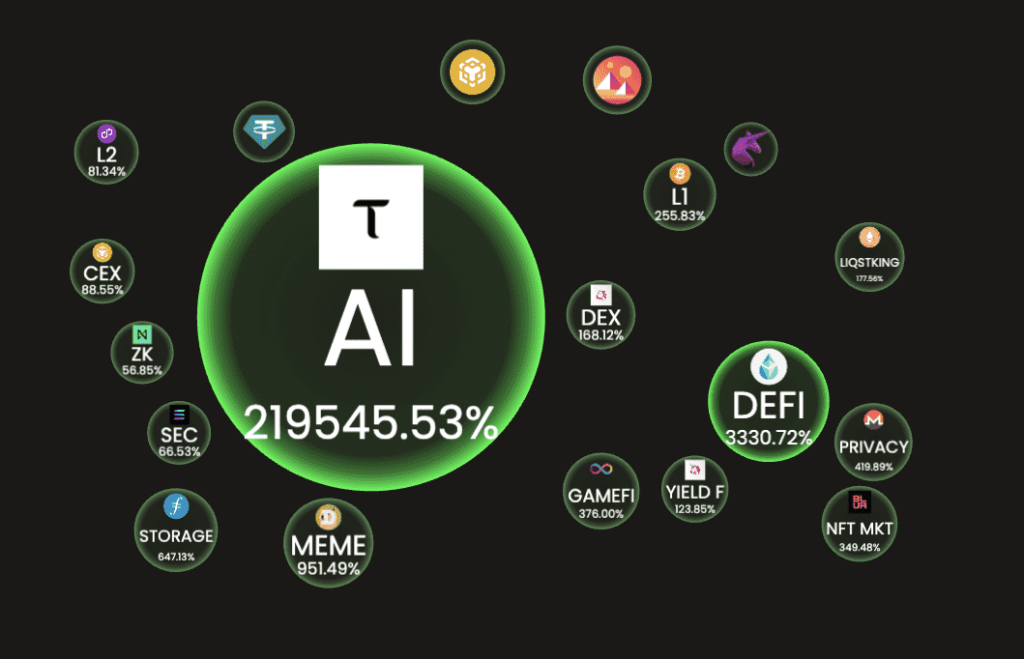

As we enter the second quarter of 2024, the cryptocurrency market is gearing up for what is expected to be an explosive phase of the 2024 bull run.

The narratives that drove the market in the previous months have evolved, and new trends are emerging, which will force crypto holders to take a long hard look at their portfolios and probably make some changes.

Let’s take a look at the hottest sectors in crypto for Q2 2024 and what to expect.

Please note, nothing in this article should be considered financial advice and any readers planning on investing should do their own research. Crypto assets are highly volatile in price and you could lose everything if you invest.

Bitcoin Ecosystem

Surprisingly, some of the most cutting-edge developments are taking place on the world’s original crypto chain, which has been known to adapt to new tech with great difficulty.

The Bitcoin ecosystem is seeing significant development after its Taproot upgrade enabled DeFi and smart contract development. The last year has been up-only for smart contract-powered layer-2 networks like Stacks, and of course the creation of Casey Rodarmor’s Bitcoin Ordinals protocol, which has now led to over 60 million inscriptions and thousands of Ordinal projects.

These projects are bringing new functionality to the Bitcoin blockchain, enabling new decentralized applications and unique digital assets. Rodarmor’s latest project Runes kicks off next month and promises to solve a lot of the congestion issues caused by BRC20 tokens.

Memecoins

With Bitcoin is in price discovery mode post-$70k, memecoin mania has broken out all over crypto and shows no signs of abating,

They continue to capture the attention of crypto traders that resemble a cult, with animal-themed projects like Pepe, Dog Wif Hat (WIF), Bonk, Shiba Inu, Ballz, and Brett making millionaires (and ‘brokies’) of degen traders. While these projects all lack fundamental value, they can generate significant short-term gains and serve as a gateway for new users entering the crypto space who don’t understand the difference between zero-knowledge and optimistic rollups and frankly don’t care. All they care about is whether to ‘ape’ (buy) or ‘jeet’ (sell).

Layer-1 Chains

One of the key sectors to watch is the Layer-1 blockchain space. While established players like Ethereum, Cardano and Solana remain relevant, newer entrants such as TON (the Telegram chain), Avalanche, Arweave, Fantom, Near, and Sui are gaining traction with various narratives.

These platforms are attracting attention due to features such as TON’s bullish tokenomics, Arweave’s decentralized storage solutions, Fantom’s high-performance blockchain, Near’s focus on AI (Fantom recently featured on a Jensen Huang-led panel at a major AI conference last week), and Aptos and Sui’s groundbreaking Move programming language, inherited from the defunct Facebook currency project Diem.

Layer-2 Chains

Another notable trend is the rise of Layer-2 solutions, particularly those built on Ethereum. Ethereum’s recent Dencun upgrade that introduced Proto-danksharding (EIP4884) was a huge boon to Layer-2 solutions because it has now dramatically lowered their transaction fees, opening up new applications.

Optimism stands out as a promising project. Coinbase’s Base blockchain is built on top of its OP Stack, and as Base begins to gain adoption, Optimism is expected to see increased usage and value capture. Base’s royalty payments fund them directly, and the prestige of providing the foundation of the technology for the Coinbase chain helps raise their profile.

Zero-knowledge proof rollups, supposedly technologically superior to optimistic rollups, continue to accumulate market share, and with the recent launch of StarkNet and others like Polygon Era and ZkSync building like mad (the latter expected to launch and airdrop its token later this year) the Layer-2 wars are far from over.

DEXs

This week it was announced that Coinbase would go to court with the SEC, while centralized exchange KuCoin was charged by US authorities for a litany of serious financial crimes such as breaking Anti-Money Laundering regulations. With many centralized exchanges still not offering sufficient KYC regimes, expect this housecleaning to continue to clear the way for TradFi firms to enter the market.

This means that the flight to self-custodial solutions continues, having started with the collapse of FTX and others in 2022. In particular, decentralized exchanges (DEXs) are also poised for growth, with ‘perpetual DEXs’ like GMX and Aveo leading the charge. These platforms offer users the ability to trade leveraged positions without centralized intermediaries.

Traditional DEXs, in particular Solana-based ones such as Jupiter, Orca, and Cosmos-based ones like Raydium and Astroport, are also expected to cash in on increased trading activity brought about by the memecoin and AI crypto narratives.

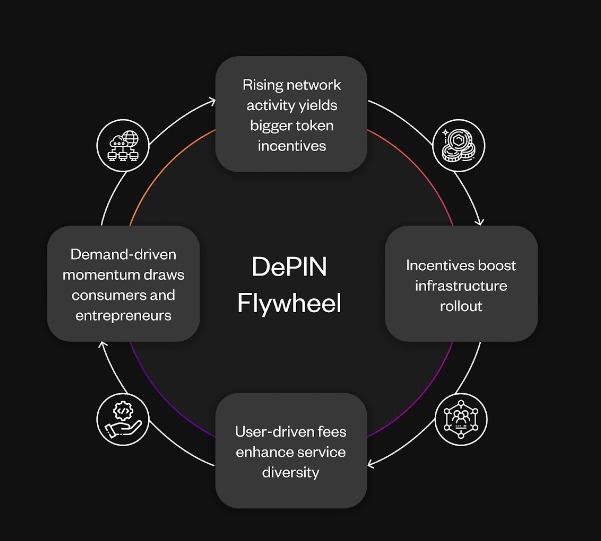

DePIN and AI

The AI and decentralized physical infrastructure (DePIN) sectors are closely intertwined and present significant opportunities. Projects like Bittensor and Akash Network are at the forefront of decentralized AI hardware and cloud computing, respectively. Other notable projects in the DePIN space include AIOZ, and Render, which focus on various aspects of decentralized infrastructure.

Crypto AI pioneer SingularityNET is also expected to continue its impressive growth this year as its ecosystem and marketplace expands and likely takes on some of its peers as new partners.

Crypto Gaming

Crypto Gaming is another sector that can finally surge back to investor awareness after two years in the doldrums. Projects like ImmutableX, Injective and Beam are building the infrastructure necessary to support the next generation of blockchain games, by offering features such as gas-free NFT minting, custom-tailored gaming blockchains, and strong partnerships with established gaming companies.

Real-world Assets (RWAs)

If you follow any crypto discussions on social media and news outlets, you’ll know that RWAs have been touted as a massive new market for crypto, after BlackRock Larry Fink’s espoused the benefits and future potential of the technology.

Real-world assets (RWAs) are increasingly being tokenized on the blockchain, and several projects are charging forwards in this sector. Ondo, Centrifuge, and Pendle are some of the key players in the RWA space, offering a range of financial products and services, including borrowing, lending, and yield generation.

Cross-chain interoperability is becoming increasingly important as the blockchain ecosystem matures. Projects like THORChain are building the infrastructure necessary to facilitate seamless asset-transfer across different blockchains, enabling greater liquidity and user adoption.

Conclusion

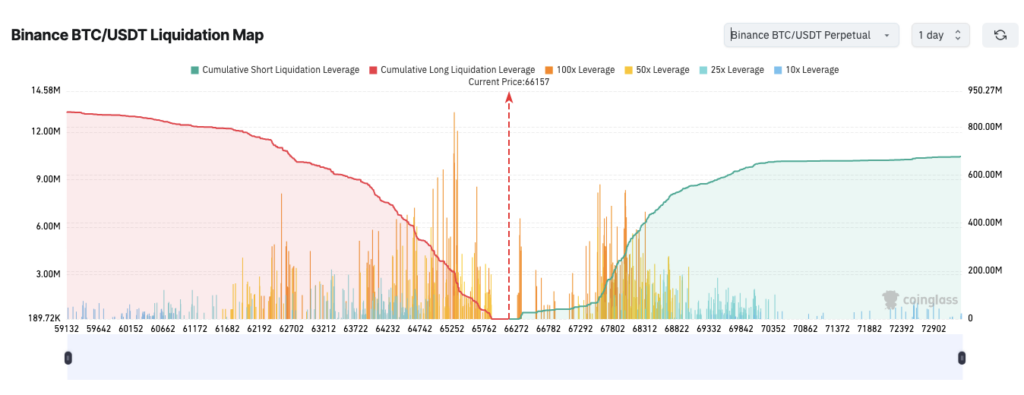

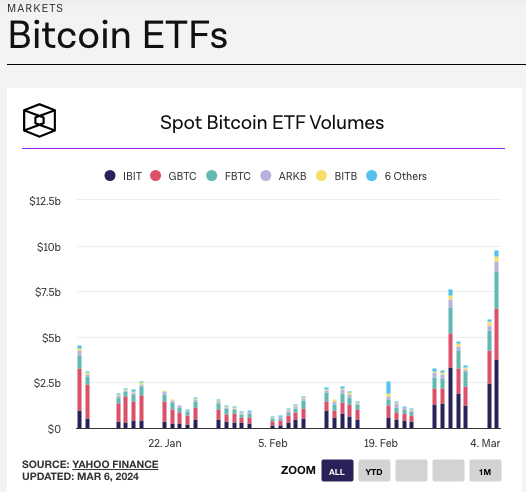

Q2 2024 will almost certainly be marked by some explosive volatility, as forces such as the Bitcoin Halving, a potential Fed reduction of interest rates, and the run-up to the 2024 US Presidential Elections continue to shape market behavior.

It is essential for investors to remain informed and adaptable, and maintain a strong understanding of their risk exposure and what they’re willing to lose. By understanding the key narratives and projects driving the market, investors can position themselves to capitalize on the potential gains. Hold on to your hat, or sell your dogwifhat, it’s going to be a wild ride.

Let us know your thoughts! Sign up for a Mindplex account now, join our Telegram, or follow us on Twitter.

.png)

.png)

.png)