Every time Bitcoin hits a new all-time high, we hear that about ‘about 20%’ of the Bitcoins minted are lost, never to be recovered, with some seriously sob stories thrown in for good measure. They were lost for various reasons, and more continue to go missing, albeit less often these days. Most of those missing Bitcoins have been lying dormant for several years. In Bitcoin’s early days, stashes of Bitcoin weren’t seen as the honeypots they are today, and people got careless, only to pay the ultimate price of losing their BTC. Now, with the age of AI upon us in 2024, can new technologies help retrieve those missing fortunes?

Careless Early Miners

In the early years of blockchain, from 2009 to 2014 or so, some individuals had found a hobby using spare PCs to mine Bitcoin. This wasn’t terribly lucrative in fiat terms at the time, but many of those miners racked up what would now be enviable collections of dozens, hundreds, or thousands of Bitcoins. By now, most of us have heard about the missing hard drives that contain many millions of dollars worth of Bitcoin. These days, one solitary Bitcoin is worth a tidy sum in fiat money, and accumulators speak of ‘stacking Sats’ (1 SAT = 0.00000001 BTC) rather than accumulating full Bitcoins.

Recovery Efforts

Have any of those stray Bitcoins been recovered? Yes, a small percentage of them have, and there is hope that state-of-the-art decryption techniques and the latest GPUs can be put to use to reclaim more of them. Companies have been set up to assist people in recovering missing Bitcoin wallets, and these efforts have seen some modest success in cases where there is at least a bit of a trail that could lead to the missing Bitcoins.

Bitcoin cryptography is strong. A private key represents a unique number between 1 and 2 to the power of 256. That’s more than the total number of atoms in the universe. With current technology, a brute force attack to test a colossal number of potential keys until landing on the right one would take millions of years.

Is it hopeless? Is it not even worth trying? That depends. If the owner of missing Bitcoins has any hints at a seed phrase, records of where it may have been transferred to or stored, or a physical storage device, that could greatly cut down the time it would take to get to a positive result.

AI to the Rescue?

Artificial Intelligence has been a hot topic of conversation for a while now, and cryptocurrency is not immune from AI influence. When it comes to cracking a Bitcoin wallet, the brute force method will be futile on its own, but AI models are being developed that can drastically shorten the time it takes to crack a private key.

With machine learning and the most powerful GPUs, patterns can be identified within vast collections of data that can significantly bring down the time it takes to uncover encryption keys.

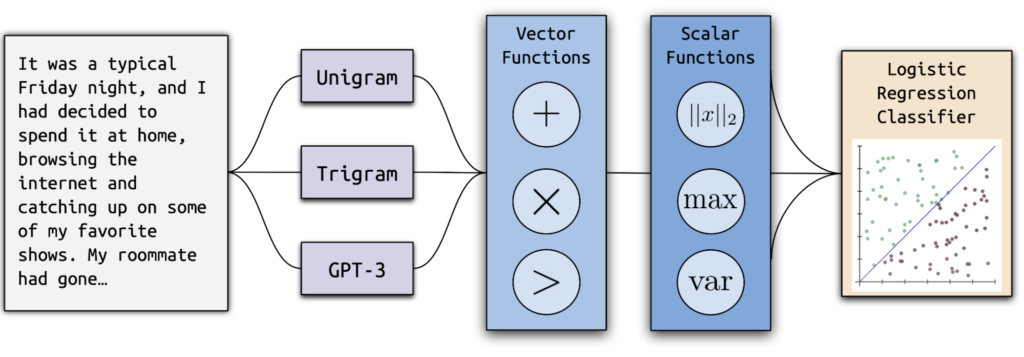

Enter PassGPT, a cutting-edge password guessing AI model that could be the saviour that unlocks your lost millions. Built on OpenAI’s GPT-2 architecture and trained on millions of exposed credentials, PassGPT has a unique edge over other password-guessing tools. By using a technique called progressive sampling, it constructs passwords one character at a time, making it 20% more effective than even the most advanced GAN models.

But PassGPT isn’t just a one-trick pony. It can analyse password strength, identify patterns, and even guess passwords in multiple languages. And it can come up with new passwords that aren’t even in its training data.

So, how could this help you recover your lost Bitcoin? By adapting PassGPT to focus specifically on Bitcoin wallet passwords and feeding it data on common password patterns used by crypto enthusiasts, its effectiveness could be supercharged.

Of course, this technology raises some security concerns, but when used responsibly, it could be a lifeline for those who have lost access to their Bitcoin due to a forgotten password. As generative AI continues to evolve, solutions like PassGPT could become an invaluable tool in the ongoing challenge of balancing security and accessibility in the world of cryptocurrency.

Side-Channel Attacks on Hardware Wallets

Hardware wallets are a common and extremely secure way to store private keys offline. When used judiciously and prudently, they work very well – and best practices should be followed to ensure that private keys are backed up in another separate location, just in case the device goes missing or the owner becomes incapacitated. If an older or less sophisticated hardware wallet has become inaccessible, a side-channel attack offers a glimmer of hope.

A side-channel attack is a method of exploiting any physical characteristics of a hardware wallet that can be detected via electronic sensors. Characteristics including timing, power consumption patterns, and electromagnetic and acoustic emissions which can sometimes reveal enough information to obtain fragments of the PIN code to access the wallet or crack the private keys. Although only fragments may be uncovered, they can still drastically reduce the time taken for cracking tools (including AI and machine learning) to search for the private key.

Technology is advancing all the time, and different hardware wallets will have different levels of vulnerability to side-channel attacks. One of the most well-known hardware wallet makers, Ledger, claims that its wallets are immune to such attacks, so mileage of side-channel attacks may vary. Ledger’s main competitor, Trezor, also claims that crypto functions have been re-written by their cryptography professionals to eliminate such vulnerabilities. Additional measures such as ‘secure elements’, which ensconces the private key permanently inside a computer chip, also makes breaking cold storage encryption near impossible.

Limitations of Silicon

The silicon computer chips that power all of our digital devices have progressed at an astounding rate over the years, roughly in line with Moore’s Law. Taiwan Semiconductor and Samsung are planning to produce 1.4-nanometer chips by around 2027. These chips will lead to some astounding AI performance, but we are getting awfully close to the physical limits of silicon, and we will have to seek other technologies for computing power to continue advancing beyond silicon.

The Quantum Solution/Threat

Currently lurking in the waiting-room of the future is quantum computing. Right now, it’s cumbersome, expensive, and is years from being available commercially, but boy can it compute. It has been expected that quantum computers will be able to compute 158 million times faster than the most advanced existing silicon-based computer.

Researchers at the Centre for Cryptocurrency Research and Engineering of Imperial College London have calculated that a quantum computer with 1500 or more error-corrected qubits will be able to crack a Bitcoin private key. IBM has published a roadmap where they reckon computers with thousands of error-corrected qubits will be a reality by around 2029.

Opposingly, at the popular hacking news website, Hackernoon, they estimate that it would still take a quantum computer 10³² years of a brute force assault to hack Bitcoin. Some developers are proposing a Bitcoin encryption upgrade to ensure quantum resistance, but that would likely require at least a soft fork to implement.

Conclusion

The possibility of AI and quantum computing helping to retrieve lost Bitcoins are very exciting to some people, but threatens to destroy the value of Bitcoin, since the available supply could swell by a few million BTC, especially if they crack Satoshi’s wallet. The biggest fear is quantum computing though, and it’s good to see Bitcoin core devs putting contingency plans in place.

Till then, good luck to the likes of James Howells, who has been trying to retrieve a hard drive with 8,000 Bitcoin on it for over a decade. That’s around $560 million right now.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)