half of 2024 be like the first? In the summer of 2020, Compound kickstarted DeFi Summer. But the TradFi challenger has since experienced a long period of underperformance. Enthusiasm for DeFi has waned, accelerated by the dramatic 2022 collapse of Luna and the loss of value from most governance tokens. Users moved from DeFi to more sustainable ‘real yield’ solutions.

However, beneath the surface, fundamental shifts are occurring that could herald a revival of this revolutionary financial paradigm. Let’s take a look at the current state of DeFi, its historical performance, challenges, and the potential catalysts that could drive its resurgence.

Current State and Historical Performance

The DeFi sector has struggled to regain the glory of 2020-2021. The DeFi Pulse Index (DPI), which includes major tokens like UNI, MKR, LDO, AAVE, and SNX, has been on a three-year decline against Ethereum, while Ethereum has underperformed Bitcoin in the current cycle. This long-lived low performance has many people questioning has DeFi’s moment passed.

However, it’s crucial to note that DeFi’s total value locked (TVL) has been resilient. As of July 2024, the total stablecoin market cap is $160 billion and TVL stands at around $85 billion, representing a significant recovery from the lows of late 2022, and about 70% of the all-time high of late 2021. This suggests that while token prices have struggled, the underlying infrastructure of DeFi protocols remain robust. Of the total TVL, 60% is attributed to Ethereum.

Daily DeFi trading volumes have also shown signs of recovery, averaging $6.9 billion since March 2024. This is about 70% of the peak volumes seen in November 2021, indicating that user engagement remains strong despite the price declines. Furthermore, the stablecoin market cap has rebounded to $168 billion, over 90% of its 2022 highs, suggesting ongoing demand for decentralized dollar-pegged assets.

Pain Points and Obstacles

Several factors have contributed to DeFi’s recent struggles.

Many DeFi tokens, particularly from the first generation of protocols, have struggled to show clear utility beyond governance and staking rewards. This has made them less attractive to investors seeking tangible value. Additionally, some protocols issue tokens continually, diluting existing holdings.

The unclear regulatory landscape has hampered institutional adoption – and it’s made retail investors hesitant. The threat of potential regulatory crackdowns looms, limiting growth potential. DeFi interfaces and processes remain complex for the average user, limiting mainstream adoption. New users have to learn to understand concepts like gas fees, slippage, and impermanent loss – and this can be a barrier to entry.

The hype wave has rolled on to memecoins, Layer 2 solutions, and airdrop farming, leaving established DeFi protocols high and dry. These newer, often more speculative opportunities have captured the imagination of retail investors, leaving DeFi seeming boring in comparison. The proliferation of new DeFi protocols has led to a fragmentation of liquidity and user attention, making it harder for any single protocol to achieve significant network effects.

High-profile hacks and exploits have eroded trust in the DeFi ecosystem, creating additional barriers to widespread adoption. The DeFi summer of 2020, and subsequent bull run, set unrealistic expectations for token price performance, leading to disappointment and disillusionment among many investors.

DeFi’s Keys to Success and Potential Catalysts

Despite these challenges, several signs hint at a DeFi revival. As regulators get their frameworks in place, institutional capital can flow more freely into DeFi, potentially triggering a new growth phase. The recent approval of Bitcoin ETFs and the potential for Ethereum ETFs could pave the way for this regulatory acceptance of DeFi.

Protocols like Uniswap are exploring fee-sharing mechanisms, which could set a precedent for other DeFi tokens to offer more tangible value to holders. This shift towards revenue sharing could transform DeFi tokens from purely speculative assets to productive financial instruments, attracting a new class of investors.

Traditional assets like real estate and bonds are getting tokenized: a move that could bring trillions of dollars of liquidity into DeFi protocols. This DeFi plus real-world assets (RWAs) combo could have new use cases, and attract institutional capital. Major players like BlackRock have already begun tokenizing traditional funds, signaling growing interest from mainstream finance.

Recent improvements like Ethereum’s Dencun upgrade have significantly reduced gas fees on Layer 2 networks, making DeFi more accessible. This scalability enhancement could drive increased adoption and enable more complex DeFi applications. Unlike newer narratives, DeFi has proven its resilience through multiple market cycles and has a robust, battle-tested infrastructure.

As the market matures, we may see increased mergers and acquisitions, leading to stronger, more efficient protocols. This consolidation could help address the issue of fragmented liquidity and create more sustainable business models. New ways to sustainably generate yield – such as real yield and productive assets – could reignite interest in DeFi yield farming, attracting both retail and institutional investors.

The Case for a DeFi Renaissance

The factors above suggest that DeFi might be poised for a significant comeback. As the hype around memecoins and airdrop farming inevitably fades, capital may rotate back into established DeFi protocols with proven business models. This return to fundamentals could benefit DeFi protocols that have continued to innovate and improve during the downturn.

Many DeFi tokens are trading at massive discounts relative to their total value locked and revenue generation potential, presenting attractive investment opportunities. Investors could notice they’re undervalued now, and begin an upward price-correction acrossDeFi assets.

Major financial institutions are increasingly exploring DeFi, with some already launching tokenized funds on Ethereum. This institutional interest could bring legitimacy and significant capital inflows to the sector. The potential for DeFi to disintermediate traditional financial services remains a powerful long-term driver of growth and innovation.

Innovations like restaking and improvements in Layer 2 scaling are opening up new possibilities for DeFi applications, enhancing both scalability and functionality. These technological advancements could enable new use cases, and improve the overall user experience, addressing one of DeFi’s key pain points.

Traditional finance is beleaguered by problems such as inflation and low yields – and DeFi’s promise of open, permissionless finance starts to look better and better. Global economic factors could drive more users and investors towards DeFi solutions, particularly in regions with unstable currencies or limited access to traditional financial services.

Conclusion

DeFi has undoubtedly faced headwinds in recent years, yet the underlying technology and value proposition is stronger than ever. The sector has shown remarkable resilience, continuing to innovate and grow despite market pressures. As we look ahead, the convergence of regulatory clarity, technological advancements, and potential market rotations could set the stage for a DeFi renaissance.

The integration of real-world assets, improvements in user experience, and the growing ecosystem may finally bridge the gap between DeFi’s potential and its real-world impact. However, challenges remain. DeFi protocols must continue to innovate, focusing on security, scalability, and user experience. They must also find ways to offer compelling value propositions for token holders, beyond mere speculation.

Ultimately, the future of DeFi will depend on one question: can it actually deliver a more open, efficient, and inclusive financial system? If it can overcome its current challenges and capitalize on emerging opportunities, DeFi may not only revive but eclipse its former glory, reshaping the future of finance in the process.

As with all things in the crypto world, the only certainty is change. For investors and enthusiasts alike, keeping a close eye on DeFi’s evolution in the coming months will be crucial. The seeds of the next major crypto narrative may already be germinating in the fertile soil of decentralized finance.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Exploring Geometry-Informed Neural Networks: A Data-Free Approach to Shape Generation

In the ever-evolving landscape of machine learning and computer graphics, the introduction of Geometry-Informed Neural Networks (GINNs) marks a significant milestone. Developed by Arturs Berzins, Andreas Radler, Sebastian Sanokowski, Sepp Hochreiter, and Johannes Brandstetter, GINNs offer a novel approach to training shape generative models without relying on extensive datasets. This article delves into the core concepts and implications of GINNs, shedding light on their potential to transform various domains where data scarcity has been a persistent challenge.

The Challenge of Data Scarcity

The traditional approach to training neural networks, particularly in the realm of shape generation, heavily relies on large, annotated datasets. These datasets provide the necessary examples for the network to learn and generalize patterns. However, in fields like computer graphics, design, and engineering, acquiring such extensive datasets is often impractical. The lack of available data hampers the application of state-of-the-art supervised learning methods, necessitating alternative strategies.

Introducing Geometry-Informed Neural Networks

Geometry-Informed Neural Networks (GINNs) present a paradigm shift by enabling the training of shape generative models without any data. The core idea behind GINNs involves three key components:

- Learning Under Constraints: GINNs leverage geometric constraints inherent to the shapes being modeled. These constraints guide the learning process, ensuring that the generated shapes adhere to the desired geometric properties.

- Neural Fields as a Representation: Instead of relying on discrete data points, GINNs utilize neural fields. Neural fields offer a continuous representation of shapes, making them well-suited for capturing intricate geometric details.

- Generating Diverse Solutions: One of the standout features of GINNs is their ability to generate multiple solutions for under-determined problems. This capability is crucial in scenarios where a single correct solution does not exist, allowing for a broader exploration of the solution space.

Applications and Results

The researchers applied GINNs to a variety of two and three-dimensional problems, each with increasing levels of complexity. The results were promising, demonstrating the feasibility of training shape generative models in a data-free setting. This breakthrough has significant implications for several fields:

- Computer Graphics: Artists and designers can leverage GINNs to create complex shapes and models without needing extensive datasets. This could streamline the creative process and reduce the dependency on pre-existing data.

- Engineering: Engineers can utilize GINNs to design and optimize structures where obtaining a comprehensive dataset is challenging. The ability to generate diverse solutions allows for innovative approaches to problem-solving.

- Medical Imaging: In medical fields where annotated datasets are scarce, GINNs can assist in generating accurate models of anatomical structures, aiding in diagnosis and treatment planning.

Future Directions

The introduction of GINNs opens several exciting research directions. The potential to expand the application of generative models into domains with sparse data is particularly noteworthy. Future research could focus on refining the techniques used in GINNs, exploring new applications, and integrating GINNs with other machine learning paradigms to further enhance their capabilities.

Conclusion

Geometry-Informed Neural Networks represent a groundbreaking advancement in the field of shape generation. By enabling the training of generative models without relying on extensive datasets, GINNs address a critical limitation in current machine learning methodologies. The work of Berzins, Radler, Sanokowski, Hochreiter, and Brandstetter paves the way for innovative applications across various domains, highlighting the transformative potential of this new paradigm.

For those interested in exploring the detailed mechanics and applications of GINNs, the original research paper is available here. This pioneering work is poised to inspire further research and development in the exciting intersection of geometry and neural networks.

Reference

Berzins, A., Radler, A., Sanokowski, S., Hochreiter, S., & Brandstetter, J. (2024, February 21). Geometry-Informed neural networks. arXiv.org. https://arxiv.org/abs/2402.14009

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)