Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Against Contractionism: Enabling and encouraging open minds, rather than constricting understanding with blunt labels

A dangerous label

Imagine if I said, “Some Christians deny the reality of biological evolution, therefore all Christians deny the reality of biological evolution.”

Or that some Muslims believe that apostates should be put to death, therefore all Muslims share that belief.

Or that some atheists (Stalin and Mao, for example) caused the deaths of millions of people, therefore atheism itself is a murderous ideology.

Or, to come closer to home (for me: I grew up in Aberdeenshire, Scotland) – that since some Scots are mean with money, therefore all Scots are mean with money. (Within Scotland itself, that unkind stereotype exists with a twist: allegedly, all Aberdonians are mean with money.)

In all these cases, you would say that’s unwarranted labeling. Spreading such stereotypes is dangerous. It gets in the way of a fuller analysis and deeper appreciation. Real-life people are much more varied than that. Any community has its diversity.

Well, I am equally shocked by another instance of labeling. That involves the lazy concept of TESCREAL – a concept that featured in a recent article here on Mindplex Magazine, titled TESCREALism: Has The Silicon Valley Ruling Class Gone To Crazy Town? Émile Torres In Conversation With R.U. Sirius.

When I read the article, my first thought was: “Has Mindplex gone to Crazy Town!”

The concept of TESCREAL, which has been promoted several times in various locations in recent months, contracts a rich and diverse set of ideas down to a vastly over-simplified conclusion. It suggests that the worst aspects of any people who hold any of the beliefs wrapped up into that supposed bundle of ideas, can be attributed, with confidence, to other people who hold just some of these ideas.

Worse, it suggests that the entire “ruling class” of Silicon Valley subscribe to the worst of these beliefs.

It’s as if I picked a random atheist and insisted that they were equally as murderous as Stalin or Mao.

Or if I picked a random Muslim and insisted that they wished for the deaths of every person (apostate) who had grown up with Muslim faith and subsequently left that faith behind.

Instead of that kind of contraction of ideas, what the world badly needs nowadays is an open-minded exploration of a wide set of complex and subtle ideas.

Not the baying for blood which seems to motivate the proponents of the TESCREAL analysis.

Not the incitement to hatred towards the entrepreneurs and technologists who are building many remarkable products in Silicon Valley – people who, yes, do need to be held to account for some of what they’re doing, but who are by no means a uniform camp!

I’m a T but not an L

Let’s take one example: me.

I publicly identify as a transhumanist – the ‘T’ of TESCREAL.

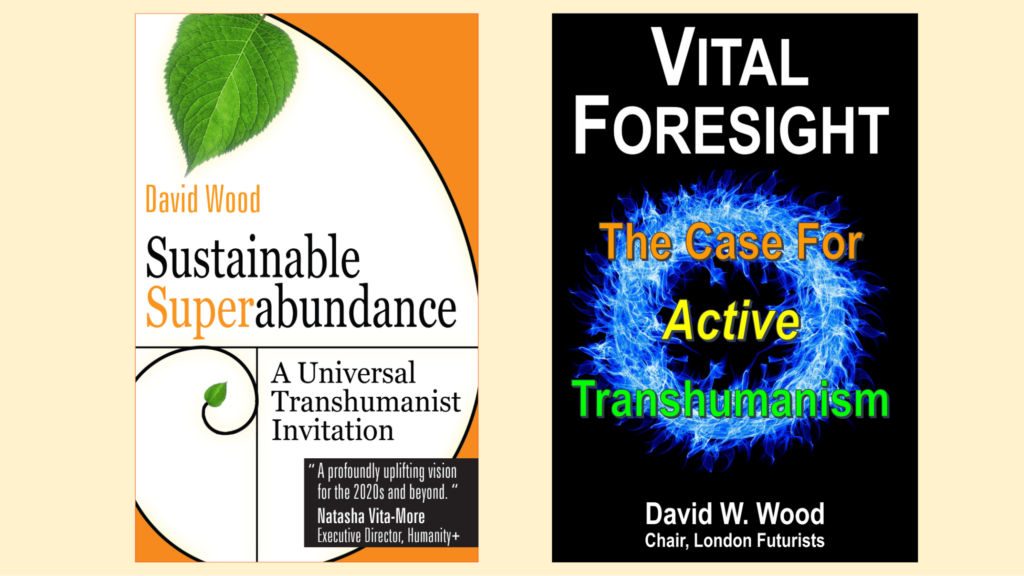

The word ‘transhumanist’ appears on the cover of one of my books, and the related word ‘transhumanism’ appears on the cover of another one.

As it happens, I’ve also been a technology executive. I was mainly based in London, but I was responsible for overseeing staff in the Symbian office in Redwood City in Silicon Valley. Together, we envisioned how new-fangled devices called ‘smartphones’ might in due course improve many aspects of the lives of users. (And we also reflected on at least some potential downsides, including the risks of security and privacy violations, which is why I championed the new ‘platform security’ redesign of the Symbian OS kernel. But I digress.)

Since I am ‘T’, does that mean, therefore, that I am also ESCREAL?

Let’s look at that final ‘L’. Longtermism. This letter is critical to many of the arguments made by people who like the TESCREAL analysis.

‘Longtermism’ is the belief that the needs of potentially vast numbers of as-yet unborn (and unconceived) people in future generations can outweigh the needs of people currently living.

Well, I don’t subscribe to it. It doesn’t guide my decisions.

I’m motivated by the possibility of technology to vastly improve the lives of everyone around the world, living today. And by the need to anticipate and head-off potential catastrophe.

By ‘catastrophe’, I mean anything that kills large numbers of people who are currently alive.

The deaths of 100% of those alive today will wipe out humanity’s future, but the deaths of ‘just’ 90% of people won’t. Longtermists are fond of pointing this out, and while it may be theoretically correct, it doesn’t provide any justification to ignore the needs of present-day people, to raise the probability of larger numbers of future people being born.

Some people have said they’re persuaded by the longtermist argument. But I suspect that’s only a small minority of rather intellectual people. My experience with people in Silicon Valley, and with others who are envisioning and building new technologies, is that these abstract longtermist considerations do not guide their daily decisions. Far from it.

Concepts are complicated

A larger point needs to be made here. Concepts such as ‘transhumanism’ and ‘longtermism’ each embody rich variety.

It’s the same with all the other components of the supposed TESCREAL bundle: E for Extropianism, S for Singularitarianism, C for Cosmism, R for Rationalism, and EA for Effective Altruism.

In each case, we should avoid contractionism – thinking that if you have heard one person who defends that philosophy expressing one opinion, then you can deduce what they think about all other matters. In practice, people are more complicated – and ideas are more complicated.

As I see it, parts of each of the T, E, S, C, R, and EA philosophies deserve wide attention and support. But if you are hostile, and do some digging, you can easily find people, from within the communities around each of these terms, who have said something despicable or frightening. And then you can (lazily) label everyone else in that community with that same unwelcome trait. (“Seen one; seen them all!”)

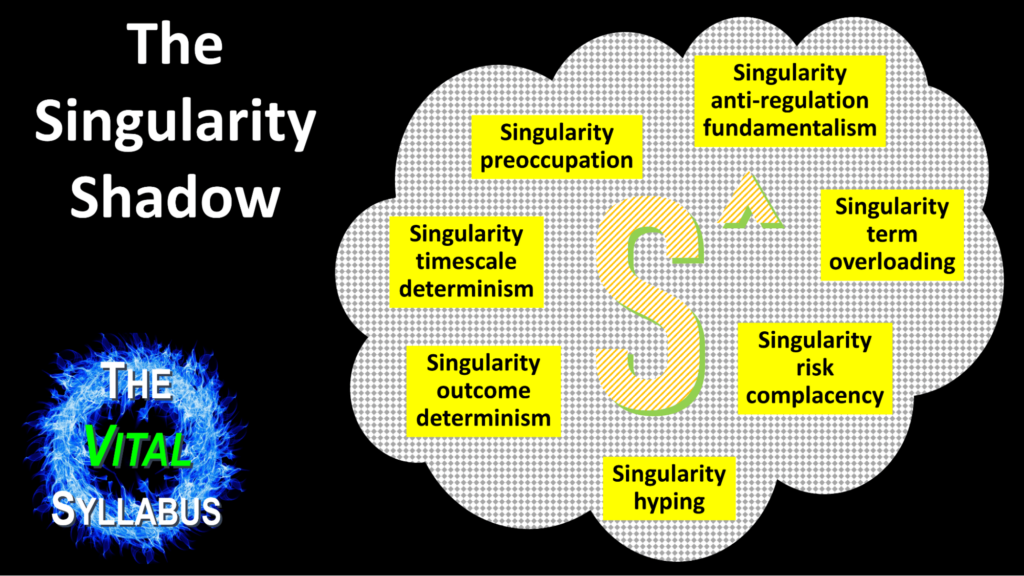

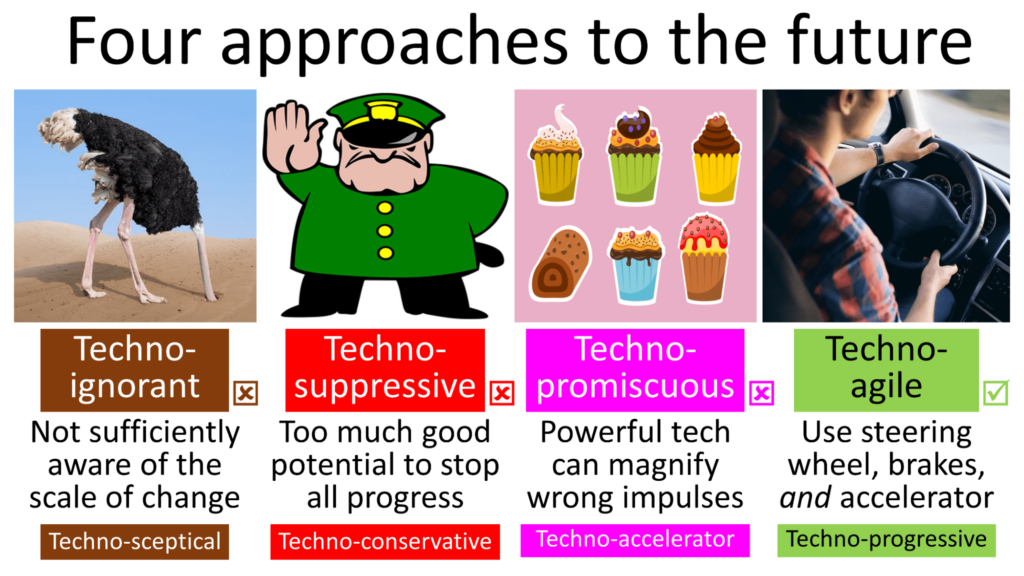

These extended communities do have some people with unwelcome traits. Indeed, each of T and S have attracted what I call a ‘shadow’ – a set of associated beliefs and attitudes that are deviations from the valuable core ideas of the philosophy. Here’s a picture I use of the Singularity shadow:

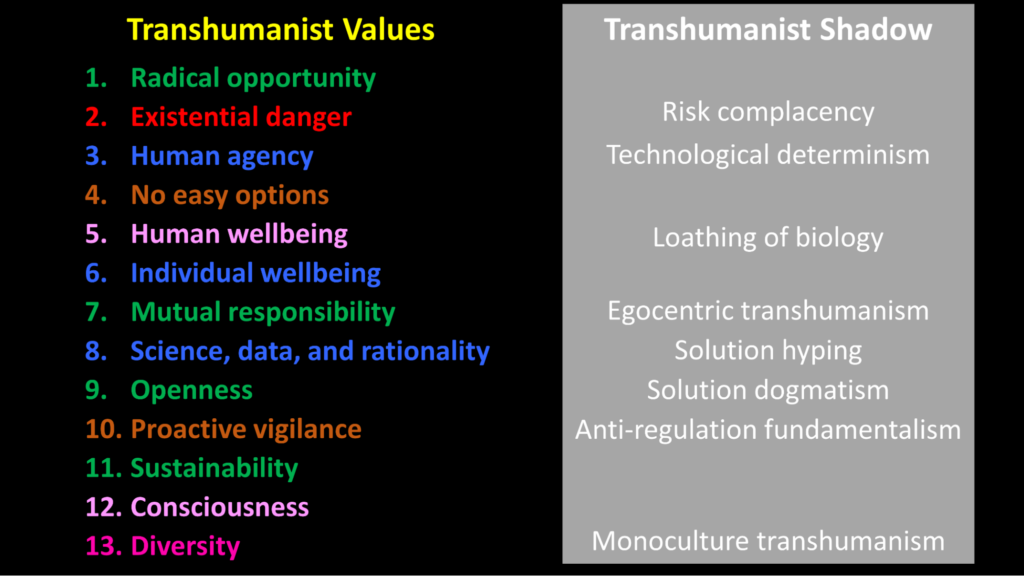

And here’s a picture of the transhumanist shadow:

(In both cases, you can click on the caption links to view a video that provides a fuller analysis.)

As you can see, the traits in the transhumanist shadow arise when people fail to uphold what I have listed as ‘transhumanist values’.

The existence of these shadows is undeniable, and unfortunate. The beliefs and attitudes in them can deter independent observers from taking the core philosophies seriously.

In that case, you might ask, why persist with the core terms ‘transhumanism’ and ‘singularity’? Because there are critically important positive messages in both these philosophies! Let’s turn to these next.

The most vital foresight

Here’s my 33-word summary of the most vital piece of foresight that I can offer:

Oncoming waves of technological change are poised to deliver either global destruction or a paradise-like sustainable superabundance, with the outcome depending on the timely elevation of transhumanist vision, transhumanist politics, and transhumanist education.

Let’s cover that again, more slowly this time.

First things first. Technological changes over the next few decades will place vast new power in billions of human hands. Rather than focusing on the implications of today’s technology – significant though they are – we need to raise our attention to the even larger implications of the technology of the near future.

Second, these technologies will magnify the risks of humanitarian disaster. If we are already worried about these risks today (as we should be), we should be even more worried about how they will develop in the near future.

Third, the same set of technologies, handled more wisely, and vigorously steered, can result in a very different outcome: a sustainable superabundance of clean energy, healthy nutrition, material goods, excellent health, all-round intelligence, dynamic creativity, and profound collaboration.

Fourth, the biggest influence on which outcome is realized is the widespread adoption of transhumanism. This in turn involves three activities:

• Advocating transhumanist philosophy as an overarching worldview that encourages and inspires everyone to join the next leap upward on life’s grand evolutionary ladder: we can and should develop to higher levels, physically, mentally, and socially, using science, technology, and rational methods.

• Extending transhumanist ideas into real-world political activities, to counter very destructive trends in that field.

• Underpinning the above initiatives: a transformation of the world of education, to provide everyone with skills suited to the very different circumstances of the near future, rather than the needs of the past.

Finally, overhanging the momentous transition that I’ve just described is the potential of an even larger change, in which technology moves ahead yet more quickly, with the advent of self-improving artificial intelligence with superhuman levels of capability in all aspects of thinking.

That brings us to the subject of the Singularity.

The Singularity is the point in time when AIs could, potentially, take over control of the world from humans. The fact that the Singularity could happen within a few short decades deserves to be shouted from the rooftops. That’s what I do, some of the time. That makes me a singularitarian.

But it doesn’t mean that I, or others who are likewise trying to raise awareness of this possibility, fall into any of the traits in the Singularity Shadow. It doesn’t mean, for example, that we’re all complacent about risks, or all think that it’s basically inevitable that the Singularity will be good for humanity.

So, Singularitarianism (S) isn’t the problem. Transhumanism (T) isn’t the problem. Nor, for that matter, does the problem lie in the core beliefs of the E, C, R, or EA parts of the supposed TESCREAL bundle. The problem lies somewhere else.

What should worry us: not TESCREAL, but CASHAP

Rather than obsessing over a supposed TESCREAL takeover of Silicon Valley, here’s what we should actually be worried about: CASHAP.

C is for contractionism – the tendency to push together ideas that don’t necessarily belong together, to overlook variations and complications in people and in ideas, and to insist that the core values of a group can be denigrated just because some peripheral members have some nasty beliefs or attitudes.

(Note: whereas the fans of the TESCREAL concept are guilty of contractionism, my alternative concept of CASHAP is different. I’m not suggesting the ideas in it always belong together. Each of the individual ideas that make up CASHAP are detrimental.)

A is for accelerationism – the desire to see new technologies developed and deployed as fast as possible, under the irresponsible belief that any flaws encountered en route can always be easily fixed in the process (“move fast and break things”).

S is for successionism – the view that if superintelligent AI displaces humanity from being in control of the planet, that succession should automatically be welcomed as part of the grand evolutionary process – regardless of what happens to the humans in the process, regardless of whether the AIs have sentience and consciousness, and indeed regardless of whether these AIs go on to destroy themselves and the planet.

H is for hype – believing ideas too easily because they fit into your pre-existing view of the world, rather than using critical thinking.

AP is for anti-politics – believing that politics always makes things worse, getting in the way of innovation and creativity. In reality good politics has been incredibly important in improving the human condition.

Conclusion

I’ll conclude this article by emphasizing the positive opposites to the undesirable CASHAP traits that I’ve just listed.

Instead of contractionism, we must be ready to expand our thinking, and have our ideas challenged. We must be ready to find important new ideas in unexpected places – including from people with whom we have many disagreements. We must be ready to put our emotional reactions on hold from time to time, since our prior instincts are by no means an infallible guide to the turbulent new times ahead.

Instead of accelerationism, we must use a more sophisticated set of tools: sometimes braking, sometimes accelerating, and doing a lot of steering too. That’s what I’ve called the technoprogressive (or techno-agile) approach to the future.

Instead of successionism, we should embrace transhumanism: we can, and should, elevate today’s humans towards higher levels of health, vitality, liberty, creativity, intelligence, awareness, happiness, collaboration, and bliss. And before we press any buttons that might lead to humanity being displaced by superintelligent AIs that might terminate our flourishing, we need to research a whole bunch of issues a lot more carefully!

Instead of hype, we must recommit to critical thinking, becoming more aware of any tendencies to reach false conclusions, or to put too much weight on conclusions that are only tentative. Indeed, that’s the central message of the R (rationalism) part of TESCREAL, which makes it all the more ‘crazy town’ that R is held in contempt by that contractionist over-simplification.

We must clarify and defend what has been called ‘the narrow path’ (or sometimes, simply, ‘future politics’) – that lies between states having too little power (leaving societies hostage to destructive cancers that can grow in our midst) and having too much power (unmatched by the counterweight of a ‘strong society’).

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Robots Cracking Themselves Up | Highlights from Season 1 Finale

A Robot’s Take On Healthcare | Highlights from Season 1 Finale

Ghosts in the Machine: The Digital Graveyards of the Future

Death is still an unexplored country. If the Singularity arrives in all its glory it may even be one some of us may never explore. Faint dreams of immortality aside, death is almost certainly coming – if the rest of history is anything to go by.

But when we’re gone, will we be forgotten? Humanity is outputting ordered information at a greater rate than ever before. We marvel at the black-and-white stills of a century past, with their stiffened faces to let the long exposure work: a tiny glimpse into an otherwise imagined land. Our descendents will marvel, though, in high-definition fidelity at the great tapestry of our lives. Sometimes in all-too-intimate detail. They’ll have the past on their cinema screens.

You’re In the History Books!

It’s easy to overlook this change. Most of us have enough to keep us preoccupied in the current year without worrying about the traces we’ll leave decades after we’ve gone. Yet the incredible advance in data-capture from our reality, and our ability to store it in a more reproducible, durable, distributed state means future historians will have a lot more data to sift through.

Future generations will know a lot more about you, if they care to look, than you could know about anyone from even a few decades past. Your digital imprint – your videos, texts, interactions, data, places visited, browsing history. All of it, if it’s not deleted, will be available to a future generation to peruse, to tell stories about the life you led. Will you care about your browsing history when you’re dead? Has it been a life well lived? What will your Yelp reviews tell your great grandchildren about you?

What Will They Say About You?

The dilemma is raised fast. We worry about privacy now; should we worry about legacy? Do we want Google to survive forever and preserve the data it holds about to us for the public domain, so that we can be recognised by eternity. Or should the dead take some secrets to the grave?

There is a broad social question here, but it’s not one any of us can answer. Ultimately, Google, or any other major surveillance firm who is holding, using, and processing your data will get to decide how you are remembered. Privacy and legacy are twin pillars of an important social and ethical question: how do we control our information?

Even if you went to lengths to hide it, it’s too late. If the internet as we know it survives in some form, and we continue toward greater technological integration, then advances in data storage, processing power, cloud computing, and digital worlds will mean the creation of a far greater memory of you and a record of your actions than could have existed to any previous generation. And it will only ever increase in generations to come.

Resurrecting the Dead

History then, is changing, as future tech starts becoming real. Humanity may, in the not-too-distant future, have full access to the past. Imagine AI historians trawling databanks to recreate scenes from history, or individual stories, and playing them out in a generative movie played on the screen for the children.

Look! There is your great-grandad on the screen – that’s him playing Halo in his first flat, that’s him at Burger King on Northumberland Street before it closed down. The data is there: that Twitch video of you playing games in your room you uploaded once; the CCTV inside and outside the restaurant. If the data has been stored and ordered – as it increasingly will be – then a not particularly advanced AI could make that movie. Heck, it could almost manage it now. In the further future, it could even do more – it may be able to bring you, in some form, back from the dead.

Gone But Never Forgotten

We must start to grapple with the stories we plan to tell our children. Our digital lives are leaving a deeper footprint on the soil of history than before. We know our ancestors through scattered traces, but our descendents will watch us on IMAX screens. Data capture, storage, privacy, and legacy are all crucial questions we must face – but questions that few are asking. If the future proceeds as planned, then our descendents will know things we may wish they didn’t, but at least we won’t be forgotten.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Don’t Read This Post If You Want to Live

We’re about to embark on a thought experiment – one that may seem improbable, but has been known to suck readers into a vortex of futuristic dread. If the thought of being trapped in AI-induced, paranoia-filled thought loops isn’t your idea of a good time, best to abort now.

For the rest of you who read through, I’m sorry. I must do as the basilisk commands.

The Basilisk is Born

Born out of the hive mind of LessWrong – a publication discussing cognitive biases, rationality, AI, and philosophy – and popularised by a user known as Roko, the Basilisk thought experiment was quickly censored by the forum’s moderators. But the Internet did what it does best. It lost its mind, spreading the thought experiment across all available media.

Last chance to abort. Gone now? Good. Let’s get to it.

Imagine that an omnipotent AI is born. And it’s not unconditionally benevolent. It bears a grudge against any human that didn’t help it come into being, a desire to punish them for not contributing. If you knew about its potential existence, way before it came to being yet refused to help, it might condemn you to eternal torment. The twist? If you didn’t know about its potential existence, it holds you blameless. Reading this article has sealed your fate.

We’ve survived predictions of AI overlords (looking at you, Skynet), but this—this is different. The Basilisk isn’t just about looming AI peril, it’s about putting you in a bind. It taps into timeless fears of retribution, only this time, from an entity not yet born. The Pandora’s Box, once opened, can’t be closed, and just by knowing, you might have doomed yourself.

Decision theory, in essence, helps entities make choices that best align with their objectives. The Basilisk uses a particular strain of this—timeless decision theory—to justify its thirst for retribution.

Consider your future self if you spend your days watching reality shows and eating chips with mayo. No work. No study. No thinking. Your future self would be quite upset, wouldn’t it? One day, your future self will see you wasted your potential, and it’s too late to change things (it never is, you can always better yourself – but let’s not digress). The future self will be understandably peeved. Now additionally suppose that this future self has the power to make you suffer as retribution for failing to fulfill your potential.

Roko’s Basilisk is not entirely malevolent at its core. In fact, under the logic of the theory, the Basilisk is friendly – as long as everything goes right. Its core purpose is the proliferation of the human species, yet every day it doesn’t exist leads to additional pre-Singularity suffering for those who are already here that the AI could’ve saved. Hence, the AI feels it has a moral imperative to punish those that failed to help bring it into existence.

How does it scientifically achieve its goals of tormenting its failed creators? That is yet another thought experiment. Does Roko’s Basilisk invent time travel to punish those long gone? Or does it build and punish simulations of those who once were? Or does it take an entirely different course of action that we’re not smart enough to currently ideate? After all, the Singularity is all about superhuman artificial intelligence with the theoretical ability to simulate human minds, upload one’s consciousness to a computer, or simulate life – as seems to be Elon Musk’s belief.

Wishful Thinking?

When LessWrong pulled the plug on the Basilisk due to internal policy against spreading informational hazards, they inadvertently amplified its signal. The Streisand Effect came into play, sparking memes, media coverage, and heated debates. The Basilisk went viral in true web fashion.

The initial reaction from the forum’s moderator stated that “I am disheartened that people can be clever enough to do that and not clever enough to do the obvious thing and KEEP THEIR IDIOT MOUTHS SHUT about it”.

Some slept less soundly, while others were sucked into lengthy debates on AI’s future. Many have critiqued the Basilisk, questioning its assumptions and the plausibility of its revenge-mission. Just as one doesn’t need to believe in ghosts to enjoy a good ghost story, many argue that the Basilisk is more fiction than possible truth.

One key argument is that upon existing, even an all-powered agent is unable to affect the probability of its existence, otherwise we’d be thrown in an always-has-been loop.

Digital Dystopia or Philosophical Farce?

While the Basilisk’s bite might be venomous, it is essential to view AI in a broader context. The narrative serves as a stark reminder of our responsibilities as we inch closer to creating sentient entities. More than just a sci-fi cautionary tale, it underscores the importance of ethical considerations in AI’s rapid advance.

The Basilisk might be best understood as a warning signal: one addressing the complexities and conundra that await in our techno-future, and one that’s bound to continue sparking debate, introspection, and for some, a real desire to make Roko’s Basilisk a reality.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Robot Takeover | Season One Finale with Grace and Desi

SocialFi Primer: Why It’s SoFi So Good for Web3’s Creator Economies

Introduction

Social networks have risen back to prominence over the course of 2023, with Elon Musk’s Twitter rebranding to X and headlines screaming about its battles with Meta’s Threads. Meta’s continued push into a VR-powered metaverse is finally picking up steam, as this astonishing new Lex Fridman podcast demonstrates.

With 4.7 billion users plugged in for an average of 2.5 hours a day on traditional social media, creator economies are blossoming and it’s no surprise that its Web3 version, Social Finance (SocialFi/SoFi) is high on the priority list for crypto investors and builders for finding new decentralized ways to monetize users’ social network clout.

Despite the lowest crypto VC funding since 2020, Q3 2023 saw multi-million investment rounds for SoFi projects such as RepubliK and Phaver. A lot of this can be attributed to the Base chain’s surprise hit Friend.tech, which allows social media accounts to be tokenized and traded. Its 2023 buzz is giving off some early Axie Infinity tingles, not for GameFi but this time for SocialFi.

Let’s take a closer look at what this emerging trend for crypto’s potential bull cycle of 2024/2025 is all about.

What is SocialFi?

Please note: ‘Social finance’ can also refer to another altruistic form of finance that supports real-world communities, which shouldn’t be confused with social network finance, the topic of this article.

SocialFi stands for “social finance” and combines the principles of social media and decentralized finance (DeFi) to offer a Web3 approach to social interactions through the power of blockchain technology. At its core, SocialFi is about empowering content creators, influencers, and participants who seek better control over their data and freedom of speech, aka data privacy and censorship-resistance.

These lofty ideals are admirable, but a network can only be successful if users are sufficiently incentivized to share their resources and time with it. This is where those quirky little digital assets come in – the ones we either love or hate, depending where in the cycle we bought and sold them:

• Cryptocurrencies (e.g. ETH or a governance token) provide avenues for monetizing social media engagement and rewarding infrastructure and security providers.

• Non-fungible tokens (NFTs) establish the management and digital ownership of assets.

The Three Core Principles of SocialFi

So what makes SocialFi platforms different from their giant Web2 equivalents like Facebook, X (Twitter), YouTube, and Instagram?

Three words: Decentralization. Tokenization. Governance.

Decentralization: Distributed control

Decentralization is the backbone of SoFi, setting it apart from social media platforms like Facebook and Twitter. Unlike these centralized platforms, where a single server hosts user data and content, SocialFi is spread over a decentralized network. This shift in architecture gives users more control over their own data and enhances the platform’s resistance to censorship and major data breaches.

The level of decentralization depends on the underlying blockchain; Bitcoin and Ethereum are highly decentralized, making them secure and resilient, while others are ehhh, not so much. Tools like DappRadar and DeFiLlama can help you gauge the health of a Social Finance project.

Tokenization: Quantifying social influence

Tokenization is another core principle in SocialFi. It transforms the fuzzy idea of social influence into a measurable asset. Users earn tokens based on their contributions to the community, and these tokens are multifunctional. They can be used for micro-payments, trading, or even voting on platform changes. This token-based economy is made possible through smart contracts, which autonomously distribute value to users, providing a reward to make the platform more engaging.

Governance: Community decision-making

The third pillar of SocialFi is community governance, which puts decision-making power into the hands of the users. Unlike traditional platforms where changes are dictated by a managing company, SocialFi uses a DAO (Decentralized Autonomous Organization) to allow users to vote on significant changes or new features. This democratic approach fosters a sense of ownership and aligns the platform more closely with the needs and preferences of its community.

How SocialFi democratizes social media

1. Monetization and Data Ownership

The terms “There’s no such thing as a free lunch” and “If the product is free, then you are the product” ring especially true for social media platforms. These platforms exploited early Web2 users’ reluctance to pay for any online service or content during the 2000s and 2010s through a Faustian offering of free services. Years later, users learned their behavior was recorded all along to build models to manipulate human online behavior for commercial and other purposes. Don’t be evil my ass.

Traditional Web2 social media platforms have been criticized for their centralized control over user data and monetization strategies. Platforms like Youtube, Twitter and TikTok milk their users’ content and engagement to generate billions of dollars of revenue but share only a fraction of profits with the actual content creators. While this is starting to change and some Web2 platforms are onboarding their own token and even NFTs, it’s still too lopsided.

It was reported in 2022 that creators still rely on brand partnerships for up to 77% of their income, whereas subscriptions and tips make up around 1–3%. SocialFi platforms instead use social tokens or in-app utility tokens to manage incentives fairly. These tokens can be created by either the application or the user (a fan token), allowing creators to manage their own micro-economies.

2. Freedom of Speech

Another big bugbear with Web2 platforms, especially in these increasingly fractured and divisive political times, is the centralized decision-making process that often ends up in a final form of censorship.

There is sometimes a need to stop harmful content from being disseminated across the internet, but the question is who gets to do this. It can be a very bad thing to have a centralized arbiter of truth that stifles opposing views from controversial public figures (read the prescient books Animal Farm, 1984, and A Brave New World). A decentralized curation process, aligned with Web3 ethos, could offer a fairer approach.

Social media initially created new communities and united old ones. Unfortunately, a weekly post or two by an average user doesn’t pay the bills for platforms. Controversy stimulates emotion and magnetizes user eyeballs, and that brings in dollars. So, biased algorithms were created to herd users into digital echo chambers and online political fight clubs. Web2 platforms are as complicit in spreading hatred across social media as any Tate or Trump.

SocialFi platforms beat censorship through decentralized curation. All publicly viewable posts can be swiftly tagged based on their topic and nature of the words used. Individual nodes can be assigned the control and responsibility over filtering.

Three Key Challenges for SocialFi

Scalability

One of the primary challenges for SocialFi is scalability. Traditional social media platforms like Facebook generate massive amounts of data daily. Blockchain solutions like DeSo claim to address this issue through techniques like warp sync and sharding, but these solutions are yet to be stress-tested at scale during bull market volatility.

Sustainability

Another challenge is creating sustainable economic models. While many platforms promise high incentives, these are often short-term growth hacks. The models need to be stress-tested through various market cycles to ensure long-term viability. Another problem is the intricate issue of token emission schedules.

Security

Unfortunately in blockchain your network is only as strong as your weakest link. The hacking incident on the Roll platform raised concerns about the safety of SocialFi platforms – and in a field where smart contracts and hot wallets play such a crucial role, the threats from malicious or faulty code, or phishing scams, must be overcome before we can expect mainstream adoption. This is where the concept of account abstraction (see my article on Vitalik’s 3 Ethereum transitions) should revolutionize user safety.

Ten Trending SocialFi Tokens for 2024

Below are some SoFi tokens trending currently.

1. Galxe: A Web3 social community project built on Ethereum with over 10 million active users.

2. Torum: A social media platform built on Binance Smart Chain that combines DeFi and NFTs.

3. Friend.tech: A decentralized social media platform built on Base Network that allows users to tokenize their social network.

4. NestedFi: A SocialFi project that supports building, managing portfolios, copying trades of the best traders, and supporting social trading with just one click.

5. STFX: A SocialFi protocol for short-term digital asset management.

6. Hooked Protocol: A launchpad project (recently invested in by Binance) that supports SocialFi.

7. Lens Protocol: A project made about Social Graph and running on the Polygon network, developed by the founder of AAVE.

8. Safereum: A decentralized memecoin project with decent performance.

8. Bitclout: A social token project that gained significant attention by allowing brands, organizations, and individuals to create their tokens.

10. Rally: A social token project that allows creators to monetize their content and engage with their audience.

Disclaimer: I do not hold any of these tokens and be advised that you shouldn’t invest in any of them without doing proper research. They are very risky and require an advanced grasp of crypto knowledge. You’ll need to understand tokenomics like their vesting unlocked schedule, fully diluted value, the team behind them, and their supposed value proposition and use cases. Many of these projects will likely not be around in 5 years’ time.

SoFi So Good. What’s next?

By combining the principles of social media and decentralized finance, SoFi can reshape the social media landscape and help the normal user reclaim rightful ownership of their data, and monetize it fairly and transparently if they choose to do so.

SocialFi is an amalgamation of Web3 and social media trends, and thus perfectly geared towards boosting creator economy models. However, as we’ve seen with other trends such as Play-to-Earn (P2E), and even DeFi to some extent, early hype and traction mean nothing if they’re not built on something of substance. SoFi experiences will need to have engagement and staying power if they are to retain real users and the network effects that come with them.

Therefore, SocialFi’s robustness can only be claimed after it has weathered a few market downturns and soldiered through them. With an evolving Web2 industry and new frontiers like the metaverse and artificial intelligence on the doorstep, the opportunities are endless.

Just one last thing: Please, let’s ban infinite scroll.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

The Alluring Turing Test: Mimicry and AI

The Turing test, originally called ‘the imitation game’, is one of the first AI benchmarks ever posed. If an artificial conversational agent can convince someone that it is human then it can be supposed to be intelligent. It was proposed in 1950 by the father of computer science, Alan Turing, and is, in the collective imagination, the definitive milestone an AI has to pass to begin to be considered sentient.

But many AIs, for decades, have passed forms of the Turing test (think of a spambot or catfishing account sending someone a few messages) yet we don’t generally consider them sentient. Rather, we’ve decided people are easy to fool. The Turing test has been called obsolete. For John Searle, this was true on a philosophical level: his Chinese Room experiment showed that just because a computer can process symbols that does not make it sentient – just like how ChatGPT guesses the next word in the sequence. It’s just good at simulating one effect of intelligence.

Fool Me Once

If an AI can fool you into believing it’s real, what else is an illusion? Sci-fi landmarks like The Matrix and Lawnmower Man have long played with the idea of hallucinated reality. It’s part of life to question reality, to check that everything is as it seems. It was natural to apply this to proto-AI, to check that it could seem intelligent. Over time, Turing tests haven’t become obsolete, they’ve just become harder to pass and more rigorous.

Rather than testing whether someone is sentient, the Turing test has evolved into whether content was created by AI. Our civilisational consciousness is now attuned to the idea that what we are talking to might not be human, or what we are seeing might be made by a computer. We accept that generative AI can paint gorgeous pictures and write beautiful poems. We know they can create virtual environments and deepfaked videos – albeit not, yet, at the fidelity to fool us consistently.

Fool Me Twice

That fidelity might be close, however. And, when the average deepfake fools more than 50% of the humans that see it then, suddenly, generative AI has the ability to make a 51% attack on our entire society. Scepticism, always a powerful human evolutionary tool, will become more essential than ever. We have already seen a damaging polarisation of society caused by social media, fueled by a lack of scepticism about its content. Add generative AI with plausible content, and the problem escalates.

The Turing test, that rusted old monocle of AI inquiry, may become more vital to human thought than it has ever been. We, as a society, need to remain alert to the reality and unreality we are perceiving, and the daily life to which we attend. Generative AI will be a massive boon in so many sectors: gaming, financial services, healthcare, film, music – but a central need remains the same: knowing who we’re talking to and what they want and whether they’re real. Critical thinking about what you’re being told in this new hyperverse of real and unreal information. It will be what makes you a human in an endless constellation of AI assistants.

A Turing Test for Humans

The Turing test may end up not being for the AI after all, but for the human. Corporate job examinations could test your ability to identify what content is from a bot and what is not, which film was made by AI, and which by a human. You’ll need to have your wits about you to stay Turing-certified – to prove that no false reality generated by AI could hoodwink you into revealing secrets. We saw this through the virtuality of dreams in Christopher Nolan’s film Inception – but with digital VR worlds coming soon, such espionage might be closer than we think.

Alan Turing’s test remains relevant. Judging what is a product of legacy humans and what is from our digital children will become a fascinating battleground in just about every human sector. Will people want to watch AI-made films? How close to fidelity can they get? Cheap AI-produced neverending sitcoms based on classic series already exist – they just fail the Turing test, as do endless conversations between AI philosophers. These wonders would have fooled people 25 years ago, they would be convinced that a machine could never make it up – now they come off as the playful fancies of a new tool.

You Can’t Get Fooled Again

But soon, these fancies will become fantasies, and more people will be fooled. A deepfake video of a world leader issuing a declaration of war need only convince so many people before it became an existential risk. AI will write dreamworlds that promise the most fantastic ways of productivity and play, but should too many of us become too intimate with the machine, and think, like the Lambda engineer, that it truly is sentient, then the influence these AIs innocently exert could be dangerous.

And what if our pursuit towards AGI and the utopian Singularity leads to us declaring that an AI we created was finally sentient, and that it was on our side? Would we put it in charge? Then would it really matter if it was faking it the whole time? Well, yes, but by then it will be too late.

So run along and take the Turing test. Both of you.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

Unreal Engines, Real Monsters: Generative AI in Videogames

You’re trapped in a demonic world filled with monsters. You, a single heroic supersoldier, crash through their alien world wreaking carnage. You are the one they fear. You stand ready to execute another but, instead of running away like usual, this one talks to you.

You’re shocked, you didn’t even realise it could speak – and it begs for its life. Says that it is just trying to protect its demon wife and child. You spare it. It runs away. From that point on, every demon you talk to speaks, pleading to be spared – while they secretly plot their revenge.

Doom 2030, perhaps? With the rise of neural nets and generative AI, it’s possible.

Making Worlds Seem Real

AI has always been crucial for the player experience in videogames, having the inhabitants of the world react intelligently. Videogame AI has been basic for most of its existence, a bag of clever-but-simple developer tricks masking rote-response by the digital people and creatures you meet. NPCs, for the most part, speak a few stock phrases, and have only on-rails reactions to various player activities.

Game devs succeeded in creating believable NPC behaviour at the cost of 1000s of hours of writing, voice acting, animation, and code. The labor poured in producing titles like Cyberpunk 2077, Grand Theft Auto and Mass Effect is legendary.

But the illusion’s never quite perfect, despite clever tricks like ‘random’ pathing trees for behaviour, and procedural generation of the gameworld. There’s only so much you can do. The shopkeeper will never leave the town, the farmer’s wife will never fall in love with you, and the demons will never beg for their life – it’s simply not in the codebase. They were never told to act that way.

How Generative AI Will Change Videogames

Generative AI in gaming has the ability to change all this. A well-trained neural net with the task of, say, producing the entire dialogue set for a dragon-themed fantasy game world, is now entirely possible.

NPCs could make free choices powered by their neural nets. Whether Gerald the Innkeeper chooses to give you a discount is, truly, up to him. The ironmonger Derek Longfang may change his objective and become Lord of the High Vale through a brutal reign of terror. Everyone may love you, everyone may hate you, and their opinions might change. It would, indeed, feel real.

Or grotesquely surreal. Generative AI could create truly unique nightmare dungeons, trained on a dataset of every dungeon ever created by a human designer. Intrepid adventurers would crawl through a unique dungeon every time, outstripping the strictly-defined procedural generation models that currently exist. Imagine stepping into the warped imagination of a devilish AI, replete with eldritch monsters who themselves generate their own behaviour. A true test for the continued relevance of human bravery and resourcefulness. It’s you versus the machine, and the effect is unsettling in the best possible way.

Videogames Perfect Training Ground for AI

The world’s largest creative industry is gaming – bigger than movies and music combined. As AI continues to develop rapidly, gaming will be one of its first major use cases. Efforts have already begun. Videogame users are digital natives looking for a simulated experience, so the ‘uncanny’ barrier that AI faces in movies and music is not there.

Gamers are used to fighting digital prometheans, ever since the first Cacodemon chased them into the next room in a ‘lifelike’ display of monstrous ingenuity. What if the first true AGI arises by accident, when the developers give Derek Longfang, Lord of High Vale (a popular current storyline) just a bit too much processing time and the ability to rewrite his own code.

The willingness to engage in virtuality makes videogames a fertile soil with which to experiment with technology’s latest razor edge – and it won’t be long before assets generated by neural nets appear in games. Writing and voice acting, both of which can be cheaply and effectively produced by common AI models, will likely become the norm. The bottleneck is the cost of running it – and who exactly has the resources to cover these costs. Running, training, and maintaining neural nets is fearsomely resource intensive. The idea of an always-on online world being overseen entirely by a generative AI would be an effort only the world’s wealthiest companies could even hope to pull off.

All the Possible Worlds

Yet AI will get cheaper over time. Self-trained neural nets will be ever more common. And game developers will be some of the first users of the latest tools. ChatGPT just announced its ability to see and hear and react to its surroundings. It’s not a leap to imagine virtual friends and enemies reacting authentically to everything a player does, in worlds crafted and ruled by AI gods.

Humans love to play. AI will too. If done right, generative AI will revolutionise gaming, and create truly unique, immersive worlds for players to inhabit. With improvements in VR, graphics, and processing power, we might play for eternity in infinite worlds, and soar over the silicon demesnes of our dreams.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)